Dear reader,

Welcome to the November 2024 edition of the Summit Stocks Portfolio Letters.

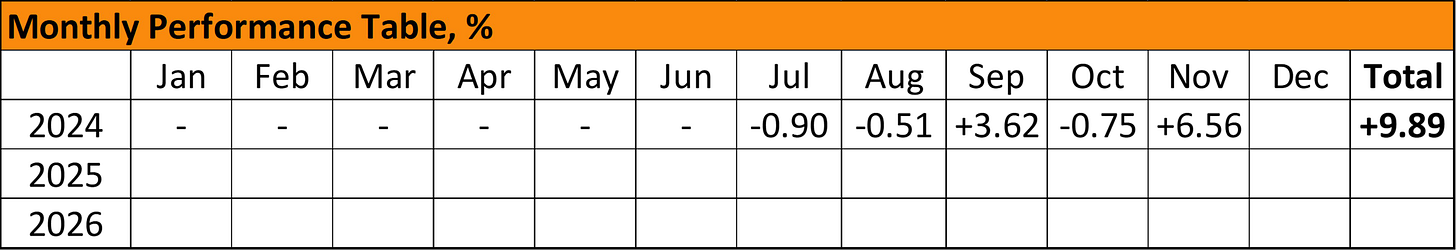

November has been a strong month for the portfolio, marking the best performance since inception. Performance was largely driven by overall market gains, partially offset by weaker performance from some holdings. Despite this, we outperformed the S&P 500 benchmark, though short-term comparisons like this aren’t particularly meaningful.

Top performers were Salesforce, Amazon, and MSCI, delivering returns of 17%, 15%, and 10%, respectively. On the other hand, Evolution and LVMH continued to slump, with returns of -5% and -3%. ASML and Airbnb posted gains of 6% and 4%.

There were no trades this month, which I’m perfectly content with. I don’t see many opportunities within my investable universe at the moment.

In November, I published a deep dive on L’Oréal, a stock struggling similar to LVMH. While an excellent company, its overlap with LVMH limits diversification benefits. Therefore, I won’t be buying unless the stock reaches an undeniably attractive price.

I also released a post on the importance of having an investing checklist, which you may find useful if you’re unsure how to approach stock analysis. Additionally, I published a deep dive into Salesforce, one of our best performers since inception, and a guide on reverse-engineering a DCF valuation. I’m still experimenting with this valuation method myself, but I find it both intuitive and insightful. Going forward, I’m sure it will be a key part of my investing toolkit.

The portfolio composition remains largely unchanged, as there were no trades in November.

The cash position has more than doubled, due to ongoing deposits and no trades, while other positions have seen only minor percentage shifts within the portfolio.

Looking at the portfolio today, I feel confident in the future, yet it still feels… unfinished. While I’m happy with my core holdings, Evolution increasingly seems to stand out as an outlier within the portfolio. It’s the smallest position, but I haven’t given it the attention it deserves, and that’s on me. With the stock continuing to slump, I plan to dedicate time soon to reevaluate Evolution’s place in the portfolio. I won’t rush the decision, but remaining indecisive isn’t right either.

Beyond Evolution, I see room to further reduce diversifiable risk by expanding the portfolio to 8-12 positions. However, I’m cautious not to add new positions simply for the sake of diversification. Any additions must either match or surpass the quality of my current holdings.

For now, I don’t see any better businesses trading at attractive prices. The S&P 500 is up nearly 30% year-to-date, following a 25% gain in 2023. In other words, the market is becoming increasingly expensive as investor sentiment turns greedy. I’m determined not to get swept up in this greed. This is a time for caution, not recklessness.

In case you missed it:

Reverse-Engineering The Discounted Cash Flow (DCF) Valuation

Stock Deep Dive - Salesforce: Bringing Companies and Customers Together

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.