Amazon: The Everything Company

A deep dive into one of the most valuable companies in the world

Dear reader,

Welcome back to another deep dive into a wonderful company.

Today, find out all about Amazon, from its founding by Jeff Bezos at the dawn of the Internet, to how he built a global empire. Explore how Amazon evolved from an online bookstore into "The Everything Company," and take a closer look at Amazon’s prospects today.

In 2013, journalist Brad Stone published the book The Everything Store: Jeff Bezos and the Age of Amazon, a bestseller that chronicles Amazon’s rise. The title was fitting at the time, but Amazon has since outgrown even that description. Today, the company isn’t just the everything store—it’s the everything company. Amazon is a market leader in e-commerce, cloud computing, advertising, and streaming, generating a staggering, mind-boggling $575 billion revenue in 2023, demonstrating unparalleled magnitude.

Table of Contents

1. Amazon’s Rise

1.1 Jeff Bezos

1.2 Bubbles and Missteps

1.3 From Books to Everything

1.4 Scale, Scale, Scale

2. The Everything Company

2.1 Amazon’s Business Segments

2.2 Amazonian Moat

2.3 The Numbers

2.4 Into the Future

2.5 Passing Down the Reins

3. Conclusion

Not interested in Amazon’s history? Scroll down to “2. The Everything Company”.

1. Amazon’s Rise

1.1 Jeff Bezos

From a young age, Jeff Bezos displayed remarkable intellect. Described as friendly, serious, confident, and highly competitive, his intelligence was evident even early in his childhood. As a toddler, he would dismantle his crib with a screwdriver and later rigged an electric alarm to keep his younger sibling out of his room. In the early 1970s, Bezos, then in his early teens, enrolled in the so-called Vanguard program at River Oaks Elementary School, an unusual public-school program for gifted children. The program emphasized creativity, independent thinking, and intellectual exploration, nurturing Bezos's already keen mind.

Bezos developed a deep passion for computers, which led him to graduate from Princeton University in 1986 with a degree in computer science and electrical engineering. He began his career on Wall Street, impressing colleagues with his intellect and determination. By 1990, he became the youngest vice president at the quantitative hedge fund D. E. Shaw. Despite his success, Bezos grew increasingly frustrated with the conventional environment on Wall Street and began seeking opportunities to start his own business. Although his initial startup attempt failed when his partner withdrew, Bezos remained determined.

In 1994, Bezos came across a startling statistic revealing a 2,300-fold increase in web usage—a 230,000 percent surge. This discovery sparked the idea for a business that could leverage the rapidly growing Internet. Bezos and his boss, David Shaw, brainstormed ideas, eventually conceiving “the everything store”—an online platform that would serve as an intermediary between customers and manufacturers, selling nearly every type of product globally. Realizing that such a vast endeavor would be impossible to build from the start, Bezos methodically narrowed his focus. He chose books as a starting point because they were a commodity, logistics were simplified by the presence of only two primary book distributors, and there were three million titles in print—far more than any physical store could hold. Interestingly, online bookstores weren’t completely new. Bezos investigated some of the earliest online bookstore websites, and quickly found out that no one yet knew how to do a good job at selling books online.

Determined to pursue his vision, Bezos left his secure, lucrative job on Wall Street and moved to Seattle. Together with his then-wife, MacKenzie Scott, and Shel Kaphan, Amazon’s first official employee, Bezos launched Amazon in the converted garage of his home.

Within a few months, the rapidly growing Amazon team moved to a more professional office space, with a basement serving as the warehouse. In the spring of 1995, Amazon’s website went live, with the first purchase credited to John Wainwright on April 3, 1995. The early website was primitive, but over time, new features and improvements were introduced. The first major feature was customer reviews, which initially sparked backlash from book publishers, particularly when negative reviews were posted. One publishing executive remarked that Bezos didn’t understand his business was to sell books, not criticize them. However, Bezos countered, “We don’t make money when we sell things. We make money when we help customers make purchase decisions.” This was an early sign of Amazon's and Bezos’s relentless customer-focus—a strategy that would prove highly profitable. Other features followed, including “Similarities,” a personalization tool recommending books to customers based on their interests, affiliate links, and the revolutionary “1-Click” feature, which streamlined the online purchasing process.

While Amazon's revenue grew explosively, its net losses also mounted. Bezos remained laser-focused on growth over profitability, aiming to “level the playing field in terms of purchasing power with the established booksellers.” He understood that size was critical to achieving this goal. The company went public on May 15, 1997, raising $54 million and garnering widespread attention.

Under Bezos’s leadership, Amazon was on a relentless quest for growth, racing to dominate the market at all costs.

1.2 Bubbles and Missteps

From 1998 to early 2000, the world was caught up in the dot-com bubble. Internet companies, especially those with “.com” in their names, like Amazon.com, were hyped to astronomical levels. Optimism was high, capital in abundance, and opportunities seemed limitless. Bold and confident, Amazon and its founder Jeff Bezos fully embraced this frenzy.

The company's first major missteps came through acquisitions and venture-capital investments. Amazon aggressively acquired numerous companies but grew too rapidly to effectively integrate these businesses and their employees. The rapid expansion led to chaos and inefficiencies within the company.

In addition to acquisitions, Amazon also invested heavily in various internet startups, such as Pets.com, Kozmo.com, and Gear.com. When the dot-com bubble burst in early 2000, nearly all of these startups failed, resulting in hundreds of millions of dollars in losses for Amazon. These setbacks forced the company to refocus on its core business—its distribution centers and website.

In 1998, eBay emerged as a worrisome rival. In response, Bezos introduced Amazon Auctions in March 1999, but the platform went nowhere due to eBay’s established network. The power of the network effect proved too strong for Amazon to overcome. Nonetheless, Amazon Auctions provided a glimpse into the company’s future third-party seller services, where merchants could sell their products through Amazon’s marketplace.

To expand its selection into product categories requiring industry-specific expertise, Bezos began pursuing strategic partnerships. This led to a significant deal with Toys “R” Us in August 2000. Amazon had struggled with selling toys on its own due to the challenges of managing seasonal demand and the inability to return unsold toys to distributors. Stocking the right amount of toys at the right time required deep industry knowledge that Amazon lacked.

Toys “R” Us, on the other hand, was struggling with its online operations. To address these challenges, Amazon agreed to sell Toys “R” Us products through its website. This partnership allowed Amazon to enter the toys category while Toys “R” Us could depend on Amazon for its e-commerce department. The deal marked the beginning of third-party merchants selling goods online through Amazon.

In November 2000, Amazon launched Marketplace, enabling third parties to easily sell used products on the same pages where Amazon sold its items. Unlike Amazon Auctions, which was on a separate and less-visited page, Marketplace was integrated into Amazon's existing pages with high traffic, contributing to its success.

When the dot-com bubble burst, most internet startups evaporated, and anything ending with ".com" became shunned rather than celebrated. It became increasingly difficult to raise capital, but Amazon was fortunate, having raised $672 million just a month before the bust. The dot-com crash also marked a shift in the company’s strategy. Bezos’s relentless pursuit of growth had to pause; the business was still significantly unprofitable. To survive, Amazon needed to focus on profitability.

The company slowed the rollout of new product categories and began improving efficiency in its distribution centers. Where many internet startups failed, Amazon adapted. In January 2002, the company reported its first profitable quarter. 2003 was Amazon’s first profitable year, generating net income of $35.3 million.

Amazon had faced the dot-com crisis and survived. During the crisis, the company became more efficient and effective, and it reinvented itself by allowing third parties to sell through their website. The company was profitable and poised for further growth.

1.3 From Books to Everything

Emerging from the dot-com crisis, Amazon offered books, music, electronics, toys, jewelry, apparel, kitchen appliances, and much more. Alongside Amazon’s own products, third-party sellers filled gaps in the marketplace. Despite the company’s broad selection of goods, however, Amazon remained centered around a single primary business: retail.

So, how did Amazon evolve from “the everything store” into “the everything business?”

As operational efficiencies improved, Amazon was able to deliver goods to customers increasingly faster. In 2004, Amazon engineer Charlie Ward proposed a subscription service where customers could pay an annual fee in exchange for faster shipping. The service would cost $79 a year and would be called Prime. One insider said, “It was never about the seventy-nine dollars. It was really about changing people’s mentality so they wouldn’t shop anywhere else.” The Prime service initially operated at a loss—fast shipping was typically more expensive if customers frequently ordered—but it increased customer loyalty and encouraged larger purchases.

Beyond Prime, Amazon continued to innovate, introducing new products and expanding its offerings. In 2006, Amazon launched the Simple Storage Service (S3), enabling businesses to store files on Amazon’s servers. A few months later, the company introduced the Elastic Compute Cloud (EC2), which allowed developers to run their programs on Amazon’s infrastructure. These services marked the beginning of Amazon Web Services, or AWS, as we know it today. AWS actually launched in 2002, but was initially focused on providing APIs for web developers, allowing them to incorporate Amazon.com content and features into their own websites. Today, AWS is Amazon’s highly lucrative cloud computing business. But how did an online retail company develop such a seemingly unrelated venture?

AWS grew out of Amazon’s own challenges. As the company expanded, it struggled with insufficient computing resources, which created bottlenecks and hindered innovation. Project leaders couldn’t test their ideas due to limited resources, slowing progress. Amazon needed to ensure that its developers always had access to the necessary resources. Because of those bottlenecks, Amazon gained expertise in building a stable computing infrastructure, spawning the idea that Amazon could sell raw computing power to other organizations. According to an employee working on S3, Bezos “had this vision of literally tens of thousand of cheap, two-hundred-dollar machines piling up in racks, exploding. And it had to be able to expand forever.” These machines would eventually form Amazon’s vast data centers, now relied upon by millions of organizations worldwide. Recognizing Amazon’s own need for such a service, Bezos saw the broader market demand and capitalized on it.

In 2006, Amazon launched “Fulfillment by Amazon”, a service that gave small and medium-sized businesses access to Amazon’s distribution network, further enhancing the third-party sellers segment.

In 2007, Amazon introduced the Kindle, a sophisticated and widely popular e-reader. The inspiration for the Kindle originally came from Apple and Steve Jobs, who had revolutionized the music industry with iTunes. Books were still a major revenue source for Amazon, and Bezos didn’t want his book business to be disrupted by other companies. Realizing that books would inevitably go digital, he aimed to ensure Amazon’s continued dominance in the market, thereby cannibalizing Amazon’s physical book business. Development on the Kindle began in 2004, and upon its release, it became a massive success, selling out in 5.5 hours and remaining out of stock for five months.

By the end of the 2000s, Amazon had evolved from an online retailer with a limited range of products into a full-fledged technology company. However, it was the 2010s that truly defined Amazon, transforming it from a billion-dollar enterprise into a trillion-dollar powerhouse.

1.4 Scale, Scale, Scale

Amazon continued to innovate, with some inventions proving successful while others fell short. In 2014, Amazon launched the Fire Phone, a smartphone that quickly failed in the market and was discontinued by 2015. However, the same year, Amazon introduced Alexa, a virtual assistant designed for smart homes. Unlike the Fire Phone, Alexa was a success, and is still in the product line-up today. Whether Amazon’s innovations failed or not, one thing became increasingly certain: Amazon was no longer just a retailer.

But retail was still the company’s core business. In 2011 and all prior years, Amazon was required to pay sales taxes only in states where it had a physical presence. As the company sold products nationwide and even internationally, many of its sales were tax-free. This advantage prompted states to pass legislation mandating that online retailers pay taxes in every state. Initially, Jeff Bezos opposed this, but he soon recognized the long-term benefits for Amazon. With tax concerns out of the way, Amazon could expand its offices and distribution centers across the U.S. without hesitation—a move that fueled its rapid growth.

Along the way, Amazon also launched Prime Video, its streaming service, and made several strategic acquisitions, including Twitch, Whole Foods, and Goodreads. The company continued to innovate with ventures like Amazon Go, a cashier-less grocery store, and Prime Air, one of the first drone delivery services.

Between 2010 and 2023, Amazon’s revenue skyrocketed from $34 billion to $575 billion. Today, Amazon is one of the world’s largest companies, employing over 1.5 million people.

2. The Everything Company

2.1 Amazon’s Business Segments

Amazon has grown from a humble online bookstore into a global powerhouse. The company generates revenue through seven channels:

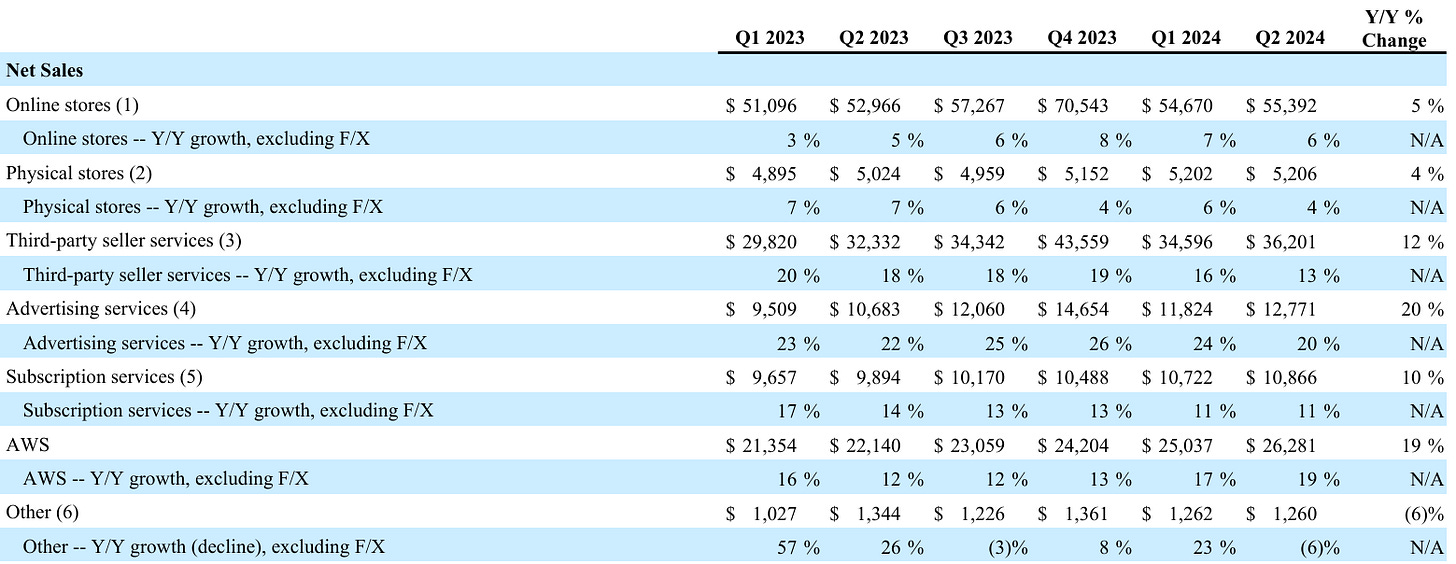

Online stores is Amazon’s largest business revenue-wise. It represents Amazon’s online retail marketplace. The company offers an incredibly wide variety of products through its website, selling basically everything, from books, music, and games, to fashion, toys, and furniture. Amazon operates an expansive network of distribution and fulfillment centers, allowing for better customer service in the form of faster delivery, as cheaply as possible. According to MWPVL International, a supply chain consulting firm, Amazon operates 2,539 facilities worldwide as of Q1’24. The segment generated $232 billion in revenue in 2023.

Physical stores represents product sales in Amazon’s physical stores. The company operates Amazon Go stores—a type of corner store offering which includes ready-to-eat breakfast and lunch, Amazon Fresh stores—a grocery store, and Whole Foods Market—a leading natural and organic foods retailer. The segment generated $20 billion in revenue in 2023.

Third-party seller services is the segment which allows merchants to sell their products and services through Amazon’s marketplace. According to Amazon, there are about 1.7 million small and medium businesses around the world selling on Amazon.com, resulting in lower prices and better selection for customers. Amazon allows merchants to sell through their websites and use Amazon’s distribution network. In return, Amazon collects commissions and fulfillment and shipping fees from merchants. The segment generated $140 billion in revenue in 2023 and is still growing rapidly.

Advertising services allows sellers, vendors, authors, and others to advertise their products and services on Amazon’s platforms. This includes the Amazon.com marketplace and Amazon’s streaming service Prime Video. Advertisements can be sponsored ads, displays, and video advertising, among others. Amazon is the third biggest advertiser in the world, behind only Alphabet—parent company of Google—and Meta Platforms. The segment generated $47 billion in revenue in 2023.

Subscription services includes Amazon Prime memberships, as well as digital video, audiobook, digital music, e-book, and other non AWS subscription services. Amazon Prime provides customers with same-day, one-day, or two-day delivery on millions of items, exclusive deals at Amazon Fresh, access to Prime Video, Amazon Music, Prime Day, and more. Prime has transformed from a faster shipping service into an often irresistible money-for-value service. The segment generated $40 billion in revenue in 2023.

Amazon Web Services provides on-demand cloud computing solutions. Organizations have the option to “rent” Amazon’s servers, freeing them from managing and scaling their own servers. Amazon has build many data centers across the world over the years, so that they can provide countless of organizations with the computing power they need. AWS comprises over 200 specific products and services, and it is the biggest cloud provider in the world. The segment generated $91 billion in revenue in 2023.

Other includes licensing and distribution of video content, health care services, shipping services, and Amazon’s co-branded credit card agreements. The segment is insignificant as it’s not part of Amazon’s core business and it generated only $5 billion in revenue in 2023.

Amazon generated $575 billion in revenue in 2023, of which $396 billion was generated in the United States. In other words, the company still has a lot of room for growth internationally, expanding to new countries and penetrating countries it already operates in.

Amazon’s fastest-growing segments—third-party seller services, advertising services, subscription services, and AWS—also boast higher margins compared to its online and physical stores. As these segments continue to outpace growth in the retail sector, Amazon’s overall margins should improve over time.

2.2 Amazonian Moat

The traditional five sources of economic moat—network effect, intangible assets, cost advantage, switching costs, and efficient scale—all surface in discussing Amazon’s moat. The company is powerful and diversified; different business segments have different sources of moat. By analyzing each business segment as if it were a standalone company, we can more effectively address Amazon’s moat.

Online stores / Third-party seller services:

The Amazon.com marketplace thrives on powerful network effects. As the dominant leader in e-commerce, Amazon attracts the largest amount of buyers, which in turn draws in more sellers. Amazon's own significant sales on the platform further enhance this effect, attracting even more buyers. This network effect accelerated when Jeff Bezos recognized the “flywheel effect”: lower prices drive increased customer visits, leading to higher sales volumes and attracting additional third-party sellers. As more sellers join, Amazon's revenue grows through commissions, and the expanded seller base continues to attract more buyers. This dynamic enables Amazon to lower prices further, perpetuating the cycle.

The marketplace enjoys significant cost advantages due to economies of scale, vertical integration, and a negative cash conversion cycle. Amazon’s vast scale allows for greater purchasing power, while its distribution network is largely owned and operated by the company. This scale also allows Amazon to better distribute fixed costs across its operations. Additionally, Amazon’s online retail business benefits from a negative cash conversion cycle, receiving payments from customers before paying suppliers, providing a strong financial advantage.

Amazon.com also leverages intangible assets, including advanced technology, branding, partnerships, and data. With nearly 30 years of e-commerce experience, Amazon has developed sophisticated technology and algorithms. The company collects extensive data on customer behavior, which it uses to refine algorithms, personalize the shopping experience, and optimize inventory management. Amazon’s brand, associated with trust and global recognition, is among the most valuable in the world, further reinforcing its competitive edge.

Amazon Web Services:

AWS imposes high switching costs on its customers, making it challenging for them to migrate to another cloud provider. Organizations store large amounts of data on AWS servers, and transferring this data can be risky, time-consuming, and expensive. Furthermore, many applications are specifically customized to leverage AWS’s unique services and APIs, making them difficult to reconfigure for another platform. The technical expertise required to effectively use AWS also adds to the challenge, as transitioning would require retraining staff and readjusting workflows.

AWS benefits from substantial cost advantages through economies of scale. As the market leader in cloud computing, Amazon can invest heavily in its extensive network of data centers, which are costly to build and maintain. This scale advantage allows AWS to spread costs across a larger customer base, enabling more efficient operations than smaller competitors. As AWS continues to grow, it can further invest in additional data centers, continuously widening the competitive gap.

Subscription services:

Amazon Prime plays a crucial role in ensuring customer loyalty and retention. With its unique value proposition, Amazon Prime enhances the shopping experience by offering benefits like faster shipping, access to digital content, and exclusive deals. While the subscription services segment may not have a wide moat on its own, it significantly strengthens Amazon's overall moat by deepening customer loyalty and engagement and making it more difficult for competitors to lure away Prime members.

Advertising Services:

Unlike other advertising platforms like Google or Instagram, Amazon collects data directly linked to customers’ purchase behavior, often resulting in higher returns on ad spend, making it more attractive for marketeers to advertise through Amazon. Similar to the marketplace, Amazon's advertising services benefit from intangible assets, particularly in the form of this data.

Additionally, Amazon’s advertising services capitalize on the same network effect as the marketplace. As more customers visit Amazon.com, the platform becomes increasingly attractive to advertisers, further driving the growth and effectiveness of its advertising services.

Amazon as a whole possesses an exceptionally wide moat, with its various business segments complementing and reinforcing each other. Each segment—whether it's e-commerce, AWS, or advertising—strengthens the others, creating a powerful and integrated ecosystem. Given this reinforcement and the advantages in each area, Amazon's moat is as strong as it has ever been.

2.3 The Numbers

Amazon’s 5-year compound annual revenue growth rate stands at an impressive 20%. Impressive, although the COVID-19 pandemic did boost the company’s sales in the short-term, which is why a slower, more sustainable growth rate should be expected going forward.

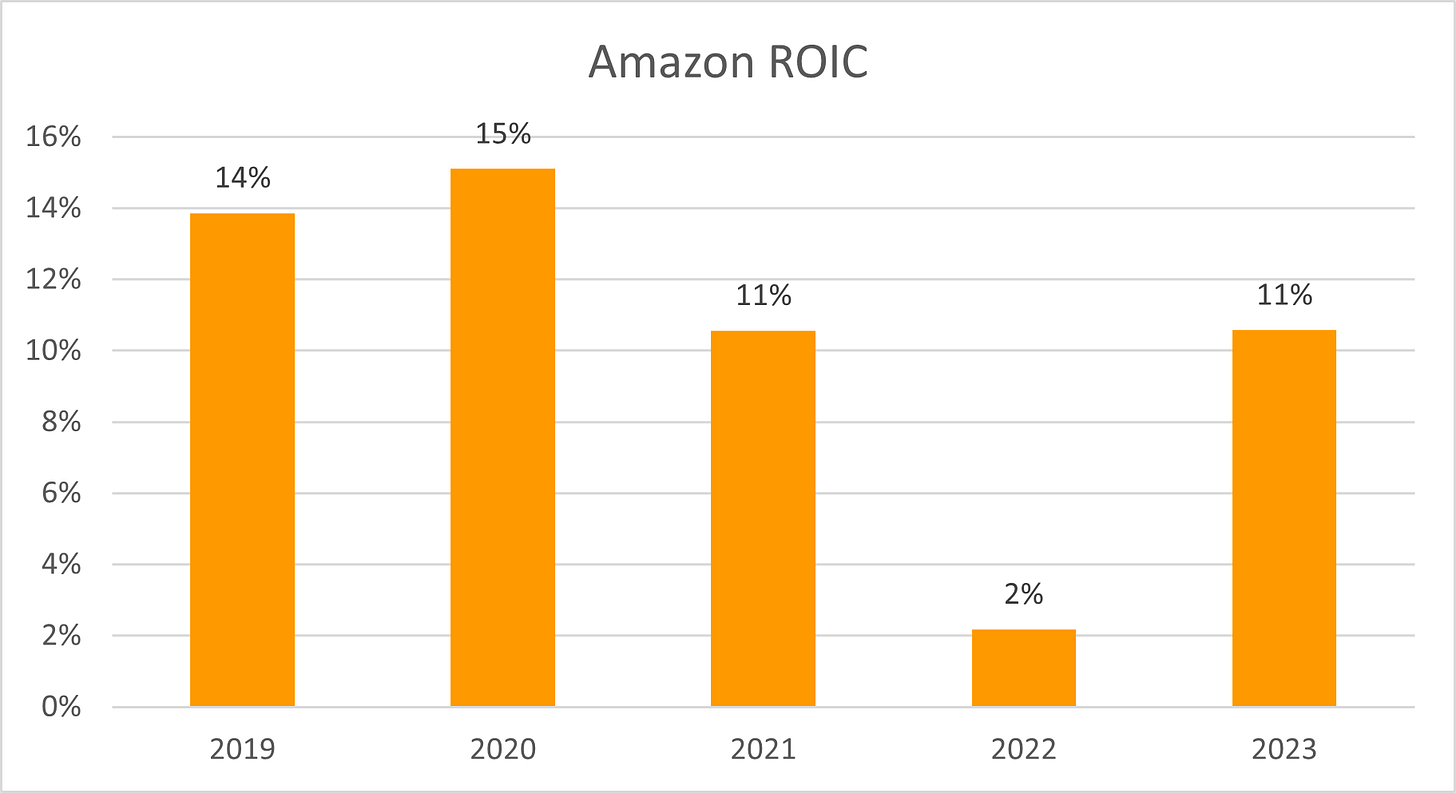

Next, Amazon’s return on invested capital (ROIC) is lower compared to typical high-quality companies, and it has been particularly low over the past three years. This decline is attributed to Amazon’s substantial investments in research and development (R&D) and significant expenditures on property and equipment. These investments have increased invested capital and reduced operating income, naturally leading to a lower ROIC. However, this strategy aligns with Amazon’s and Bezos’s long-term vision. The company has a history of deliberately suppressing short-term profits in favor of long-term growth and value creation, reflecting its commitment to a long-term perspective for both the company and its investors.

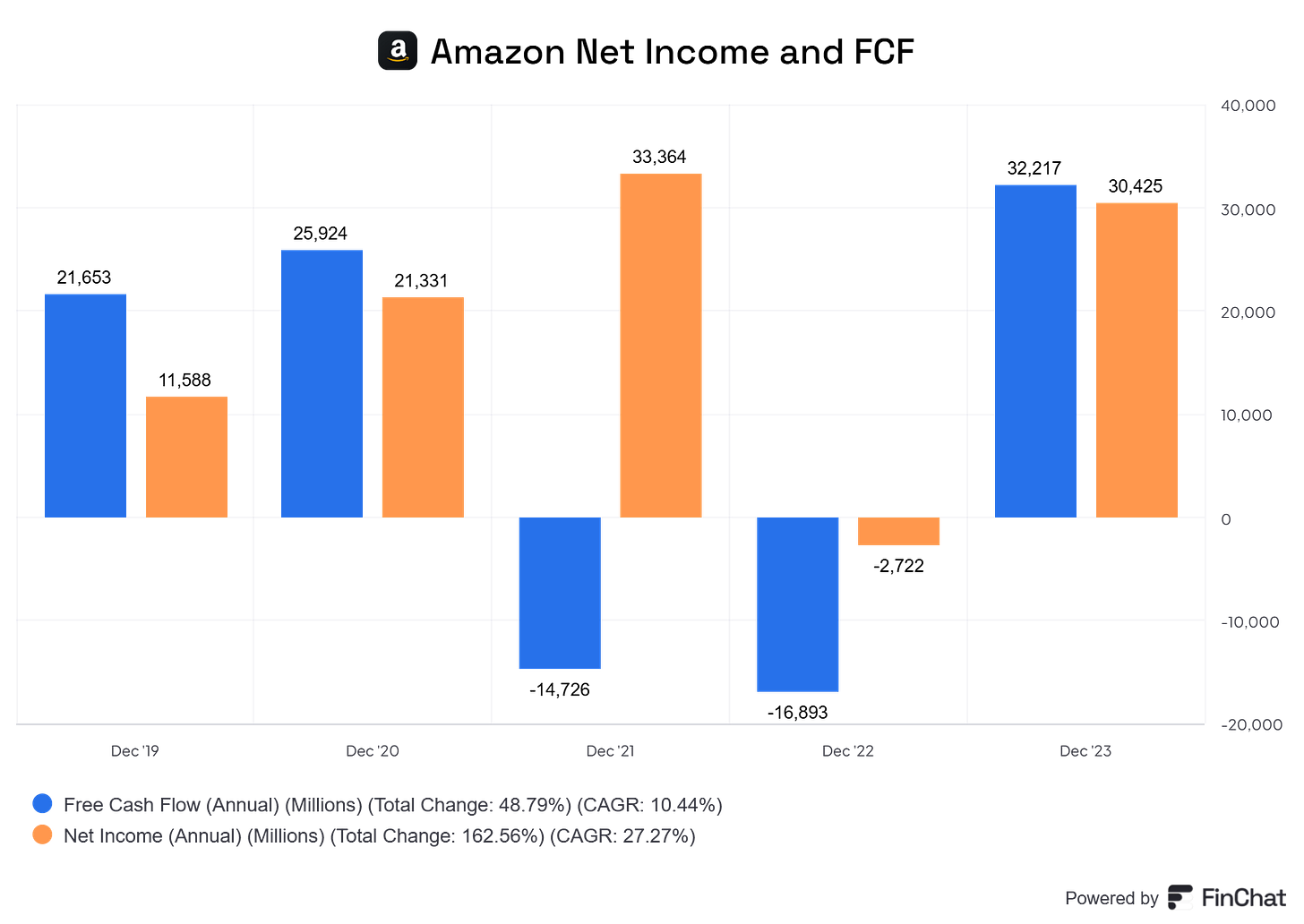

Similar to ROIC, Amazon’s free cash flow has been relatively unimpressive over the past five years, but, again, this is largely due to deliberate strategic decisions. However, recent results indicate a shift towards greater profitability. In the trailing twelve months, Amazon’s free cash flow has surged to nearly $50 billion, while operating cash flow reached $108 billion, marking a 75% increase year-over-year. It seems like Amazon is refocusing on enhancing profitability.

Finally, as of the latest quarter, Amazon’s balance sheet is robust. The company holds $71 billion in cash and equivalents against $133 billion in debt and leases, resulting in a net debt position of $59 billion. This translates to a net debt-to-free cash flow ratio of slightly over 1. In other words, Amazon could repay all its debt within a little over one year using its free cash flow and current cash reserves.

2.4 Into The Future

Investing is about anticipating the future, so it's crucial for a company to be aligned with secular trends that drive sustained revenue growth over the long term. Additionally, a company should have sufficient optionality and the ability to innovate, enabling it to discover new revenue streams.

Amazon is the prime example of optionality. Few would have predicted that an online bookseller would evolve into a trillion-dollar tech giant, and even Jeff Bezos could not have anticipated the significant revenue streams from AWS or advertising. Amazon’s consistent ability to create new revenue streams highlights its innovative edge and suggests that it will continue to do so.

At the same time, e-commerce is projected to grow at high single-digit rates in the foreseeable future, and Amazon is well-positioned to continue to benefit from the ongoing shift of market share from traditional retail to online shopping.

Similarly, AWS stands to gain from the increasing migration of organizations to the cloud. Cloud computing offers clear advantages over in-house servers in terms of cost efficiency, scalability, flexibility, and accessibility. With the cloud computing industry expected to grow at an annual rate of at least 15% in the coming years, AWS, as the market leader, is well-positioned to capitalize on this trend.

Moreover, Amazon has yet to fully penetrate international markets, indicating substantial room for further growth. By riding these two major secular trends and expanding globally, Amazon is poised for continued growth.

2.5 Passing Down The Reins

Founder Jeff Bezos, now 60, stepped down as CEO of Amazon in 2021 to focus on his second venture, Blue Origin, and his philanthropic activities. Although he is no longer CEO, he remains active as executive chairman and continues to hold a substantial 10.8% stake in Amazon, valued at over $202 billion. His ongoing involvement and significant ownership demonstrate his enduring commitment to the company.

Andy Jassy succeeded Bezos as CEO. Jassy joined Amazon in 1997 and has a notable history with the company, including a memorable incident in 1997 where he struck Bezos with a kayak paddle during an intense game of “broomball,” a recurring Amazon game. Bezos must have forgiven him, or else he wouldn’t have succeeded him. Jassy’s deep familiarity with Amazon, particularly through his leadership of AWS since its inception, positions him well to steer the company’s future. His extensive knowledge of AWS, a crucial segment for Amazon’s future, is a strong asset.

Jassy owns over 2.1 million Amazon shares, valued at more than $382 million. His total 2023 compensation was $29.2 million, meaning he owns a substantial stake in the company.

Amazon's management, under Jassy’s leadership, continues to embrace a capital allocation strategy that aligns with Bezos’s long-term vision. The company is willing to accept temporary net losses and negative free cash flow if it means investing heavily in future growth. Amazon prioritizes reinvestment over dividends or share buybacks, focusing on always achieving the highest possible returns. This approach underscores Amazon's exceptional ability to allocate capital effectively for long-term value creation.

3. Conclusion

Amazon is an exceptional company known for its continual reinvention and adaptability. It boasts one of the strongest economic moats and maintains a leadership position in nearly every industry it operates in. The company’s management is outstanding, with interests closely aligned with long-term shareholders.

By capitalizing on major secular trends and expanding into international markets, Amazon is well-positioned for a promising future.

This is why Amazon is the largest holding in my portfolio and is expected to remain the largest for the future.

Thank you for reading. I hope you’ll have learned a ton about Amazon. Don’t forget to subscribe for more deep dives into other wonderful companies!

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.