The Ultimate Investing Checklist

Learn about the most important aspects an investment must have

Dear reader,

Welcome to today’s post. In this article, we’ll discuss the importance of having a well-thought-out investment checklist. We’ll break down the key requirements a company needs to meet before we consider investing in it. This is the third entry in our series on broader investing topics, designed to help you grasp key concepts while saving you valuable time.

Why Use a Checklist?

Checklists are invaluable—not just for investing but in many areas of life. They help reduce errors, ensuring you don’t overlook anything. For investors, a checklist keeps your investment philosophy consistent across equities while streamlining your process. Instead of trying to remember everything, you simply work through the list.

Investing involves real money, and the stakes are high—after all, no one wants to lose money.

“The first rule of an investment is don’t lose [money]. And the second rule of an investment is don’t forget the first rule. And that’s all the rules there are.” — Warren Buffett

A well-constructed checklist can help reduce the risk of losses, offering a framework to make informed decisions.

The Qualitative Checklist

Researching a stock—or rather, a company—consists of two dimensions: qualitative and quantitative. The story and the numbers. Therefore, our checklist is separated across those two aspects. Let’s start with the qualitative side.

A Solid Understanding of the Company

Consider this example: I’d been eyeing a company called Fortinet, a leading cybersecurity company, but didn’t purchase. I first noticed the stock when it was around $50 per share; today, it’s nearly doubled, reaching almost $100. The company’s fundamentals have been impressive, with consistent annual revenue growth of 20% or more, strong ROIC, expanding margins, and a solid balance sheet. On top of that, Fortinet has been actively buying back a ton of shares.

So, why didn’t I pull the trigger and buy?

Despite the attractive numbers, I didn’t fully understand the cybersecurity industry or Fortinet’s complex products.

Not understanding a stock leads to poor decision-making. For instance, had I bought, and the stock dropped, I might have panicked and sold, convincing myself that the company’s prospects weren’t as strong as I thought, or that I had missed something that caused the decline. Short-term volatility is extra dangerous when you lack conviction in your holdings, and conviction is built through continuously learning about them.

Additionally, understanding a company’s business is crucial when putting financial results into perspective. A disappointing earnings report may be mere noise to the informed investor, while it may raise unnecessary doubt and concern for the ignorant, further leading to wrong choices.

Sustainable Competitive Advantages

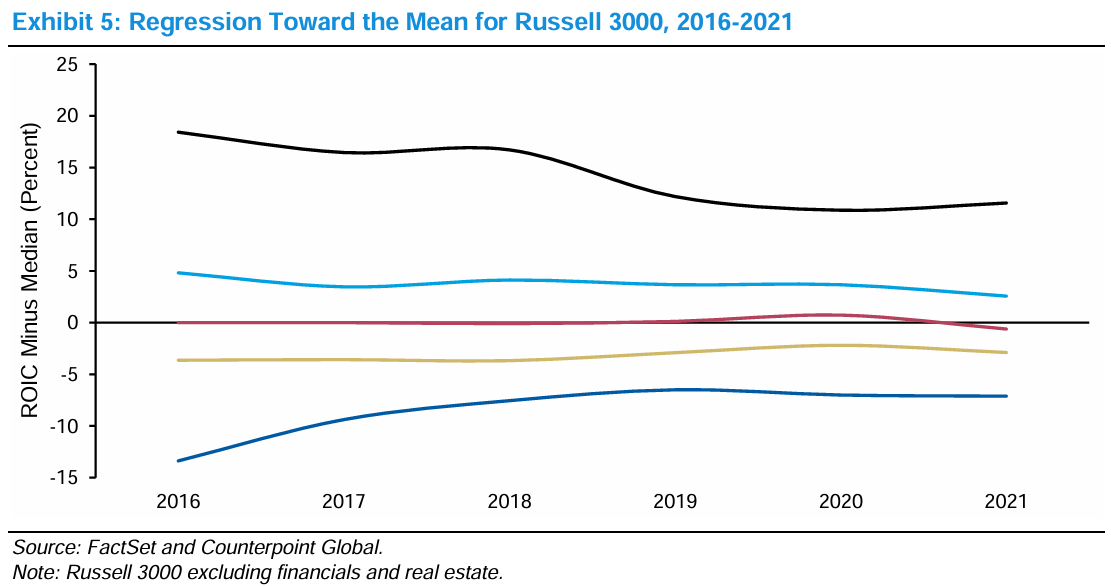

Investing is for the long-term, and successful investors should aim to hold quality companies for as long as possible. To make that possible, the companies we invest in must possess sustainable competitive advantages. This ties into the concept of the regression toward the mean, which suggests that businesses with high returns on invested capital (ROIC) typically see those returns decline over time, while those with low ROIC tend to experience improvement. This phenomenon occurs because high returns in an industry attract competition, leading to increased pressure on profits in the industry.

As long-term investors, our goal is to identify companies with consistently high ROIC that can maintain their edge. This is where the concept of a "moat" becomes vital. Historically, a moat was a deep, water-filled trench that protected a castle from invaders. In the business world, a company’s moat refers to its competitive advantages—unique qualities that shield it from rivals and safeguard its profitability over time.

There are different types of competitive advantages:

Switching Costs: These hinder customers from moving to competitors. Examples include Salesforce, whose software is deeply integrated into businesses, and Apple, whose ecosystem locks users in. Essentially, switching costs arise when lower prices from competitors do not outweigh the cost of switching to those competitors.

Network Effects: These occur when the value of a product or service increases as more people use it. Think of Meta’s platforms (Facebook, Instagram) or payment networks like Visa and Mastercard. The bigger the network and the more touch points, the more difficult it becomes for competitors to compete.

Intangible Assets: Strong brands, patents, licenses, intellectual property, or relationships can create substantial barriers for competitors. A strong brand enables a company to charge a premium for identical products while simultaneously fostering customer recognition, loyalty, and trust. When nurtured effectively, brands can serve as powerful defensive assets. In fact, some of the most iconic brands remain resilient even when mishandled.

Take The Coca-Cola Company, for example. In 1985, they attempted to revamp their brand and formula, introducing “New Coke.” The move sparked significant backlash from loyal customers who demanded the return of the original formula. This misstep is widely regarded as a marketing failure, yet Coca-Cola's powerful brand helped it weather the storm.

Similarly, patents play an important role in protecting innovation, and companies like Disney own a valuable portfolio of intellectual property, including beloved characters and franchises like Mickey Mouse, Star Wars, Marvel, and more.

Cost Advantages: Economies of scale provide companies with a significant cost advantage by allowing fixed costs to be spread across a larger number of units. This also enables consolidation of expenses like R&D, CAPEX, or marketing. For example, Netflix can invest much more in creating new content than its competitors, simply due to its size. Amazon leverages its vast scale to offer Amazon Prime at competitive prices while still turning a profit. Companies with cost advantages can use them to achieve higher margins or undercut competitors, creating a durable competitive edge.

Efficient Scale: This arises when a market is limited in size with high barriers to entry, creating monopolistic markets on a local or global level. For example, Copart often operates as a local monopoly in certain areas with its salvage yards, as these markets are too small to attract additional competitors. Entering such a market typically isn’t worth the required capital investment. Other classic examples include airports (most cities can sustain only one), utilities, and railroads.

A Long Runway of Revenue Growth

Long-term revenue growth is essential for multiple reasons. Most importantly, however, revenue growth is necessary because profit growth is limited with stagnant revenue. While cost-cutting can boost profits temporarily, growth ultimately depends on increasing revenue.

Companies can achieve long-term revenue growth through various methods, including but not limited to:

Secular Trends: Growing markets naturally drive revenue growth. For example, Amazon’s AWS thrives in a fast-growing cloud industry, ASML serves growing end markets, and LVMH benefits from an expanding middle-class in Asia and premiumization across the world. It’s best to avoid shrinking markets, as they limit growth and often have fiercer competition.

Pricing Power: Companies with pricing power can increase prices regularly without losing customers, often with minimal added costs. This boosts revenue and profits, making pricing power a highly valued growth factor.

Innovation and Reinvention: Innovation fuels growth, as seen with Apple’s evolution from the Macintosh to the iPhone and iPad under Steve Jobs’s leadership. Amazon reinvented itself from an online bookstore to an “everything store,” expanding with AWS, Kindle, Prime, third-party sellers, advertising, and even satellite networks through Project Kuiper. Companies like Amazon sustain growth by constantly finding new revenue streams.

Competent Management

Evaluating management can be tricky. It goes beyond insider ownership, attractive returns, or capital allocation; integrity and honesty also play key roles.

A strong track record of generating attractive returns under the same leadership is a good indicator of management’s skill. Insider ownership and experience are crucial as well. Management with significant ownership is more likely to prioritize shareholder value, as they are shareholders themselves. This is especially true for founder-led companies, which tend to focus on long-term growth.

Capital allocation is another critical task. High-quality companies generate a lot of cash, which should be spent wisely. Management can reinvest into the business, acquire companies, pay down debt, issue dividends, or buy back shares. For firms with high ROIC, reinvestment is typically the best option. An optimal capital allocation strategy varies by company, but generally, it’s best to reinvest heavily into the business, while keeping debt under control, and use any remaining cash for dividends or share buybacks.

Finally, assessing honesty and integrity requires listening to management. Tune into earnings calls, read transcripts, or watch interviews. Ask yourself: Is management transparent? Do they take responsibility for mistakes? Avoiding questions or blaming external factors for poor results are warning signs.

The Quantitative Checklist

Now, we’ll turn to the numbers.

Consistent Revenue and Profit Growth

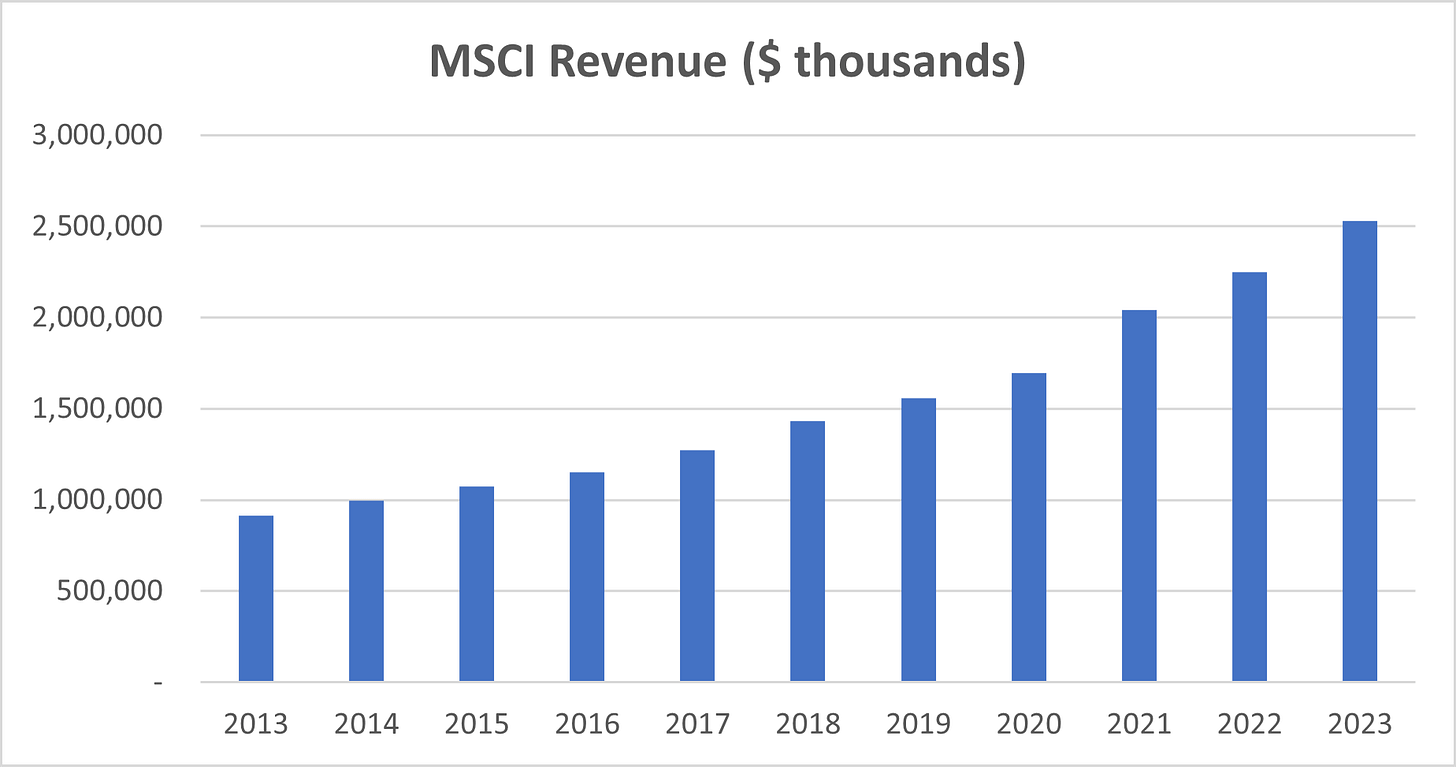

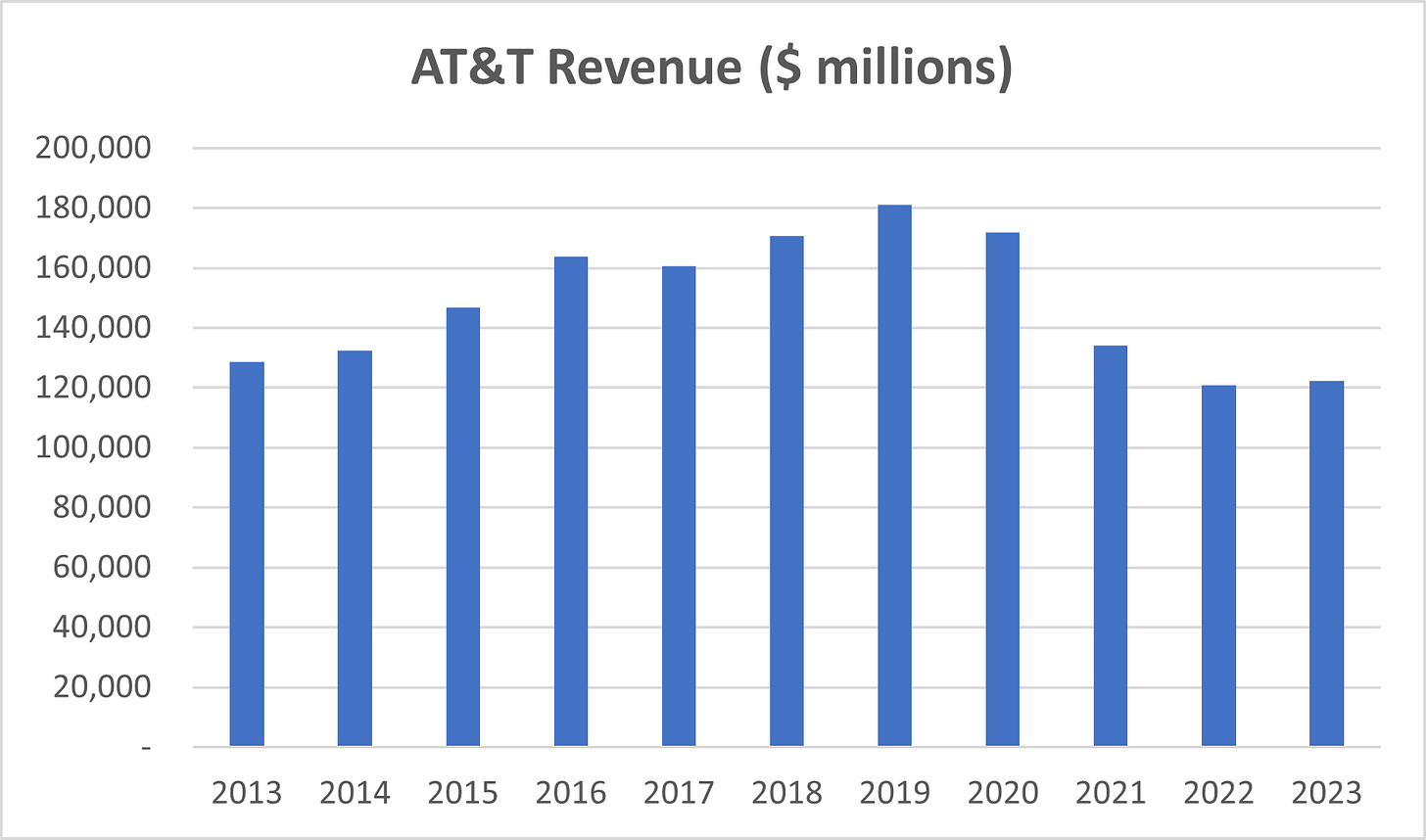

We’ve already discussed the importance of a long runway for revenue growth, but it’s equally important for companies to have a solid track record. Consistent, steady growth in both revenue and profit is ideal—especially when profits are growing faster than revenue, often due to scale benefits that lead to expanding margins. Expanding gross margins are particularly attractive, as they suggest pricing power.

As an investor, you want revenue that’s predictable and stable. Take a look at the following two charts and compare:

It should be clear that, in this case, MSCI has a far more favorable track record than AT&T.

High and Consistent Returns on Invested Capital

Return on Invested Capital (ROIC) measures how effectively a company uses its capital to generate profits. The best companies require minimal capital to produce additional profit. For value to be created, ROIC should be well above the cost of capital. Like revenue and profit, a consistently high ROIC is key.

I’ve dedicated an entire post to ROIC, so if you’d like to learn more, check it out here:

A Strong Balance Sheet

A strong balance sheet minimizes risks, which is crucial when investing. Bankruptcy could wipe out your entire investment, so it's essential for a company to maintain financial strength. The easiest ways to assess this are through the net debt-to-free cash flow ratio and the interest coverage ratio.

The net debt-to-free cash flow ratio indicates how long it would take a company to pay down its debt using current cash flow. It's calculated by dividing free cash flow by net debt (total debt minus cash).

The interest coverage ratio measures how easily a company can cover its interest expenses. Ideally, interest should be a small portion of total expenses. It’s calculated by dividing operating income by interest expenses.

Conclusion

If a company checks all the boxes, it's likely a high-quality investment. Of course, there’s more to evaluating a stock, including valuation. I’ve covered the discounted cash flow (DCF) method in a separate post, and I’ll be expanding on stock valuation soon.

Here’s a quick recap of the checklist:

A Solid Understanding of the Company

Sustainable Competitive Advantages

A Long Runway of Revenue Growth

Competent Management

Consistent Revenue and Profit Growth

High and Consistent Returns on Invested Capital

A Strong Balance Sheet

Thank you for reading. I hope this post has been helpful!

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.

Great stuff!