Compound interest has been famously described by Albert Einstein as the “eighth wonder of the world”. The concept is simple: reinvesting interest earned over time leads to exponential growth.

A common metaphor for compounding is the snowball effect—a tiny snowball rolling down a hill, gathering more and more snow and growing larger at an accelerating pace. This is the essence of compounding.

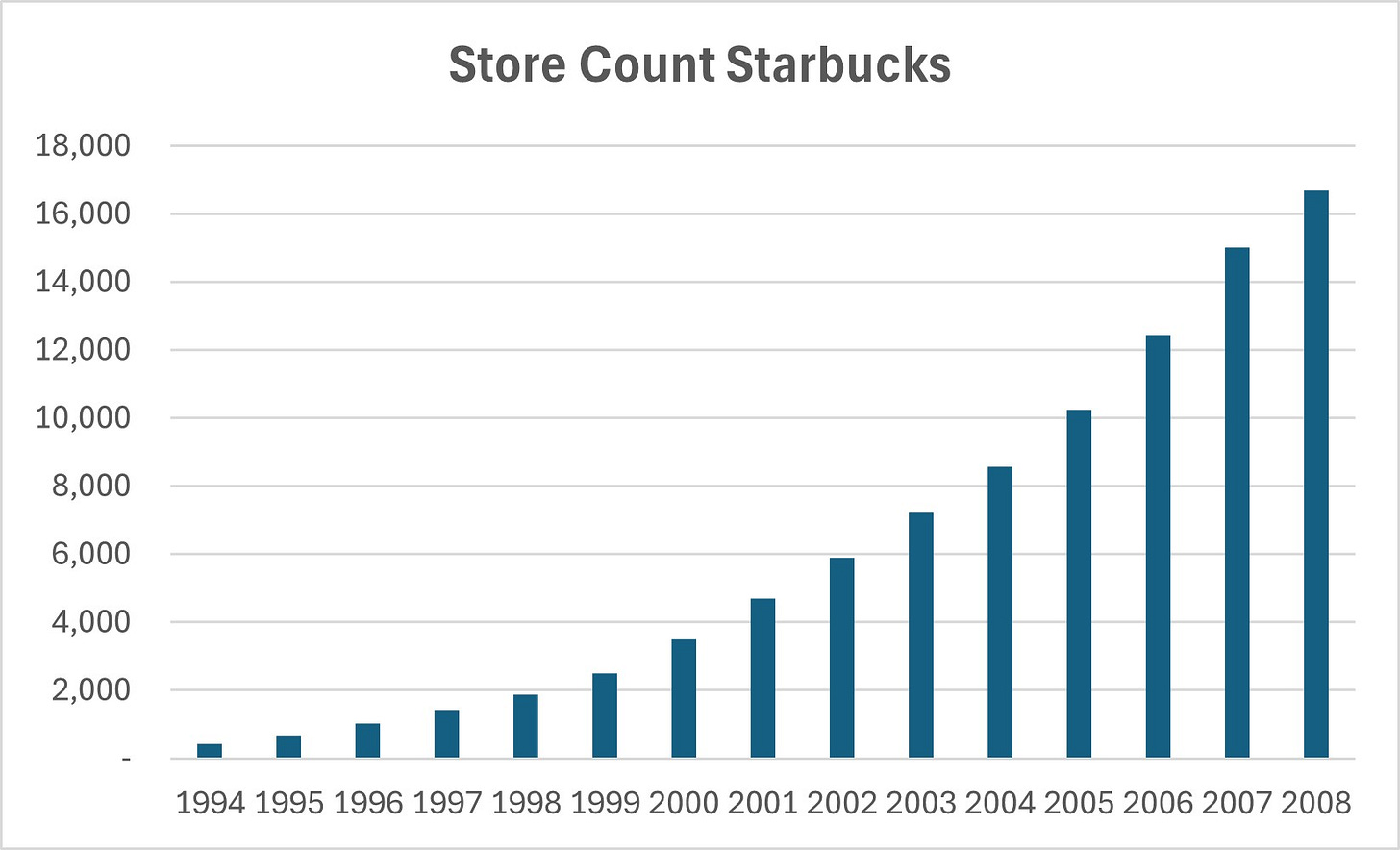

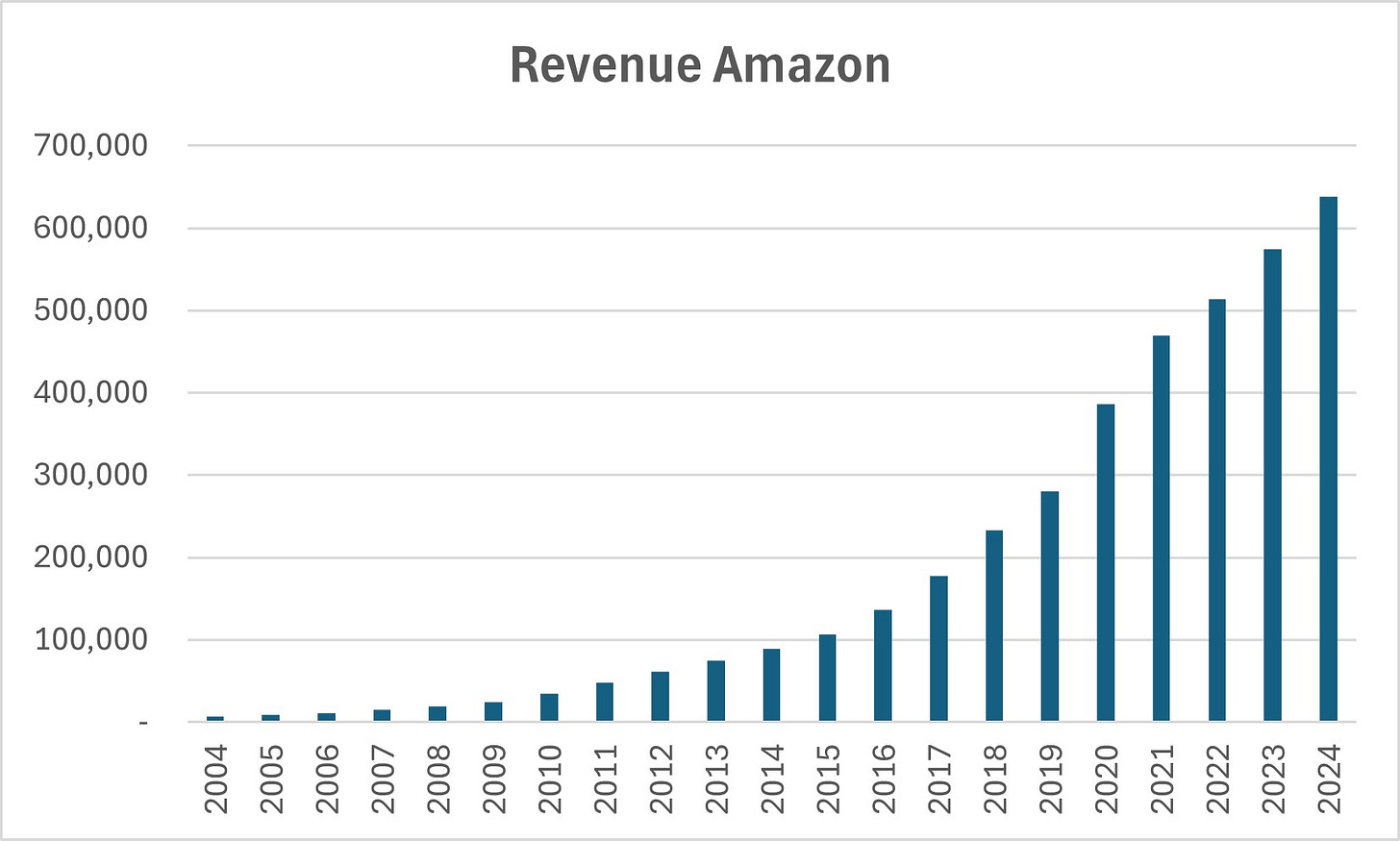

Just like snowballs, businesses can compound too. Take Starbucks, for example, where store growth exploded in the early 2000s. Or look at Amazon, which has seen exponential revenue growth over the past decades.

This kind of growth is driven by high levels of reinvestment. Therefore, we should focus on acquiring and holding onto companies that demonstrate this strategy. In this article, I’ll explore how to measure reinvestment and provide some examples of businesses that compound today.

What You’ll Read Today

Tangible Reinvestment

Intangible Reinvestment

An Investable Universe

Tangible Reinvestment

Measuring reinvestment is fairly straightforward for capital-intensive businesses. Think retailers, restaurants, manufacturers, etc. These companies reinvest through their balance sheets by purchasing or developing assets, which are then depreciated over time.

The cash outflow for these investments appears on the cash flow statement under capital expenditures. Acquisitions should also be considered an investment.

For these businesses, we can simply divide total investments by cash flow available for reinvestment—either operating cash flow or NOPAT seem appropriate—to assess how much is being reinvested.

Take Texas Roadhouse, for example. In 2024, the restaurant chain generated $754 million in operating cash flow, of which $354 million went to capital expenditures. There were no acquisitions. This means the company reinvested about 47% of its cash flow.

What happened to the rest of the cash flow? Texas Roadhouse paid a $163 million dividend, repurchased $80 million in shares, and left $141 million sitting on the balance sheet.

Now, consider a larger player like Chipotle Mexican Grill. The company generated $2.1 billion in operating cash flow, while $594 million went toward capital expenditures. It spent over $1 billion repurchasing shares. While Chipotle is reinvesting, it’s doing so less aggressively than Texas Roadhouse.

Finally, let’s look at GEN Korean BBQ, a much smaller chain. In 2024, the business generated $18 million in operating cash flow but reinvested $24 million in capital expenditures and another $3 million through an acquisition. The company invested more than it earned, using debt and cash from its balance sheet.

This comparison shows that more mature businesses tend to reinvest less of their cash flow. In the search for compounders, smaller companies often stand out as more aggressive reinvestors.

Intangible Reinvestment

In the restaurant example above, reinvestment was tangible, through the purchase of property, equipment, or acquisitions. But in today’s economy, investments are increasingly intangible. Developing software or creating new medicines isn’t classified as a capital expenditure, yet these activities represent long-term investments that drive future growth.

Asset-light businesses reinvest primarily through operating expenses like R&D or SG&A rather than capital expenditures. Since these costs are expensed immediately rather than capitalized, standard cash flow metrics can understate a company’s true reinvestment rate.

One approach to measuring reinvestment for these companies is to capitalize a portion of R&D and SG&A, treating them as investments. By adjusting NOPAT and invested capital accordingly, we can estimate the reinvestment rate as:

Calculating reinvestment rates like this can also be applied to capital-intensive businesses, only it’s more time consuming than simply analyzing the cash flow statement.

A faster, more practical way is to adjust operating cash flow by adding back the investment portion of R&D and SG&A. We can then use this adjusted figure as the denominator and measure reinvestment. Be sure to first subtract stock-based compensation to avoid double counting, as stock-based compensation is already included in these expenses. A study from Columbia Business School provides useful estimates for different industries, outlining what percentage of these expenses should be treated as investments. You can find the relevant data on page 33 if you’re interested.

Take Salesforce as an example. In FY2025, it generated $9.9 billion in operating cash flow adjusted for stock-based compensation. After adding back the investment portion of its R&D and SG&A, this figure rises to $22.9 billion. Using this adjusted measure, its total investments account for ~71% of operating cash flow.

These estimates are imperfect and should be considered a back-of-the-napkin approach. However, they provide a useful way to get a sense of the level of reinvestment.

Examples of High Reinvestment Businesses

Now that I've covered some ways to measure a company’s reinvestment, it’s time to identify businesses that do so at a high rate.

I have a few examples of companies that show the characteristics of a compounder—or at least the potential to become one. But I’d love to hear your thoughts: What businesses do you know that reinvest heavily while earning high returns?

Capital-Intensive Compounders

Amazon

While coined a tech company by most, Amazon heavily reinvests through both capital expenditures and R&D, even at its already massive scale. Over the past three years, Amazon generated $248 billion in operating cash flow, spending $199 billion on capital expenditures and $21 billion on acquisitions. That translates to a reinvestment rate of 89%, and that’s before factoring in intangible investments.

Basic-Fit

Basic-Fit has been reinvesting significantly more than its operating cash flow, funding growth through debt. Over the past three years, net operating cash flow totaled €588 million, while capital expenditures plus acquisitions reached nearly €1 billion, leading to a reinvestment rate of ~165%. As I discussed in a recent post on Basic-Fit, the company is now slowing this pace to reduce debt and improve profitability as its existing clubs mature.

Dino-Polska

Dino-Polska is a well-known name here on Substack, but this is the first time you’re reading it here. It’s a Polish supermarket chain that has managed to grow rapidly while maintaining high returns on capital. From 2021 to 2023, the company generated 3.9 billion PLN in operating cash flow, reinvesting nearly 4 billion PLN into capital expenditures.

Capital-Light Compounders

Shopify

Shopify is a leading global e-commerce platform. The company reinvests heavily through acquisitions, R&D, and SG&A. Over the past three years, Shopify has generated $2.4 billion in operating cash flow. Adjusting for capitalized R&D and SG&A, this figure rises to $7.5 billion. Based on this adjusted cash flow, Shopify has reinvested approximately 93% of its cash flows since 2022.

Duolingo

Duolingo, the online language learning platform, primarily reinvests through R&D. From 2022 to 2024, its reinvestment rate was ~64%—lower than Shopify but still significant.

Meta Platforms

Meta, the parent company of Facebook and Instagram, reinvests through capital expenditures and R&D. Despite its size, it has maintained a reinvestment rate of 66%.

The essence of compounders lies in reinvesting cash flow to ultimately generate significantly more free cash flow. Amazon exemplifies this strategy, with founder Jeff Bezos embracing its importance repeatedly in his shareholder letters. The company often chooses to be “unprofitable”—sacrificing short-term profit for long-term gains.

Strong underlying profitability—measured by operating cash flow or NOPAT—should be high and consistently growing. Meanwhile, free cash flow should ideally remain low due to heavy reinvestment. This is a deliberate trade-off.

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.