Before we begin, I want to take a moment to thank each of you: Summit Stocks has reached 1,000 readers. Hitting this milestone only motivates me more to keep delivering valuable content for you.

Welcome to the March 2025 Portfolio Letter.

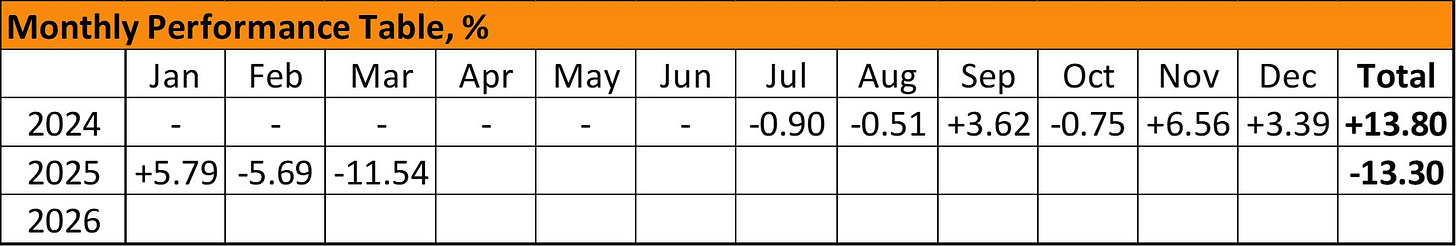

March was even tougher than February. Markets dropped big, and so did my portfolio. But with that comes opportunity—especially while the portfolio is still in an infant phase. I’d rather experience a drop like this sooner than later. It hasn’t even been a year, and I’m constantly working to refine my investing process.

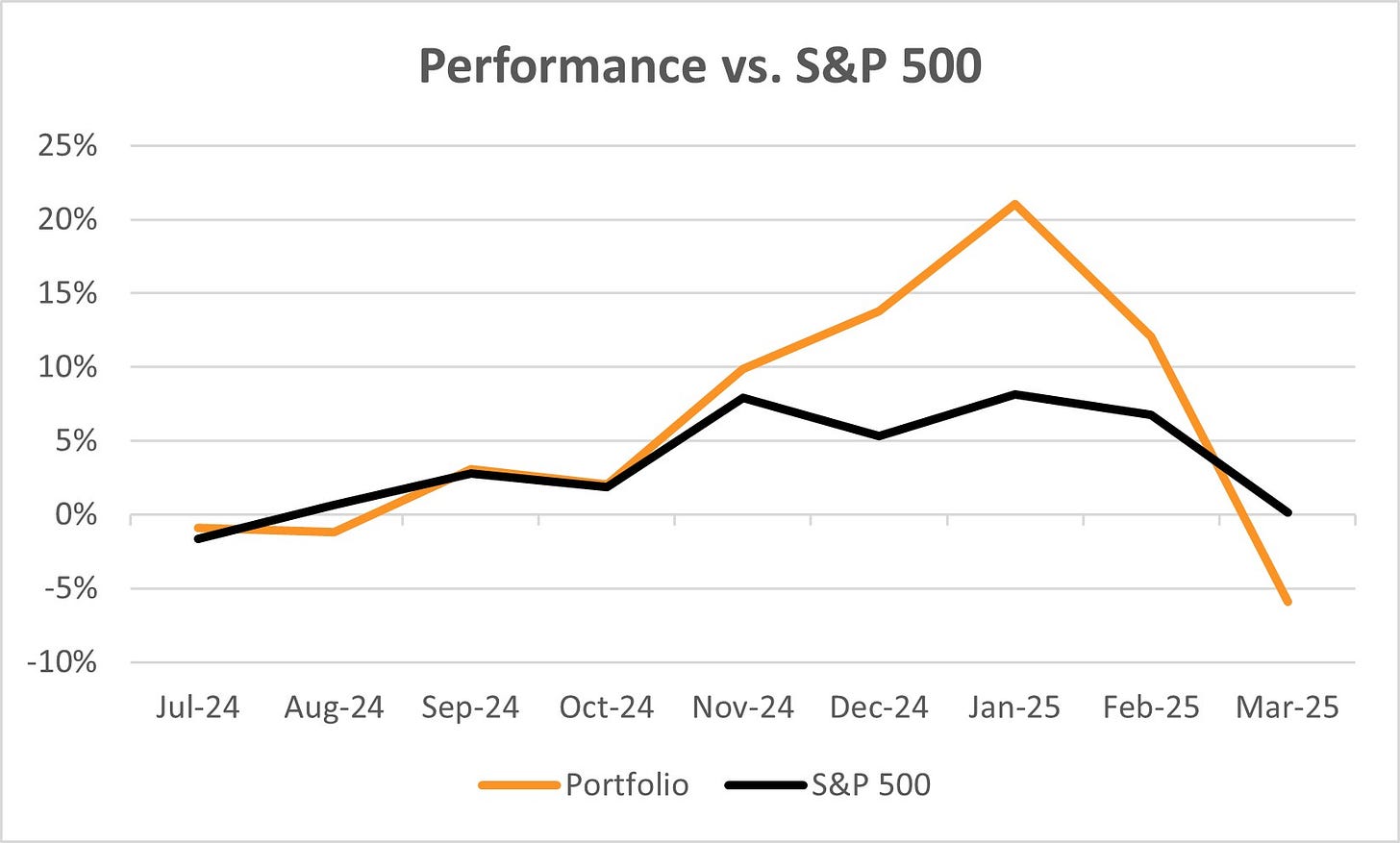

Beating the S&P 500 is tough, but it remains my long-term goal. A year is much too short to judge performance, and we haven’t even reached that mark yet. The portfolio’s swings—outperforming early on and now underperforming—are mostly a reflection of my higher-beta stocks. Additionally, this month was particularly weak due to persistent negative sentiment around some of my holdings, including Basic-Fit and LVMH. Airbnb also underperformed, giving back all gains from February’s post-earnings jump. I don’t expect sentiment to shift anytime soon, especially for Basic-Fit.

I’m not actively trying to compare myself against a benchmark, but it’s important to keep a market index in mind when managing your own portfolio. Why put in the effort when you could simply invest in an index and sit back? For me, there are a few key reasons:

Stock picking, while significantly more time-consuming than index investing, is something I genuinely enjoy.

Broad market indexes include plenty of companies I would never want to own—especially those that destroy value over time.

The potential for higher returns is much greater when picking stocks selectively.

Either way, whether through individual stocks or an index, investing in equities has historically been a winning strategy. Short-term volatility won’t shake me out, but I do continue to look critically at my holdings as I refine my knowledge—more on that below.

This month, I published two Deep Dives and a particularly insightful article on so-called “Quality Traps”. Many businesses with high returns and a mature market position seem like great investments but don’t necessarily lead to outperformance. The key difference is high reinvestment at strong incremental returns. Mature companies often fail to reinvest their cash effectively, opting instead for large dividends and buybacks—both nice, but ultimately inferior to reinvestment. True compounders not only generate high returns on capital but also reinvest most, if not all, of those returns.

Some of my companies lean more toward “Quality Traps” than true compounders. Salesforce, for instance, is a phenomenal business offering the complete CRM package, but expansion seems limited, reflected in a flat invested capital base.

I will need to time to think about my holdings and consider the types of businesses I truly want to own.

This month, I also shared my thoughts on Salesforce’s earnings, Basic-Fit’s earnings (which were especially interesting), a post on moat analysis, and an article on Google explaining why I’m not buying yet.

All in all, March was a productive month of learning and refining my approach. I hope you’ve been compounding knowledge as well.

In March, I added more cash than usual and still have cash on hand.

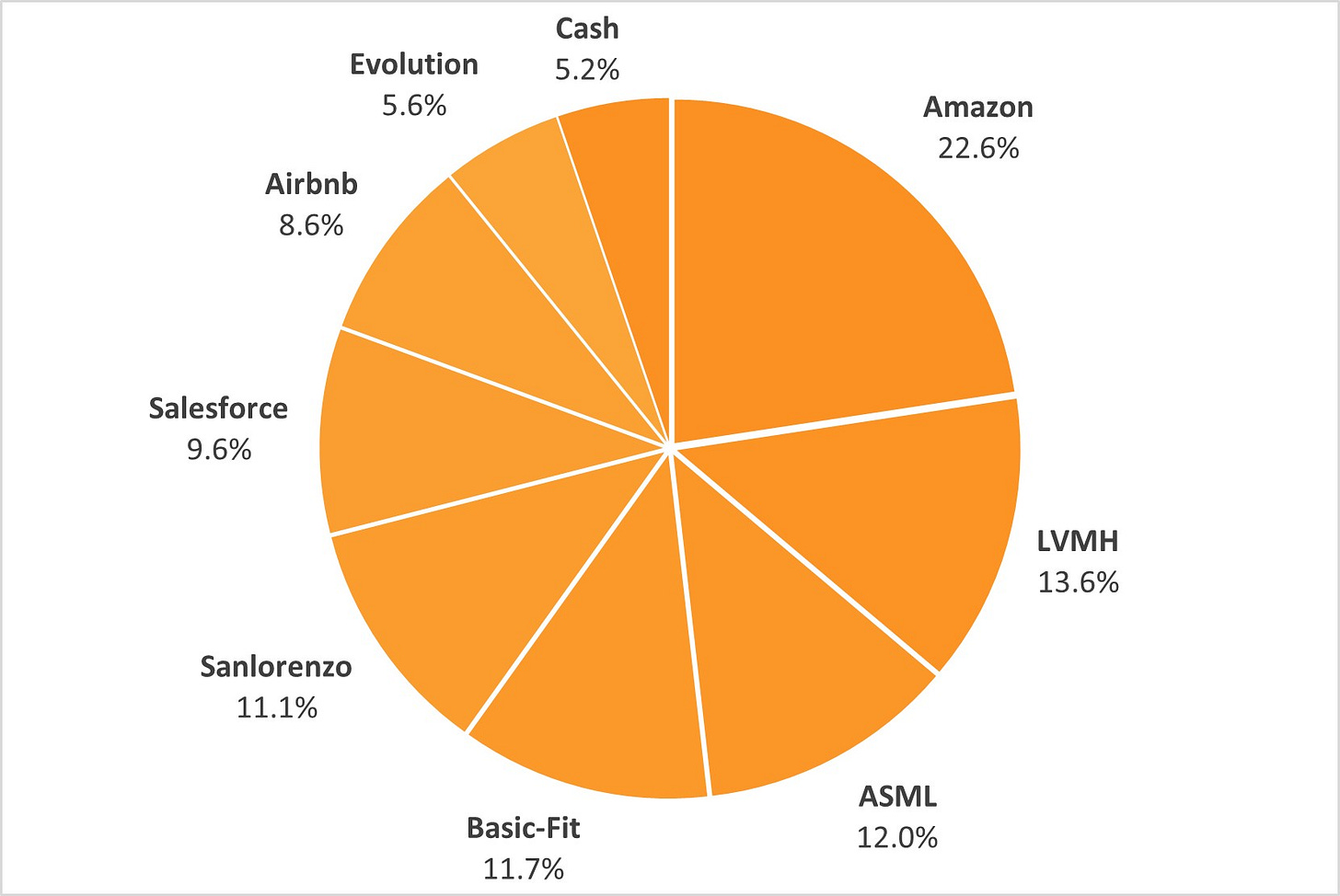

I increased my positions in Amazon at around $192, Basic-Fit at €19, and Sanlorenzo at €28. These are exceptional businesses that reinvest the majority of their cash flows. They fit the profile I’m looking for—high-quality companies with sustainable competitive advantages and a long runway for growth and reinvestment. Each is either founder-led or run by a highly experienced insider (Andy Jassy at Amazon), and their capital allocation approach resonates with my philosophy.

That’s all my transactions for March. My portfolio now looks as follows:

I’m always considering adding to existing positions, as I did this month, but I’m also monitoring other stocks that may reach attractive prices. In my view, the current market presents great opportunities to build out a portfolio.

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.

🤝🏻 I am also DCAing into ASML, had an article about it this week. Was my very first one on Substack.

If the stock is trading below intrinsic value, then buybacks can provide exceptional returns to owners, even if reinvestment opportunities are limited. AutoZone is one example; I'm sure there are others.