Basic Fit Full-Year Results: I'm Buying

Basic-Fit's shares dropped over 20% following earnings, creating a great buying opportunity

Basic-Fit shared its full-year results yesterday, and there’s a lot to go through. Shares are down big despite solid results. Free cash flow was lower than expected, and Basic-Fit is shifting its strategy, which are the most probable reasons for this sell-off.

In this review, I’ll share my thoughts on the sell-off, as well as the company’s new strategy.

What You’ll Read Today

Full-Year Results

Basic-Fit’s Strategy Update

Why I’m Buying

Full-Year Results

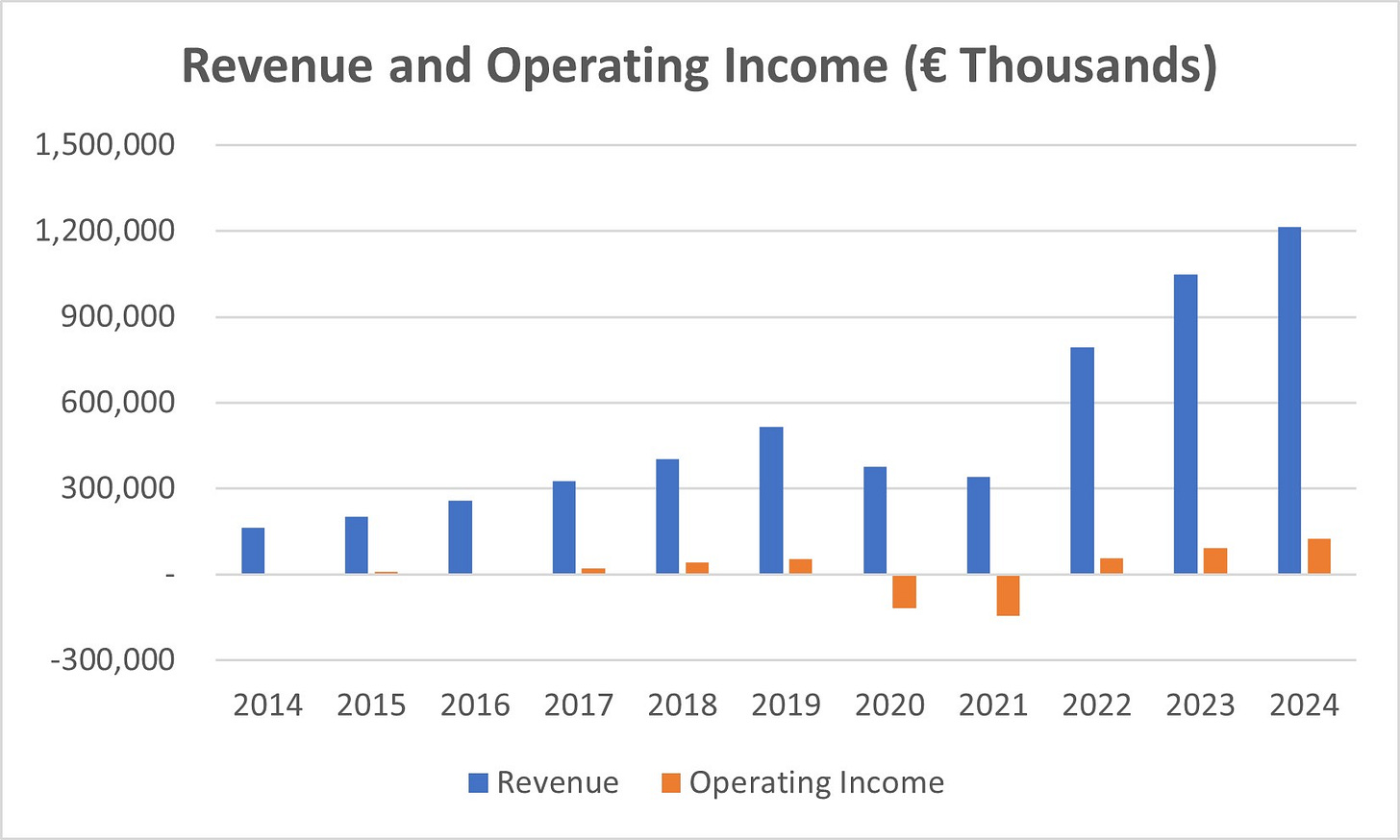

Basic-Fit had a solid year—business as usual. Revenue grew 16% to €1.22 billion, within the company’s guidance of €1.2 to €1.25 billion. Memberships reached 4.25 million, while the club network expanded to 1,575 locations, up 12% year-over-year. Operating income rose 36% to €124 million.

Basic-Fit opened 173 new clubs, mainly in France and Spain, and now has 28 clubs in Germany, with 16 openings there in 2024. After initially testing the German market by scattering clubs, Basic-Fit is now shifting to its cluster-based expansion strategy. In Spain, national marketing campaigns have been launched as the company has surpassed 200 clubs.

Membership growth remains strong, with 2025 already adding 202,000 members. Growth in immature clubs is being driven by founding member campaigns, while post-COVID clubs (opened in 2023 and 2024) are ramping up much faster, reaching cash flow breakeven within six months.

Basic-Fit continues to push its unstaffed, 24/7 model, with 75% of its Benelux clubs already operating this way. In France, where unstaffed clubs are not allowed, the company is testing 24/7 operations with staff, with 333 clubs already running around the clock. This improvement will add €35 million in costs, which is expected to be offset by higher membership numbers.

For 2025, Basic-Fit expects revenue between €1.375 million and €1.425 million—about 15% growth—despite a significant slowdown in club openings. The company now plans to open just 100 clubs in both 2025 and 2026, a clear shift in strategy. While the long-term target of well over 3,000 clubs remains, the 2030 target seems to have been quietly dropped.

Franchising also continues to be delayed, with more details now expected in the second half of 2025. One analyst raised concerns about this, and CEO René Moos acknowledged that the process is taking longer than expected:

“… It’s something we will do in the coming 10 to 20 years, so starting off with the right partner … is more important than starting six or twelve months earlier.”

I don’t think Basic-Fit’s founder could have given a better answer. I say let the company takes its time. This is uncharted territory for the company, and rushing into it wouldn’t benefit shareholders. The company now expects to be able to monetize franchising in 2026 or 2027.

Basic-Fit’s Strategy Update

The biggest surprise of this update was Basic-Fit’s decision to slow down club expansion over the next two years. By opening fewer clubs, the company expects to generate meaningful free cash flow, which it will use to pay down debt and… drumroll… buy back shares.

I speculated about this just last month when Basic-Fit announced a share management program. An investment firm had been urging management to initiate buybacks, and it looks like they listened.

During the earnings call, however, Moos insisted that the slowdown wasn’t done to fund buybacks, but rather to deleverage and focus on franchising. Not sure that’s entirely true, but either way, I think repurchasing shares at the current valuation is highly accretive. The company plans to buy back €40 million worth of shares—about 3% of its market cap—starting very soon.

Something else Moos said is extremely crucial: Basic-Fit expects around 90% of its clubs in 2026—90% of what should be around 1,775 clubs—to be mature. By slowing down expansion and taking a breather, Basic-Fit is allowing its overall network to mature. I expect this will result in significantly higher profitability in two years. Even more importantly, beyond this point, club growth could be entirely funded by cash flow, which would greatly improve the balance sheet.

I think this was a solid update, but the market seems to disagree. Basic-Fit’s stock is down nearly 20%, likely due to the need to digest this strategic shift. Investors are uncertain whether this is positive or negative news, and in today’s market, uncertainty leads to a sell-off.

Another factor behind the drop has to be the lower-than-expected free cash flow before club expansion, which came in at €2.36 per share, below the guided range of €2.60 to €2.95. This was driven by higher maintenance costs and other capex. Maintenance costs rose due to developments in France as discussed earlier, and other capex increased because of investments in sustainability—think solar panels and transitioning to electricity instead of gas. To me, this doesn’t seem like an issue.

Why I’m Buying

By now, I’m sure you know my view: I believe Basic-Fit is severely undervalued, especially after this sell-off and the company’s plans to reduce debt and derisk. But the thesis has changed. The target of 3,000 clubs by 2030 is unrealistic, which is why I’ve updated my projection.

Instead of reaching 3,000 clubs by 2030, I’m now forecasting it will happen by 2032. Even with this change, Basic-Fit still looks like an amazing investment. While my model has changed little from the last time I wrote about Basic-Fit, I’ll share the updated version here:

The model assumes no further club growth after 2034 and excludes any franchising income—as if Basic-Fit’s potential franchising efforts simply don’t exist. Still, to justify the current stock price, a discount rate of around 16% is required.

In the coming years, Basic-Fit will grow into a higher-quality company, both in terms of the balance sheet and market leadership, all while returning cash to shareholders through buybacks.

With the recent price drop, Basic-Fit’s shares have become less risky, not more. Despite the volatility, I remain a confident shareholder.

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.

I am happy to see that I am not crazy. When I first read the results that morning I was thinking that this is actually good news... but perhaps the stock market does not see it that way, specially the change in strategy. Ouch. If anything, this is even more bullish, since the transition to a higher quality balance sheet and unlocking the cash flow from those mature clubs will make the stock look safer and more attractive. You really need to dig into the numbers to understand this company is undervalued, because it does not look like that from traditional PE ratios or P/B. So my reasoning is, if their numbers improve, even if at the cost of future club growth, share price will go up. All of this not taking into account the positive surprise that could come from franchising. As I see it, it is a huge asymmetrical opportunity. If franchising doesn't work, the business will go on. If it is a success, it's easy money by selling your brand at a very low cost for the company. And PlanetFitness is mainly a franchise, so we have antecedents to know that it can work.

Another strong analysis! Liked reading about the buy back part.