Today, we’re looking at the most important news from the past two weeks for the companies I own.

Most of my holdings have reported earnings, with Airbnb and Sanlorenzo most recently. For updates on Amazon, LVMH, ASML, and Evolution, check out my previous posts:

Besides earnings, it’s been a relatively quiet period. No news is good news, right?

Looking ahead, Salesforce reports tomorrow, followed by Basic-Fit in March. Stay tuned.

Quick announcement: Starting this week, you'll receive new articles every Tuesday and Thursday instead of Tuesday and Friday!

Airbnb

Full-Year Results

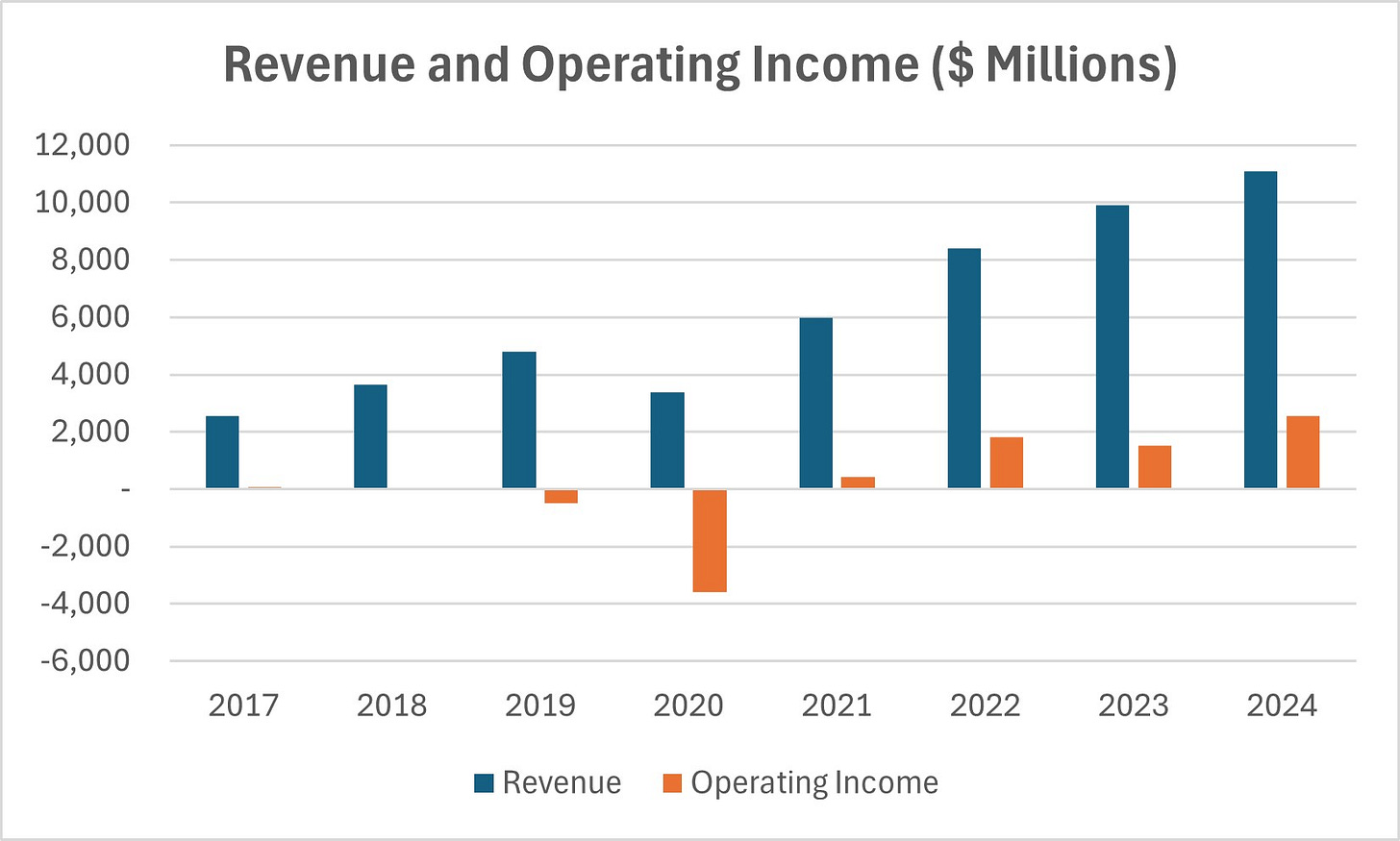

On February 13th, Airbnb reported its full-year results, posting $11.1 billion in revenue, up 12% year-over-year, and $2.6 billion in net income. The company generated $4.5 billion in free cash flow, with an adjusted figure of $3.1 billion after accounting for stock-based compensation. Airbnb now holds $10.6 billion in cash and short-term investments.

But the emphasis of this earnings call was very much on the future and Airbnb’s “next chapter”.

Historically, Airbnb has been a once- or twice-a-year app. People use it when they travel, then forget about it. CEO Brian Chesky wants to change that:

“The goal is for Airbnb to be used once or twice a week instead of once or twice a year.”

That means expanding beyond travel, much like Amazon evolved from selling books to becoming an everything store. Airbnb plans to launch one or two new businesses every year for the next five years, aiming for some to reach $1 billion in revenue.

The company will invest $200-250 million in 2025 toward launching and scaling new offerings.

To prepare for this expansion, Airbnb is perfecting its core service. Key improvements have already led to higher conversion rates:

Guest Favorites to highlight top stays

Better search functionality

A new welcome guide for guests

Flexible payment options and local methods

Airbnb also removed 400,000 listings that didn’t meet guest expectations, strengthening reliability and trust in the platform.

Chesky believes quality control is key to attracting “classic hotel users”. Right now, for every person who books an Airbnb, nine book a hotel. Winning over even a fraction of them would be a massive growth driver.

Furthermore, Airbnb emphasized its third growth driver beyond perfecting the core service and launching new businesses, which is geographic expansion. The company is still heavily concentrated in five markets—the U.S., U.K., Canada, France, and Australia—which account for 70% of Gross Booking Value (GBV). Expanding into underpenetrated international markets represents a major opportunity. The company highlighted Japan, a large global travel market, but where many locals didn’t feel Airbnb was relevant to them. By localizing Airbnb and reintroducing the brand, Airbnb aims to gain market share.

Chesky also briefly touched upon AI. This summer, Airbnb will launch AI-powered customer support, with plans to integrate AI into search and eventually create an AI-driven travel “concierge”.

With over $10 billion in cash, Airbnb has room to reinvest, pursue M&A, and return cash to shareholders. The company repurchased $838 million in stock during Q4—nearly 1% of its market cap—and $3.4 billion for the full year.

Management remains price-sensitive and will adjust buybacks based on valuation.

On regulation, Chesky noted that many cities increasingly see Airbnb as a partner, but New York remains an outlier. After banning most short-term rentals, New York expected rent prices to drop. Instead, rents rose, and hotel prices jumped 7% year-over-year.

“New York is a cautionary tale, and I do not think cities are going to follow it.”

Chesky positioned Airbnb as a solution during major events, helping cities accommodate visitors without allowing hotels to exploit surge pricing. Airbnb also plays a vital role during disasters, most recently housing displaced residents during the LA wildfires.

For Q1 2025, Airbnb expects 4-6% revenue growth, or 7-9% when adjusting for FX headwinds. Accounting for tough comps (Easter shift + leap year impact), underlying growth is expected to be 10-12%.

Looking ahead, Airbnb is preparing for its largest-ever summer product release, with Chesky hinting that future updates will be even bigger.

I believe this has been a great quarter for Airbnb. The company is executing well, and the future remains promising.

Source:

Sanlorenzo

Full-Year Results

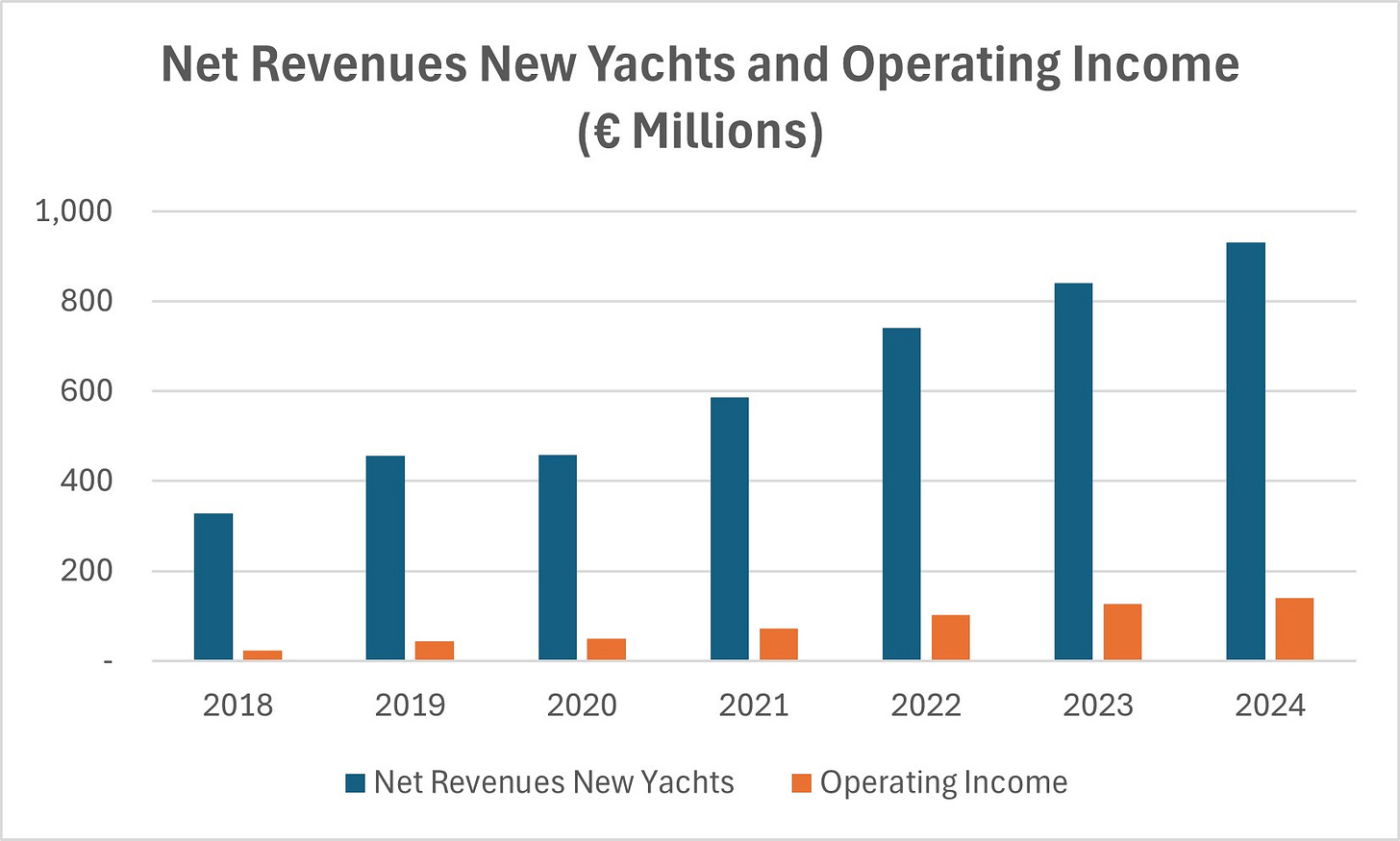

Sanlorenzo reported strong full-year results, also on February 13th, with Net Revenues New Yachts growing 11% to €930.4 million and operating income rising by the same percentage to €139.3 million. The company achieved a record EBITDA margin of 19%, while the operating margin remained stable at 15%.

Performance per segment:

Superyacht division was the standout, growing 17.6% for the full year and accelerating to 23.2% in Q4.

Yacht division grew by a modest 1.8%, but saw a strong 9.9% increase in Q4.

Bluegame grew 1% for the year, despite “the weakness of the market below 24 meters”.

Nautor Swan, acquired in August, contributed €38.3 million to revenues over its first five months under Sanlorenzo. Management sees significant growth potential outside Europe, as 80% of Nautor Swan’s current revenue comes from the region.

Sanlorenzo saw exceptional growth in the Americas (+58.4%) and MEA (+55%), while Europe remained stable, maintaining its position as the company’s most important market. Asia-Pacific showed some weakness, but CEO Massimo Perotti remains confident in the region’s long-term potential, reminding investors of the recent acquisition of Simpson Marine, the Hong Kong-based yacht broker.

“… we think that in the middle, long-term, that market will really grow much more, thanks to the increase of billionaires, which is expected in the Asia-Pacific region.”

Over the next three years, Sanlorenzo aims to expand Nautor Swan’s presence in the Middle East and Asia-Pacific.

Sanlorenzo recorded a full-year order intake of €813 million and ended the year with a net backlog of €1.02 billion, including €623 million allocated for 2025—covering approximately 60% of next year’s expected revenue. This implies that 2025 Net Revenues New Yachts will surpass €1 billion.

Furthermore, Sanlorenzo is actively working on integrating Nautor Swan, having already implemented €3 million in cost reductions (about 3% of Swan’s revenue). Additional savings of €3-4 million are expected through lower material costs, thanks to Sanlorenzo’s strong supplier relationships. To support production, Perotti is considering acquiring Codecasa, a niche superyacht and megayacht builder located on Sanlorenzo’s property. Codecasa’s shipyard could serve as a production site for Nautor Swan.

Additionally, Sanlorenzo is developing two new sailboat lines to expand Swan’s offering:

One focused on comfort, offering an alternative to Swan’s traditionally performance-oriented models.

The Maxi-Maxi line, to be produced in Viareggio.

Overall, Sanlorenzo delivered a strong performance this year. I’m optimistic about Nautor Swan, and the ongoing integration efforts look promising. Despite some weakness in Asia-Pacific, overall revenue growth was decent, and the backlog remains strong. The performance across segments underscores how the Superyacht division is the most resilient to economic conditions, while other segments are more sensitive to market fluctuations. Management remains confident about the future—and so do I.

Source:

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.