LVMH, ASML, Evolution Earnings

Key annual results, Salesforce restructures workforce, and Basic-Fit to possibly buy back shares

Today, we’re looking at the most important news from the past two weeks for the companies I own.

Earnings season is in full swing, and there’s plenty to cover. Amazon, LVMH, ASML, and Evolution have all reported their results. I recently broke down Amazon’s earnings in another post—you can check it out here:

Additionally, we’ve got restructuring developments around Salesforce, and some speculative news regarding Basic-Fit.

LVMH

Full-Year Results

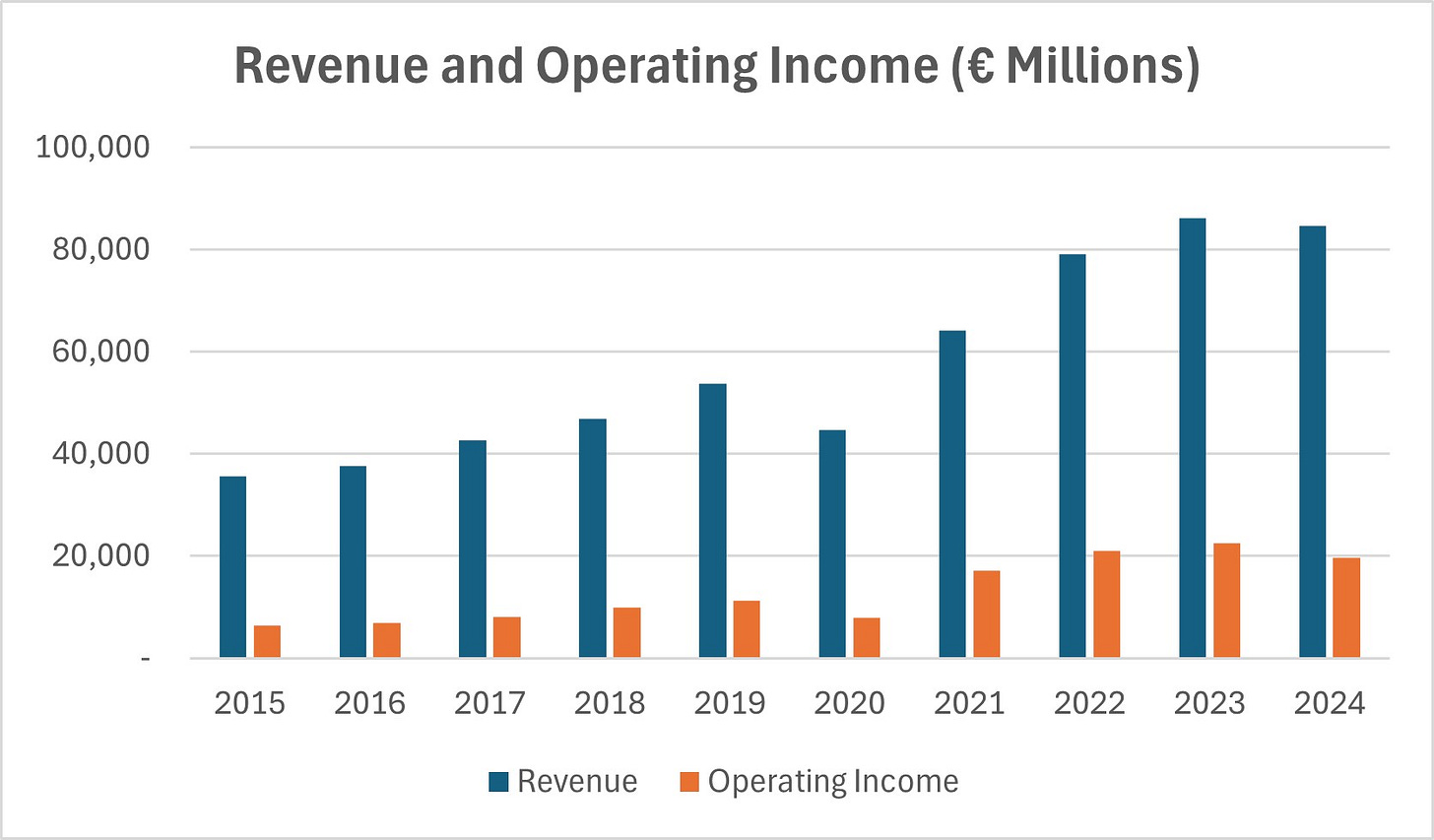

On January 28th, LVMH released its fourth-quarter and full-year results, reporting modest 1% organic revenue growth in a challenging year. Operating income dropped by 13%, mainly due to one-time events:

Olympic Sponsorship Costs

As the main sponsor of the 2024 Olympic Games, LVMH faced high expenses that hurt profitability but provided significant brand exposure.

Wines & Spirits Struggles

Operating profit in this segment plunged 36%, impacted by weaker volumes, pricing, and product mix. This division has been underperforming for some time.

No Major Price Hikes

Gross margin fell by 180 basis points, as LVMH chose not to increase prices to offset inflation and currency fluctuations. CEO Bernard Arnault criticized aggressive price hikes by other luxury brands, saying:

“Pushing prices up 15% just doesn’t make sense if there’s no change in the product … You have to be realistic, honest about it, and give clients high-quality products.”

Currency Headwinds

Exchange rate fluctuations negatively impacted operating profit by €1 billion.

Higher Expenses

Marketing expenses rose by 1% despite negative reported revenue growth, though LVMH still managed to cut overall marketing spending by 5%. General and administrative costs increased by 9%, due to Olympic sponsorship and a one-time employee share plan.

LVMH’s operating margin was 23.1%. Free cash flow surged by €2.4 to €10.5 billion, despite the drop in profit, thanks to stable inventory levels and a €2 billion reduction in investments.

The company maintained its dividend at €13 per share, pausing its consistent upward trend after a weaker year.

Performance by business segment:

Fashion & Leather Goods

Still the powerhouse of LVMH, driven by Louis Vuitton and Dior. Organic growth was down 1%, but overall performance remained solid.

Wines & Spirits

The division continues to struggle, posting an 8% drop in organic growth. Wines & Spirits were down 3%, while Cognac & Spirits slumped 14%. Arnault expects a recovery within 2 years, with leadership changes in place: longtime CFO Jean-Jacquies Guiony is taking over as CEO of the division, with Alexandre Arnault (Bernard Arnault’s son) as Deputy CEO.

Perfumes & Cosmetics

The segment saw 4% organic growth, with Sauvage Dior and Miss Dior remaining the most important brands.

Watches & Jewelry

Organic growth dropped 2%, but Arnault was optimistic and highlighted Tiffany, which posted 9% organic growth in Q4 2024.

Selective Retailing

Sephora delivered standout results, with Arnault recalling its 1998 purchase when sales were just €100 million—now over ten times that. The segment's overall performance, however, was held back by DFS struggles in Hong Kong and Macao. Still, organic growth came in at 6%.

Performance by region:

US & Europe

Both reported similar results, with 2% and 3% organic growth, respectively.

Japan

The region saw a very strong 28% growth over the year.

Asia (ex-Japan)

A tough year, with organic growth down 11%. Arnault noted that while LVMH’s luxury appeal remains strong in China, the recovery has been volatile. He expects gradual improvement in China, while the US recovery could be more explosive.

For 2025, LVMH remains focused on maintaining its leadership luxury. The year has started well, with Louis Vuitton and Tiffany posting double-digit growth. But management remains cautious, choosing not to anticipate too much.

Arnault showed confidence in LVMH’s talent pool, emphasizing that the best designers stay with the group long-term, contributing to brand stability.

“We have the best designers, and they are loyal—we keep them in the house for a very long time … All employees here in the room have been with us for a very long time, I would say on average 20 years. I must say, they are faring well and they will fare well in the future as well.”

On the global business climate, Arnault contrasted the pro-business environment in the US—which he recently visited and where lower taxes and subsidies support luxury manufacturing—with France’s rising tax burden, which he warned could encourage outsourcing.

“[Raising taxes in France is] a good way to encourage outsourcing. I don’t know if that’s the government’s ambition, but this is what they are going to achieve if they stick to this plan.”

Source:

ASML

Full-Year Results

On January 29th, ASML reported its full-year results, with revenue at €28.3 billion, showing minimal growth, and operating income flat. Q4 sales hit €9.3 billion, with €7.1 billion from net system sales and €2.1 billion from installed base sales, which exceeded guidance due to strong upgrade business. While the installed base generates recurring revenue, upgrades can delay new system purchases. Still, upgrades obviously are the best route, ensuring long-term customer satisfaction. Gross margin for the quarter was 51.7%. Net income reached €2.7 billion, and free cash flow reached an extraordinary €8.8 billion, reflecting the lumpiness of ASML’s business quarter-to-quarter: one (or a few) quarter(s) cash flow is really low, and the next quarter cash flows surges. It’s simply the nature of the business.

For the full year, ASML’s gross margin was 51.3%. EUV sales were down 9%, while DUV grew by 4%, and metrology & inspection rose by 20%. R&D expenses were €4.3 billion, or 15% of sales.

Looking ahead, ASML expects Q1 sales of €7.5-8 billion, up from €5.3 billion in Q1 2024, and a gross margin between 52% and 53%, up from 51%. For 2025, the company is targeting revenue of €30–35 billion and a gross margin of 51–53%.

CEO Christophe Fouquet highlighted AI as a major growth driver and an influencing factor for 2025 revenue:

“If AI demand continues to be strong and customers are successful in bringing on additional capacity online to support that demand, there is potential opportunity towards the upper end of our range [€35 billion]. On the other hand, there are also risks related to customers and geopolitics that could drive results towards the lower end of the range [€30 billion].”

ASML also reaffirmed 2030 revenue guidance of €44-60 billion, with gross margins of 56-60%.

Another update from the call: starting in 2026, ASML will report total systems backlog on an annual basis instead of quarterly, due to the volatility of order intake that can distort performance figures. I thinks this is a great move as it should help reduce volatility for the stock following quarterly results. The company sees 2026 as a potential growth year but is not yet making any predictions.

Lastly, ASML expects revenue from China to represent a low 20% of total sales in 2025, a more normalized level.

Source:

Evolution

Full-Year Results

Evolution reported earnings on January 30th. In Q4, revenue increased by 31.5% to €625.3 million, though €91.4 million of that come from a one-time benefit. Adjusted revenue grew by 12%. EBITDA rose by 35% to €455 million. For the full year, revenue increased by 23.1% to €2.2 billion, with adjusted revenue growing 14.7%. Full-year EBITDA was up 23.2%, while adjusted EBITDA rose 11.3%.

Growth was impacted by ongoing cyber attacks in Asia. While countermeasures have been launched, the situation is still unfolding. Management expects improvements in Asia this year. In contrast, the performance in America and Europe remained strong. Global demand continues to grow, and the company expanded its live casino operations, ending the year with over 1,700 tables. More than 300 tables were added, but strikes in Georgia forced the closure of 200 tables, resulting in a net increase of just 100 tables, further limiting growth. Evolution is closely monitoring the situation but has no plans to increase capacity in Georgia for now.

The regulatory landscape continues to evolve, with more countries introducing online casino legislation, the latest being Brazil. Latin America remains a relatively small market for Evolution, so developments like this could be key drivers of long-term growth. Looking ahead, market trends for 2025 remain strong, and the live casino segment is still in its early stages.

For 2025, Evolution expects an EBITDA margin of 66-68%, slightly lower due to continued challenged in Asia. However, if I understood CEO Martin Carlesund correctly, this guidance seems to be more about management being cautious rather than a sign of underlying weakness.

The company has proposed a dividend of €2.80 per share and a €500 million share buyback, representing a 4% dividend yield and buybacks amounting to 3.3% of its market cap. These returns alone add up to more than 7%. Very impressive.

2024 had to be one of Evolution’s most challenging years, yet results were strong overall. Adjusted revenue growth of 15% is impressive given the headwinds the company faced—and continues to face. While the share price has struggled, I remain a happy Evolution shareholder.

Source:

Salesforce

Salesforce COO Steps Down

Salesforce COO Brian Millham is retiring after 25 years at the company. As the 13th employee at Salesforce, he played a key role in its growth and success.

Robin Washington will take over as both COO and CFO, following former CFO Amy Weaver’s plan to step down once a successor was named. This dual role has raised some uncertainty about Salesforce’s leadership structure.

Salesforce to Cut 1,000 Jobs

Salesforce is making more workforce changes, cutting 1,000 roles across various departments while hiring additional positions focused on selling its AI products, particularly Agentforce. The company is clearly using its own AI tools to boost efficiency, cutting roles that can be automated and shifting resources toward sales and marketing.

Sources:

Basic-Fit

Basic-Fit Starts Share Management Program to Support Stock Liquidity

Now, I know this title might sound like financial jargon, but let me explain.

On February 3rd, Basic-Fit announced a program aimed at improving the liquidity of its shares. The company has set aside €3 million to buy and sell its own shares, making sure there are always enough buy and sell orders in the market.

The goal is to create a smoother, more stable stock, reducing big price swings and making it easier for investors to buy or sell shares without much impact on the price.

While this may seem like minor news, one could speculate and see it as a sign that Basic-Fit is preparing for a future share buyback program. This could be in response to a letter from two months ago by Impactive Capital, an investment firm with a 10% stake in the company, urging management to buy back shares to unlock significant value for shareholders.

It would be great to see this happen, but for now, this is all we have.

Source:

In the next few weeks, the rest of my companies will be reporting earnings, and I’ll be covering those too. Airbnb is up in just two days, and we’re still waiting on Salesforce, Basic-Fit, and Sanlorenzo.

Stay tuned!

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.

We also made a deep dive into ASML, an incredible company! :)