Stock Deep Dive - Universal Music Group

Music industry leader with a compelling business model and moat

Welcome to a new edition of Deep Dives.

Universal Music Group (UMG) is one of the world’s largest music companies, dedicated to discovering and developing artists, composers, and songwriters.

UMG represents some of the biggest names in music, including Taylor Swift, Drake, Billie Eilish, and The Weeknd, helping them reach success. In 2023, the company’s artists dominated streaming charts—6 of the top 10 most-streamed artists on Spotify, 13 of the top 20 songs on Apple Music, and 3 of the top 5 songs on YouTube were from UMG.

Yet, for a company so influential, it operates largely in the background, and you don’t hear much about them.

What You’ll Read Today

UMG’s History

UMG’s Business

Products

Moat

Key Financials

Management

Conclusion

Risks

Valuation

UMG’s History

UMG traces its roots back to 1934, when British Decca Records—originally a manufacturer of record players—set up an American subsidiary called Decca Records US. Since 1929, Decca had already begun selling records, realizing that making record players but not records was like producing razors without the blades.

The American subsidiary quickly grew, signing popular artists and becoming a standalone business before World War Two. Over the following decades, Decca Records US continued growing, signing major artists like Bing Crosby, Louis Armstrong, Mantovani, and The Rolling Stones.

By 1962, Decca had largely moved away from manufacturing record players, focusing primarily on the record label business. That year, it was acquired by MCA, an American media conglomerate. The merged business became one of the biggest record labels in the U.S., signing stars like The Who and Elton John. Over time, the Decca music division was rebranded as MCA Records.

MCA continued expanding by acquiring other record labels until 1990, when Matsushita Electric (now Panasonic) purchased the company. Matsushita, however, soon ceded control after “failing to master the vagaries of Hollywood and a disgruntled American management team”, which led it to sell 80% of MCA to Seagram in 1995.

Seagram’s move into media was unusual from the start—it was a beverage company trying to create synergies between drinks and entertainment. Remember, MCA wasn’t just a music business; it also owned major film hits like E.T. and Jurassic Park. Seagram rebranded everything under the Universal name, formally splitting the music and film divisions. Universal Music became its own entity, separate from Universal Studios.

Despite the rebrand, Seagram struggled to make things work and eventually sold everything to Vivendi, a French media conglomerate, in 2000. Under Vivendi, Universal Music and Universal Studios completely split apart. In 2004, Universal Studios was sold to General Electric (later forming NBCUniversal), while UMG remained part of Vivendi until 2021, when it went public on the Amsterdam Stock Exchange.

Before the IPO, major investors like Tencent and Bill Ackman took stakes in UMG. Importantly, while the company is technically Dutch due to tax reasons, its headquarters and leadership are in California, and UMG is very much a global business.

UMG’s Business

Products

Today, UMG is a global leader in music, with businesses spanning recorded music, music publishing, music-based merchandise, and audiovisual content. Essentially, UMG’s success is tied to the success of its artists. Of course, it’s a bit more complicated than that. The company’s revenue streams are diverse, and it breaks it down into three main segments:

Recorded Music

This is UMG’s biggest segment, generating revenue by supporting artists in creating audio and video content, and marketing, distributing, selling, and licensing that content across various formats and platforms. These include physical formats like CDs and vinyl, streaming platforms like Spotify, and films, TV shows, video games, and social media.

A crucial point: this segment deals with the actual sound recordings, also known as “masters”. When you stream a song on Spotify or buy a CD, you’re paying for the recording of that song—the specific version performed by the artist.

Streaming accounts for 67% of this segment’s revenue, reflecting the industry’s digital transformation. Interestingly, 62% of UMG’s recorded music revenue—both digital and physical—comes from content older than three years. In other words, UMG’s content catalog is timeless and has a lasting value, thanks to iconic artists like ABBA, The Beatles, Guns N’ Roses, Bob Marley, Queen, U2, and many more.

To illustrate how UMG makes money in this segment, take Taylor Swift—one of its signed artists.

When fans buy CDs or vinyl records of Swift’s albums, UMG earns revenue.

When her music is streamed on platforms like Spotify and Apple Music, UMG earns revenue.

If her recordings are used in movies, TV shows, video games, or advertisements, UMG earns revenue.

Even when her songs appear in social media posts, UMG gets paid.

A major strength of this segment is that it relies on recurring royalties, meaning UMG continues to generate revenue long after a song is initially released.

UMG operates through a network of decentralized record labels, each focused on specific genres and styles. Artists sign with UMG’s labels for several key reasons:

Recording, marketing, and distributing music isn’t cheap. Labels help cover production costs, tours, promotions, and more. Even if artists did have the money, I can imagine figuring out how to handle all that on their own can be a challenge.

UMG has a huge scale. For emerging artists who want to go global, signing with a label that has the resources to market on such a large scale makes a lot of sense.

UMG’s connections with top producers, songwriters, and collaborators are a major plus. These relationships open doors to opportunities that would be much harder to secure independently.

Being signed by a well-known label like one of UMG’s gives artists instant credibility. It can lead to more recognition, bigger opportunities, and a stronger presence in the music industry.

In 2023, the recorded music segment generated €8.5 billion in revenue, or 76% of total revenue.

Music Publishing

This segment is closely related to Recorded Music, but fundamentally different. Instead of owning the audio recordings, UMG owns the rights to the songwriting itself—the lyrics and melody. This is known as publishing rights.

Again using Taylor Swift as an example, UMG earns publishing revenue when:

Her songs are streamed or sold, because the underlying composition is being used.

A radio station plays one of her songs.

A live concert features one of her songs (even if performed by another artist).

Another musician covers one of her songs.

Even if Swift herself isn’t the one performing, UMG’s publishing segment still earns royalties from the use of her songwriting.

This is important, because often UMG owns both the master recording and the publishing rights for a song. This means when a song is streamed on Spotify, UMG gets paid for both segments—one for the recording, one for the composition.

The music publishing segment generated €2 billion in revenue, or 18% of total revenue.

Merchandising

UMG’s third segment consists of developing high-quality licensed consumer products that reflect an artist’s brand and identity. The business is called Bravado, which has a portfolio of over 220 artists.

More specifically, Bravado provides access to an end-to-end merchandising ecosystem, which includes apparel and accessories, home goods, toys, games, luxury goods, food, and other merchandise. Products are sold through retail outlets, both directly and through third parties, online and offline, and even on live tours.

Bravado’s clients include Ariane Grande, Billie Eilish, Lady Gaga, Selena Gomez, Shawn Mendes, The Weeknd, Post Malone, Taylor Swift, and many more.

The segment generated €706 million, or 6% of total revenue.

Moat

UMG has a wide moat driven by intangible assets—its reputation, industry relationships, and vast catalog of successful artists—as well as scale advantages.

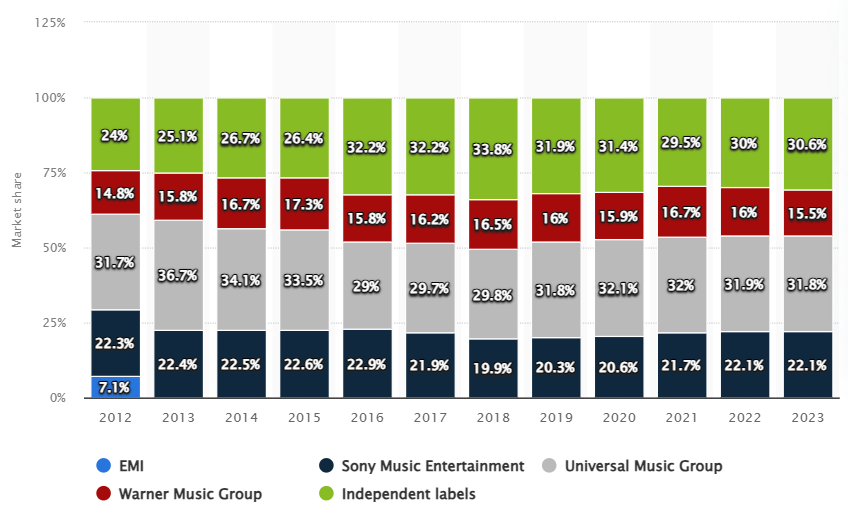

As the largest record label, UMG, alongside Sony Music and Warner Music Group, forms the “Big Three” of the industry. UMG alone holds a market share of over 30%, giving it significant competitive advantages. Its scale makes it difficult for smaller labels to compete in artist recruitment, marketing, and global distribution. With the deepest financial resources, UMG can sign and develop more artists while also retaining its best artists by offering the best deals.

Nearly all top artists are signed to major labels, reinforcing the importance of UMG, Sony, and Warner. Major labels not only provide larger payments, but they also help artists earn significantly more income than they would under smaller labels or as independents.

Small-label and independent artists earn less per stream. Streaming platforms like Spotify pay labels a percentage of streaming music revenue, which is then distributed to artists. Major labels negotiate better terms than smaller labels or independent artists, ensuring their artists receive higher payments per stream.

Spotify, for instance, cannot afford a dispute with UMG—its catalog is too valuable. If UMG were to pull its music off the platform, the impact on Spotify would be severe.

Beyond streaming, artists generate revenue from other sources like film, TV shows, and commercial licensing—opportunities that are far more accessible through major labels, which have the expertise and industry connections to secure these deals.

UMG also benefits from long-term intellectual property ownership, as it controls both recording and publishing rights. Many of its iconic songs and artists remain highly valuable for decades, ensuring a steady stream of recurring revenue.

With the most capital, the most influential labels, and the most negotiating power, UMG is positioned to retain its competitive advantages for years ahead.

Key Financials

Revenue

UMG’s revenue growth has been solid, with a slight acceleration since 2020, coinciding with the pandemic and the IPO in 2021.

The compound annual growth rates (CAGR) by period:

5-year: 13%

3-year: 14%

1-year: 7%

Growth slowed in 2023, but that’s mostly due to tough comparisons—2022 revenue surged by 22%. Looking at the 2-year CAGR of 14%, the trend is more in line with the other growth rates.

Revenue per segment hasn’t changed much, though Music Publishing and Merchandising have take a slightly larger share. That’s not necessarily great since they have lower margins.

The 5-year CAGR per segment:

Recorded Music: 12%

Music Publishing: 16%

Merchandising: 21%

Several trends should keep UMG’s revenue growth strong:

Streaming Platforms

The rise of streaming has revived the music industry after years of decline. In 2023, there were 670 million paid subscribers across streaming platforms, and that number is expected to surpass one billion by 2028. This isn’t unrealistic, considering the low penetration rates in markets like China, Brazil, and India. The bigger streaming gets, the more UMG benefits.

Social Media

Short-form video platforms like TikTok and Instagram have fueled a music resurgence, driving viral hits. As social media expands, so does UMG.

Under-Monetization

UMG sees opportunities in better monetizing streaming platforms. Music subscriptions are relatively cheap, and price increases, premium tiers, and improved ad-supported revenue could all boost growth.

Superfan Monetization

UMG is seeing strong growth from “superfans”, the die-hard fans who purchase merchandise and physical products. Merchandising is UMG’s fastest-growing segment, and when combined with physical album sales (which falls under the Recorded Music and Music Publishing segments), revenue has been increasing by almost 20% annually. The company believes there’s still room to expand in this area.

Profitability

UMG is consistently profitable, though its margins might be lower than you’d expect from a royalty-like business. That’s because artist costs are high—UMG signs and retains top-tier artists, and they demand premium compensation.

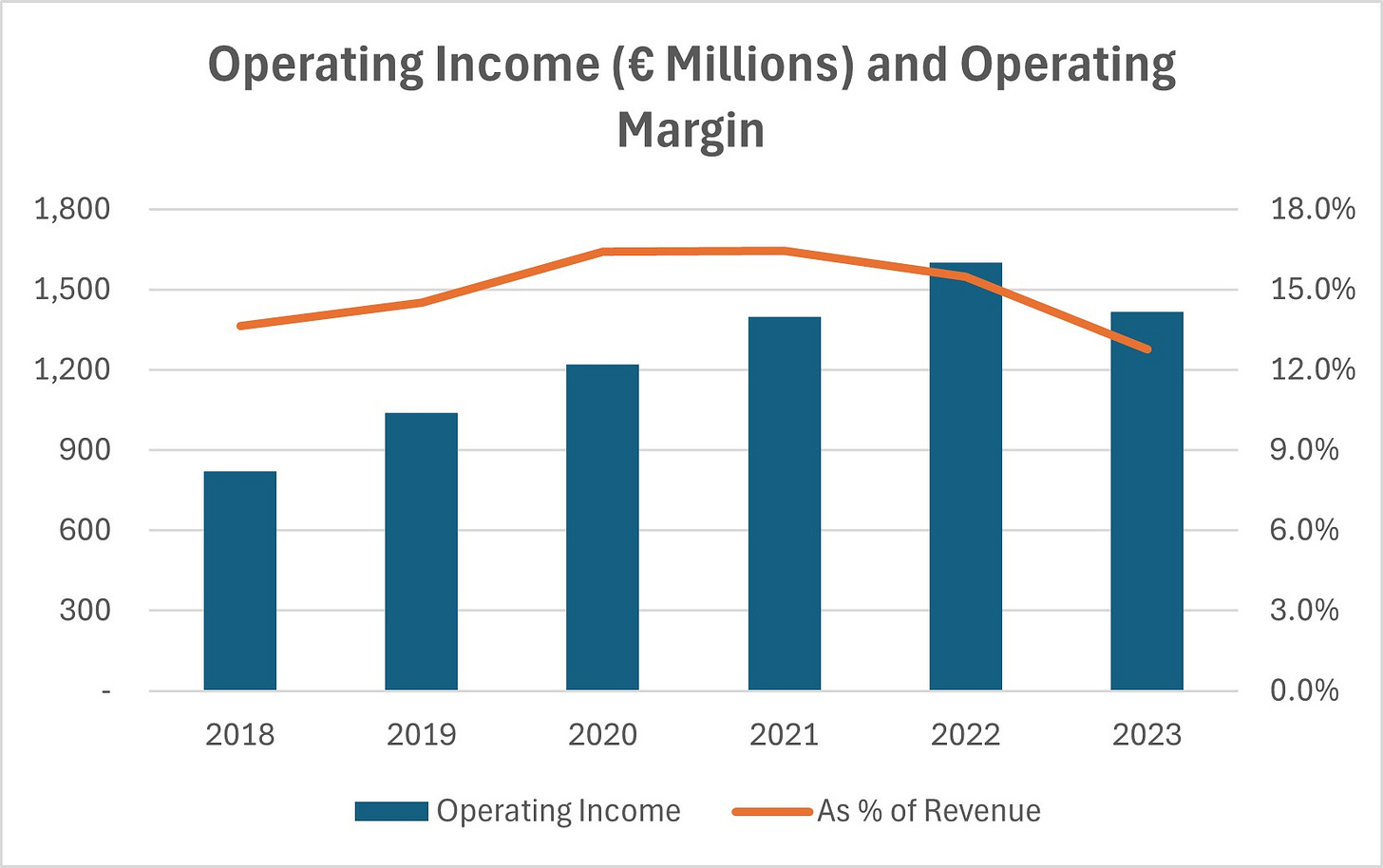

Operating income had been rising steadily but dropped in 2023 due to higher artist costs as a result of a growing share of Music Publishing revenue, which has thinner margins. Higher share-based compensation, however, is also responsible for this drop, but it looks like a one-time expense. Margins have been rising again in 2024, with share-based comp dropping significantly.

That said, with Music Publishing and Merchandising growing faster than Recorded Music, margins will likely stay under pressure. These segments simply have lower margins.

On free cash flow, growth doesn’t look great. I factor in catalogue investments under capex, which is money spent to acquire music rights, when calculating free cash flow. While it’s not really growing, it’s still well over a billion euros. The drop in 2023 was mainly due to higher tax expenses, but over time, I expect free cash flow to recover and track profit more closely.

UMG’s return on invested capital (ROIC) is outstanding, consistently above 30%, thanks to negative working capital and relatively low non-current assets. The company’s biggest operating asset is its music catalogue, valued at €3 billion as of December 31, 2023.

Financial Health

As of June 30, 2024, UMG has €438 million in cash against €1.2 billion in short-term debt and €1.8 billion in long-term debt. While short-term debt looks high compared to cash, free cash flow is over €1 billion, meaning UMG could pay off its debt in about a year if needed.

Net debt-to-free cash flow is just 2.5, a healthy level. Plus, with a 9x interest coverage ratio, UMG has no trouble covering its debt obligations.

Overall, UMG is financially stable and has solid control over its debt.

Management

UMG has been led by CEO Sir Lucian Grainge since 2011. Under his leadership, UMG acquired EMI’s recorded music assets in 2011, adding iconic artists like The Beatles, Coldplay, Adele, and Katy Perry to its roster. Grainge has also played a significant role in UMG’s strong presence on streaming platforms.

One thing I don’t love is Grainge’s relatively low share ownership—he only holds 11,499 shares. While he does have a significant number of restricted stock units, performance stock units, and options, I’d still like to see a bit more direct ownership from him.

On a more positive note, it’s encouraging that legendary investor Bill Ackman holds a 10% stake in UMG and is part of the board.

UMG’s capital allocation strategy looks fine. About half of its operating cash flow is allocated to a semiannual dividend, similar to Evolution’s approach. The remaining cash is reinvested into catalogue investments, capex, and acquisitions, with any excess used to pay down debt. Given UMG’s capital-light model, it can return substantial cash to shareholders while continuing to reinvest.

Conclusion

Risks

Here are two major risks UMG shareholders should keep in mind:

Attracting and Retaining Artists

UMG’s success depends on discovering and signing the next big artists, as well as keeping its current stars. While UMG is in a strong position, it faces increasing competition from independent labels and artists going solo, thanks to advances in global distribution and technology. Still, UMG has the best resources to attract and retain talent, and I believe I’ve made it obvious earlier how important major record labels are for artists.

AI

There’s growing concern about the impact of AI on the music industry. AI-generated music can mimic styles, genres, and even voices, which poses a challenge to UMG’s artist-centric business model. However, there are a few counterarguments worth considering:

Music’s Human Connection

Music is an art form, and people deeply appreciate the creative process, the personal connection, and the storytelling behind it. Music that lacks these elements—like AI-generated music—won’t thrive. This is evident in the fast growth of the Merchandising segment, which shows fans value their relationship with artists. AI-produced music lacks fans.

AI as a Tool

Rather than being a threat, AI can be a tool that enhances music creation. It can speed up production, explore new sounds, and even help democratize music-making, potentially leading to more artists rather than fewer.

Increased Discovery and Consumption

AI can improve music recommendations and personalization, leading to more music discovery and increased consumption. By better understanding listener preferences, AI can create a more engaging music experience and promote more music from UMG’s artists.

Valuation

Based on a 20-year discounted cash flow model, which assumes conservative growth of 8% in the early years and gradually dropping to 3% in the later years, along with moderate operating margin expansion to 18% by year 20, UMG looks very overvalued.

It’s unfortunate because I’d love to own this business, but at its current price, it’s a no for me. Even with very optimistic assumptions, I just don’t see a scenario where UMG becomes a buy.

One reason for this overvaluation in my model might be that I factor in catalogue investments. These aren’t technically considered capex, but I think they should be. If you were to exclude them, though, you’d also need to exclude amortization, which isn’t really possible since UMG doesn’t provide a separate figure for amortization.

Either way, I’m passing on UMG, but it’s definitely staying on my watchlist. If you’re interested in seeing the model I used, feel free to message me or reply to this email!

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.

Thanks, great analysis. I came to the same conclusion on valuation, hard to make it work. on SPOT you could always argue podcasts and education + EM penetration could make it worth, but UMG has less levers to pull in my view

Great writeup as always. Is it possible to see to model used?