Welcome to a new edition of Deep Dives.

Texas Roadhouse is a casual dining chain in the United States. With over 780 locations and steady expansion, a loyal customer base, and strong financial performance, this steakhouse continues to defy the broader challenges facing average restaurants. Known for its hand-cut steaks, fresh-baked bread, and lively atmosphere, Texas Roadhouse has built a model that keeps diners coming back.

In this deep dive, we’ll explore what sets the company apart, and find out if this is a compelling story for investors.

What You’ll Read Today

Texas Roadhouse’s History

Texas Roadhouse’s Business

Products

Moat

Key Financials

Management

Conclusion

Risks

Valuation

Before you continue reading, let me know in the comments which company you’d like me to break down next!

Texas Roadhouse’s History

Texas Roadhouse’s story begins in 1993 with Kent Taylor, a Louisville native and University of North Carolina graduate who had a passion for track running—and, as it turns out, the restaurant business.

Taylor’s journey in the industry started early. In 1969, he took a part-time job as a busser while in high school. After earning a business degree in 1977, he returned to restaurants as a server—at the same place where he had once cleaned tables. From there, he moved on to bartending before taking a job managing his uncle’s nightclub.

His first attempt at entrepreneurship came when he partnered with two others to open a pub. He was soon forced out, however, teaching him the importance of handling legal agreements before entering a business venture. By 1983, Taylor became a restaurant manager at Bennigan’s, an Irish-themed casual dining chain. There, he learned key management principles that would later shape Texas Roadhouse, including:

Leading by example and working alongside staff

Listening to employees and eliminating toxic team members

Aligning bonuses with company goals and keeping them consistent

This philosophy is still embedded in Texas Roadhouse today. Every restaurant manager invests $25,000 upfront and receives 10% of their store’s profits—a deal Taylor called “the best financial deal they’ll ever make.”

Despite a relatively successful tenure at Bennigan’s, Taylor wasn’t satisfied—he wanted to be his own boss. He spent years brainstorming restaurant concepts, including a Texas-style steakhouse, but struggled to secure funding. Investors repeatedly turned him down.

A short stint at Hooters as an area manager and a role at KFC followed. Then, after four failed pitches, he finally convinced John Y. Brown—the man responsible for KFC’s massive expansion—to invest in his restaurant. Brown gave him $80,000 to convert one of his existing restaurants into Buckhead Mountain Grill, a chicken-based restaurant where Taylor owned a 20% stake.

Buckhead, however, struggled. Sales declined, execution was poor, and Taylor was working around the clock with little success. Out of desperation, he changed the concept into a bar/pub/live entertainment venue that also served food. The change worked, and sales went up.

Encouraged, Taylor wanted to open a second location, this time in Clarksville, Indiana, where he believed a country steakhouse idea would work better. He envisioned live music, affordable steaks and ribs, and a lively atmosphere. But when he approached Brown for funding, negotiations fell apart—Taylor wanted equal partnership, while Brown was only willing to offer 20%.

After facing an incredible 130 rejections Taylor finally secured funding. Three doctors invested $100,000 each, and in 1993, the first Texas Roadhouse opened in Clarksville.

Expansion followed quickly. By 1994, Texas Roadhouse had five locations—but not all were successful. Three of them struggled due to poor real estate choices, forcing Taylor to shut them down. It was an expensive but valuable lesson. Fortunately, the other two locations thrived, and momentum built soon thereafter.

By the end of 1999, Texas Roadhouse had grown to 67 restaurants, and in 2004, the company went public.

Today, Texas Roadhouse operates over 780 locations, along with two additional restaurant concepts: Bubba’s 33 and Jaggers.

Tragically, Kent Taylor passed away by suicide on March 18, 2021, after suffering from severe tinnitus for months, a complication from COVID-19.

Following his passing, Gerald Morgan, who had been with Texas Roadhouse since 1997, was named CEO and continues to lead the company.

Texas Roadhouse’s Business

Products

Texas Roadhouse comprises of three concepts, with restaurants in the US and ten foreign countries. In addition to outright owning its restaurants, the company also franchises its concepts, and acquires its most successful franchisees.

As of September 24, 2024, there were 713 Texas Roadhouse’s (of which 112 franchises), 48 Bubba’s 33, and 11 Jaggers (of which 3 franchises).

Texas Roadhouse

Texas Roadhouse is an affordable, full-service, casual dining restaurant concept offering hand-cut steaks, ribs, seafood, chicken, pork chops, pulled pork and vegetable plates, as well as hamburgers, salads and sandwiches. Guests are met with free roasted peanuts and fresh baked yeast rolls, for which the restaurant is well known.

Texas Roadhouse restaurants have a rustic southwestern lodge décor accentuated with hand-painted murals, neon signs, and southwestern prints, rugs and artifacts. The atmosphere is lively thanks to upbeat country music and enthusiastic employees.

Bubba’s 33

Bubba’s 33 is an affordable, full-service, casual dining restaurant concept blending a sports bar atmosphere with a family-friendly dining experience. The menu’s focus lies on burgers, pizza, and beer. These restaurants lean into rock music and a lively, social setting.

Jaggers

Jaggers is a fast-casual concept offering burgers, hand-breaded chicken tenders and chicken sandwiches. The restaurants offer drive-thru, carry-out and dine-in service options.

Moat

The restaurant industry is fiercely competitive, and at first glance, Texas Roadhouse doesn’t seem to have a dominant edge. I’d mostly agree. You could argue that its scale provides cost advantages, particularly against standalone restaurants or smaller chains. But Texas Roadhouse’s moat isn’t built on a single defining factor. Instead, it comes from a stack of smaller advantages—each individually insufficient to fend off competitors, but together forming a competitive moat.

Value Perception

Texas Roadhouse’s biggest advantage is its exceptional value. Portions are large, customers get free rolls and peanuts (made possible through cost savings by avoiding national advertising), and pricing remains very affordable. A full meal can cost as little as $20, and the quality is hard to beat at that price.

Nearly everything is made from scratch, with in-house butchers ensuring steaks are cut fresh daily—never frozen. Proprietary recipes and manager-inspected dishes add to the consistency. This is value-for-money at its finest, driving repeat business and fostering loyalty.

Culture

A strong company culture can be a real competitive advantage, and Texas Roadhouse gets this right.

First, the company embraces decentralization. Local managers, as mentioned earlier, are financially invested in their stores—putting up $25,000 of their own money and earning 10% of pre-tax profits. That’s skin in the game, creating real incentives for performance. These managers also hire their own staff, ensuring they build teams that fit the culture.

Second, service is more personal. Servers handle just three tables instead of the industry-standard four to six, leading to:

Better service quality

Faster turnaround times

Happier customers (and higher tips)

Less stress and higher job satisfaction

Unique Atmosphere

The mix of upbeat country music, fun rustic décor, and line-dancing servers (yes, they do that) creates a memorable, high-energy atmosphere that keeps people coming back.

Is this a durable competitive advantage? Probably not—it’s replicable in theory. But it is yet another factor that makes Texas Roadhouse more unique.

The restaurant industry isn’t winner-takes-all. Customers will dine at multiple restaurants, and that’s fine. Texas Roadhouse doesn’t need to dominate—it just needs to be the place people keep coming back to. And it’s clearly succeeding at that.

Key Financials

Revenue

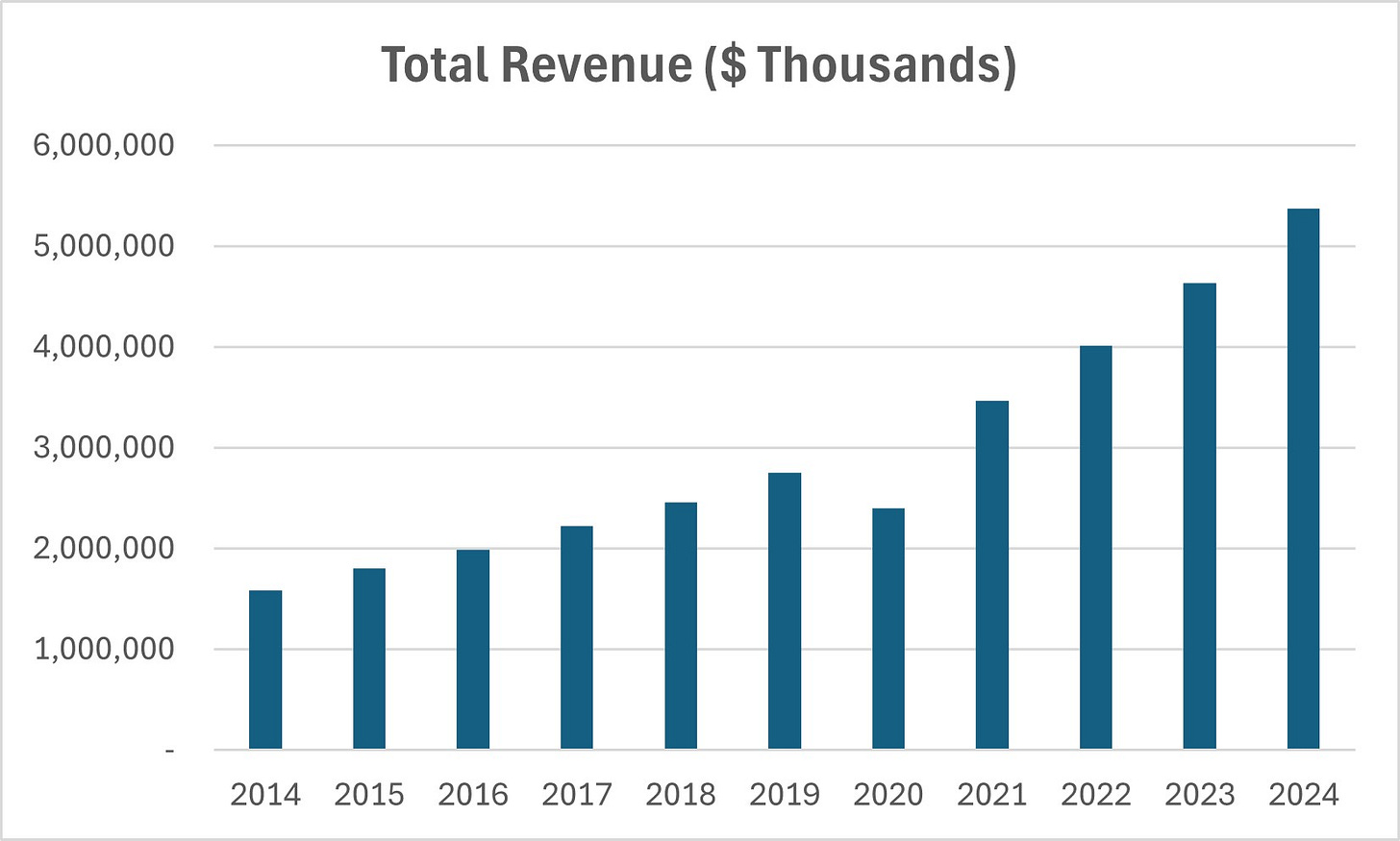

Texas Roadhouse is a true growth company, with a beautiful track record of consistent and predictable growth, the only flaw being the brief dip during the pandemic—quickly followed by a strong rebound. The company reported its 2024 results only yesterday, and revenue has grown to a record high of $5.4 billion.

Compound annual growth rates (CAGR) by period:

10-year: 13%

5-year: 14.3%

2-year: 15.7%

1-year: 16%

Growth has accelerated post-pandemic, reinforcing the company’s strong position.

The vast majority of revenue comes from company-owned Texas Roadhouse restaurants. Bubba’s 33 contributes a small share, while Jaggers remains negligible. Additionally, franchise royalties make up only a tiny fraction of total revenue.

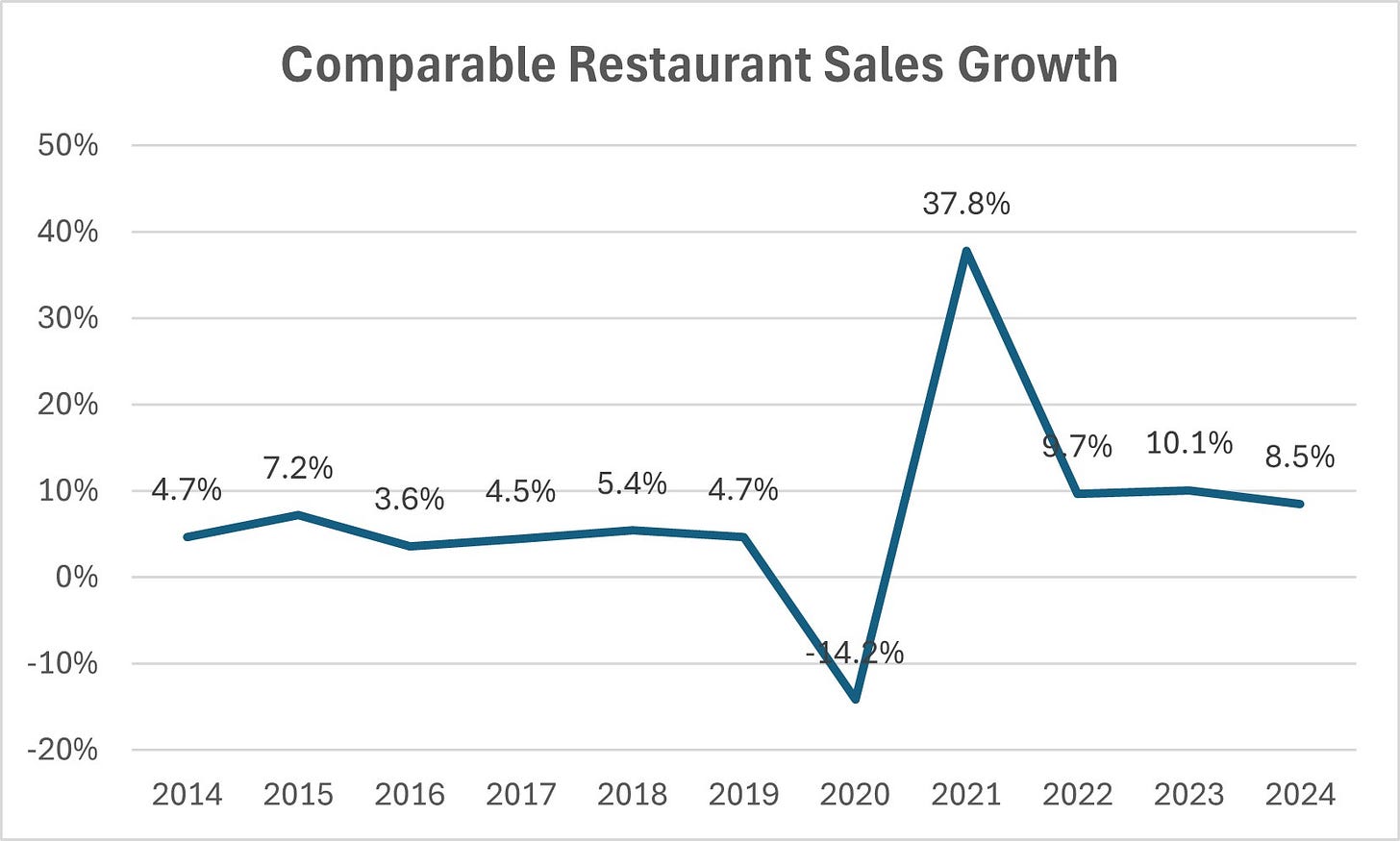

Texas Roadhouse grows revenue by opening new restaurants and increasing comparable restaurant sales, which measures sales growth in existing locations. This is a key metric for all restaurant chains and is driven by two factors:

Guest traffic

Per person average check

As shown in the graph, normalized comparable sales growth pre-pandemic hovers around 4-5%. When combined with restaurant unit growth of around 5%, this supports consistent double-digit revenue growth. Post-pandemic, comparable sales growth remains well above historical levels, raising the question of how sustainable this trend is.

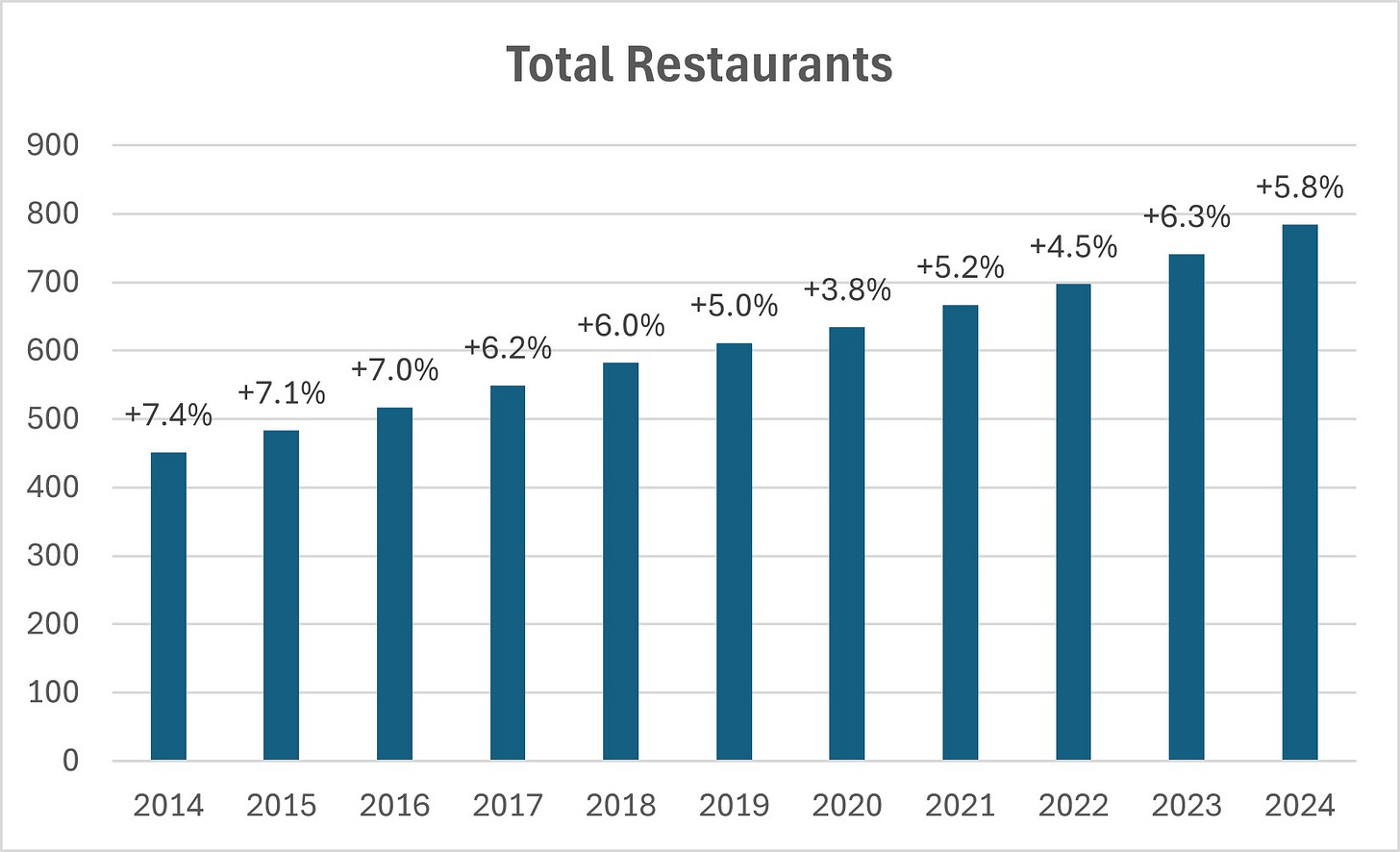

Restaurant expansion is also solid. Growth was at its lowest in 2020 but has since reaccelerated.

With its strong value-for-money offering and robust cash flow generation, Texas Roadhouse is well-positioned to drive both comparable restaurant sales and total restaurant growth for years to come.

Profitability

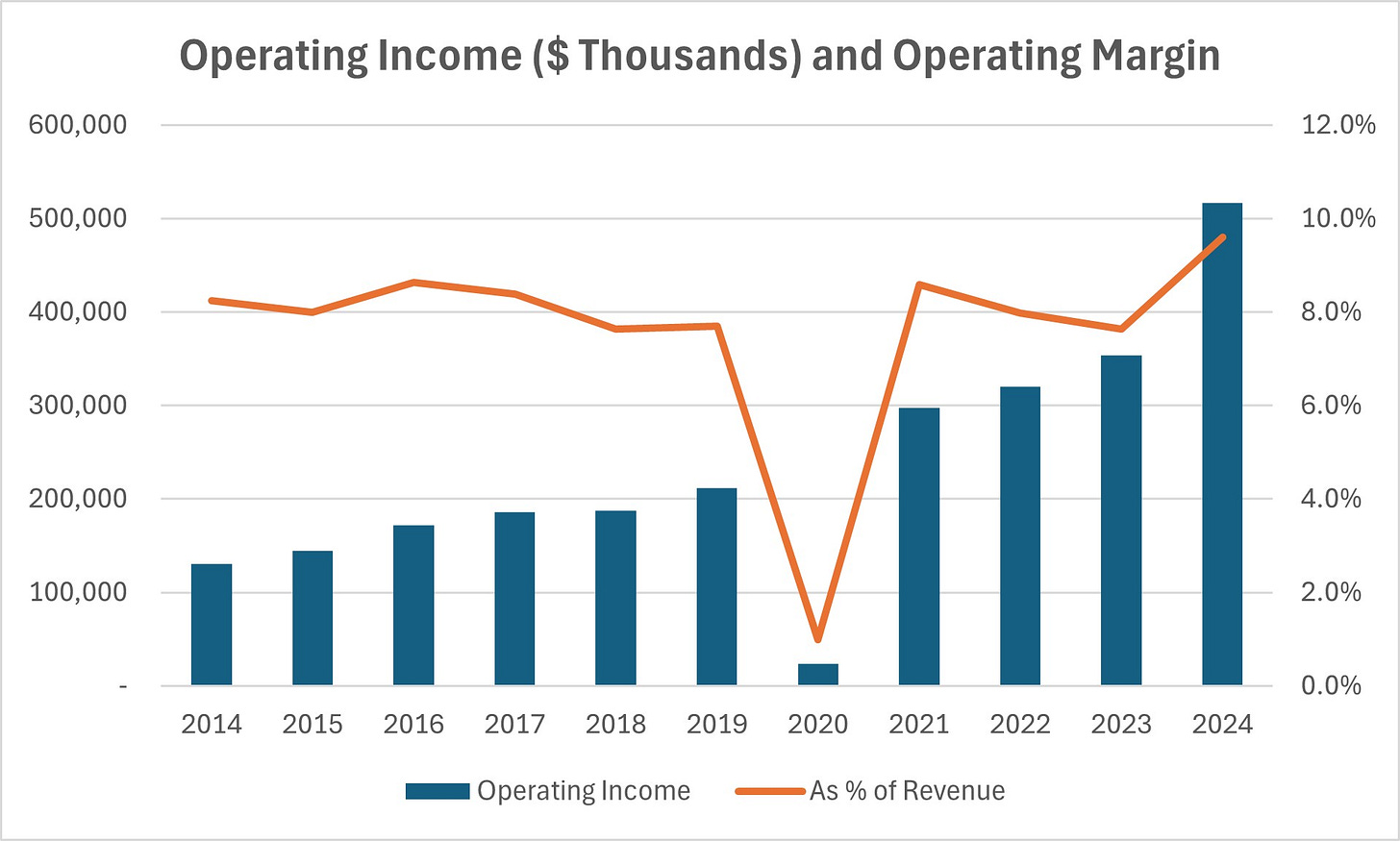

Texas Roadhouse has delivered steady profit growth over the years, though operating margins remain relatively low.

The company passes cost savings on to customers, evident in its free rolls and peanuts, competitive menu pricing, and large portions. Additionally, margins are structurally lower than some peers due to:

A full-service dining model, which carries higher costs than fast casual or quick service.

Higher labor expenses, as Texas Roadhouse pays above-average wages, performance bonuses, and prioritizes staff retention.

This lower-margin approach is a competitive advantage, driving strong guest loyalty and sustained traffic growth.

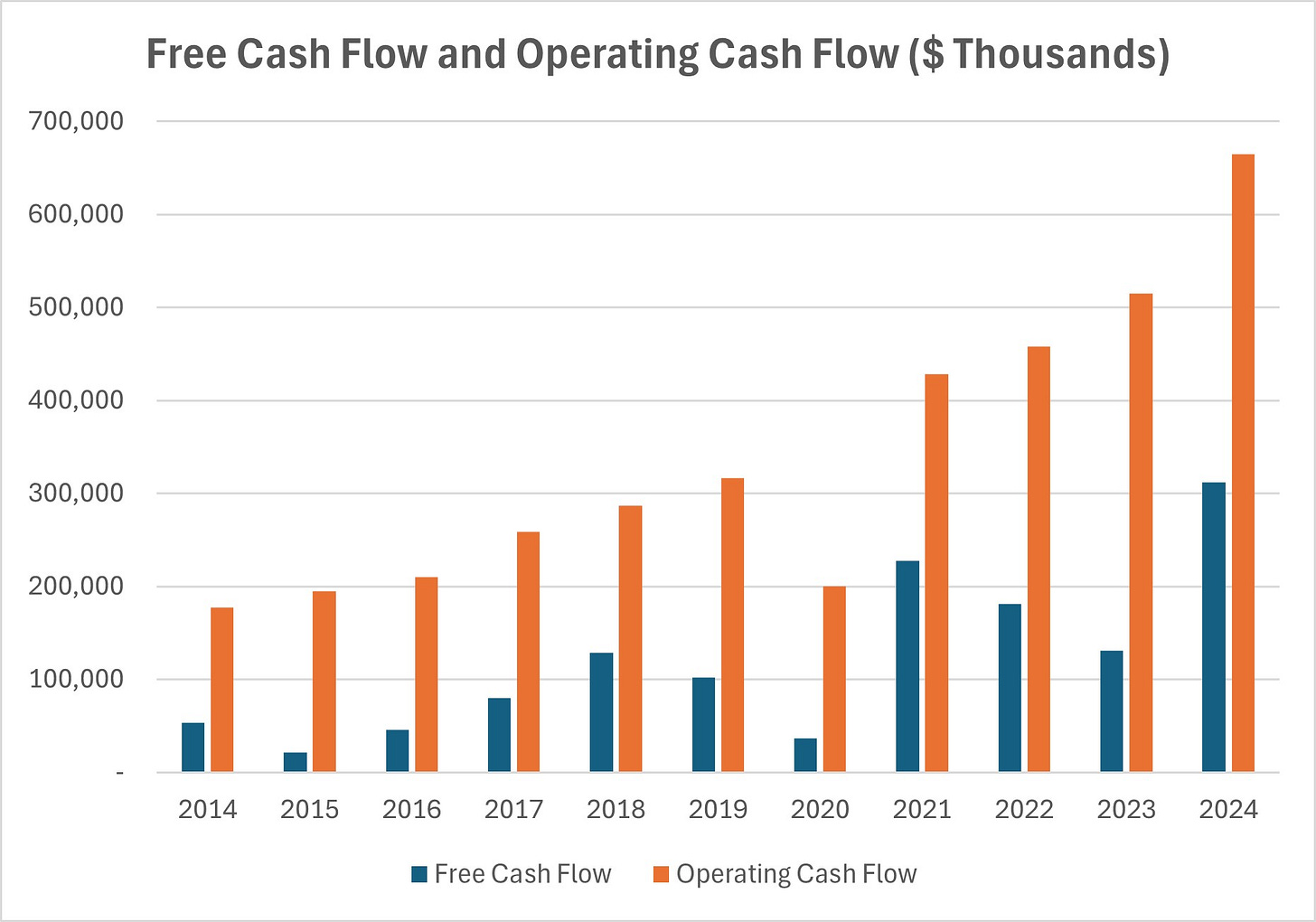

Free cash flow is volatile but grew explosively in 2024, with Texas Roadhouse trading at a 2.7% free cash flow yield. Operating cash flow remains much stronger due to ongoing capital investments.

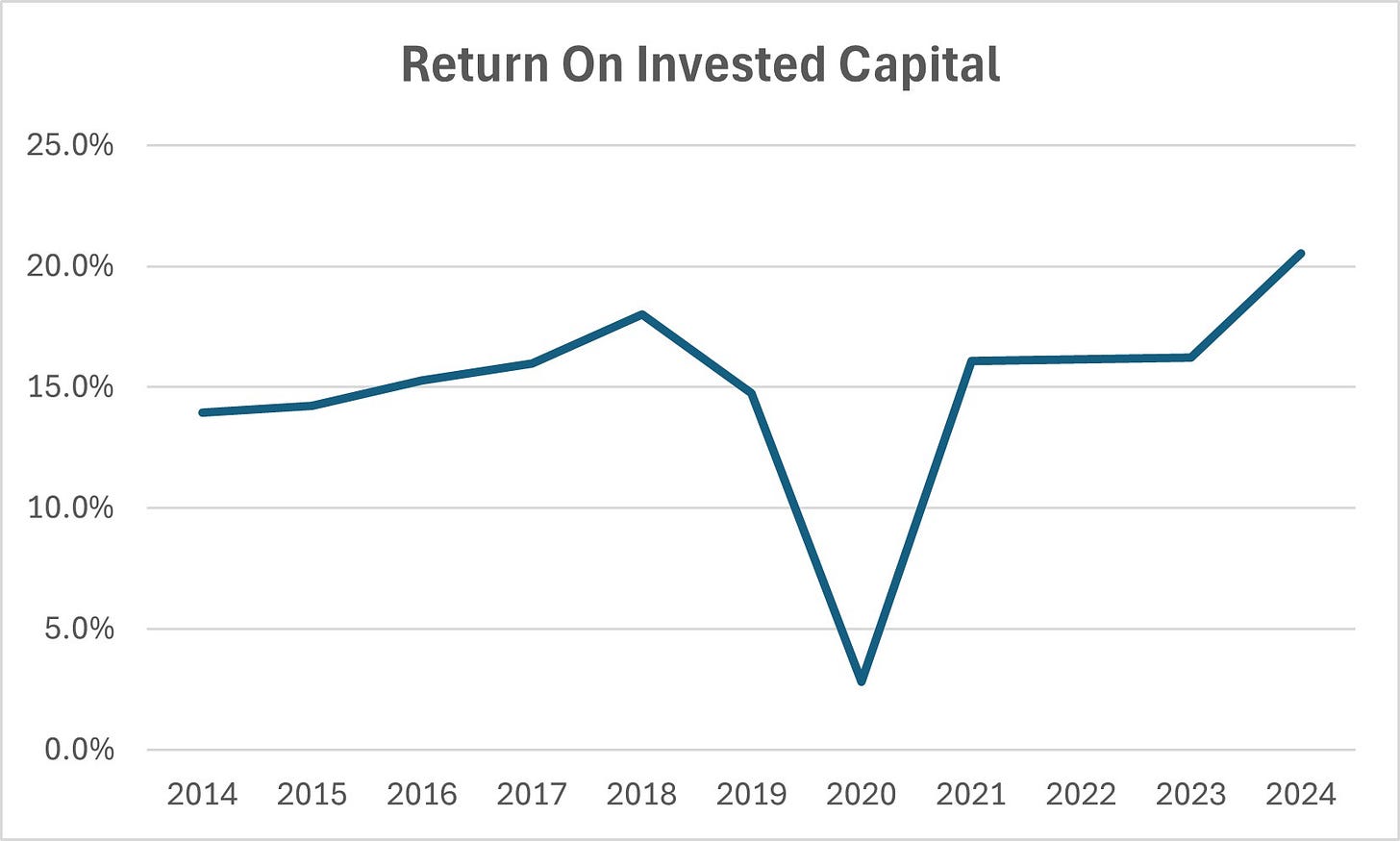

With return on invested capital (ROIC) hovering around 15%, this reaffirms that Texas Roadhouse is a strong business, though not a formidable one. ROIC did jump toward 20% in 2024.

From 2014 to 2024, the company had a 73% reinvestment rate, indicating aggressive expansion. Over that same period, return on incremental invested capital (ROIIC) was 22%, meaning that these reinvestments were value-accretive.

Over the last six years, reinvestment has actually declined to 47% while ROIIC increased to 36%—suggesting a shift toward efficiency over growth. This aligns with slightly slower restaurant expansion in recent years. However, revenue growth has remained exceptional, thanks to high comparable restaurant sales growth, which requires little to no capital investment.

This raises the same key question as before: How sustainable is comparable restaurant sales growth? If this metric slows while the reinvestment rate remains low, overall growth will decline. It’s worth monitoring.

Financial Health

Texas Roadhouse has a pristine balance sheet, with $245 million in cash and equivalents and zero debt. As a result, the company has no interest expenses.

Management

Founder Kent Taylor has been crucial in setting Texas Roadhouse’s culture. A people-first mentality, high-energy and lively atmospheres, and a commitment to quality are some of the company’s most important aspects shaped by Taylor.

Current CEO Gerald Morgan, better known as Jerry Morgan, honors Taylor’s legacy by running the company the same way and preserving what’s made it successful thus far. Morgan joined the company in 1997 and has held numerous positions. It’s safe to say he knows the company inside out, and his tenure as CEO, although relatively short, has been successful.

Morgan holds 84,704 shares in the company, equivalent to around $14.9 million at the time of this writing. It is a tiny stake relative to the entire company’s value, but with an estimated net worth of at least $20 million, it is a large personal stake.

Something else that caught my eye: The executive team’s average tenure is 17 years, which is great.

Management’s capital allocation is sound. The majority of cash flow is reinvested into restaurant expansion, with all other cash paid out as a dividend or used to repurchase shares. The company also acquires franchise restaurants when it sees the opportunity, which I think is super smart. By franchising, the company can test locations and see what works well. Next, Texas Roadhouse can simply acquire their best franchisees.

Conclusion

Risks

Texas Roadhouse faces several risks, some more apparent than others:

Competition

The restaurant industry is intensely competitive, where even minor missteps can be punished. Texas Roadhouse benefits from unique competitive advantages, but its success depends on management’s execution—more so than companies with wider moats. Failure to stick to the company’s culture and strengths would pose a significant risk. While I have confidence in current leadership, this remains something to keep an eye on.

Inflation

With relatively low margins, Texas Roadhouse is particularly vulnerable to inflation. Nearly a third of its operating costs come from labor expenses, and another third from food and beverage costs. Significant fluctuations—especially in beef prices—could materially impact profitability.

Expansion Risks

This is an important factor to watch. Texas Roadhouse must continue its strong expansion, particularly if comparable restaurant sales growth slows down.

Valuation

An investment case for Texas Roadhouse depends on two key drivers: unit expansion and comparable restaurant sales growth.

I modeled three scenarios—bullish, neutral, and bearish—projecting cash flows 20 years forward before assuming a terminal growth phase. At the current stock price of around $170-175, the expected returns are compelling:

Bullish Case

Assumes 6% annual restaurant expansion slowing to 3%, with comparable sales growth starting at 8% and declining to 5%. This results in a 15% annual return.

Neutral Case

Assumes 5% annual restaurant expansion slowing to 2%, with comparable sales starting at 6% and declining to 3%. This results in an 11% annual return.

Bearish Case

Assumes very slow restaurant expansion, with fewer than 1,300 restaurants by year 20. Furthermore, this assumes comparable sales starting at 5% declining to 2%, barely above inflation. This still results in a 9% annual return.

Even in the bearish scenario, Texas Roadhouse offers solid potential. But let’s be clear: Texas Roadhouse is not a wide-moat company like Big Tech, Visa/Mastercard, or S&P Global/Moody’s. While it does have competitive advantages, its moat is relatively narrow.

I am still considering a position in Texas Roadhouse, and it will remain on my watchlist.

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.

Great Deep dive, don’t underestimate the power of small advantages adding up, very few are willing to copy everything, instead they pick and choose.

If you haven’t already, check out Kent Taylor’s book Made from scratch, it’s a great read.

Perhaps the company has some type of moat like quarries? Do they have some competition in the same place (street), for example?