This is the first in a new series called Pre-Thesis, a high-level look at companies I’m actively exploring as potential full Investment Thesis candidates for premium members.

Each post uses a consistent framework to break down businesses that may (or may not) merit deeper research. Some of these names will go on to become full premium writeups. Others will not.

Pre-Thesis #1 is about Vinci.

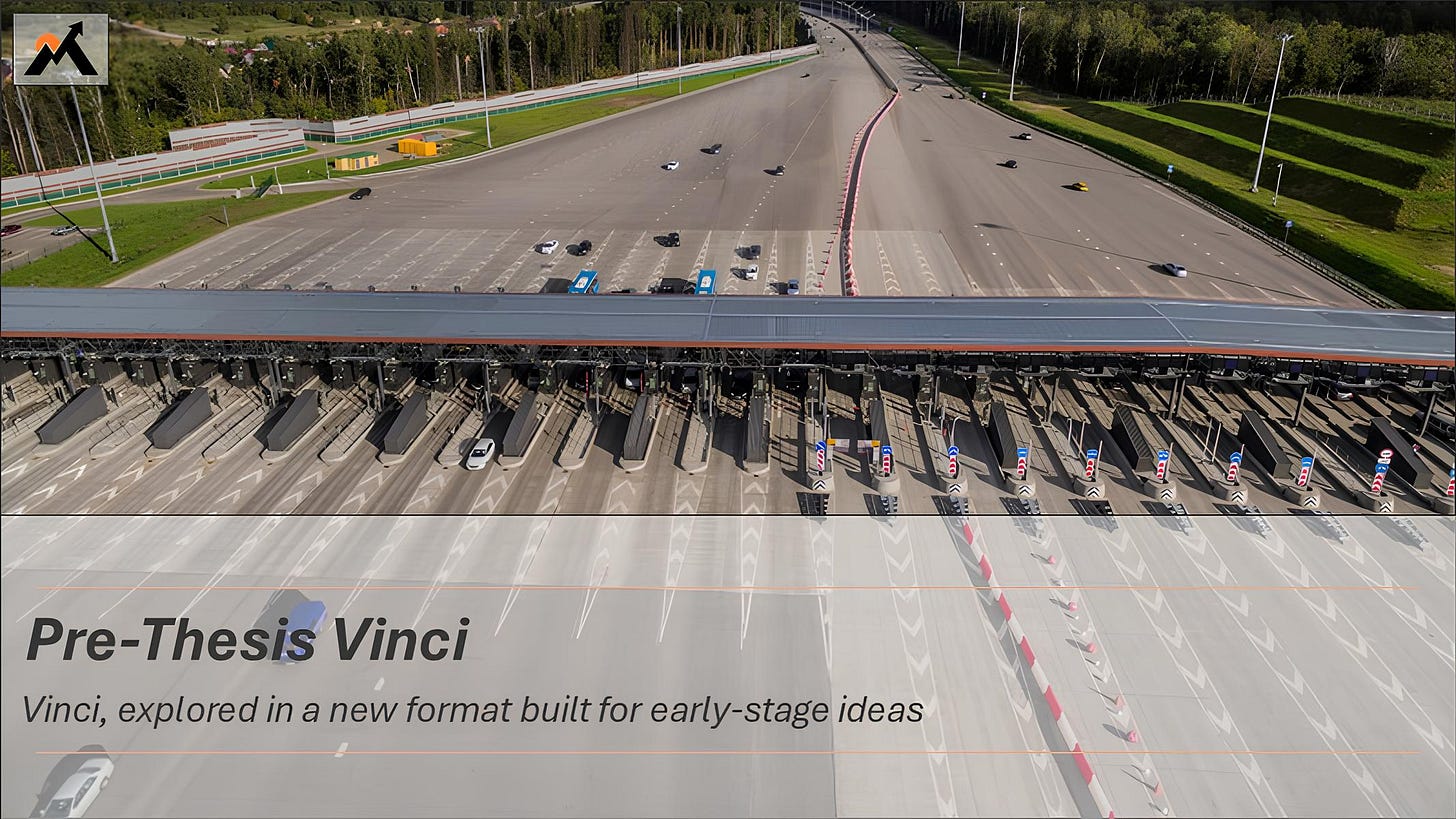

Vinci is a tollbooth business. Literally.

Not in the way Visa or Moody’s are metaphorical tollbooths; Vinci actually owns and operates the physical toll roads (and airports, and infrastructure assets) across Europe and beyond.

Let’s take a closer look.

What Vinci Does

Vinci is an infrastructure operator that specializes in long-term concession contracts. Its core business involves owning and operating toll roads, highways, bridges, and tunnels across Europe and beyond, with many contracts extending decades into the future.

The company also operates airports, stadiums, and public infrastructure networks like EV charging stations and street lighting. Its assets generate recurring revenue through tolls, passenger fees, service charges, and maintenance contracts.

Beyond concessions, Vinci has two other segments:

Construction, which handles large civil and urban projects.

Energy, which includes the development and operation of wind farms and solar power plants, as well as energy services for municipalities and industrial clients.

What makes Vinci’s concession model appealing is the predictability and scale of the business. These are long-duration, monopolistic assets that generate cash with relatively little costs, allowing Vinci to reinvest and refresh its portfolio while returning cash to shareholders.

How I Discovered Vinci

Vinci operates monopolistic assets, protected by regulatory hurdles and high capital requirements. These are exactly the kinds of businesses that Chris Hohn of TCI Fund Management is known for owning: durable, cash-generative, and monopolistic.

While it’s unclear if Hohn still owns Vinci today, we know that in 2019, TCI disclosed a 2% stake in the company in a letter, worth roughly €1.2 billion at the time. Vinci doesn’t show up in 13F filings because it’s a European company, but the public letter Hohn wrote to Vinci’s management confirmed Hohn’s ownership.

That was enough to get my attention.

I don’t invest just because someone else does, but when a world-class fund manager stakes a billion euros on a business I’ve never heard of before, it’s worth taking a closer look.

Initial Moat Thoughts

Vinci’s value is concentrated in its Concessions segment, which generated just 16% of revenues but 63% of operating income in 2024.

The other two segments—Construction and Energy—are much lower margin. They do, however, serve a purpose: Vinci’s Construction business often feeds work into the concession network, while the Energy segment is involved in modernizing existing assets with things like EV charging and inductive charging. I don’t know yet how synergistic this is, but it’s worth studying.

What surprised me was Vinci’s consolidated ROIC of just ~10%, while Concessions’ ROIC was 12%. That’s much lower than I expected for a business with “tollbooth” characteristics. In the Concessions business, motorways generated 18% returns on capital, while airports diluted this figure.

The industry has high barriers to entry, with regulatory hurdles, huge capital requirements, and no obvious substitutes. But with that context, Vinci’s return profile is disappointing at a glance.

Verdict

Vinci is not a high-ROIC compounder, but rather an infrastructure conglomerate with a strong core business—toll roads—surrounded by lower-margin, lower-return businesses.

The Concessions segment, especially motorways, looks like a standout despite its modest 12% ROIC. But the rest of the Concessions portfolio drags: airports, railways, and stadiums are capital-heavy and underperforming. Construction and Energy are enormous businesses in terms of revenue, but their margins are thin (4% and 7% operating margins).

Still, the core infrastructure business is attractive enough to merit further research. The industry has all the right characteristics: high barriers to entry, minimal disruption risk, and little substitution risk.

Vinci is going on my watchlist.

This is a new format, so feedback is welcome, whether it’s on the structure, tone, length, or ways to make these early-stage writeups more useful. Let me know what you think.

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.

They dont generate any ROIC after deducting the WACC

https://www.gurufocus.com/term/wacc/VCISF

Nice company, but nothing to own for years with compounding effect. It is more a value play that has to be bought cheap and sell "higher".

I like the format. Vinci‘s motorway concessions expire in 2032 I believe. They have to replace a huge cash generator.