Welcome to the May 2025 Portfolio Letter.

What Worked (and What Didn’t)

As this newsletter continues to evolve and grow, I’m adding a monthly reflection: what worked, what didn’t, and what I’m learning along the way.

There are two reasons for this:

It forces me to step back and evaluate both the investing side and the publishing side of what I’m building here.

It helps me focus on delivering real value to premium members and to everyone else who reads.

So, what worked this month, and what didn’t?

I published 13 articles in May, excluding the April Portfolio Letter. That’s a lot more than the usual 7-8, but you didn’t seem to mind. Open rates held steady around 34%, and subscriber churn wasn’t above average.

That doesn’t mean this is the new normal. I’m not aiming to pump out more content just for the sake of it. Besides, four of those posts were earnings updates, and outside of earnings season, the number will naturally come down.

That said, the earnings updates didn’t perform particularly well. My guess is that while they’re timely, they’re not that unique—mostly just my notes and summaries of results and calls.

Still, they serve a purpose: they give me a natural point to revisit valuation for premium members. Once a quarter is a good rhythm for that.

Besides earnings, I published nine other posts. Not all of them worked.

One that didn’t was my attempt to summarize my investing philosophy as briefly as possible. It got relatively little attention, and in hindsight, not surprisingly. No one asked for it.

If I’m communicating clearly across the rest of my writing, then my investing philosophy should speak for itself. You’ll know I’m a long-term, concentrated investor who pays close attention to market expectations. You don’t need a separate post spelling that out.

And if no one’s asking for something, why bother?

What did work was my piece on Chris Hohn’s investing philosophy. That one resonated with you, because Hohn is one of the best investors in the world, and his approach is practical. His teachings are easy to apply and worth studying.

What I take away from the contrast is this: readers engage more when the material teaches them something concrete, especially if it’s from someone with a real track record. I need to earn your precious time by showing the process in action, not by summarizing it from a safe distance.

Moving on. This month’s Investment Thesis was on Floor & Decor, the largest specialty flooring retailer in the U.S. The post received fewer views than the first thesis on Novo Nordisk, but that’s likely because I decided to place more of it behind the paywall.

With Novo Nordisk, everything up to and including the business model section was free. For Floor & Decor, the paywall came earlier. But more importantly, three readers decided to upgrade to premium (thank you) after reading the Floor & Decor preview, versus just one after the Novo Nordisk thesis. More exclusivity leads to higher conversion.

Premium members already know what the next Investment Thesis will be about. It’s a rare opportunity: a business with incredibly valuable monopolistic assets, right at a key inflection point. Premium members: stay tuned.

I still like the rhythm of one Investment Thesis per month. It gives me time to go deep and keep the research differentiated. It’s working.

Lastly, we updated our own stock research tool—Summit’s Analytics, available exclusively to premium members—for the first time in May. We’re aware of a few bugs and problems, and we’re actively working on them. The roadmap remains unchanged: first, perfect the core product (that is, searching for stocks and getting the key financials at a glance). Then we’ll build out new features like valuation tools and watchlists.

Now, let’s move on to the portfolio.

Performance Update

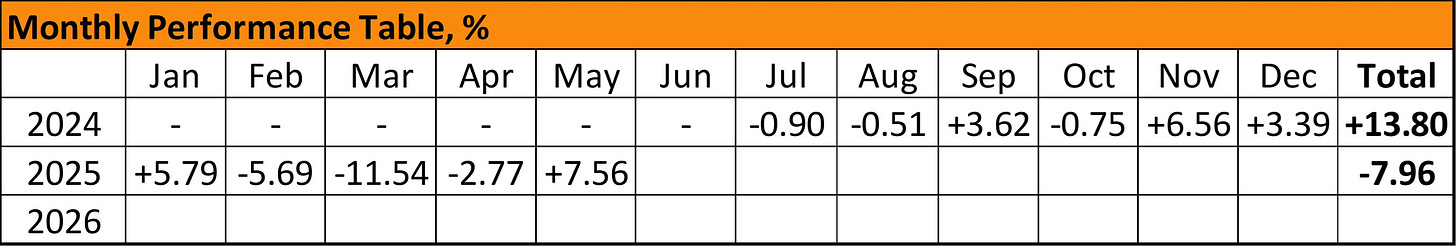

In May, the portfolio returned 7.56% (money-weighted), outperforming the S&P 500 by over a percentage point. Midway through the month, the gap was wider, but a couple holdings gave back some gains.

Here’s the performance since inception:

Needless to say, I’m not satisfied with the year overall, despite a strong month. I’m focused on sharpening the portfolio’s construction: more durability, more balance, and stronger risk-rewards.

That wraps up the public portion of the May update. From here, we get into portfolio composition, trades, and positioning, available exclusively to premium members.

You can still get 30% off using the following link: