Welcome to the June 2025 Portfolio Letter.

What Worked (and What Didn’t)

Last month, I introduced this section to reflect on what’s working, what’s not, and what I’m learning along the way. I’ll continue doing that, while making it more insightful.

From now on, I’ll also include a short behind-the-scenes update on the newsletter and website. The goal is transparency and progress.

But let’s start with the content.

I published 8 articles in June, down from 13 in May. I’d expected this. May was packed with earnings, and June less so. On a personal level, it was also a busy month.

Probabilities and Monte Carlo

June opened with two posts on probabilistic thinking and Monte Carlo simulation:

The first post crossed 1,000 views. Both were well-received, and for good reason. Probabilities, expected value, and asymmetry are critical tools for serious investors.

If you’re relying on a single-point fair value, you’re ignoring the wide range of future outcomes, filled with knowns, unknowns, and unknowables.

Monte Carlo simulation helps model this range by running thousands of scenarios and generating a distribution of outcomes. With that range in hand, measuring asymmetry becomes simple. If the stock trades near the low end, the odds are in your favor. Near the top, and they aren’t.

Behind the scenes, I’m still building a more advanced Monte Carlo model. The one used in the post was intentionally simple. I’ll likely write a follow-up article when the new version is ready, and it will eventually be added to Summit’s Analytics.

Pre-Thesis: A New Format

I also launched Pre-Thesis, a short format for exploring potential candidates for full Investment Theses.

The first post was about Vinci, a literal tollbooth business that made it onto my watchlist but probably won’t make it much further. Despite the moat, Vinci fails to generate adequate returns on capital. That might be fine if there were signs of improvement, but I don’t see them.

Still, the post did well, and the format is promising. I’ll continue the series as new ideas come up.

Vail Resorts

I also published a full Investment Thesis on Vail Resorts, which owns 42 ski resorts. It’s a unique business with some compelling dynamics. If you missed it:

Pricing Power

June ended with two posts on pricing power, sparked by Salesforce’s second price hike in three years.

Both posts performed poorly. In hindsight, this is probably because pricing power is a concept most investors already understand. Even beginners are constantly bombarded with it. That probably made it a slightly stale, undifferentiated topic, despite featuring three high-quality stocks trading at a discount.

And while the posts didn’t perform as well as I’d hoped, these three stocks are still worth your time today:

Still, lesson learned. You’re clearly looking for more advanced and differentiated ideas.

Summit’s Analytics

The final post of the month went live yesterday: the second product update for Summit’s Analytics, our website available for free to premium subscribers.

It’s been a busy month, and so we haven’t had a lot of time to work on the website, but we expect the pace of updates to improve from here.

This update focused on important fixes and smaller improvements. Most notably, we added a long-overdue home page to make the platform feel more tangible. It’s still a work in progress, but it should give you a clearer sense of what the site offers.

Newsletter Performance

We’re nearing 1,200 total subscribers. Since launching the premium tier in April, 12 have become premium members. To those 12: thank you.

To everyone else: what’s holding you back?

The newsletter is now generating just under $2,000 in annualized revenue. A milestone I’m happy to reach.

June saw just over 10,000 views, compared to nearly 14,000 in May. That drop makes sense, as I published half as many articles.

I hope you enjoy the behind-the-scenes look. I like sharing some of this stuff.

Let’s check out this month’s performance.

Performance Update

Before we continue, this update was written on June 29, so it doesn’t include the final trading day of the month.

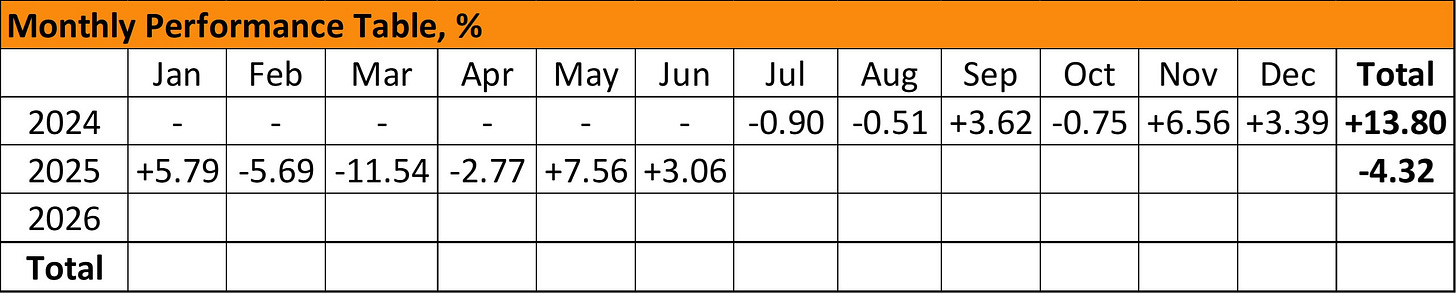

In June, the portfolio returned 3.06%, compared to 4.64% for the S&P 500.

Underperformance on a one-month basis doesn’t worry me. It shouldn’t worry you either. One month isn’t a meaningful timeframe for comparison.

More importantly, I’ve been repositioning the portfolio toward asymmetrical bets, where the downside is limited, and the upside meaningful.

Mentally, I feel sharper than ever. The psychological side of investing matters as much as the analytical side. I don’t rush into important decisions, I don’t panic during drawdowns, and I don’t chase noise. Importantly, I’m not afraid to say no, even to stocks I’ve researched and invested a lot of time in. I’m more rational and more focused.

With a clearer understanding of valuation, risk-reward, and asymmetry, confidence increases.

Having said that, here’s the performance since inception:

We’re moving in the right direction, both in performance and in strategy.

That wraps up the public portion of the June update. What follows is available exclusively to premium members: portfolio composition, trades, and strategy.

Reminder: today’s the final day to get 30% off an annual subscription.

With that, premium access is just €105 (~$123) for the year, or less than €9/month (~$10/month).