Two days ago, I looked at Salesforce’s latest list price increase. That raised a broader question for me: what actually counts as real pricing power?

Which businesses can raise prices consistently, without any churn? And more importantly, which of them are trading at a discount?

Warren Buffett put it simply:

“The single most important decision in evaluating a business is pricing power. If you've got the power to raise prices without losing business to a competitor, you've got a very good business. And if you have to have a prayer session before raising the price by 10%, then you've got a terrible business.”

With that in mind, let’s look at three companies with real pricing power.

ASML

In my deep dive last August, I called ASML a one-of-a-kind monopoly. That remains true. Here’s what I said about pricing power:

“As the sole provider of EUV lithography systems globally, ASML wields substantial pricing power, reflected in its rising gross margins.”

The company checks nearly every box in terms of pricing power. Its products are unique. There are no substitutes. Switching costs are high due to extremely high prices and deep customization. And willingness to pay isn’t really a choice: TSMC, Intel, Samsung, and other customers either buy ASML machines or fall behind.

One of the best signals of pricing power is a stable or rising gross margin. ASML’s gross margins have expanded from the mid-40s to just above 50%, with management guiding to 56-60% by 2030.

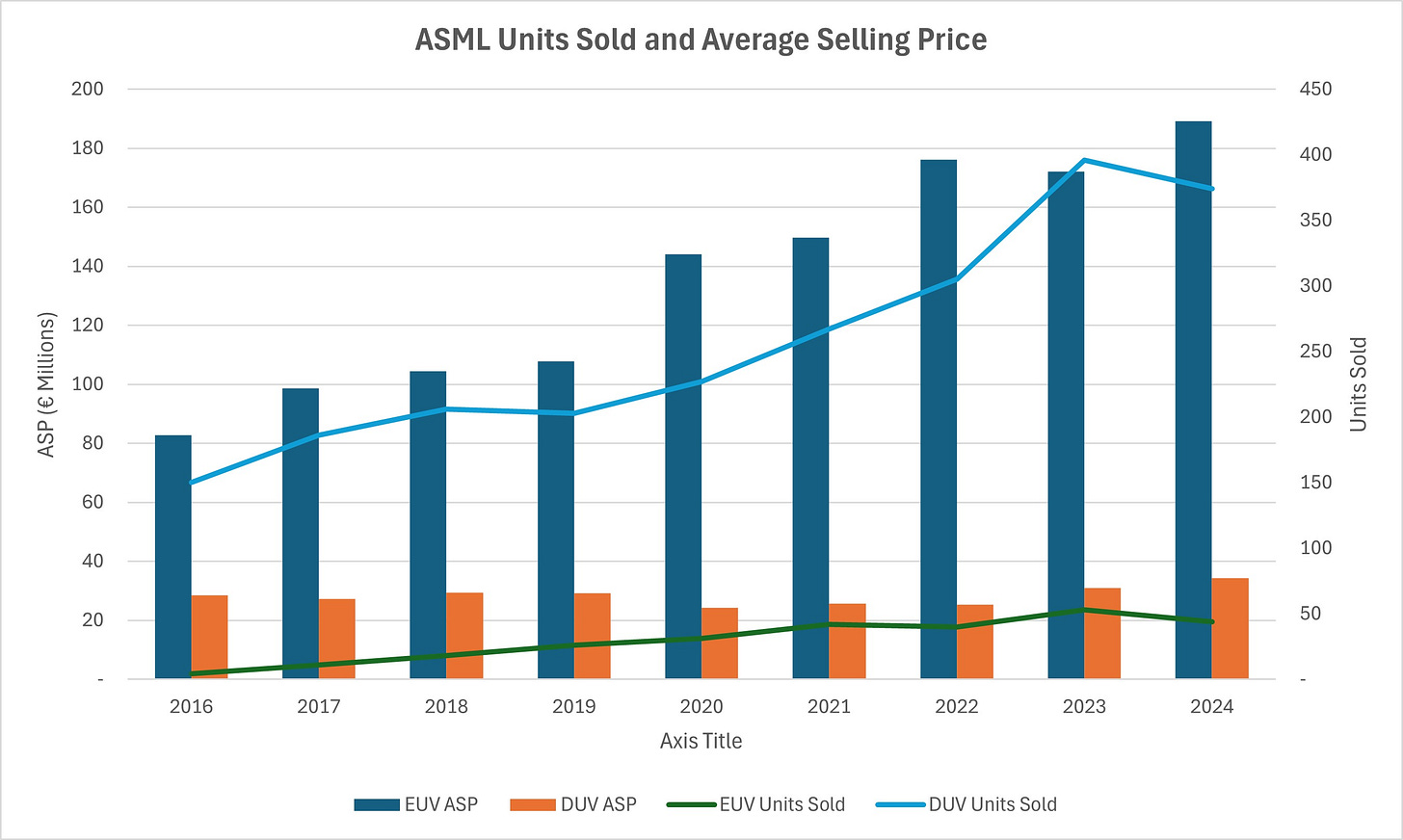

What’s driving this? A more favorable product mix. EUV systems are getting more expensive with each new generation. In 2024, ASML sold 44 EUV machines at an average price of €189 million, up from €172 million last year, and €83 million back in 2016.

This year, ASML also delivered its first two High-NA EUV machines, at an average price of €233 million. These systems are more advanced, and will make up a growing share of revenue over time. That’s the tailwind behind ASML’s rising gross margin moving forward.

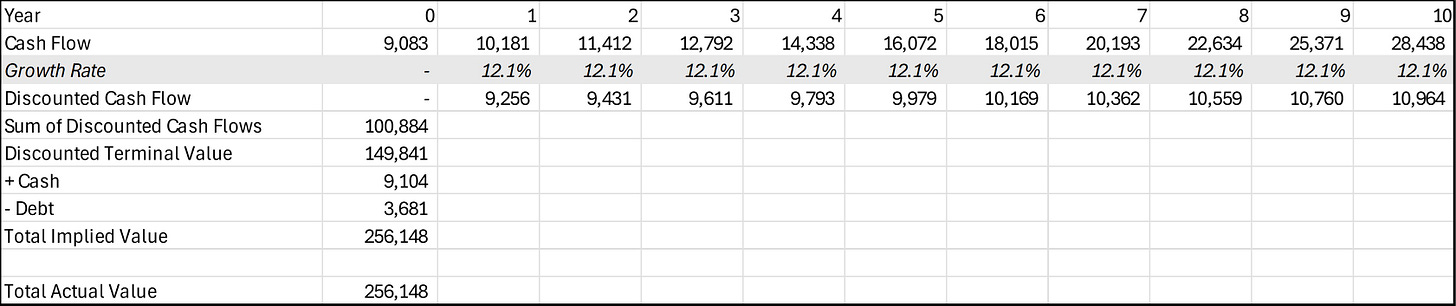

Despite all this, the stock is down 30% over the past year. That doesn’t immediately make it cheap, but it’s worth a closer look. At a 10% required return, ASML needs to grow free cash flow by roughly 12% annually over the next decade to justify today’s price.

Not a clear bargain, but for a monopolistic business with pricing power, that’s a reasonable bet.

Premium Breakdown

ASML isn’t the only company with real pricing power trading at a discount. Below, we’ll cover:

Two businesses with strong pricing leverage

That both have traded sideways despite improving fundamentals

And a quick reminder: the 30% launch discount on the annual subscription ends this week. With it, you’ll unlock:

Three in-depth Investment Theses (and more each month)

A growing library of premium posts like this one

Full access to Summit’s Analytics, our stock research tool built for long-term investors.