Welcome to the February 2025 Portfolio Letter.

Well, we’ve come back down to Earth. The markets had a fairly rough month, and the portfolio performed worse.

Amazon, my biggest position, dropped 10.5%, and Salesforce fell after its earnings report.

But while stock prices were down, the underlying businesses weren’t. Yes, Amazon and Salesforce issued weaker-than-expected guidance, but I believe making buy or sell decisions based on near-term analyst estimates is foolish.

Amazon’s decline continued amid all the macroeconomic noise—with buzzwords like “tariffs”, “consumer sentiment”, and “bearish data” showing up all too often. I’m unimpressed.

Originally, I planned to increase my Basic-Fit position, but I ended up buying more Amazon at around $215 instead. I’m still interested in buying more Basic-Fit and still have some cash at hand.

Year-to-date, the portfolio is down just 0.5%.

The only bright spot this month was Airbnb, up 5.7% thanks to a strong earnings report. Meanwhile, Salesforce, Amazon, and Sanlorenzo fell 13%, 10.5%, and 9.1%, respectively.

This month, I published two stock Deep Dives:

Both companies are fascinating in their own ways, but I find Texas Roadhouse particularly compelling. It’s an easy-to-understand restaurant chain with strong unit economics and unique competitive advantages. The stock’s current valuation doesn’t appear too demanding.

The only transaction this month was the purchase of three additional Amazon shares at an average price of $215. While already my largest position, I have strong conviction in the company and see price drops like this as opportunities.

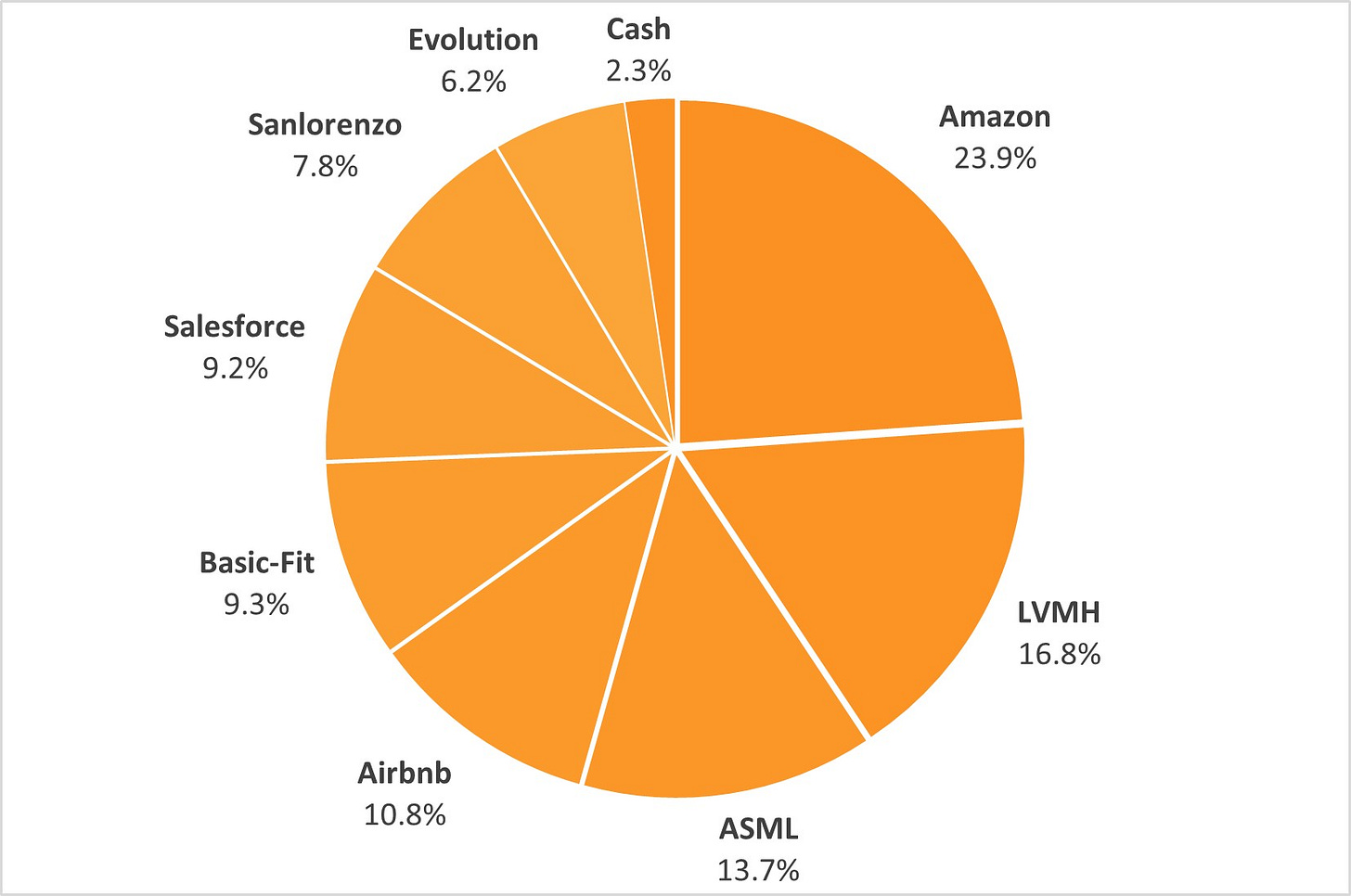

There were no other transactions—just how I prefer it. The portfolio now looks like this:

Despite adding more Amazon shares, the position remains the same size as last month.

As I write this, I’m also working on a post about Salesforce, covering its recent earnings and current valuation. The stock’s recent weakness could be an opportunity—but no conclusions yet.

Lastly, in last month’s Portfolio Letter, I mentioned introducing a premium tier for subscribers. I’ll be sharing more details in a separate post soon, and I’m really excited about it. I think the next phase of Summit Stocks is going to be great.

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.