Evolution’s Back on Track and the Valuation’s Still Cheap

Evolution: Q2 results and updated valuation

Evolution shares jumped 8% after its Q2 results.

And it wasn’t entirely unexpected.

In my recent valuation post covering both Evolution and Novo Nordisk, one Evolution share was trading around 753 SEK, near the bottom of my valuation range. Asymmetry was clear.

Heading into this report, expectations were low (they still are). But the business is handling its challenges well.

Let’s unpack the results and look at today’s valuation.

Evolution Second-Quarter Results

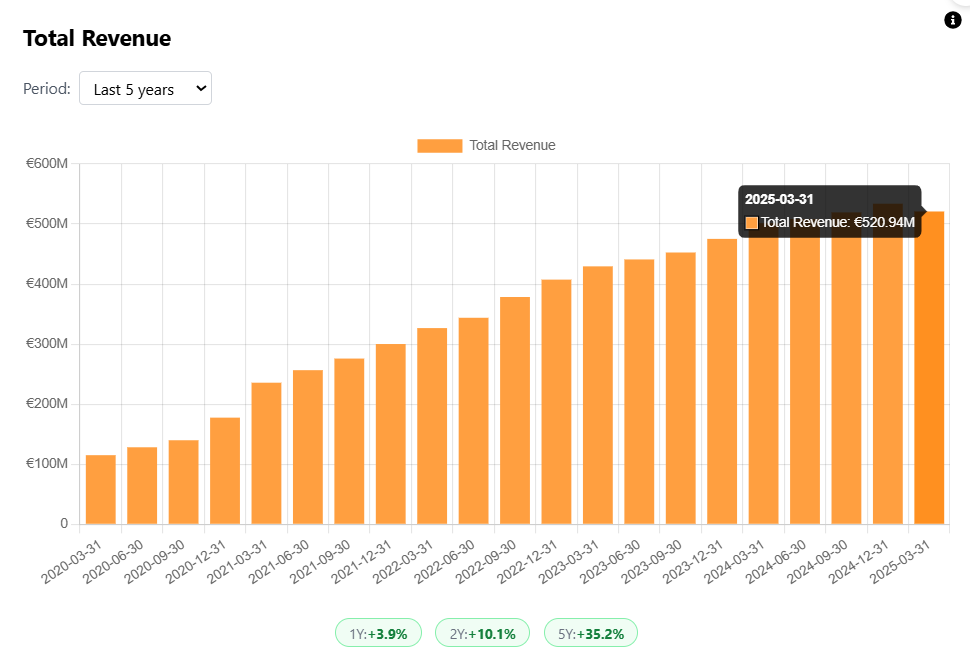

Revenue came in at €524.3 million, up 3.1% year-over-year, or 8.8% in constant currency. Still not spectacular, but solid given the circumstances, and clearly good enough to relieve investors.

Expectations going into the quarter were low. Cyberattacks in Asia, regulatory ring-fencing in Europe, structurally shrinking margins, and last year’s employee strikes had all weighed on sentiment.

Even so, Evolution delivered a set of numbers in line with expectations. But CEO Martin Carlesund didn’t sugarcoat:

“To be clear though, we are not satisfied with this quarter’s growth, and we are working hard to increase the pace.”

Carlesund’s direct language and honesty continues to be refreshing. Also, he bought 100,000 shares in June at ~670 SEK. He’s already up over 25%. Well done, Martin.

Regional Breakdown

Asia

Revenue was €209.1 million, up 3.6% YoY. This was a positive. Evolution continues to roll out countermeasures against cybercrime, and traction is improving. The first Asian studio just opened in the Philippines, another step forward.

Carlesund compared the hijacking problem to illegal sports streaming in Asia. This isn’t a company-specific problem, but it did catch Evolution off-guard. The countermeasures are improving, and once stabilized, Asia should improve.

Europe

Revenue fell 5.8% to €180.2 million. This was the weakest region. But the poor performance is self-inflicted. In Q1, Evolution began restricting certain markets to reduce grey-market exposure. It improves the quality of revenue and gets ahead of regulatory change.

Yet the negative effect of ring-fencing has been greater than management had expected.

Still, with expectations already low, I believe this is the right time to act.

North America

Revenue jumped an impressive 22.8% to €73.9 million—the fastest-growing region by far.

Most companies look to emerging markets for growth and rely on the U.S. for cash flow. For Evolution, it’s the other way around. Just seven U.S. states have legalized iGaming. Evolution is barely getting started.

A new deal with Bally’s Corporation in Rhode Island adds another state. The pending Galaxy acquisition (RNG business) will further strengthen U.S. exposure.

Latin America

Revenue came in at €37.6 million, up 2.8%. Brazil’s transition to a regulated market is underway. Management expects activity to ramp up as players and operators adapt. The new São Paulo studio is now live.

Despite players and operators needing to “adapt,” growth here seems underwhelming. Let’s hope management speaks true and growth will pick up in the second-half this year.

Other

Revenue was €23.4 million, up 20%. Evolution sees strong long-term potential in the region (mostly Africa).

Margins and Cash Flow

Operating income was €306.4 million, down 1.5% YoY. EBITDA came in at €345.3 million, with a 65.9% margin, just below the full-year guidance range of 66-68%, which remains unchanged.

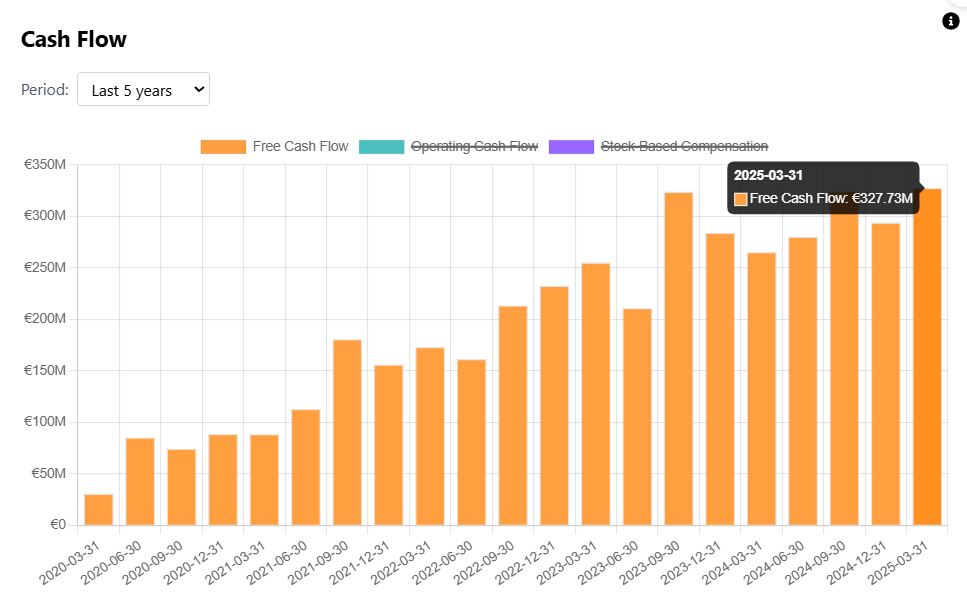

Free cash flow was €192.3 million, weaker due to seasonal tax payments and a working capital-build up. Management expects normalization next quarter.

Capex guidance is unchanged at €140 million, as well as the intention to repurchase €500 million in shares.

Overall, Evolution is doing the right things. Cybersecurity in Asia is being addressed. Ring-fencing in Europe is hurting today but will ultimately lead to higher quality revenue streams. And the potential in North America, Latin America, and even Africa remains huge.

Premium members were notified earlier this month of my intention to add to Evolution. Since then, the stock is already up ~12%. It’s a short time-frame, but the business is moving in the right direction. And over time, the stock should follow.

But now that we’re up off the May low, what’s Evolution worth today?

What’s Evolution Worth Today?

This earnings report doesn’t change the thesis.

And the thesis is simple: Evolution no longer needs hypergrowth to be a great investment.

It’s now a cash machine with some of the best margins you’ll find anywhere.

The stock remains cheap—partly because it’s a sin stock, mostly because of its recent headwinds.

My prior valuation still stands: fair value is around 864 SEK, while my valuation range is somewhere between ~745 SEK and ~1,042 SEK. That’s based on conservative assumptions: revenue growth between 0% and 8%, plus margin compression.

At current levels, Evolution still trades near the low end of that range. It’s still an asymmetric bet: limited downside, meaningful upside. And anything above my assumptions? That’s pure optionality.

In other words, I still consider Evolution a good buy.

Thanks for reading.

Lucas

Author & Founder, Summit Stocks

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.