ASML Earnings and My Updated Valuation After the Q2 Drop

ASML: Q2 results and updated valuation

ASML dropped 11% after reporting Q2 results.

Revenue and margins were strong; above expectations. So what went wrong?

The issue wasn’t the numbers, but what management said. CEO Christophe Fouquet pulled back on near-term optimism, and that was enough to send the stock down.

Does this change the long-term thesis? Let’s unpack the results and update what ASML is worth today.

ASML Second-Quarter Results

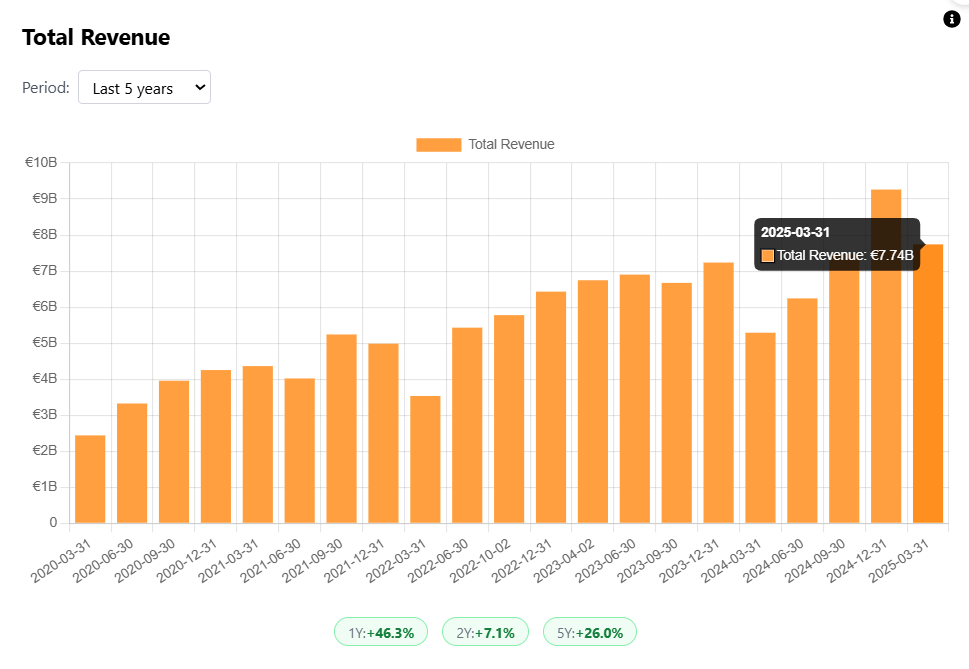

ASML reported Q2 net sales of €7.7 billion, hitting the upper end of guidance (€7.2-7.7 billion). This was driven by the recognition of revenue from one High NA system and higher-than-expected upgrade activity.

System sales came in at €5.6 billion, split between €2.7 billion in EUV and €2.9 billion in non-EUV. Installed Base Management reached €2.1 billion.

Gross margin was strong at 53.7%, above guidance (51-53%). This was supported by the higher-than-expected upgrades, one-off cost benefits, and lower-than-expected tariff impacts. These positives were partially offset by the High NA system, which carries lower margins.

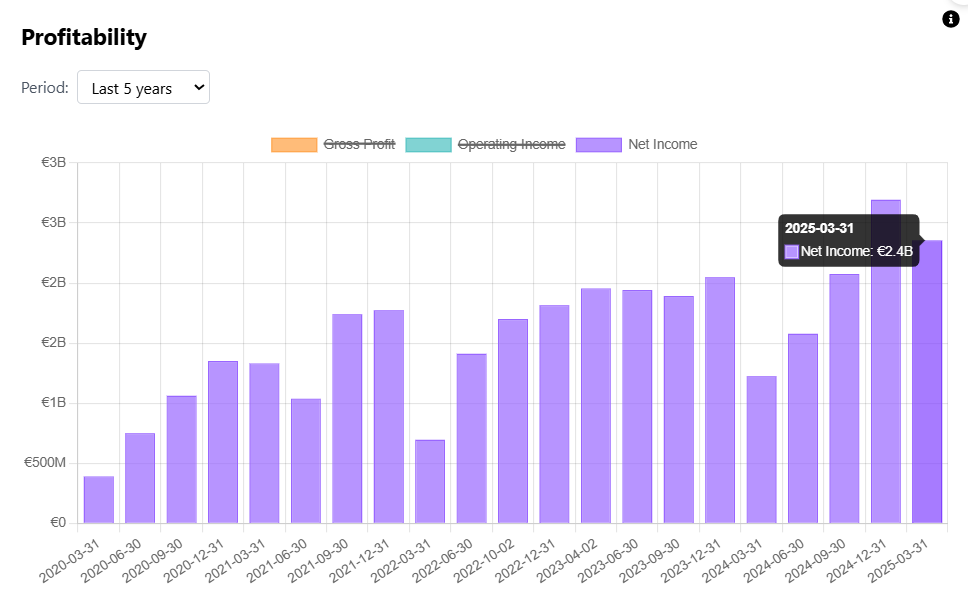

Net income for the quarter was €2.3 billion, translating to a net margin of 29.8%.

Bookings were €5.5 billion, up from €3.9 billion last quarter. Backlog remains strong at around €33 billion. And while bookings came in much higher than last quarter, this is a volatile metric that can drastically change quarter-to-quarter. That’s also the reason why ASML will stop providing bookings on a quarterly basis starting in 2026.

EUV continues to play an increasingly important role, especially in AI-related demand. DRAM customers have reported using more EUV layers in both current and upcoming nodes. Management expects full-year EUV revenue to grow by 30%, while Installed Base Management revenue is guided to grow 20%, supported by a growing installed base.

For the full year, ASML narrowed down its guidance from €30-35 billion revenue to 15% growth, implying €32.5 billion revenue, right at the midpoint. Additionally, the company expects a gross margin of around 52%.

For Q3, the company expects revenue of €7.4-7.9 billion, including about €2 billion from Installed Base Management, and a gross margin of 50-52%.

Longer term, ASML reaffirmed its 2030 targets: revenue of €44-60 billion with gross margins of 56-60%.

Now, the market fixated on 2026.

This is why ASML dropped 11%: Management said it’s still preparing for growth in 2026, but didn’t confirm growth was guaranteed. Their tone was cautious. When asked why, the answer was straightforward: macro and geopolitical uncertainty, not a deterioration in fundamentals.

Specifically, customer conversations have become more cautious over the past 90 days. Tariff discussions—especially around U.S. expansions—have introduced uncertainty around capital expenditures. Some customers are more optimistic than others, but the overall visibility of demand has declined.

Still, ASML emphasized that underlying fundamentals remain strong. CEO Christophe Fouquet pointed to geopolitical uncertainty as the main reason for hesitation, not a lack of end-market demand.

“I think the way this [geopolitics] will get solved in the next few months is very, very important to bring back both stability, confidence, et cetera, et cetera, to our customers. So hopefully, this is a short-term discussion.”

Here are my thoughts on the sell-off: the market sold off on the 2026 ambiguity, but this doesn’t break the thesis. In fact, long-term guidance remained intact, which is what matters most. ASML is exercising caution due to factors entirely outside its control. This isn’t about weakening demand or deteriorating execution. The dip looks more like external noise rather than a meaningful change in direction.