A Buffett Buy with Recurring Revenue, a Wide Moat, and Long-Term Tailwinds

Pool Corp ($POOL) Investment Thesis

Pool Corporation (POOL) is the largest wholesale distributor of swimming pool supplies and equipment in the world.

It dominates the U.S. market, where there are around 11 million pools, each one needing regular maintenance, replacement parts, and occasional upgrades.

That’s where Pool comes in.

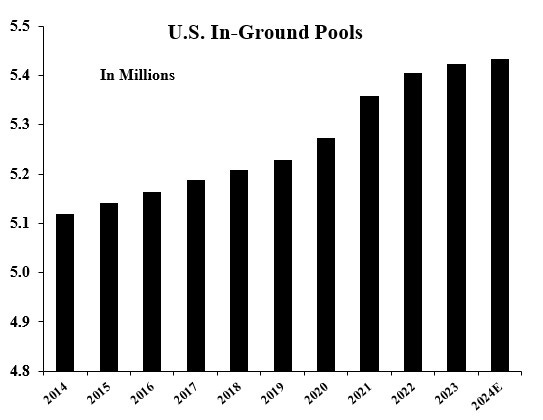

The number of pools grows every year. This is a secular trend that Pool’s been riding for decades.

But you wouldn’t know that from looking at the stock. Over the last five years, POOL has returned just 12%. Meanwhile, the S&P has doubled.

So what happened?

COVID-19.

During the pandemic, Americans were stuck at home with more discretionary income than usual. And so they built pools. Sales of pool equipment, chemicals, and related products surged. But the demand was pulled forward. Growth stalled, and the narrative flipped.

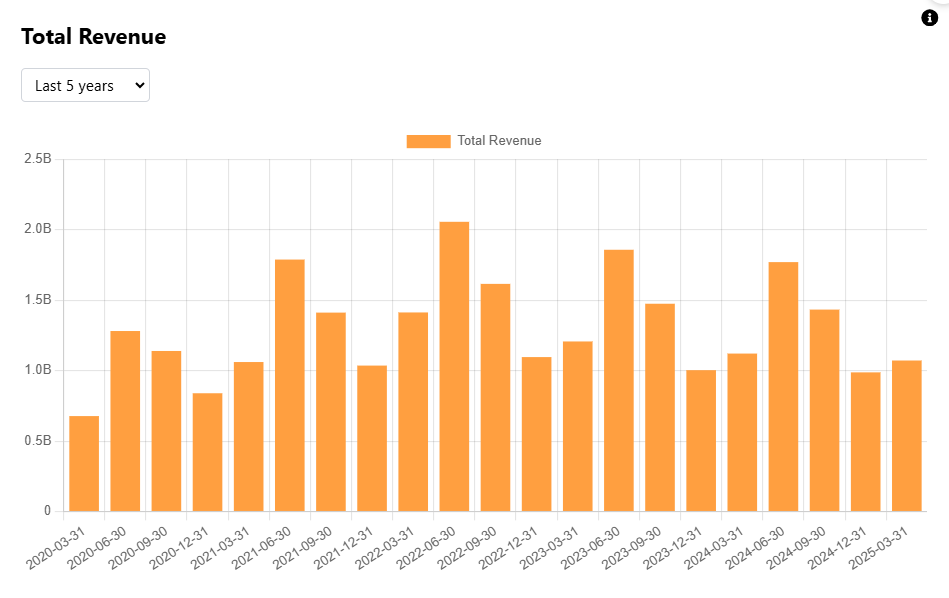

Revenue has been flat since 2021. And the market’s left Pool behind.

Which brings the opportunity.

Even Warren Buffett sees it: Berkshire started buying shares at the end of 2024 and into early 2025. Today, Pool trades at a free cash flow yield above 5%.

Underneath the current slowdown lies a compounding machine: one with high returns on capital, recurring revenue, pricing power, and a real moat.

Now that the stock’s gone nowhere, this is the perfect time to take a closer look.

What You’ll Read Today

History

Business Model

Industry Overview

Moat

Key Financials

Capital Allocation & Management

Valuation

History

Pool Corp was founded in 1980 by Frank St. Romain, a lifelong veteran of the swimming pool industry. Frank began working in wholesale pool distribution in 1959. When the company he worked for was acquired by a conglomerate, he decided to strike out on his own. Together with business partner Richard Smith, he launched South Central Pool Supply in New Orleans.

Growth in the early years was modest but steady. The company slowly expanded its network of sales centers—which are essentially localized distribution hubs—targeting swimming pool builders and remodelers, independent retail stores, and service and repair companies. Frank and Richard quickly built a reputation for strong service, reliable support, and offering the right products to the right people.

In 1993, South Central Pool Supply was acquired by a venture capital firm that saw a clear opportunity for growth, primarily through acquisitions. Wilson B. “Rusty” Sexton, who had joined three years earlier, became CEO. Frank stayed on as COO, running day-to-day operations. Richard had already stepped away, opening a family-run retail business in 1990.

The company went public in 1995 under the name SCP Pool. The IPO raised capital to accelerate its acquisition strategy. That same year, Pool acquired Orcal Pool Supplies (9 sales centers), Aqua Chemical Sales and Delivery (1 center), Crest Distributions (2 centers), Steven Portnoff (1 center), and Pool Mart of Nevada (1 center).

Following the IPO, Manuel “Manny” Perez de la Mesa joined as COO and would go on to serve as CEO for 20 years. Frank retired in 1999, ending a 40-year career in the industry he helped shape.

By 2000, SCP Pool operated 103 sales centers, generating ~$670 million in revenue, up from ~$161 million in 1995.

In 2000 and 2001, the company acquired Superior Pool Products (19 sales centers) and the pool division of Hughes Supply (26 sales centers).

With these acquisitions, Pool established a second distribution network: Superior Pool Products. At the time, the original SCP network operated 132 sales centers.

Pool adopted this dual-network strategy for two reasons:

To give customers a choice between distributors, each with distinct supplier relationships and product selections

To drive better customer service by fostering healthy internal competition.

This tells you a lot about the company’s culture. Efficiency is important, but not at the expense of execution. Rather than centralize everything under one network, Pool has long tolerated and even encouraged internal competition to sharpen customer service and tailor offerings to different types of customers.

Today, Pool operates through five distinct distribution networks.

The Great Financial Crisis tested the business, but Pool held up better than most, despite being a cyclical business. Revenue fell from $1.93 billion in 2007 to $1.54 billion in 2009, but gross margins remained intact. Pool’s products are not as discretionary as you might assume—an idea I’ll return to later.

After the GFC, growth picked up right where it left off.

In 2018, Manny retired after an exceptionally successful run. He was succeeded by Peter Arvan, who had joined the company a year earlier. Peter remains CEO today.

While he didn’t come from the pool industry, his background is deeply rooted in distribution. He served as CEO of Roofing Supply Group and spent over a decade at GE in supply chain leadership roles. So far, he’s led Pool in the right direction.

Today, Pool Corp operates 448 sales centers, generates over $5.3 billion in revenue, produces ~$600 million in free cash flow.

Business Model

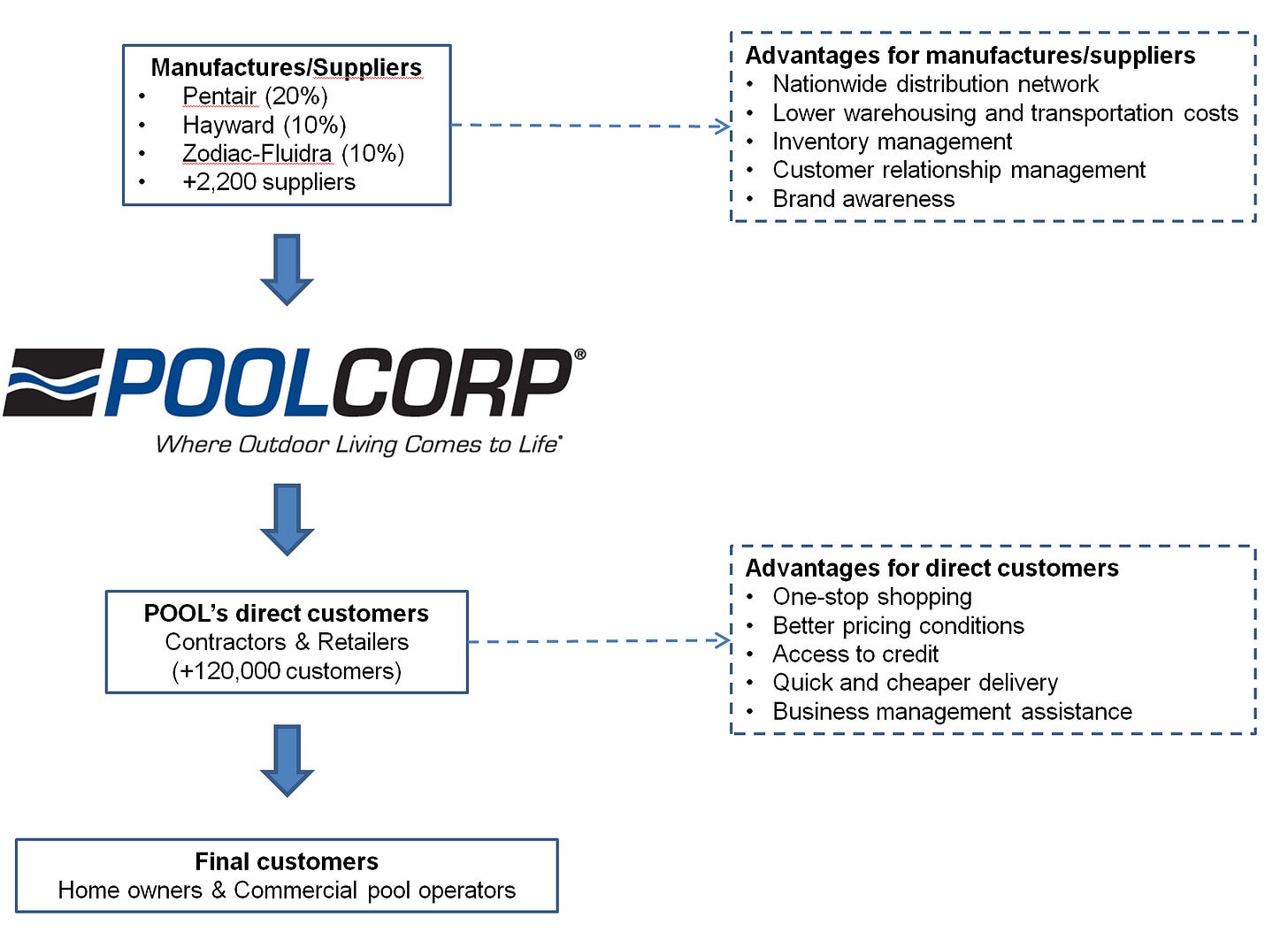

Pool Corp is the leading wholesale distributor of swimming pool supplies and equipment. Its core function is supply aggregation: it purchases products from over 2,200 manufacturers and distributes them to a fragmented, undercapitalized customer base across North America and select international markets.

The company serves roughly 125,000 customers. Most are small, family-owned businesses with limited capital—too small to purchase directly from manufacturers or hold meaningful inventory.

Pool’s three primary customer groups are:

Pool builders and remodelers

Pool service and repair companies (i.e. the “pool guy”)

Independent specialty retail stores

On the supply side, Pool has over 2,200 vendors. The three most important are Pentair, Zodiac Pool Systems, and Hayward Pool Products, accounting for 20%, 12%, and 11% of cost of goods sold in 2024, respectively.

These manufacturers partner with Pool because it offers unmatched distribution, lower logistics costs, and direct access to consumers.

Pool’s customers stick with Pool for its breadth of product, reliable service, and competitive pricing. It’s a rare situation where everyone benefits.

Across 440+ sales centers, the company sells over 200,000 products, including:

Maintenance products: chemicals, supplies, accessories

Repair and replacement parts: cleaners, filters, heaters, pumps, lights

Building materials: concrete, plumbing, electrical, decking

Construction equipment: pumps, skimmers, plumbing kits for new pools

Irrigation and turf care: system components, fertilizers, sprayers

Fiberglass pools and hot tubs

Outdoor living products: grills, kitchen components, lighting, fire pits

So this isn’t just a pool company. It’s an all-in-one outdoor product distributor, with the most comprehensive offering in the industry.

Critically, roughly 65% of revenue is non-discretionary, tied to maintenance and minor repair of existing pools. This is the best part of the business.

Pool ownership isn’t passive. Water chemistry needs constant attention. Let chlorine or pH levels drift, and the pool becomes unusable. When pumps, filters, or heaters break, they need to get replaced immediately. Pools are constantly exposed to the elements, causing wear and tear, and needing regular cleaning.

All of this creates steady and recurring demand. Pool owners—whether private, public, or commercial—need access to chemicals and replacement parts year-round. That revenue shows up regardless of the macro environment.

That said, revenue is seasonal. The weather matters. Hot, dry summers boost sales. Cold or rainy quarters drag them down. Q2 and Q3 are consistently the strong quarters.

Back to recurring revenue: as the installed base of pools grows, so does Pool’s core revenue stream. Think of it like Apple’s services business. The more pools exist, the more Pool earns.

That installed base has been growing steadily, with a boost in 2021 due to COVID. Long-term drivers of this trend include:

Ongoing housing growth in the southern U.S.

Low housing turnover leading to more renovations and upgrades

Consumers bundling pools with outdoor kitchens, landscaping, etc.

The business is concentrated where the climate is most favorable. In 2024:

96% of revenue came from North America (including Canada and Mexico)

4% from Europe, and less than 1% from Australia

Most importantly, 54% came from just four states: Florida, California, Texas, and Arizona

Pool operates through five distribution networks:

SCP & Superior: Core wholesale pool supply

Horizon: Irrigation and landscaping

NPT: Design-focused products (tile, decking, finishes)

Sun Wholesale: Franchise supply for Pinch A Penny retail stores

Sales centers function as B2B warehouse hubs, located near customer concentrations. Most carry high levels of inventory, enabling same-day pickup or next-day delivery. Some feature showrooms for product selection. Four centralized shipping locations in the U.S. act as distribution hubs, redistributing to the sales centers or, in some cases, delivering directly to customers.

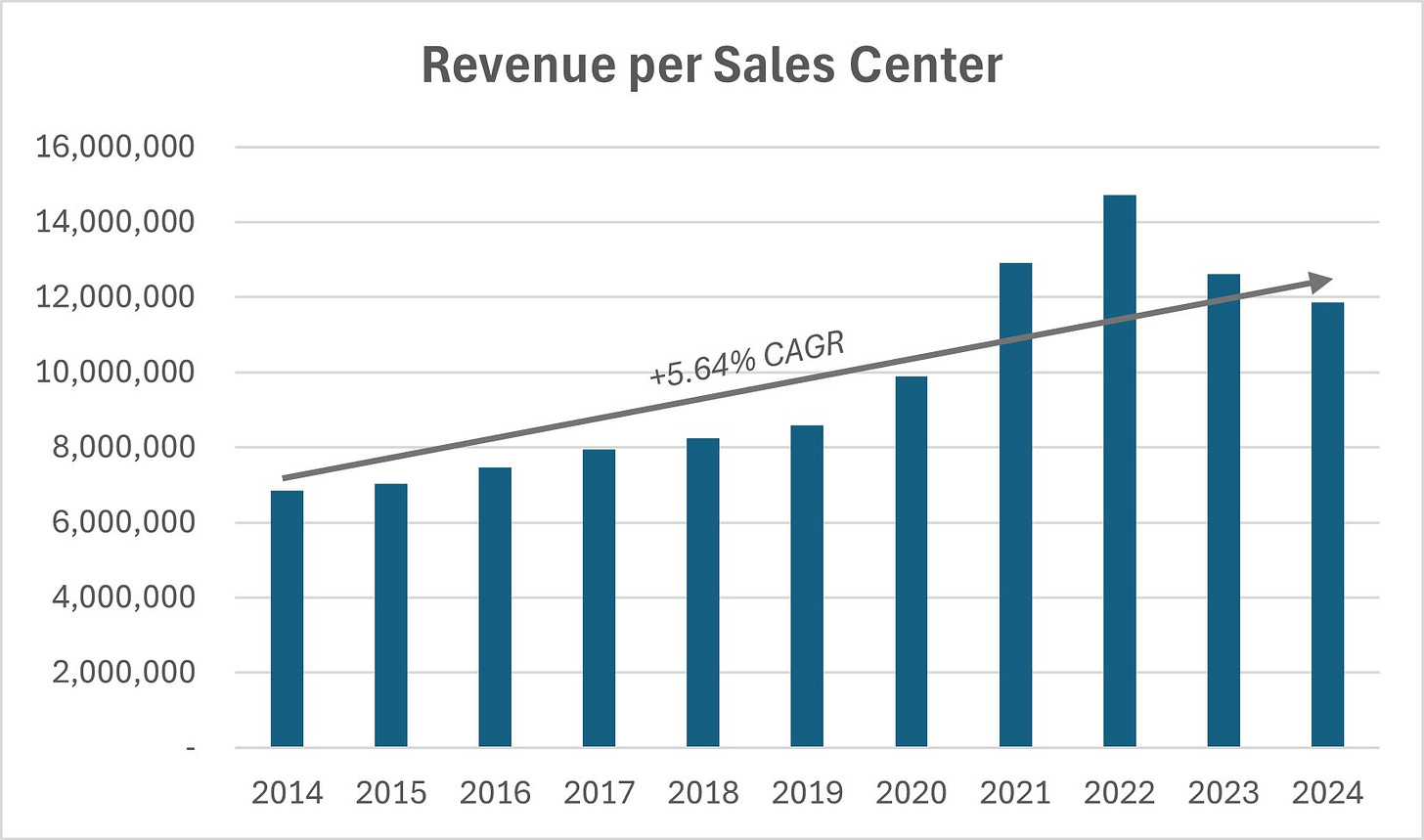

What sets Pool apart is not just the size of its network, but how well it performs. Since 2014, revenue per sales center has grown at nearly 6% CAGR, outpacing the more modest ~3% growth in center count. That implies improved utilization of each sales center.

Each sales center is evaluated using financial and operational KPIs. Performance is decentralized, with autonomy and internal competition encouraged. Combined with scale benefits like vendor rebates and early-buy discounts, as well as private-label products, Pool maintains strong unit economics.