Salesforce Full-Year Results And My Thoughts

Weak guidance and market fear presents an opportunity

Salesforce released its full-year results last week, and the market response was one of disappointment. Investors are concerned about single-digit growth, and the company’s guidance for FY26 points to a slowdown.

In this article, I’ll break down the earnings release and share my opinion on Salesforce.

What You’ll Read Today

Full-Year Results

Thoughts On Salesforce

Updated Valuation

Full-Year Results

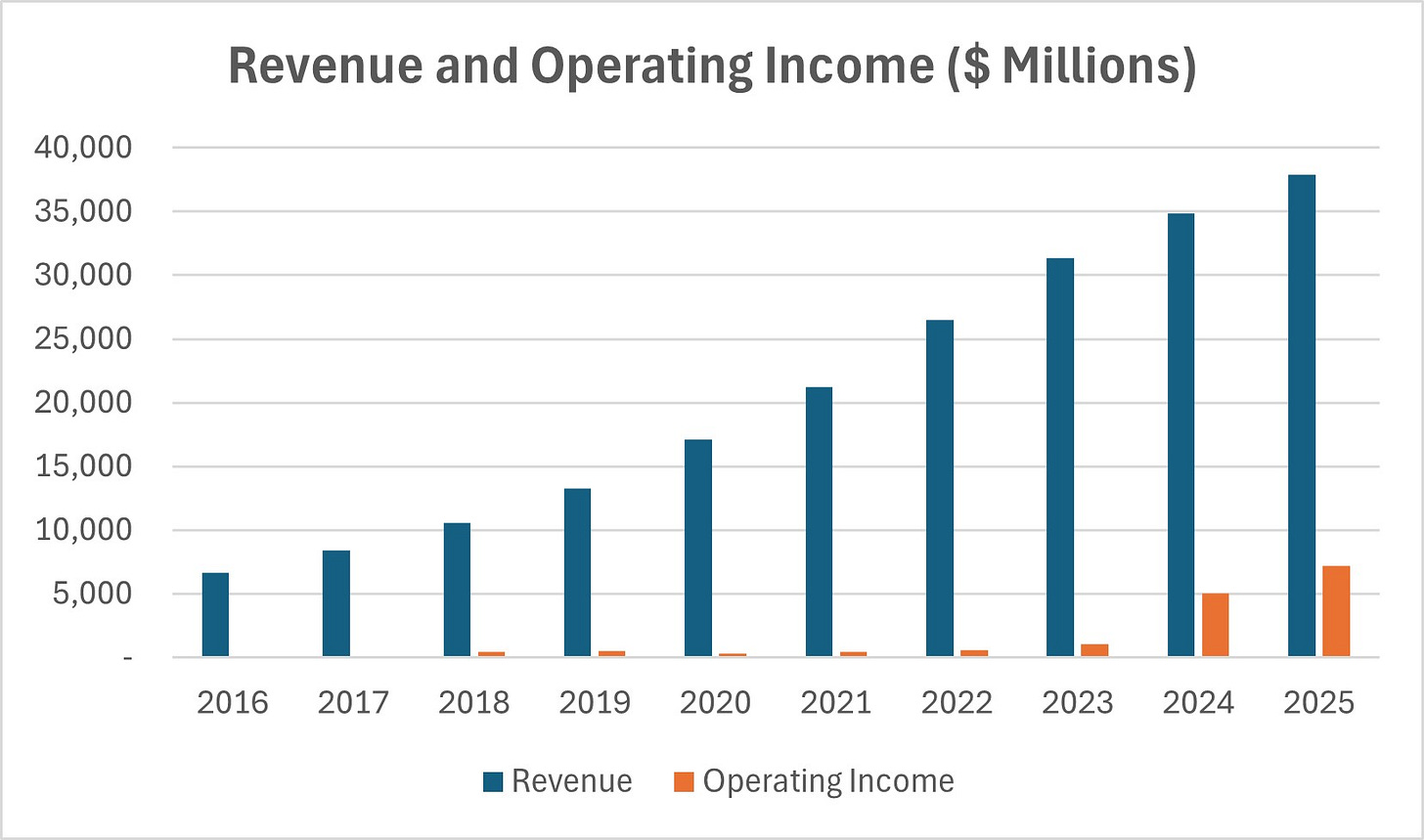

On February 26th, Salesforce reported its first-ever $10 billion quarter, with Q4 revenue growing 8% year-over-year. Full-year revenue for FY2025 was $37.9 billion, an increase of 9%. The company delivered strong profitability, with operating cash flow of $13.1 billion, up 28%, and an operating margin of 19%, expanding 460 basis points. Free cash flow for the year was $12.4 billion, or $6.5 billion when adjusted for stock-based compensation and acquisitions.

For FY2026, Salesforce is guiding for revenue between $40.5 billion and $40.9 billion, representing 7-8% growth—lower than some investors expected. The company anticipates only a modest revenue contribution from Agentforce in FY2026, with a more meaningful impact expected in FY2027. Salesforce expects an operating margin of 21.6%, implying operating profit of $8.7 billion to $8.8 billion.

CEO Marc Benioff highlighted Agentforce, along with Salesforce’s AI products such as Data Cloud, as potential multibillion-dollar businesses. Currently, AI and Data Cloud generate $900 million in ARR, growing at 120% year-over-year. Just 90 days after launch, Agentforce has already gained 3,000 paying customers.

Benioff emphasized that Agentforce is enhancing every core Salesforce product, and while the company is seeing productivity gains internally, it plans to expand its sales organization by 10-20% to support the growing demand for AI-driven transformation.

Thoughts On Salesforce

Salesforce is clearly entering a more mature phase, with future growth increasingly reliant on margin expansion rather than revenue growth. While high single-digit growth combined with improving margins often makes for a solid investment, the shift from growth to efficiency should be closely examined.

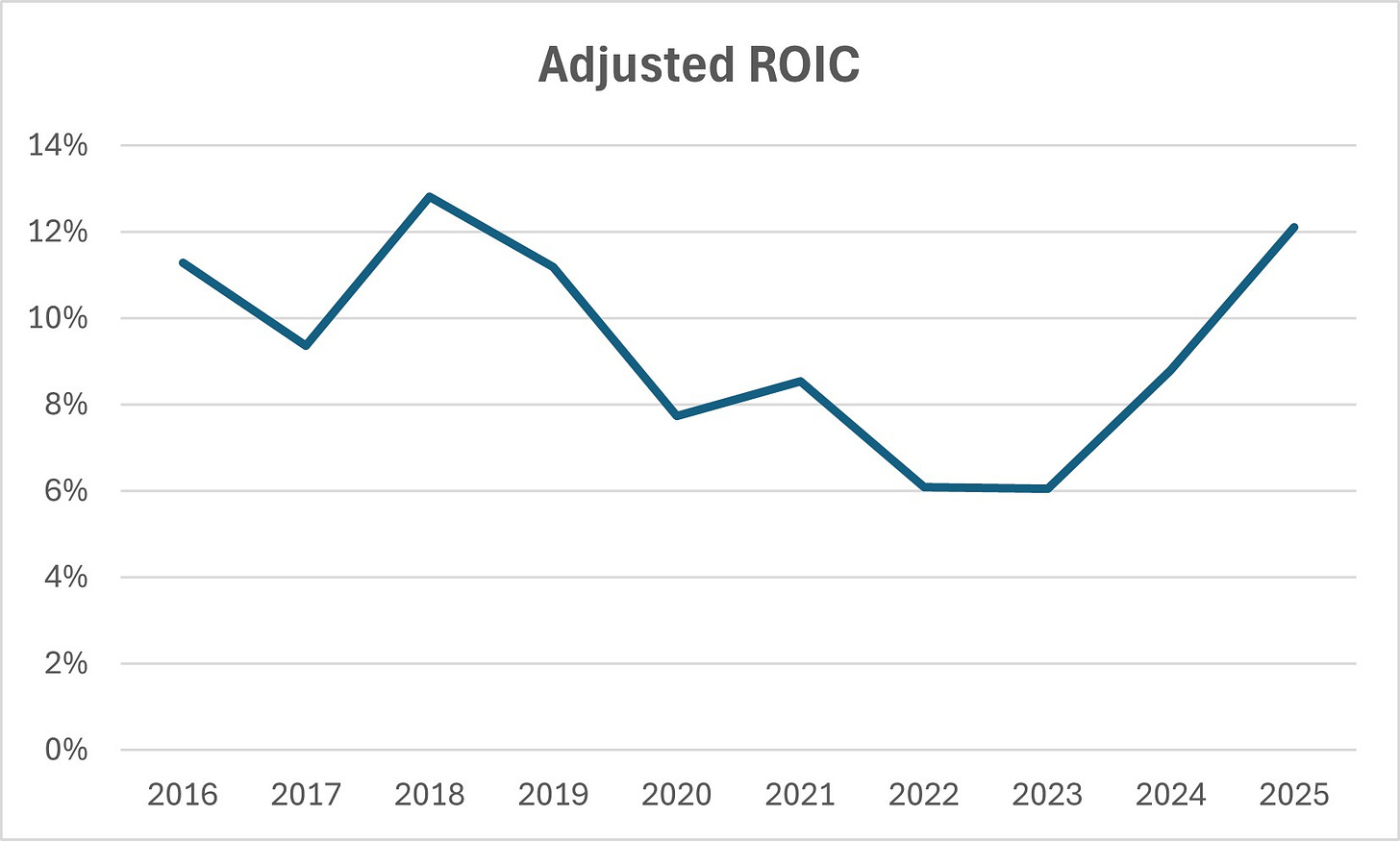

Since 2022, adjusted ROIC has been steadily rising, driven by stronger profitability, while invested capital has remained largely flat over the past four years.

On one hand, this indicates greater operational efficiency; on the other, it may suggest a lack of reinvestment, which could limit future growth. A closer look at invested capital components reveals it’s a mix of both:

Capitalized R&D continues to rise, signaling ongoing product development.

SG&A has remained flat, though plans to expand the sales organization are encouraging.

Working capital has steadily declined, reflecting operational efficiencies.

Goodwill has only gradually increased, with Salesforce shifting to smaller, vertical acquisitions instead of major deals like Slack and Tableau.

Goodwill remains the largest component of invested capital, but I expect its relative share to decline over time. With fewer horizontal acquisitions, growth is also likely to moderate, as organic expansion is naturally slower than acquisition-fueled growth.

A key sign of lower reinvestment is how Salesforce’s allocates its cash flow. While R&D and SG&A are still significant expenses, a large share is being returned to shareholders. In FY2025, Salesforce allocated $7.8 billion to share buybacks and $1.5 billion to dividends—a clear shift in priorities. Encouragingly, most buybacks occurred in Q2, when the share price was under pressure.

That said, Salesforce hasn’t stopped investing. Sales and marketing (S&M) remains a major expense, driven by high customer acquisition costs. Winning large customers is expensive due to the need for relationship-building, integration, and onboarding, but once acquired, customers generate significant lifetime value through upselling, cross-selling, and high switching costs. This justifies the company’s continued heavy S&M spending.

Salesforce’s focus has shifted from expanding its product suite to refining and improving existing offerings while attracting new customers. Large acquisitions are no longer essential, though I wouldn’t rule out the possibility entirely. At this stage, however, Salesforce appears more focused on optimizing operations rather than making another transformative deal.

Updated Valuation

I’ll not approach Salesforce with an extensive DCF model—it doesn’t seem necessary. A simple 10-year reverse DCF at a 10% discount rate implies the company must grow its free cash flow (excluding stock-based compensation adjustments) by 13% annually. Extending the forecast to 20 years lowers the implied growth rate to 9%.

The key question is whether revenue growth will be strong enough to sustain this level of free cash flow growth.

Salesforce’s FY2025 free cash flow margin was 26%. If this improves—especially with operating margins expected to rise by 260 basis points in FY2026—Salesforce looks like a great investment.

Taking it a step further, let’s assume no significant future acquisitions. Based on company guidance, FY2026 operating cash flow should be around $14.6 billion. Assuming capex of $800 million (compared to $658 million in FY2025 and $736 million in FY2024), free cash flow would be about $13.8 billion—equating to a 5% free cash flow yield. To justify today’s price, free cash flow would need to grow 6% annually over the next 20 years or 9% over the next 10. That doesn’t seem excessive.

Recent share price weakness could present a great opportunity if you believe Salesforce will be able to grow revenue at high single digits. I think the company will manage, which is why I purchased more Salesforce shares. I’ll share more details in the next Portfolio Letter.

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.