Stock Deep Dive - Duolingo

The EdTech giant with high growth, strong returns, and a long runway ahead

Welcome to another edition of Deep Dives.

I’m sure you’ve heard of Duolingo—the wildly popular language-learning app was named “Marketer of the Year” in 2024, and millions of people use the app on a daily basis to improve their linguistic skills.

The company is growing fast, with revenue surpassing $740 million in 2024. In this deep dive, we’ll explore what makes Duolingo unique and whether it’s a compelling investment opportunity. (Spoiler: it probably is)

What You’ll Read Today

Duolingo’s History

Duolingo’s Business

Products

Moat

Key Financials

Management

Conclusion

Risks

Valuation

Duolingo’s History

Duolingo began as an academic project at Carnegie Mellon University in 2009, founded by professor Luis von Ahn and his graduate student Severin Hacker. Both wanted to work on something related to education and saw a clear opportunity in language learning. Recognizing that most language learners often lack the financial resources, they saw a gap in the market—traditional language learning was expensive, leaving many people without access.

Von Ahn grew up in Guatemala and witnessed firsthand how access to high-quality education could change lives. That belief became the foundation of Duolingo and remains central to the company’s mission today:

“Our mission is to develop the best education in the world and make it universally available.”

The Duolingo app launched in 2012 with a waiting list of around 500,000 people. A year later, it had grown to 5 million users and became the No. 1 free education app on the Google Play Store. Over the following years, Duolingo went through multiple rounds of funding before going public in 2021.

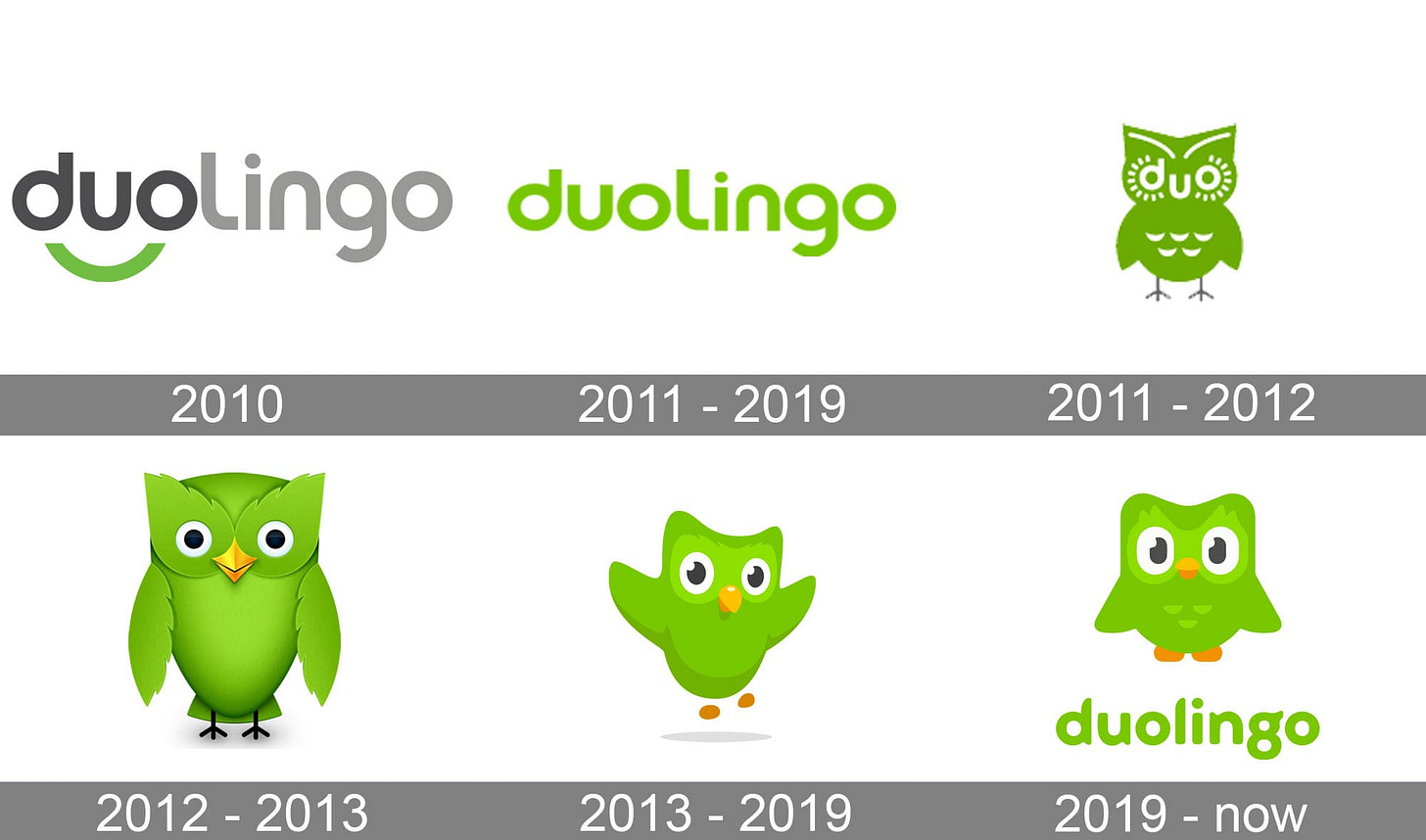

Today, Duolingo has over 116 million active users and offers courses in over 40 languages. The company has since expanded beyond languages, introducing subjects like math and music. Its iconic mascot, Duo the Owl—symbolizing knowledge and given the color green to tease Hacker, who hated green—has evolved alongside the company.

Both Von Ahn and Hacker remain at the company today, with Von Ahn as CEO and Hacker as CTO.

Duolingo’s Business

Products

Duolingo operates through a single business segment—its flagship app—where users can learn languages, math, and music in over 40 languages. Language courses, however, are by far the most important product, with math and music as new initiatives. The following product overview will focus on the language courses, and I’ll briefly talk about math and music later.

The company follows a freemium business model, generating revenue through subscriptions, advertising, in-app purchases, and more. All of Duolingo’s courses, however, remain completely free. Users can access and complete courses without any paywalls, a strategy used for two key reasons:

The more users on the platform, the greater the word-of-mouth effect, fueling organic growth with minimal marketing costs.

Over a billion exercises are completed daily, providing Duolingo with massive amounts of data to refine engagement and enhance learning experiences.

Free users still contribute to revenue through ads and in-app purchases.

For those who choose to subscribe, Duolingo offers two premium options:

Super Duolingo

This subscription enhances the learning experience with:

No ads

Unlimited “Hearts” (removing restrictions on making mistakes)

Mistake review

Additional features to support learning

Duolingo Max

Duolingo Max includes all the benefits of Super Duolingo, plus AI-driven features:

Personalized feedback on answers

Roleplay with Duolingo characters to practice real-world conversations

Video call with Lily to engage in on-demand video conversations with one of Duolingo’s characters, Lily.

Beyond its app, Duolingo also offers the Duolingo English Test (DET)—a low-cost, internet-based language proficiency exam. The test is accepted by over 5,600 educational programs worldwide, including top schools such as Yale, Stanford, and MIT, which is what makes it valuable for learners in the first place.

Finally, Duolingo offers Duolingo for Schools, a web-based tool making it easier for teachers to use Duolingo in a structured learning environment, and Duolingo ABC, an app that teaches young children early literacy skills.

The courses are created through a combination of in-house experts and volunteer contributions. The fact that volunteers contribute to a multibillion-dollar company highlights the strength of Duolingo’s mission-driven culture.

All Duolingo courses align with the Common European Framework of Reference for Languages (CEFR), ensuring learners progress through recognized proficiency levels.

A key differentiator of Duolingo’s courses is its gamification approach. Unlike traditional courses, Duolingo is designed to feel more like a mobile game than a strict educational product. Lessons are bite-sized, engaging, and structured to keep learners coming back.

Key features that set Duolingo apart from traditional methods:

Personalization

The app adjusts lesson difficulty based on each learner’s progress. Duolingo always aims to strike a balance between the familiar and more challenging content, as research shows giving learners the right level of difficulty—right at the edge of what they know—pushes them.

Interactivity

Duolingo is designed with interactive exercises, allowing learners to immediately use what they are learning. Learning-by-doing is Duolingo’s approach.

Friendly Competition

Leaderboards and streaks—part of the platform’s gamification—encourage a return to learning and give a sense of accomplishment.

Humor & Joy

The app is filled with joyful experiences and lighthearted content. Duolingo characters are cheerful, each with their own personality and backstories.

One might believe that Duolingo is a much less effective learning method, but that’s generally not true. There are many studies—both internal and independent—highlighting the effectiveness of Duolingo, some even showing the app is comparable to university-level learning, which is particularly impressive given that learners use Duolingo for just 5-20 minutes per day.

Duolingo’s subscriptions generate the majority of revenue (81% in 2024), while other revenue consists mainly of advertising, the DET, and in-app purchases.