Novo Nordisk Down 50% in Six Months: Is It Time to Buy?

Novo Nordisk operates in a rapidly growing industry, protected by meaningful patents

The past two weeks have been turbulent, to say the least. I haven’t written about the situation—not because it isn’t important, but because there’s already more than enough coverage on Trump, tariffs, markets rallying 10% in a day, and so on. I don’t think I can add anything valuable that hasn’t already been said.

Instead, I try to focus on the usual: finding high-quality companies, identifying buying opportunities, and monitoring my own portfolio. Uncertainty always brings one certainty: opportunities are more likely to show up.

One of those opportunities might be Novo Nordisk, the Danish pharma company known for its diabetes and weight-loss drugs. To be fair, the stock had been struggling well before the recent market panic. But now it’s down more than 20% in a month and nearly 50% over the past six months.

I usually avoid healthcare stocks. The industry is complex, unpredictable, and full of regulatory risk. The expiration of crucial patents can be devastating, and R&D spending doesn’t always lead to strong returns.

Yet Novo Nordisk has a unique market position and a strong track record. The company operates in an extremely rapidly growing space, and even with new competitors entering the market, Novo is expected to remain a leader.

In this post, I’ll take a closer look at Novo Nordisk—what it does, where the industry is heading, and whether the current stock price is too cheap to ignore.

What You’ll Read Today

Novo Nordisk at a Glance

Industry Outlook

Valuation

Novo Nordisk at a Glance

Novo Nordisk is a global leader in developing and manufacturing treatments for chronic diseases, including diabetes, obesity, and rare diseases. The company’s product portfolio is strongly focused on GLP-1 drugs and insulins.

Novo Nordisk’s GLP-1 treatments—marketed as Ozempic, Rybelsus, and Victoza—play a key role in managing type 2 diabetes by regulating blood sugar. These drugs help boost insulin production when blood sugar is elevated, addressing the insulin deficiency common in type 2 diabetes. In 2024, GLP-1 drugs generated 149 billion DKK, accounting for 51% of net revenue, with Ozempic being the primary contributor at 120 billion DKK.

In addition to its GLP-1 drugs, Novo Nordisk manufactures insulin products for both type 1 and type 2 diabetes patients, which are used by both type 1 and type 2 diabetes patients. Type 1 diabetes patients rely entirely on external insulin, as their bodies don’t produce it naturally. In 2024, insulin products generated 55 billion DKK, or 19% of net revenue.

For obesity care, Novo Nordisk markets Wegovy and Saxenda. Wegovy, a GLP-1 drug used specifically for weight loss, helps regulate appetite, leading to significant weight loss for patients. This product line generated 65 billion DKK in 2024, representing 22% of net revenue, with Wegovy contributing 58 billion DKK.

The company also develops treatments for rare diseases, including rare blood disorders and rare endocrine diseases. However, this segment remains very small, generating 19 billion DKK in 2024, with an operating margin of just 3.3%. For comparison, the diabetes and obesity care segment had an operating margin of 47%.

In total, Novo Nordisk generated 290.4 billion DKK in net revenue, marking another year of significant growth driven by the success of Ozempic and Wegovy. In recent years, GLP-1 drugs have gained widespread recognition for their effectiveness and safety, particularly in the treatment of obesity, which has only recently been classified as a chronic medical condition rather than a lifestyle issue.

Historically, insulin products were Novo’s main product, while this has shifted in recent years to GLP-1 drugs. Novo Nordisk was a first-mover in the industry, giving it a market leading position today.

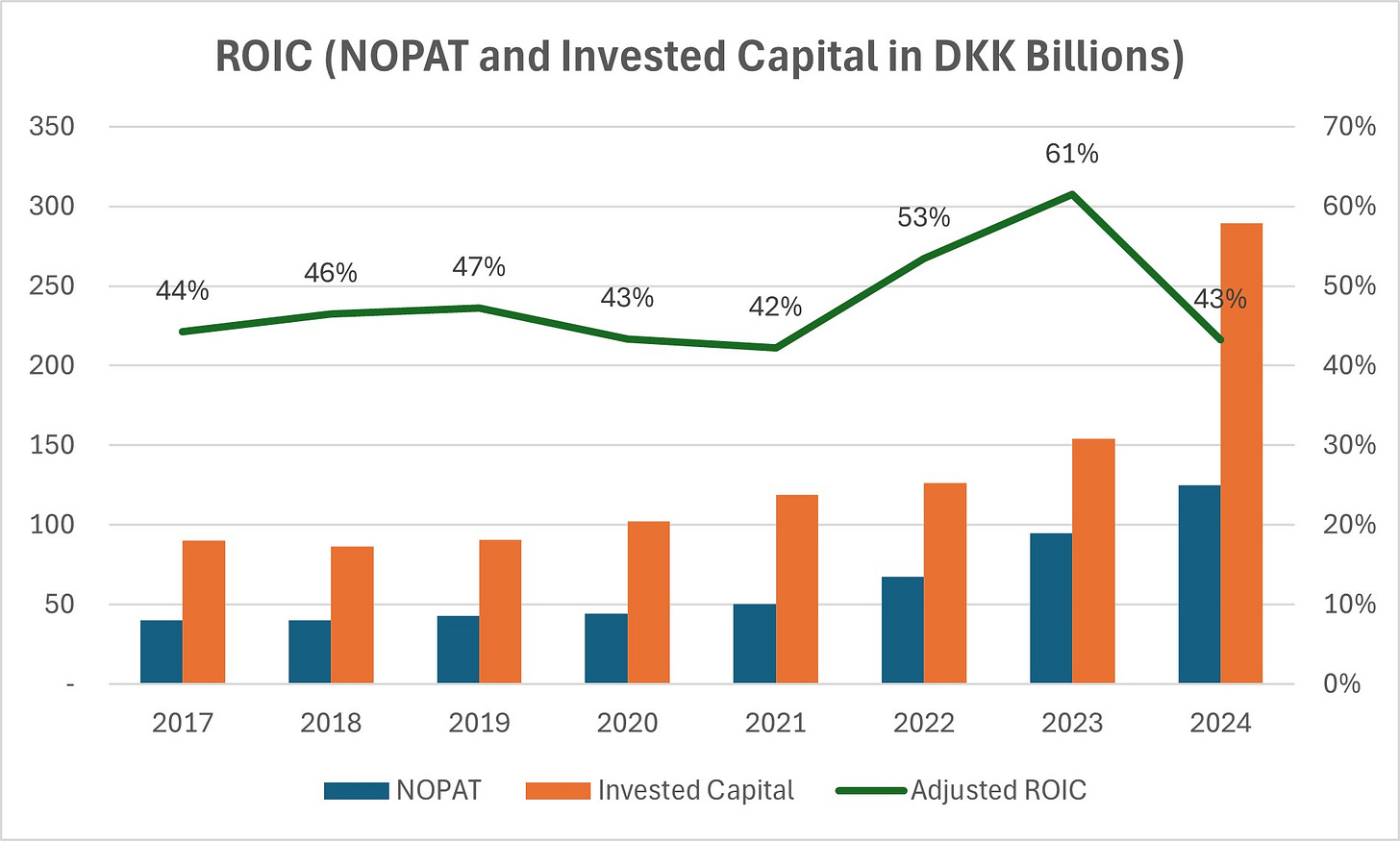

The company’s returns on capital are extremely impressive, even before the Ozempic and Wegovy boom. The problem then, however, seemed to be a lack of reinvestment options, reflected in a stagnant invested capital base and slow revenue growth. Today, the company is reinvesting heavily—in 2024, the company nearly doubled its invested capital base, by spending significant capital toward R&D, capex, and a large acquisition. Novo plans to reinvest further to meet growing demand, which will be highly accretive if incremental returns are somewhat similar to historical returns.

Industry Outlook

Investment firm Morningstar estimated the GLP-1 drug market at around $36 billion in 2023, with projections to grow to $217 billion by 2031. This significant growth is driven by the increasing number of obesity and diabetes patients, representing a lasting secular trend that Novo Nordisk is well-positioned to address.

The rapid expansion of the market, however, is attracting new entrants, including Pfizer, Roche, and Amgen, all racing to develop their own GLP-1 drugs. Despite this, Novo Nordisk and Eli Lilly currently dominate the market, and are expected to continue to dominate the market.

As a first-mover, Novo Nordisk benefits from a meaningful head start and critical patents. Ozempic and Wegovy are protected until 2032, and the company is continuously developing incremental GLP-1 products to extend patent protection. While increased competition will inevitably drive prices down, Novo Nordisk is expected to remain a leader in the rapidly growing market.

Valuation

As usual, I value stocks based on the discounted cash flows of their respective companies. For Novo Nordisk, I assume a gradual decline in return on capital until 2032, when the key patents expire. After that point, I assume ROIC to decline more sharply over the following five years, as incremental returns converge with the cost of capital.

In other words, the projection assumes Novo Nordisk will struggle to innovate and extend its patent protections beyond 2032, which I consider a conservative assumption.

I anticipate revenue growth to slow to 10% by 2032, thanks to the rapid industry growth, despite potential new entrants. Beyond 2032, revenue decelerates to 2.5% by 2037, five years later. I assume operating margins will remain mostly stable. Initial projections, including capex and D&A, are based on management guidance, while beyond 2025, I’ve applied what I consider conservative estimates.

Using a 10% discount rate, I arrive at a fair value of around 422 DKK, which aligns with the stock’s current price. Keep in mind, this assumes that Novo’s moat begins to erode once its key patents expire in 2032, which is a purposefully conservative assumption.

That said, I believe Novo Nordisk still represents a compelling opportunity to benefit from the rise in GLP-1 usage. The stock is not, however, as undervalued as it might seem after the 50% price correction—it was simply overvalued earlier.

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.

For me the critical question is the point you bring up, whether new entrants will erode their GLP-1 market share. I don't know much about pharma patents: is the magic possible to patent? There's a big difference between a monopoly on a revolutionary technology and just being the first mover in what will become an ultra competitive market with low margins.

So it is fairly valued in your calculation?