Make Smarter Investing Decisions with This 3-Part Checklist

A practical checklist to see what the market's pricing in, judge the odds, and allocate your capital with conviction

In The Checklist Manifesto, Atul Gawande explains the value of using checklists in areas where the cost of error is high, such as medicine, aviation, surgery, but also investing. As Michael Mauboussin put it:

“The power of a checklist is not that it improves your skill, but rather that it makes sure you apply your skill consistently.”

A good checklist is a repeatable process that prevents you from making inconsistent or irrational decisions, especially under pressure.

In March, I shared a checklist for analyzing a company’s moat. But competitive analysis is just one piece of investing. What ultimately matters is decision-making: when to buy, when to sell, what to buy or sell, and how much to allocate.

This is where most investors go wrong. Picking between good businesses is hard. Deciding position size is also tricky. Most investors buy a fixed amount without thinking of expected value or opportunity cost.

In this post, I introduce a checklist designed to help you make better investing decisions.

What You’ll Read Today

What’s Priced In?

Is the Setup Favorable?

Compare Expectations Across Stocks

What’s Priced In?

The most important question in investing isn’t: “Is this a good company?”

It’s “What’s already priced into the stock?”

Even the best business in the world can be a terrible investment if it’s priced beyond perfection. Yes, fundamentals matter, but the market doesn’t reward quality alone. It rewards surprises. To beat the market, expectations must be low enough to exceed.

The good news is that while valuations reflect future cash flows, short-term price action often reacts to noise: narratives, headlines, sentiment. That disconnect creates opportunity.

So how do you measure what’s priced in?

Since intrinsic value is the present value of all future cash flows, the most direct way to read expectations is with the help of a reverse DCF. You start with the current stock price and work backwards to determine what growth assumptions justify that valuation.

But like traditional DCFs, reverse DCFs have pitfalls, especially when it comes to the forecast period.

Too short a forecast period shifts too much value into the terminal state and undervalues the business. Too long, and you risk overestimating the business, although in practice, most investors build too short models.

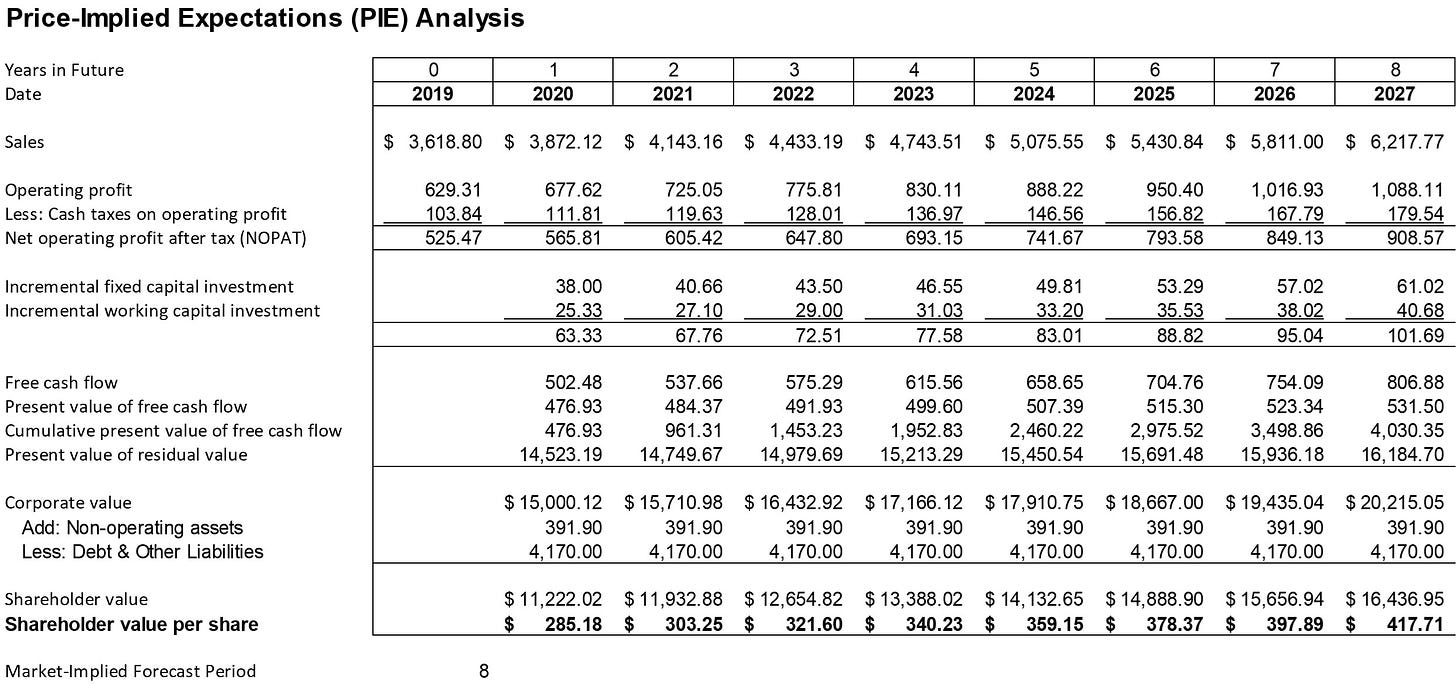

Michael Mauboussin offers one approach for estimating the forecast period. He takes analyst-projected growth rates and extends the forecast period until the implied value matches the current stock price.

It’s a great method, but it has its limits. First, it leans heavily on analyst projections. Second, and more importantly, it’s useful in a regular DCF, where you input the growth rate—not in a reverse DCF, where the growth rate is the output.

A simpler approach is to tie the forecast period to the quality of the business. A wide-moat company with durable cash flows deserves a longer forecast than a business with a narrow moat.

For instance, applying a 20-year forecast is reasonable for PepsiCo, a wide-moat business, with global distribution, brand strength, and high barriers to entry.

So what is the market pricing in?

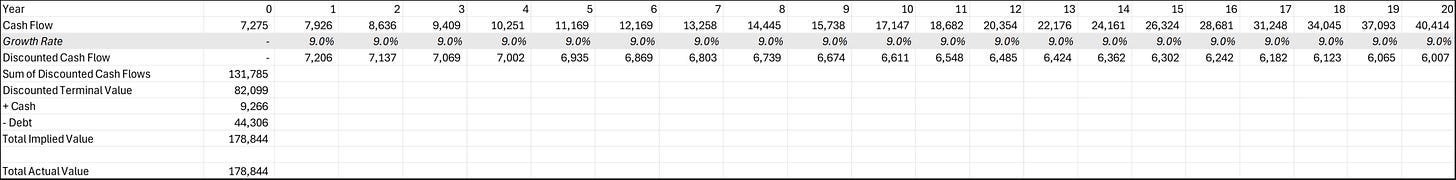

At a market cap of ~$179 billion, PepsiCo needs to grow free cash flow at 9% annually for 20 years to justify its valuation.

If you shorten the forecast to 10 years, the required growth rate jumps to 13% annually.

That’s what the market is pricing in: 9-13% annual free cash flow growth, depending on how durable you believe that growth is.

Is the Setup Favorable?

With the first question answered, the heavy lifting is done. We can now turn to the second: What are the odds the company can meet or even exceed those expectations?

This is where probabilistic thinking becomes essential.

In our example: What are the chances PepsiCo can grow free cash flow at 9% annually for the next 20 years?

You won’t reach an exact number. But if you’ve done your due diligence, and with some sound judgment, you can make a reasonable, informed estimate.

A setup becomes favorable when those odds clearly tilt in your favor. That happens when expectations are low, but fundamentals strong. Think of a high-quality business priced for stagnation.

Conversely, setups become dangerous when expectations leave no room for error. Palantir Technologies is a perfect example of a great business that could still make for a poor investment.

At a market cap of ~$280 billion, it’s priced for perfection.

To justify that valuation, the company needs to compound free cash flow at 43% annually over the next decade.

I’m not a Palantir bear; in fact, I try to avoid such debates. But I would never be comfortable investing in a business where the required outcome is that extreme.

You need to bet when the odds are in your favor.

You’re reading a FREE post.

Premium members get more:

One high-conviction stock thesis each month (first thesis is already here)

Monthly Portfolio Letters

Stock updates & in-depth valuations

Exclusive access to our research platform Summit’s Analytics (now in Beta)

Subscribe now and get 30% off: just €105/year ( that’s €8.75/month)

Compare Expectations Across Stocks

Once you understand what’s priced in, and have a view on whether the odds are favorable, you’re ready to make the most important decision of all: capital allocation.

Indeed, like any CEO, capital allocation is the most fundamental task of any investor.

Say you’ve found a new candidate for your portfolio. Or maybe you’re re-evaluating a stock after a disappointing earnings report. Perhaps it’s fallen sharply, and you’re unsure whether to add, hold, or sell.

These are all situations that demand clarity. This framework gives you just that.

Because once you know market expectations, and judge the probability of those expectations being met or exceeded, you can compare your options side by side.

Put simply: the stocks with the most favorable setups deserve the largest weights in your portfolio.

Conclusion

Every investment decision should begin with three questions:

What’s priced in?

Is the setup favorable?

How does this setup compare to my other options?

Answer those and you’ll avoid overpaying, holding on to losers, and over-allocating to the wrong positions.

In the end, successful investing isn’t just about finding great businesses. It’s also about finding mispriced ones, and taking the bet when the odds are in your favor.

If this checklist helped you out, you’ll get even more from the premium tier: investment theses, stock and portfolio updates, and exclusive access to Summit’s Analytics!

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.