Revisiting LVMH: What Went Wrong, and What Comes Next

LVMH's prolonged downturn is a real concern. Is it still worth holding?

LVMH Moët Hennessy Louis Vuitton SE, or LVMH, has been the worst performer in my portfolio since inception.

Market expectations have lowered, with the stock collapsing from a high near €900 to around €490 today. If a 45% drawdown of one of the largest European firms doesn’t spark your attention, I’m not sure what will.

This post breaks down what’s gone wrong—softening demand, operational problems, and macro headwinds—and what to expect going forward.

What You’ll Read Today

Financial Performance

What Went Wrong

Stock Valuation

Financial Performance

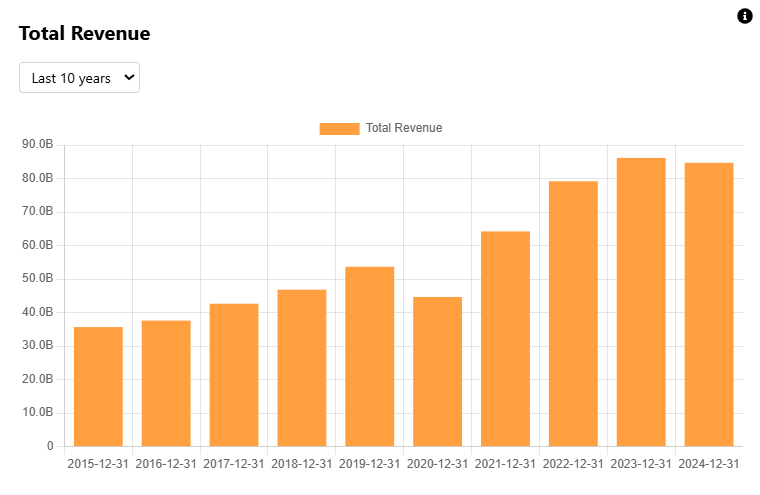

Revenue growth is one of the most important drivers of share gains, and over the past two years, LVMH’s revenue has flatlined.

Investors can point to multiple explanations for this stagnation, which we’ll break down soon. But first, some context.

LVMH operates through five business segments:

Wines & Spirits: Down 23% from Q1 2023 to Q1 2025, though in absolute terms, that’s a relatively modest decline of €389 million.

Fashion & Leather Goods: Down 6%, or €620 million. This is more material given the segment’s size and importance in terms of brands and margins.

Perfumes & Cosmetics: Up 3% (+€63 million), but hardly meaningful.

Watches & Jewelry: Down 4%, or €107 million.

Selective Retailing: The only bright spot thanks to Sephora: Selective Retailing is up 6%, or €228 million. But this is a low-margin segment, so the contribution to profitability is limited.

Notably, no single segment is dragging the group down. It’s stagnation across the board.

That said, zooming out helps: since 2017, LVMH’s revenue has still compounded at around 10% annually, even factoring in the slowdown. Long-term growth remains intact, but the current weakness is real nonetheless.

And it’s especially showing up in the margins.

In 2024, operating income fell 16%, while the operating margin dropped from 26% to 22%. That while revenue dropped just 2%. Currency headwinds accounted for roughly €1.1 billion of the income decline, but even adjusting for that, operating profit was still down 11%.

What Went Wrong

1. Post-Covid Demand Distortion

The first and most obvious driver behind LVMH’s struggles is the pandemic. During lockdowns, discretionary spending collapsed, resulting in higher savings. Once restrictions lifted, consumers surged to purchase luxury goods.

That impulse buying drove an extraordinary boom. From 2020-2022, LVMH’s revenue grew at a staggering 33% CAGR. Importantly, that growth was price-led, not volume-driven.

According to McKinsey, nearly 80% of luxury growth during 2019-2023 came from pricing, not volume. Consumers were flush with cash, and LVMH capitalized, resulting in rapid revenue growth as well as cyclically elevated operating margins between 2021 and 2023.

But that pricing power was temporary. Demand was pulled forward. And now, the luxury consumer—particularly the aspirational buyer—is showing fatigue. Revenue has stalled, and operating margins have come back down to 22%.

LVMH’s own tone around pricing also has clearly shifted, as I noted in my recent earnings update:

“Management emphasized that pricing strategy is highly brand-specific. The company can’t just raise prices by a certain amount for each brand.”

Price hikes without actually improving the offering was a temporary phenomenon, and even LVMH’s brands can’t sustain that kind of pricing power.

2. Macro Pressures in China

China has historically been LVMH’s growth market, but today, it’s become a liability.

The country is navigating a difficult economic environment thanks to weak consumer confidence, a slumping property market, and high youth unemployment. That’s a bad situation for discretionary spending, let alone luxury goods.

In Q1 2025, organic revenue in Asia (excl. Japan) fell 11%, while other regions stayed relatively flat.

Yes, a recovery at some point is likely. But the days of effortless double-digit growth are over. Going forward, LVMH will need to prioritize stability over aggressive expansion in the region.

3. Tariffs and Operational Problems in the U.S.

In the U.S., macroeconomic concerns and operational problems are amplifying LVMH’s struggles. Analysts expected 2% revenue growth in Q1 2025. Instead, LVMH reported a 3% decline. Tariff fears and weak sentiment are weighing on luxury demand.

At the same time, the company is struggling operationally. LVMH’s Louis Vuitton factories in the U.S. are facing training issues and material waste, just as local production becomes more important geopolitically.

LVMH’s challenges are a product of its own doing as well as external macro pressures. Like many other luxury companies, it overextended during the post-pandemic boom and is now dealing with the consequences. The company also overexposed itself to China, once a generational growth opportunity, but now a weakness. And in the U.S., operational inefficiencies are amplifying broader demand concerns.

The key takeaway, however, remains clear: the luxury industry’s slump is temporary, not structural. Much of the recent weakness is the result of pulled-forward demand, and now consumers are taking a pause.

Chandler Mount of the Affluent Consumer Research Company put it best:

“Short-term softness doesn’t imply long-term decline. Pricing power, global diversification and brand equity remain strong – this is a moment for measured confidence, not retreat. A 3% revenue dip at LVMH isn’t about product fatigue or failure. It’s about affluent consumers saying, ‘Not now.’”