Novo Nordisk Delivers in Q1, but U.S. Compounding Undermines 2025 Outlook

Novo Nordisk Q1 2025 earnings results

Scroll down for today’s full post.

Introducing Summit’s Analytics (Beta)

Premium members now have early access to our self-built stock research platform.

Search any listed company and instantly see the most important data at a glance.

We’re actively building new features and improving the core experience.

If you're not yet a premium member, now’s a great time to join. You’ll get full access to Summit’s Analytics, plus 30% off an annual subscription:

Financial Results

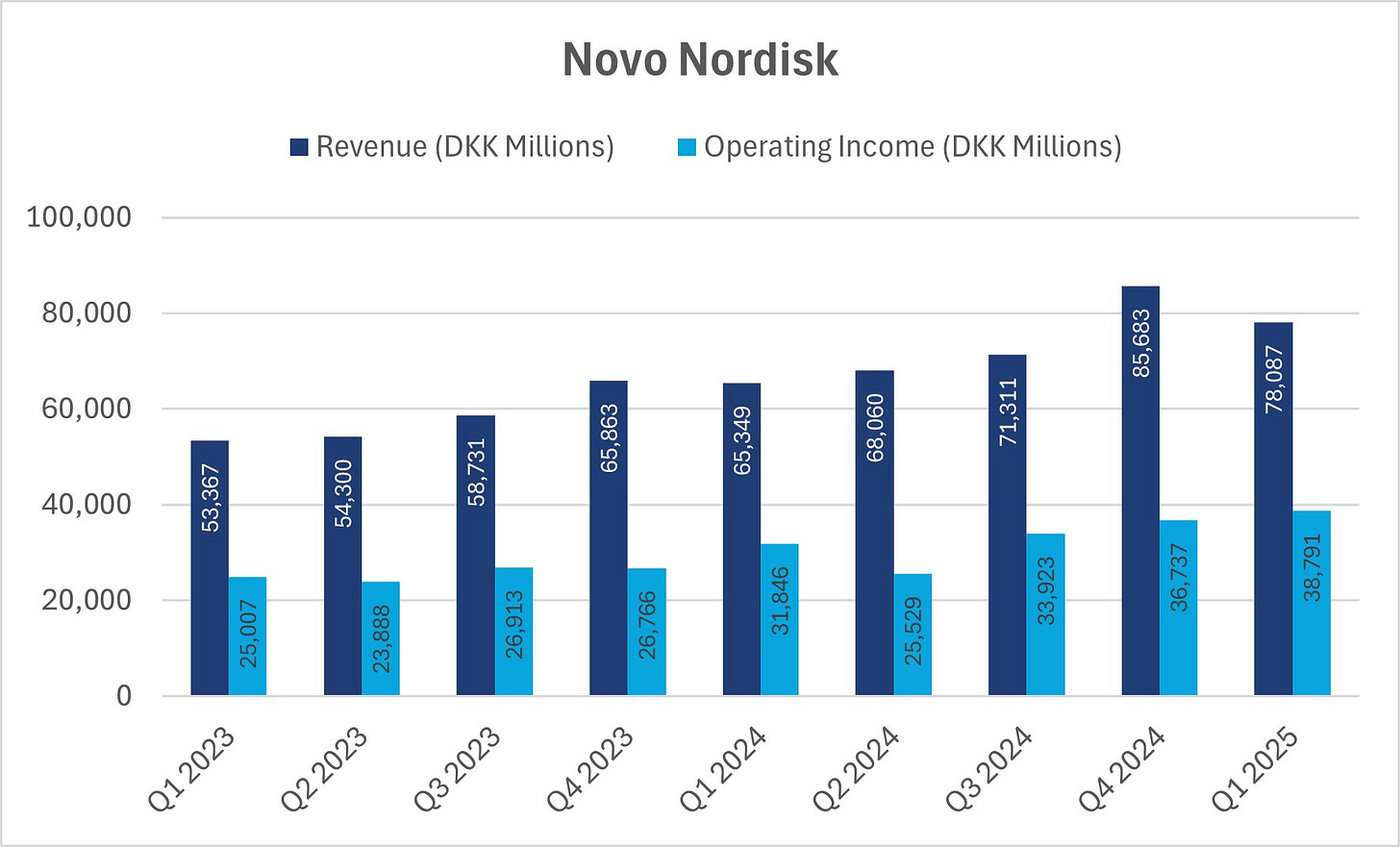

Novo Nordisk delivered strong Q1 results today. Net revenue rose 19% year-over-year to DKK 78.1 billion, while operating profit grew 22% to DKK 38.8 billion. As a result, the operating margin increased from 48.7% to 49.7%, even as R&D investments remained stable as a percentage of revenue.

Growth was driven by GLP-1 treatments for both diabetes and obesity, while insulin and rare disease segments each grew by 3%. Geographically, the U.S. grew 17%, and International Operations rose 19%. GLP-1 for diabetes increased 11%, while GLP-1 for obesity grew 65% (albeit from a smaller base).

Despite these numbers, the company lowered its full-year guidance:

Net revenue is now expected to grow between 13-21%, down from a previous range of 16-24%.

Operating profit is forecast to rise 16-24%, from 19-27% prior.

Free cash flow is now expected to be DKK 56-66 billion, down from DKK 75-85 billion, though capital expenditures remain unchanged at DKK 65 billion.

The reason for the lower guidance is a “lower-than-planned penetration of branded GLP-1 treatments in the U.S., impacted by compounded GLP-1s”.

The Compounding Problem

As of May 22, compounded semaglutide will be illegal in the U.S., per the FDA’s decision that branded supply is now sufficient. While shortages allowed pharmacies to produce copies of Ozempic and Wegovy, that exemption is ending.

So why lower guidance if compounded semaglutide is about to become illegal?

The answer lies in enforcement. While the ban is clear, enforcement will lag. Pharmacies producing compounders are expected to continue operating in a legal gray zone, relying on workarounds, vague definitions of “personalized doses”, and weak oversight.

Telehealth platforms like Hims & Hers, for example, have openly stated their intent to keep offering compounded semaglutide after the FDA’s deadline, so long as it’s framed as personalized therapy—a loophole in the law. This makes the situation more complex, especially since Novo Nordisk just announced a partnership with Hims & Hers.

When asked about this during the Q&A, management responded rather vaguely. They reiterated they don’t support unlawful compounding, expressed support for the new partnership, and emphasized the need to be “where the patients are.” Management concluded by stating they will continue to fight compounders operating under the guise of “mass personalization” ones, which is really what this is all about.

Strategic and R&D Developments

During the quarter, Novo launched NovoCare Pharmacy, a direct-to-consumer model for Wegovy, and announced new partnerships with three telehealth platforms, including Hims & Hers, to expand its distribution channels.

Moreover, CVS has selected Wegovy as the only GLP-1 covered for obesity under its plan. Importantly, this was not a paid partnership; it was CVS’s independent choice, signaling strong confidence in Wegovy and Novo Nordisk.

With supply constraints easing, Wegovy is now available in 25 countries, and more launches are expected throughout 2025. For reference, Ozempic is available in 80 markets. There’s still enormous potential for obesity care.

On the pipeline side, Novo highlighted positive Phase 3 results for CagriSema during the quarter, with the first FDA filing expected in Q1 2026. The company also submitted its oral semaglutide for obesity to the FDA back in February, which upon approval, will become the first oral GLP-1 for weight loss, with efficacy and safety profiles similar to the injectable Wegovy.

This might open up an entirely new market, with pills being a lot more appealing to potential patients.

Final Take

Overall, this was a strong quarter, even with the change in guidance. Novo still expects mid- to high-double digit growth, which is solid. But the U.S. compounding issue clearly won’t vanish as of May 22.

Even as the FDA ban takes effect, enforcement gaps and gray-market workarounds are likely to persist. But as you would’ve read in my Novo Nordisk Investment Thesis, competition is inevitable and to be expected. The thesis is playing out nicely.

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.