Dear reader,

Welcome to this edition.

Today, I’m taking the time to value my stocks.

With the year ending, it’s the perfect time to reflect on my portfolio and evaluate. Next week, I’ll share my year-end portfolio letter, summarizing December and the entire year of 2024, and I’ll share my plans for 2025.

Valuations

I don’t want to bother you with extensive details about each of my holdings. For those interested, I’ve published analyses on most of my companies, which you can find in the Deep Dives section.

Amazon

It’s been a while since we talked about my largest position, Amazon. In August, I published a deep dive on the company, explaining why it’s a fantastic business with a bright future. Since then, the stock has climbed 27%.

Let’s see if Amazon still offers upside today.

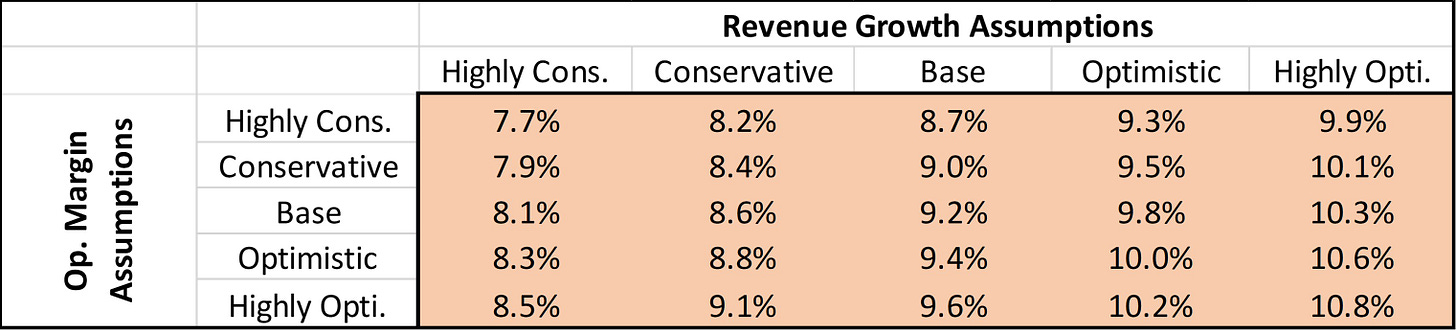

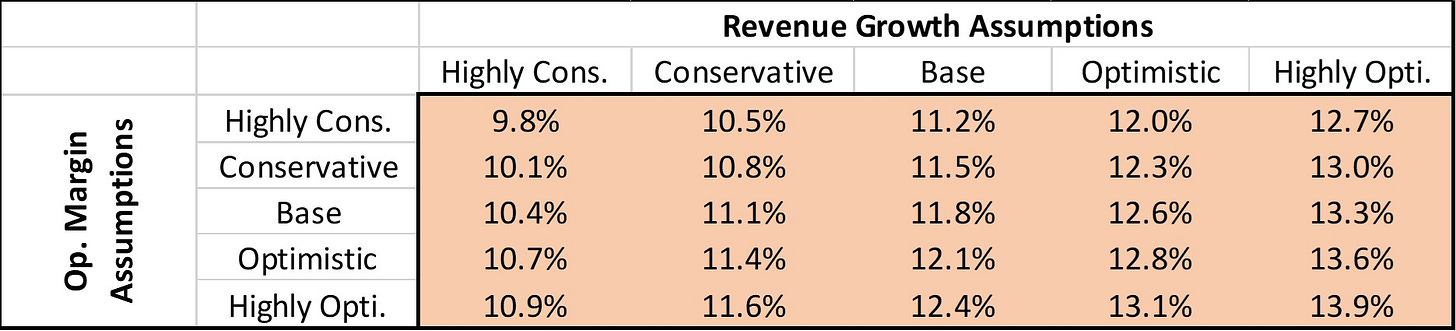

Amazon is a wide-moat business that should be able to grow revenue above the terminal rate for the foreseeable future. I’m projecting low double-digit growth from 2024 to 2028, tapering to high-single digit growth before eventually settling at the terminal rate.

Moreover, I expect a growing operating margin, driven by a shift in revenue mix. High-margin segments like AWS and advertising are taking on a more important role, while the lower-margin retail business becomes relatively smaller.

By reverse-engineering my cash flow model, the current stock price of around $225 implies a compound annual return of 9.2%. At my cost basis of $182, this jumps to 10.3%.

Nothing extraordinary, but here’s the thing: Amazon’s true profitability remains understated by high reinvestment in R&D and capital expenditures. With a simple snap of the fingers, the company could unlock much more free cash flow.

Even so, Amazon today doesn’t strike me as a strong buy or a bargain. Given that it’s my largest position, I’m happy to hold.

LVMH

LVMH Moët Hennessy Louis Vuitton SE, another core holding, has faced a tough year amid a sector-wide slowdown. When luxury picks up again, however, I expect LVMH to emerge as a winner.

At its current price of around €630, LVMH doesn’t seem expensive.

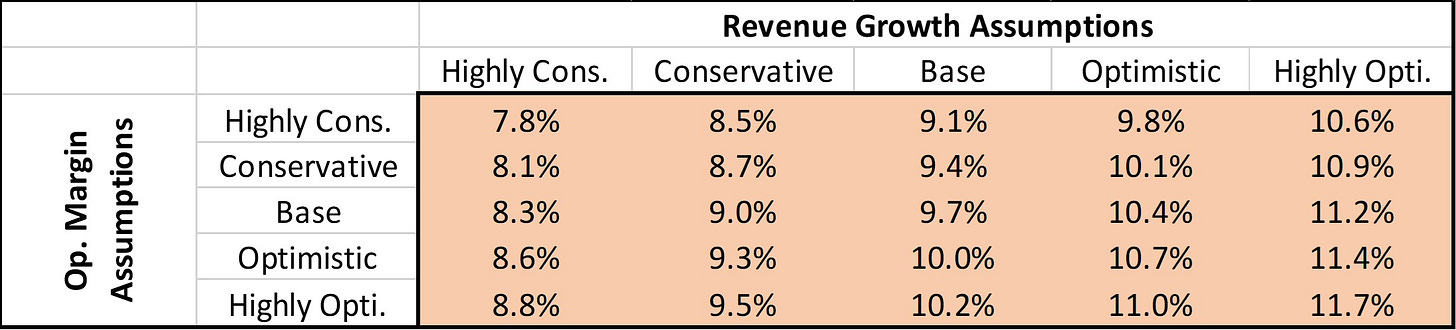

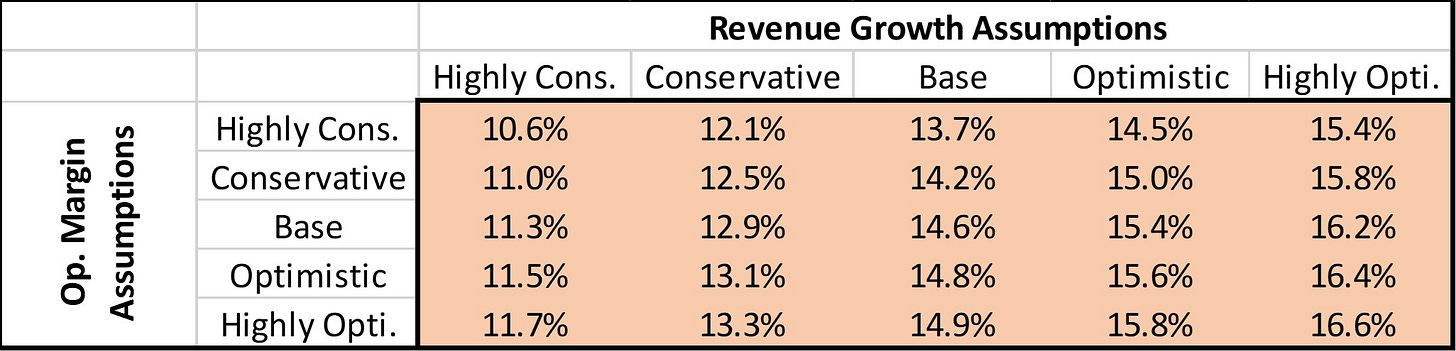

Assuming mid-single-digit revenue growth and a slightly expanding operating margin toward 30%, expected returns look promising—particularly when factoring in its 2% dividend yield.

But I'm not actively buying today since it's already a big position. I may pick up more shares if weakness continues.

ASML

ASML is my newest addition. Like LVMH, its stock hasn’t performed well, remaining flat over the past year despite strong performance from the S&P 500 and the S&P Global Semiconductor Index.

This provided an opportunity to invest in an exceptional business that I plan to hold forever. ASML is one of the most critical companies in the world, and is poised to benefit from several growing end markets.

While expected returns are fairly low today, they improve when including the dividend yield. My base scenario assumes revenue reaching around €53 billion by 2030—about midway between management’s €44-60 billion outlook. Beyond that, I expect revenue growth to slow to mid-single digits.

Operating margin expansion, as ASML has done in the past, is also baked into my assumptions.

Given its current size in my portfolio, I’m not actively buying more shares.

Salesforce

Recently, I published a deep dive on Salesforce, an exceptional company in the CRM space. It’s also been our top performer percentage-wise and our second-best in absolute terms, just behind Amazon.

My forecast assumes low-double digit growth transitioning to single-digit growth, with an expanding operating margin.

After its recent rally, Salesforce has become pricier, but it doesn’t appear overly expensive. Including a dividend yield of 0.5%, Salesforce seems to be at a fair valuation.

Airbnb

Airbnb remains one of my most exciting holdings. I admire CEO Brian Chesky, the company’s founding story, and its standout product and financials.

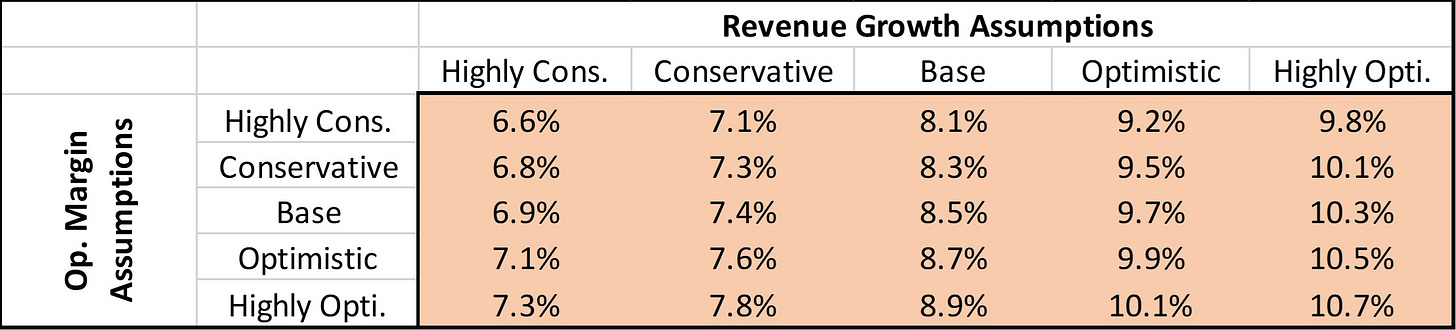

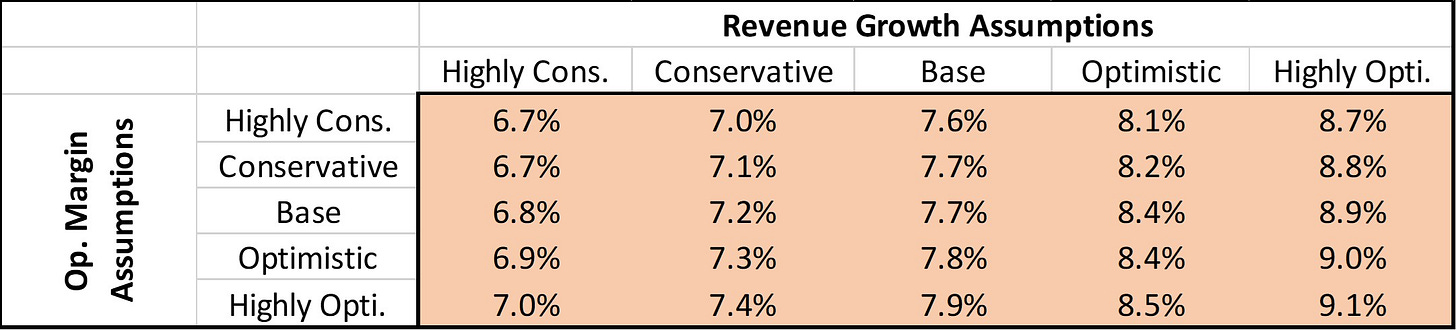

Predicting Airbnb’s future is tricky, but I’ve given it a try, and my forecast suggests great returns.

Even after accounting for stock-based compensation—a significant expense for the company—expected returns remain good.

Airbnb is a small position, and I might add to it in the future.

Evolution AB

Earlier this month, I shared my thoughts on Evolution AB, and I repeat my opinion: the company is undervalued. The price has dropped further since, which only strengthens my view.

Keep in mind that these expected returns were calculated based on a higher price than the stock’s current level. Today, returns are even higher. Add a dividend yield of nearly 3.5%, and you’re looking at seriously attractive returns.

My position in Evolution is small, but I’ve already increased it—although unfortunately just before the price drop. I’m considering adding more.

MSCI

Following my recent increase in Evolution, MSCI has become my smallest holding.

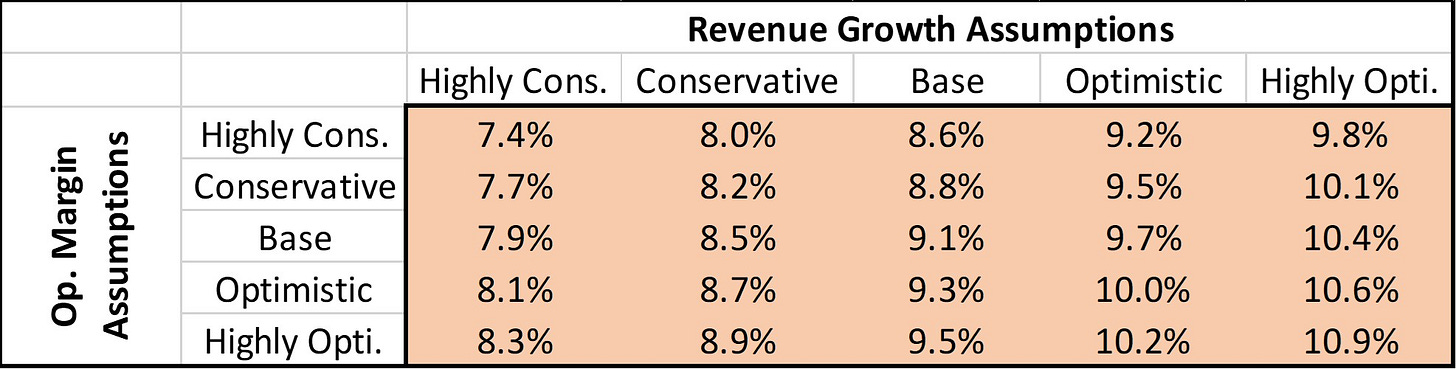

MSCI is my most expensive stock but also the highest-quality business in terms of predictability and consistency.

It’s a strong, resilient business, and the price reflects that.

On one hand, selling might make sense given opportunity costs. On the other, selling would reduce the overall quality of my portfolio.

Either way, I’ll need some time to think this through.

Conclusion

Overall, I feel most of my holdings lean towards expensive rather than cheap, which mirrors the broader market’s valuation. Opportunities seem scarcer today, and investors must turn more rocks to uncover hidden gems.

The goal of this update was to give you context on my holdings and what I plan to do with them heading into 2025. The best course of action in investing is usually to do nothing. Still, it’s important not to use this as an excuse for complacency—doing nothing can also be ignorant.

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.