Dear reader,

Welcome to this new edition.

Today’s edition takes a slightly different approach than usual. We’ll discuss Evolution AB, a leading provider of online casino software, but we won’t dive deeply into the company’s fundamentals, products, services, or moat. There’s already plenty of excellent work available about those aspects, both on Substack and other platforms.

Instead, this article will explore Evolution in a broader sense. I’ll give a brief introduction, provide an in-depth valuation, and evaluate its role in the Summit Stocks portfolio.

Think of this more as a concise investment thesis rather than a full-on business deep dive.

What You’ll Read Today

Evolution at a Glance

What’s Happening Today?

Valuation

Conclusion

Evolution at a Glance

Evolution is the leading B2B provider of online casino software, specializing in live casino systems. The company develops, produces, markets, and licenses its products globally.

Its core offering, Live Casino, features live-streamed table games like blackjack, roulette, and poker. These games are hosted by Evolution’s employees from state-of-the-art studios worldwide, enabling countless end users to play at the same table simultaneously.

The company employs more than 20,000 people, while its customer base exceeds 600 gaming operators, including industry leaders like DraftKings, 888 Holdings, Entain, and Unibet. Operators choose Evolution for its high-quality streaming technology, diverse gaming portfolio, and proven expertise.

These strengths are a part of Evolution’s competitive moat. The company also enjoys significant economies of scale and high barriers to entry.

The company operates in a rapidly expanding market, where the online casino segment is growing significantly faster than land-based casinos. Additionally, while Evolution operates worldwide, there are still certain geographical markets with untapped potential, including the United States.

Evolution’s leadership team is experienced, and insider ownership is substantial, with the founders maintaining a significant stake in the business.

The company boasts an exceptional financial track record, marked by excellent revenue growth, impressive margins, high returns on capital, and a robust balance sheet.

What’s Happening Today?

If Evolution’s business is so strong, why is its stock down nearly 20% over the past year? This is especially concerning given the overall market’s strength.

There are a few factors contributing—or that may contribute—to Evolution’s weak stock performance, and we’ll discuss each below:

Taking a Breather

Sometimes, it’s helpful to take a step back. While Evolution has dropped almost 20% over the past year, the stock has still gained over 200% in the past 5 years and almost 1400% since it started trading in 2016. Those are incredible gains, despite this year’s sell-off.

However, it’s not just the stock that’s slowing down; the company’s core metrics are also decelerating. Of course, growing revenue by more than 50% year-over-year becomes impossible as a company matures. It’s the law of large numbers at work, and investors must adjust their expectations for more modest growth in the future.

Company-Specific Challenges

Evolution has had to face several headwinds this year. In the summer, the company dealt with a strike in Georgia involving 550 employees. While this strike had “limited effect on operational capacity”, the situation escalated when union-affiliated activists illegally blocked entrances, vandalized buildings, and harassed workers. These actions forced the company to reduce its operations in Georgia, which negatively impacted performance.

Additionally, the company was targeted by cyber-attacks in Asia during the third quarter, which also hurt its financial results.

Finally, Evolution’s tax payments have risen significantly this year. New corporate tax rates are impacting the company’s bottom-line. Previously, Evolution paid tax rates ranging from just 5% to 8%, but moving forward, it will face a rate of around 15%. This increase has put additional pressure on the company’s profit for the 2024 period.

Slumping Europe

While the S&P 500 and Nasdaq are enjoying strong gains this year, Europe’s stock market is lagging. The STOXX Europe 600 is up just 9% year-to-date. As a European company, Evolution isn’t benefiting from the broader market strength in the US.

In summary, pessimism surrounding Evolution’s stock largely seems to stem from slower expected growth, temporary headwinds, and a weak European stock market. These aren’t fundamental flaws at all, but understanding them helps explain the recent stock price movement.

Valuation

Now that we know why Evolution’s stock is underperforming, we can make a more informed decision on what to do next. By constructing a discounted cash flow (DCF) model and reverse-engineering it, we can assess whether the stock is over- or undervalued based on its future cash flows.

I won’t delve into all the details, but I’ll highlight the key inputs and explain my reasoning behind them. If you’re interested in learning more about reverse DCFs, check out my recent post on the topic.

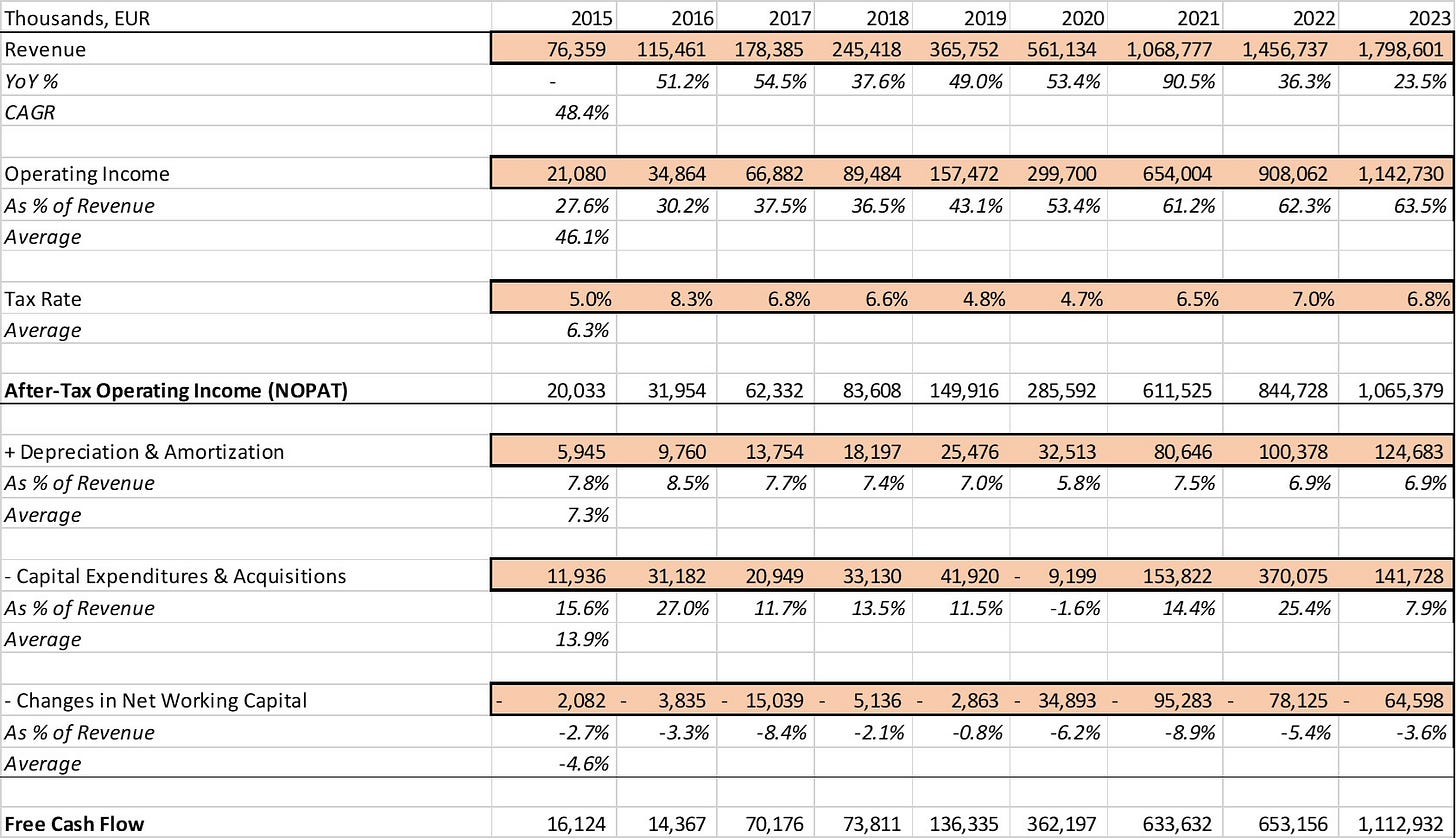

First, we’ll gather historical data such that we get a better feel for projecting growth, margins, and investments.

The data shows relatively clear trends: slowing revenue growth, expanding operating margins, and somewhat consistent capital expenditures and acquisitions as a percentage of revenue. However, margin expansion is decelerating—there’s only so much room for growth, and Evolution appears to have hit a ceiling.

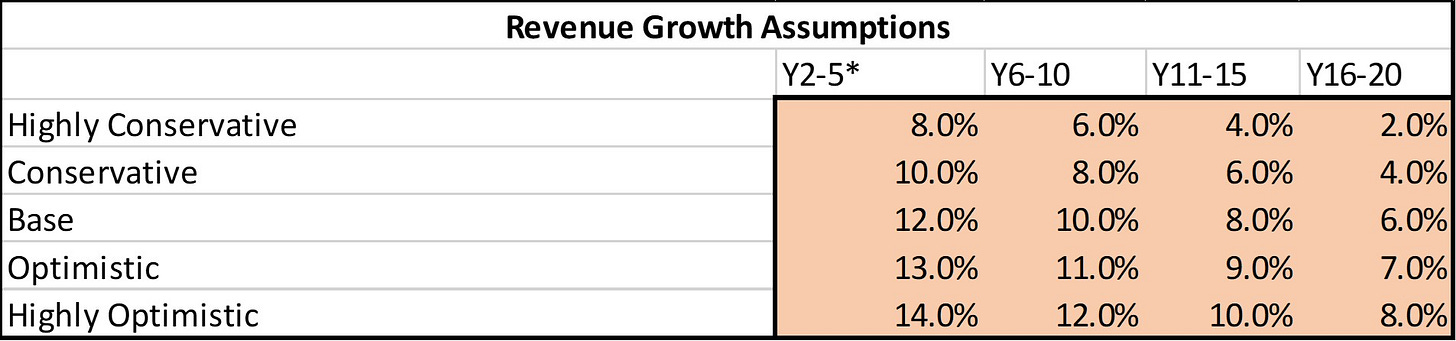

Let’s break down our forecast step by step. Year-to-date revenue for 2024 has grown 20.1% year-over-year, despite the challenges we’ve discussed. However, part of this growth was due to a one-time event, so we’ll have to take that into consideration. For 2024, I’m projecting revenue growth of 17.5%, followed by:

12% growth in years 2-5,

10% in years 6-10,

8% in years 11-15,

and 6% in years 16-20.

These assumptions are based on the company’s historical track record and the growing online casino industry, which should continue to fuel growth.

Beyond year 20, I’m assuming a terminal growth rate of 2%, reflecting Europe’s modest GDP growth, despite Sweden, where Evolution is headquartered, having faster GDP growth.

These are our base assumptions for revenue, but of course, we’ll also make conservative and optimistic scenarios.

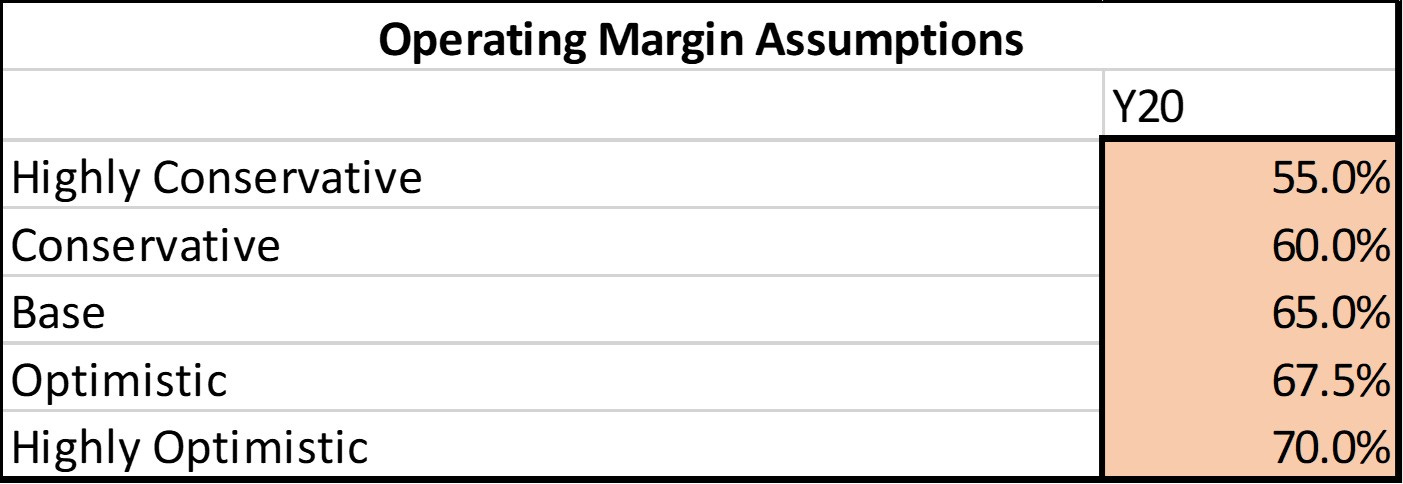

For operating margins, I’m projecting a 65% margin by year 20 in our base case.

Forecasting tax rates is difficult, but given that Evolution is expected to pay around 15% going forward, that’s the rate we’ll use.

For depreciation and amortization (D&A), we’ll use the historical average of 7.3%, as it has remained consistent as a percentage of revenue.

The same applies to capital expenditures and acquisitions, even though these should decrease as a percentage of revenue over time as the company matures and revenue growth slows. We’re simply being conservative here.

Lastly, for changes in net working capital (NWC) we’ll exclude the outliers from 2017 and 2021 to ensure a more accurate projection. This adjustment isn’t about making the model more favorable—in fact, it impacts the outcome negatively,

With our projections complete, we can find out what returns to expect at today’s price. The resulting table shows expected returns per scenario over the forecast period. For instance, under the base assumption for both revenue and operating margins, we can expect an impressive return of 14.6%.

Clearly, Evolution’s current valuation isn’t demanding. That said, this doesn’t mean you nor I should rush to scoop up every available share. The company faces its own risks, including but not limited to regulatory challenges, ethical concerns, key customer concentration, and operational risks.

Nonetheless, it’s obvious the market today values Evolution cheaply.

Conclusion

Here’s my take: I see no reason to sell Evolution. Mispricings can persist, and patience is crucial here. I’m even willing to add to my position at current prices, though I don’t plan to make it a major holding given its specific risks.

Evolution is a high-quality company and a darling among quality investors—and for good reason. Its fundamentals are exceptionally strong, the company enjoys a wide moat, and management knows what it’s doing. Plus, we haven’t even talked about the attractive 3%+ dividend yield at these prices or the recent aggressive share buybacks.

The goal of this article was to shed some light on Evolution, one of my holdings that I hadn’t given enough attention. In the process of writing, I’ve gained a deeper understanding of the company and feel increasingly confident in my position. I hope today’s post has been valuable for you as well.

In case you missed it:

Reverse-Engineering the Discounted Cash Flow (DCF) Valuation

Stock Deep Dive - Salesforce: Bringing Companies and Customers Together

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.

Thank you for the post, I wrote on this too as a very interesting case study. I am factoring in lower operating margins as the company expands into North America. Hoping for a Q1 2025 buyback announcement by management to take advantage of share price sell off.

https://charlesmccallccm.substack.com/p/evolution-gaming-risks-evo?r=4qadw