Stock Deep Dive - Sanlorenzo Group: Luxury Yacht Pioneer

A deep dive into one of the world's luxury yacht leaders

Dear reader,

Welcome to this edition of Deep Dives.

Sanlorenzo Group, a leader in the luxury yachting industry, has been crafting high-end, customizable yachts since 1958. Headquartered in Italy, the company is renowned for its craftsmanship and emphasis on personalization.

Although the business continues to perform well, Sanlorenzo’s stock has dropped by over 25% in 2024. This decline may be attributed to concerns over a potential slowdown in demand, a weak European stock market, and broader weakness in the luxury sector.

What You’ll Read Today

Sanlorenzo’s History

Sanlorenzo’s Business

Products

Moat

Key Financials

Insiders

Risks, Valuation, Conclusion

Sanlorenzo’s History

Sanlorenzo’s story began in 1958 when Gianfranco Cecchi and Giuliano Pecchia started building pleasure boats near Florence. Two years later, they relocated to Viareggio, a city along the Tyrrhenian Sea, a region known for yachting. There they established the company “Cantiere San Lorenzo di Cecchi Gianfranco e C. s.n.c.”.

In 1972, Giovanni Jannetti took over the company, marking the beginning of its expansion with larger yachts. Jannetti opened a new shipyard in Viareggio, and in the 1980s, Sanlorenzo launched the SL57, its first fiberglass yacht. This material was more durable, affordable, and lighter than the traditional wood and metal used at the time.

In 1995, Sanlorenzo entered the superyacht segment with the launch of the SL100, a 30-meter model. While today the company classifies its vessels as superyachts when they are 44 to 73 meters, yachts were generally smaller in the 1990s, and models like the SL100 were considered superyachts.

Importantly, Massimo Perotti, who is still CEO today, acquired Sanlorenzo from Jannetti in 2005, beginning a new phase for the company. Perotti quickly expanded, opening a second office and introducing new yachts and superyachts.

Under his reign, Sanlorenzo’s revenue grew by 16% annually between 2004 and 2018 through continuous product innovations and investments.

Sanlorenzo went public in 2019, listing on the Milan Stock Exchange, and since then, the company has only continued its growth, having already delivered great returns to shareholders.

Sanlorenzo's Business

Products

The Sanlorenzo Group operates across four segments:

Yacht Division

This core segment focuses on designing, manufacturing, and selling yachts between 24 and 38 meters long, under the Sanlorenzo brand. It is the company’s largest division, generating 57.5% of revenue for the nine months ended September 30, 2024.

Superyacht Division

Specializing in superyachts between 40 and 73 meters long, this segment also operates under the Sanlorenzo brand. It accounted for 29.6% of total revenue during the same period, making it the second-largest division.

Bluegame Division

This segment offers sport utility yachts under the Bluegame brand, with lengths ranging from 13 to 23 meters. The division contributed 10.3% to total revenue for the nine months ended September 30, 2024.

Swan Division

The newest segment, the Swan Division, was formed after Sanlorenzo acquired Nautor Swan in August 2024. This Finnish company specializes in luxury sailing yachts. Although the division only generated 2.6% of total revenue during the nine-month period, this figure reflects only two months of consolidation within the reporting period. In other words, this will be a fairly significant division.

Moat

Sanlorenzo's moat is built on customer loyalty, a robust supplier network, and exclusivity.

Customer Loyalty

Sanlorenzo builds lasting relationships by involving clients in the yacht design process from the very beginning. Each yacht is highly customizable, offering tailored options for interiors, exteriors, and technological equipment. While operating globally through brand representatives, Sanlorenzo primarily sells directly to end customers, enabling a closer and more personal relationship. The company holds very limited stock within its brand representative network and there’s extremely limited availability of second-hand yachts. Clearly, Sanlorenzo aims to reach its customers directly.

To further enhance customer loyalty, Sanlorenzo provides a range of high-end, exclusive services, including:

Tailor-made financing and leasing packages

Sanlorenzo Charter Fleet, made possible by the acquisition of Equinoxe in 2022

Crew training through Sanlorenzo Academy

Maintenance, restyling, and refitting services via Sanlorenzo Timeless

These offerings not only increase customer satisfaction but also reinforce the brand’s image as a high-end luxury brand.

Customer loyalty is critical for Sanlorenzo, as its customers replace their yachts about every 4.5 years, often upgrading to models that are, on average, 68.6% more expensive. This high upselling potential makes customer retention a key focus.

Supplier Network

Sanlorenzo ensures quality through a network of thousands of highly skilled artisans, primarily located along the Tyrrhenian Sea. These niche, often family-run businesses work almost exclusively with Sanlorenzo, creating a tight and unique ecosystem.

To strengthen this network, Sanlorenzo pursues vertical integration by forming partnerships with and minority investments in these suppliers. This secures key materials, expands production capacity, improves agility and flexibility, and allows for direct quality control. This is simultaneously a great way for the company to gain a cost advantage over competitors.

Sanlorenzo’s supplier network reminds me of ASML’s extensive network of over 5,000 specialized suppliers, a competitive advantage that is difficult to replicate.

Exclusivity

Sanlorenzo is the world’s second-largest yacht builder after Azimut Benetti, yet the company only manufactured 132 yachts in 2023. That should tell you enough about the industry’s exclusivity. The company carefully increases volumes by introducing new lines and models, making sure that existing offerings aren’t diluted.

Expansion into new segments, such as through the acquisitions of Bluegame and, more recently, Nautor Swan, allows Sanlorenzo to grow without sacrificing exclusivity.

In this market, exclusivity is key. By intentionally keeping supply low, Sanlorenzo ensures its products remain desirable. This strategy is evident in the order backlog, which has remained consistently strong, despite a slight decline (excluding Nautor Swan) following a sharp post-Covid surge. As of September 30, 2024, the total net backlog still exceeds €1 billion—equivalent to over a year’s worth of revenue.

Sanlorenzo has a wide moat built on hard-to-replicate competitive advantages: enduring and loyal customers, an intricate and exclusive supplier network, and a high-end, prestigious brand.

Key Financials

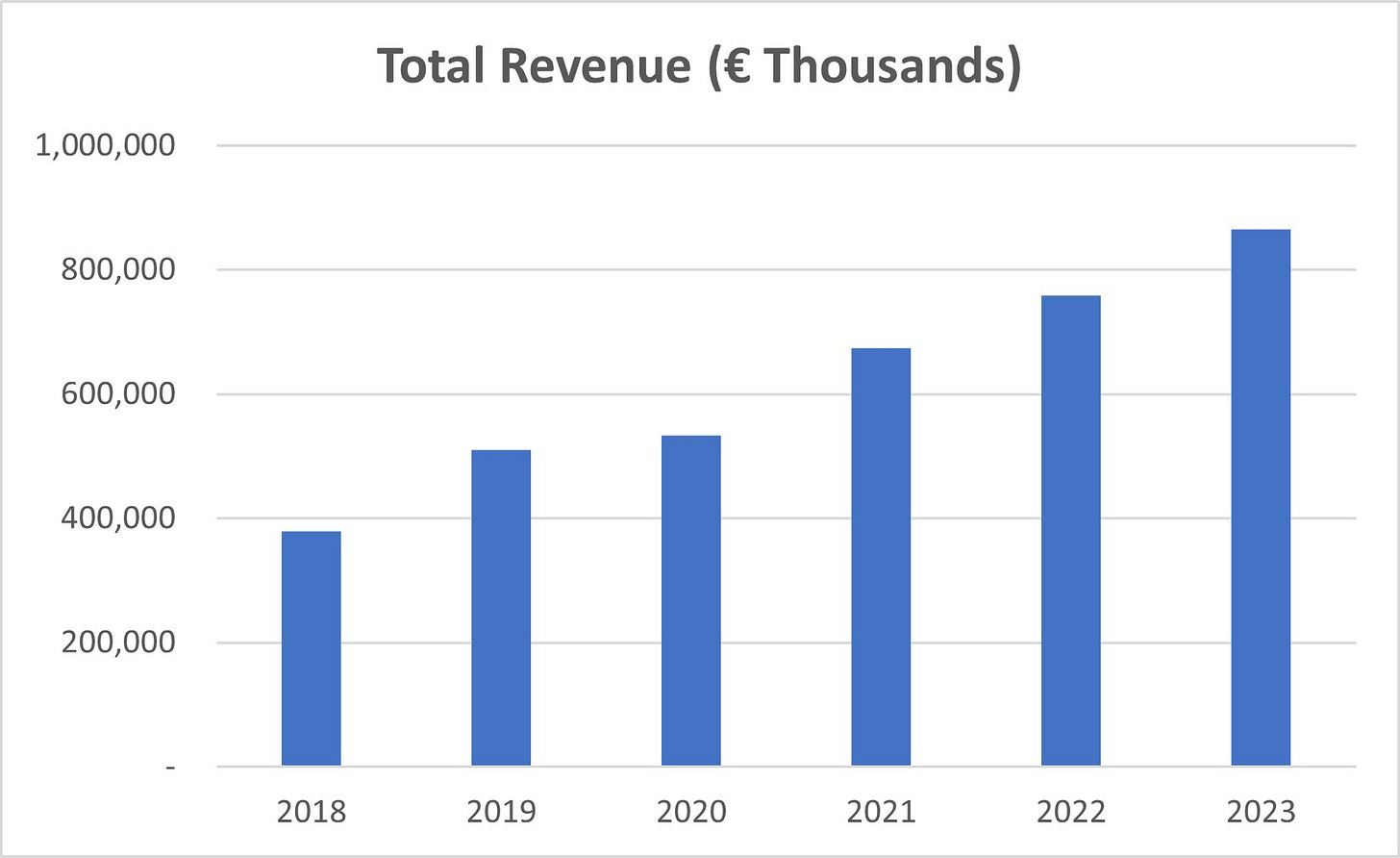

Under CEO Perotti’s leadership, Sanlorenzo has undergone remarkable growth. Between 2004 and 2018, revenue grew at a compound annual rate of 16%.

Impressively, growth accelerated since 2018, with revenue compounding at 18% annually. Revenue is growing rapidly but also consistently and predictably.

As mentioned earlier, the Yacht Division is Sanlorenzo’s largest segment, contributing the most revenue and growing slightly faster than the Superyacht Division.

The Bluegame Division, acquired in 2018, has seen explosive growth. Revenue skyrocketed from €6 million in 2018 to €91 million in 2023, representing a 73% CAGR. This shows the effectiveness of acquiring niche, high-end brands that do not overlap with Sanlorenzo’s existing brands. While Nautor Swan is already much bigger than Bluegame was in 2018, I expect the Swan Division to drive future growth.

Future revenue growth should be driven by:

Growth of Ultra High Net Worth Individuals (UHNWIs)

Sanlorenzo’s customer base consists of individuals with a net worth above $50 million. This demographic has been growing quickly, from 98,700 in 2012 to 264,200 in 2021, and is projected to reach 385,000 by 2026, according to Credit Suisse.

Moreover, yachting penetration—the percentage of UHNWIs who own a yacht—is only 2.5% as of 2023, leaving room for growth.

Pricing Power

Sanlorenzo enjoys substantial pricing power due to its wealthy and loyal clientele. From 2023 to 2025, the company has planned to implement annual price increases of 3%, and demand doesn’t seem to be affected.

Acquisitions

Successful acquisitions like Bluegame underscore the company’s ability to leverage synergies and drive global distribution. Continued M&A activity in complementary segments should unlock further growth.

Expansion of High-End Services

Sanlorenzo’s high-end services hold untapped potential according to management. The growth of these services may support future revenue growth.

Sanlorenzo has consistently improved profitability, more than doubling operating margins from 6.2% in 2018 to 14.5% in 2023. The company expects continued, although slower, margin expansion.

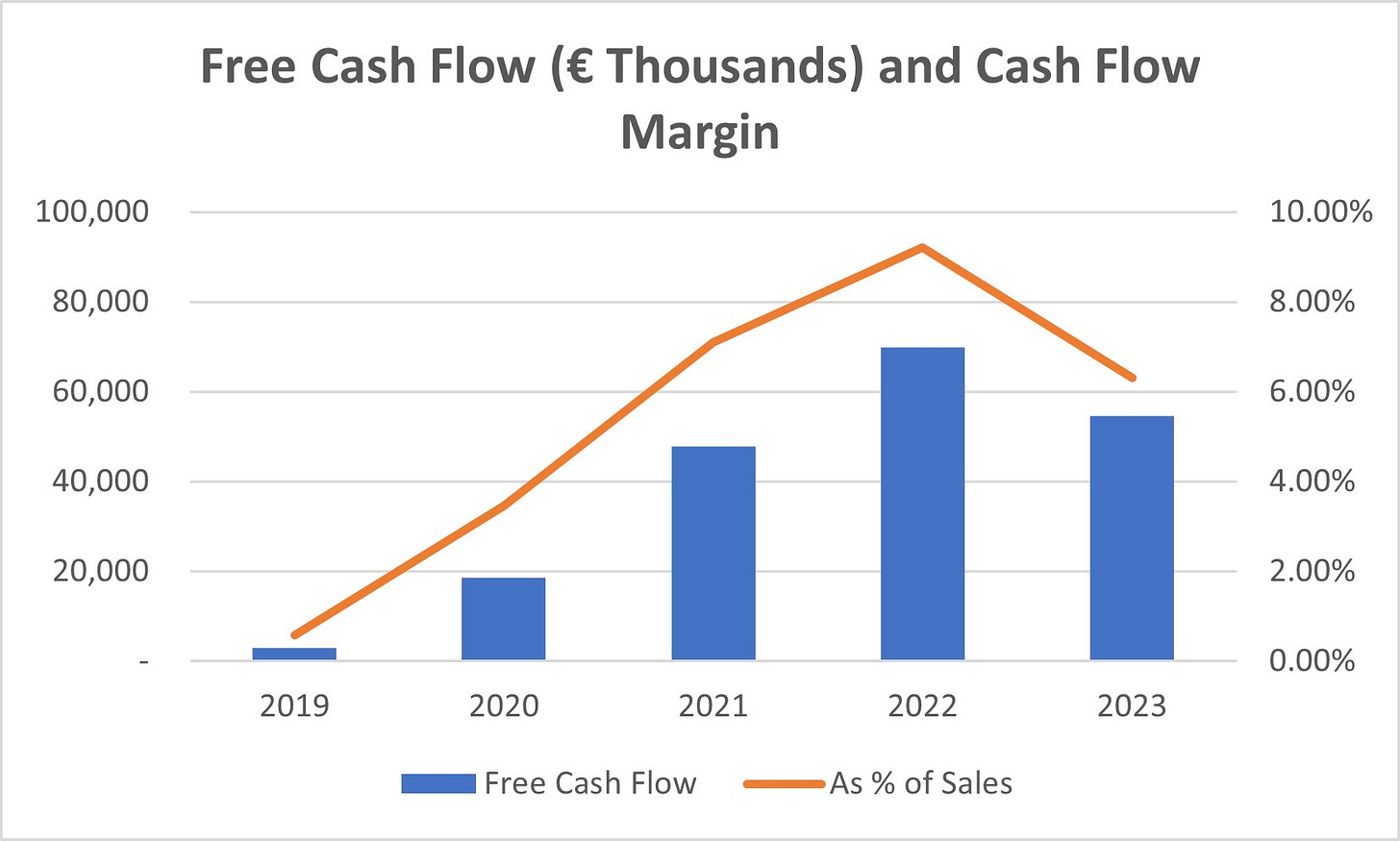

Free cash flow has also shown strong growth over time. The decline in 2023, as seen in the graph below, was primarily due to an unusually high free cash flow in 2022, driven by a significant reduction in net working capital (NWC). Such reductions are not sustainable, so a normalization in 2023 was expected.

Notably, Sanlorenzo has transitioned from positive to negative NWC, often a sign of improved working capital management.

In the first nine months of 2024, free cash flow is again lower, impacted by, among others, inventory investments to support “production ramp-up to shorten delivery times of the most requested models.” Such short-term fluctuations, tied to business seasonality, should not concern long-term investors.

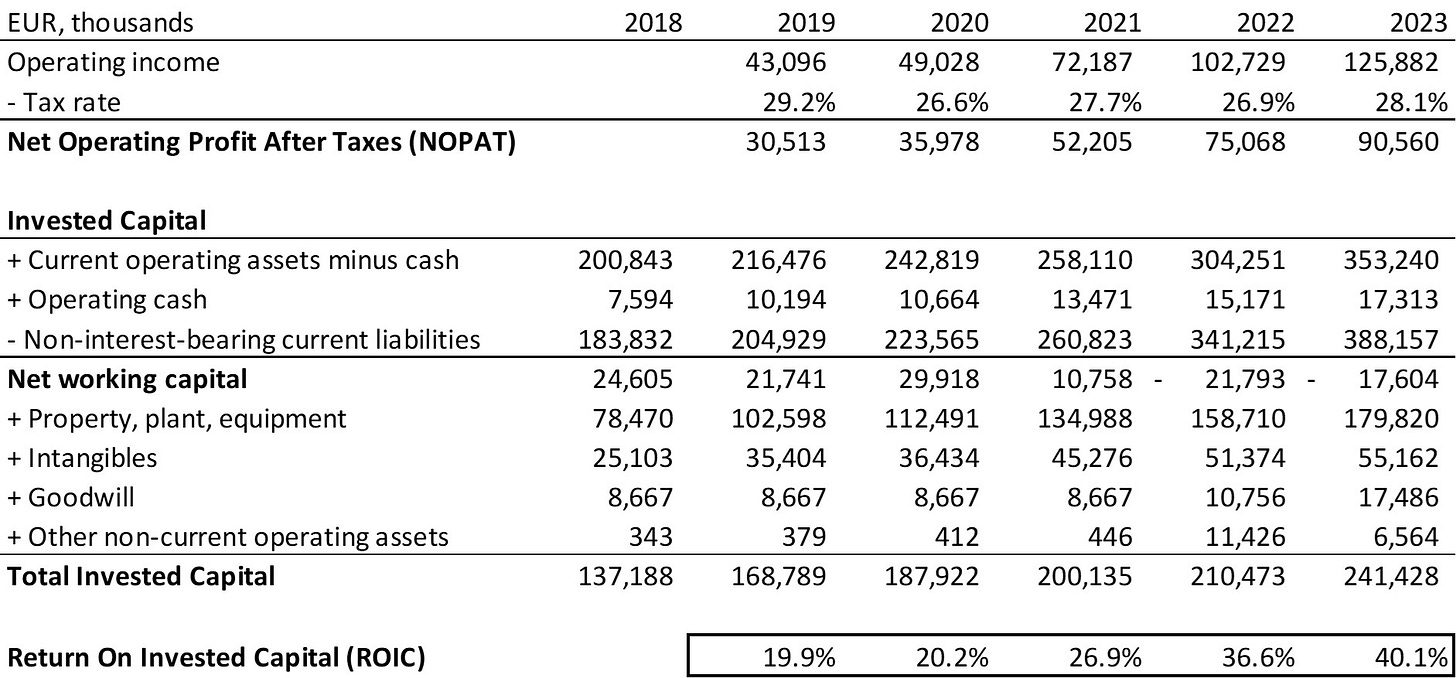

Sanlorenzo’s return on invested capital (ROIC) is impressive, driven by profit growth outpacing invested capital.

Sanlorenzo’s balance sheet is strong. As of September 30, 2024, the company holds €131.1 million in cash against €68.9 million in short-term debt and €76.3 million in long-term debt. With an interest coverage ratio of 50x in 2023, the company’s debt is clearly under control.

Insiders

Massimo Perotti, Sanlorenzo’s current CEO, has been highly influential since taking over in 2005. Under his tenure, he has grown revenue significantly, expanded product lines, acquired Bluegame and most recently Nautor Swan, and he took the company public.

Before he acquired the majority of Sanlorenzo, Perotti worked at Azimut Benetti—Sanlorenzo’s biggest competitor—from 1984 until 2004 alongside its founder Paolo Vitelli. It’s safe to say Perotti knows his way around the yachting business.

In the process of growing Sanlorenzo, Perotti has made himself a very wealthy man. That’s because he owns more than 19 million shares Sanlorenzo shares, or 54% of the company and 70% of the voting rights. Perotti is a true owner-operator. Most of his wealth is tied to the company, so, naturally, he wants the company to perform well. His incentives are definitely aligned with shareholders.

Risks, Valuation, Conclusion

Sanlorenzo is undeniably a strong company, but that doesn’t mean it’s without risks. Key risks include:

Sustaining the Brand

Sanlorenzo’s moat relies on its brand. To maintain its appeal, the company must continue delivering on exclusivity, innovation, and the quality its sophisticated clientele demands.

Dependence on a Small Customer Base

Sanlorenzo targets the wealthiest individuals—a very small segment of the global population. While there is a secular trend of increasing wealth and a growing number of ultra-high-net-worth individuals (UHNWIs), any decline in this demographic or reduced interest in yachting within it could significantly impact the company’s performance.

Leadership Transition

Massimo Perotti has been the driving force behind Sanlorenzo, shaping its vision and success. His eventual departure could bring challenges, including potential unrest, friction, or weaker performance as the company adjusts to new leadership.

Sanlorenzo’s current valuation today is compelling. The stock trades at a P/E ratio of just 11—rarely seen for a company with these growth rates and returns. My forecast also indicates attractive expected returns, particularly when including the 3% dividend yield.

This is why I’ve added Sanlorenzo stock to the Summit Stocks portfolio. It’s a remarkable company with beautiful products, strong competitive advantages, and an amazing track record. I’ll provide more details about the purchase in the January Portfolio Letter.

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.

Also TISG is interesting

Well done.