Stock Deep Dive - Basic-Fit: Leading European Fitness Chain

A deep dive into an asymmetric opportunity with fantastic expected returns

Dear reader,

Welcome to a new edition of Deep Dives.

Basic-Fit is the leading low-cost fitness chain in Europe. With over 1,500 fitness clubs and more than 4 million members, the company is the undisputed leader in the industry.

Yet, its stock price doesn’t quite reflect this. Shares are down 35% over the past five years and have risen only 53% since the company’s IPO in 2016. Over that same period, however, Basic-Fit has expanded its club network from 419 to 1570. With continued growth ahead—management aims for 3000-3500 clubs by 2030—the disconnect between stock price and business performance is worth exploring.

What You’ll Read Today

Basic-Fit’s History

Basic-Fit’s Business

Products

Moat

Key Financials

Insiders

Conclusion

Risks

Valuation

Basic-Fit’s History

Basic-Fit’s story begins in 1984 in the Netherlands with René Moos. Born in 1963, Moos quit school at 16 to pursue a professional tennis career. He was talented but struggled financially, forcing him to step away a few years later.

Out of necessity, he became a tennis coach—but he didn’t enjoy it. Moos was driven and competitive, while most of his students saw tennis as a casual hobby.

So in 1984, he opened his own tennis facility with 24 courts. But it wasn’t until he added a fitness area that the business really took off. Over the years, he expanded his operations, and in 2004, he merged his clubs with Eric Wilborts’s, a friend from his tennis days. Together, they launched HealthCity, a mid-to-premium fitness concept that still exists today.

To appeal to price-sensitive consumers, HealthCity introduced HealthCity Basic in 2006, a low-cost alternative.

In 2010, Moos and Wilborts acquired the Basic-Fit brand and its 28 clubs in the Netherlands. They soon realized that HealthCity Basic and Basic-Fit was confusing customers. To fix this, they split Basic-Fit into a separate brand, with Moos at the lead.

From then on, Basic-Fit entered its real growth phase. Private equity firm 3i Investments took a majority stake in 2013 to fuel growth, and in 2016, the company went public on the Amsterdam Stock Exchange with 419 clubs.

The pandemic in 2020 was a major setback, but Basic-Fit rebounded quickly. Today, it operates 1,570 clubs—and counting. René Moos, now 62, remains at the helm.

Basic-Fit’s Business

Products

Basic-Fit’s business model is straightforward: it operates affordable fitness clubs across Europe. The company’s clubs are in the Netherlands, Belgium, Luxembourg, France, Spain, and, most recently Germany. While heavily concentrated in France, Basic-Fit is expanding rapidly in Spain and gradually rolling out in Germany, which is expected to be an important market in the future.

Basic-Fit’s value lies in its affordability. Prices vary by country, but a standard 4-week subscription starts at just €19.99. More expensive plans offer additional perks, including:

Access to all gyms in Europe (instead of just within your home country)

The possibility to bring a friend for free once a week or an unlimited number of times with the top-tier plan

Free subscription freezes twice year, ideal for, for instance, vacations

Unlimited Yanga Sports Water

Unlimited use of massage chairs

Home bike rentals for at-home workouts

Members can also personalize their subscriptions by adding specific benefits that fit their needs.

Basic-Fit makes extra revenue from personal coach subscriptions, fees from self-employed personal trainers and physiotherapists working in its gyms, vending machines, day passes, advertising, and sales of nutrition products under its NXT Level brand. Subscriptions, however, still make up the bulk of its revenue.

Moat

Basic-Fit benefits from significant scale benefits, cost advantages through standardization and operational efficiencies, and strong local positioning due to its high club density.

First, the company’s scale is unmatched—it’s by far the largest fitness chain in Europe. In fact, the three biggest competitors combined are still smaller than Basic-Fit. This leading position creates a virtuous growth cycle: more clubs generate more cash flow, fueling faster expansion, which further widens its lead.

Scale in the fitness industry has several benefits. As Europe’s largest buyer of fitness equipment, Basic-Fit can negotiate the best deals—not just on pricing but also on service agreements, such as extended warranties and fast repairs or replacements. Beyond equipment, its bargaining power extends to leasing agreements, furniture, and other capital investments. Landlords prefer leasing to Basic-Fit over smaller operators, given its financial power.

Operationally, Basic-Fit runs an efficient and surprisingly automated model. Thanks to remote camera systems and self-service check-in via QR codes or membership cards, each club requires just three full-time employees, while most remain open 24/7.

The company also uses self-service kiosks for tasks like check-ins, membership management, and support. Moreover, Basic-Fit is investing in remote tools to optimize energy use across its clubs.

These cost savings are passed directly to members, as reflected in Basic-Fit’s competitive pricing.

But technology doesn’t just cut costs—it also enhances the customer experience, leading to a higher customer retention. Seamless self-service sign-up and support, easy club access, 24/7 customer support, the Basic-Fit app, and more all contribute to a smoother experience. As a result, the average membership length is 22 to 23 months—nearly double the industry average of less than 12 months.

Another key aspect of Basic-Fit’s moat is its high club density in local markets. The company only enters areas with a catchment population of at least 30,000, but in larger cities, it goes further by clustering multiple clubs across different neighborhoods. Instead of placing just one club in the center of a city, Basic-Fit spreads locations strategically, ensuring easy access near where people live, work, or where their friends go. Besides improved convenience, Basic-Fit’s cluster strategy brings local scale efficiencies, including for personnel planning, management, and marketing.

With both global scale and strong local presence, Basic-Fit has built a moat that should keep competitors at bay for a long time.

Key Financials

Revenue

Basic-Fit has shown solid growth over the years, although the pandemic did expose a vulnerability in its business model.

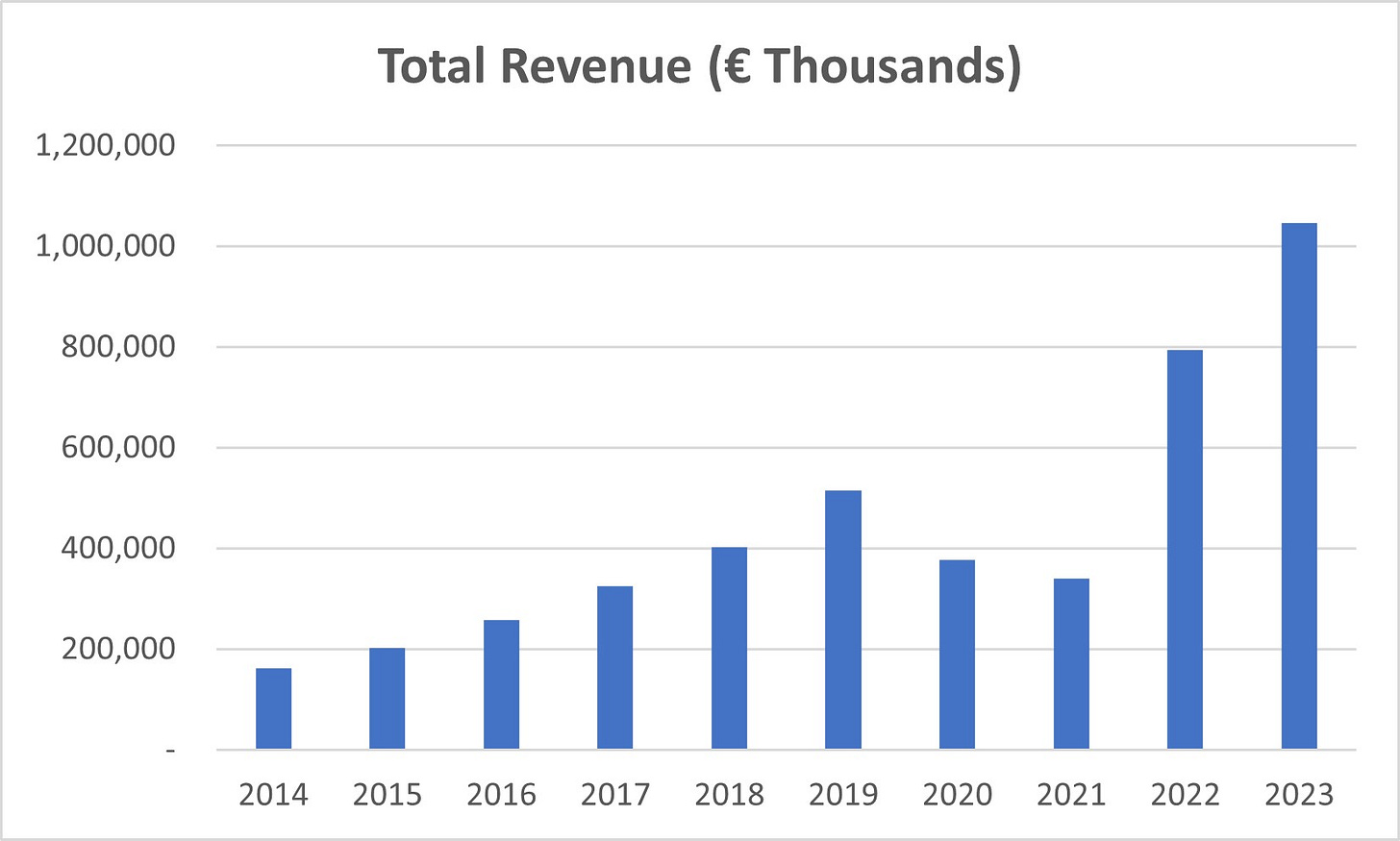

The compound annual growth rates (CAGR) vary by period:

10-year: 23%

5-year: 21%

3-year: 40%

1-year: 32%

Revenue has accelerated recently, especially as the company rebounded post-pandemic, but growth seems to normalize, with revenue of €1.2 to €1.25 billion expected in 2024.

The company’s growth is further reflected in its club expansion and membership growth. Basic-Fit’s business is fairly predictable thanks to its unit economics model.

The club network grew from 264 in 2014 to 1402 in 2023 (now at 1570). Meanwhile, the number of members has jumped from nearly 800,000 to 3.8 million (now at 4.2 million).

Basic-Fit outlines a few major trends that should help support growth:

Aging Population

With more adults trying to stay active, Basic-Fit offers an affordable and low-risk way for them to work out—especially since many can’t take part in high-impact sports.

Lifestyle Diseases Like Obesity and Diabetes

As more people struggle with health issues tied to their lifestyle, Basic-Fit provides an accessible, budget-friendly option for people to get active and improve their health.

Urbanization

With more people moving into cities, demand for conveniently located gyms is growing. Basic-Fit’s cluster strategy in urban areas helps meet that demand. Plus, cities often lack a wide variety of sports options, making Basic-Fit an accessible option.

Flexibility and Instant Gratification

People want convenience and flexibility, and Basic-Fit delivers with 24/7 access, a wide network of clubs and access to all these clubs, and digital features like the app and virtual classes.

Digitalization and Sedentary Lifestyles

With the rise of smartphones and office jobs, more people are living sedentary lifestyles. Affordable gyms like Basic-Fit are a great solution for those looking to find a balance.

I think urbanization and the growing issue of unhealthy lifestyles are some of the biggest tailwinds for Basic-Fit.

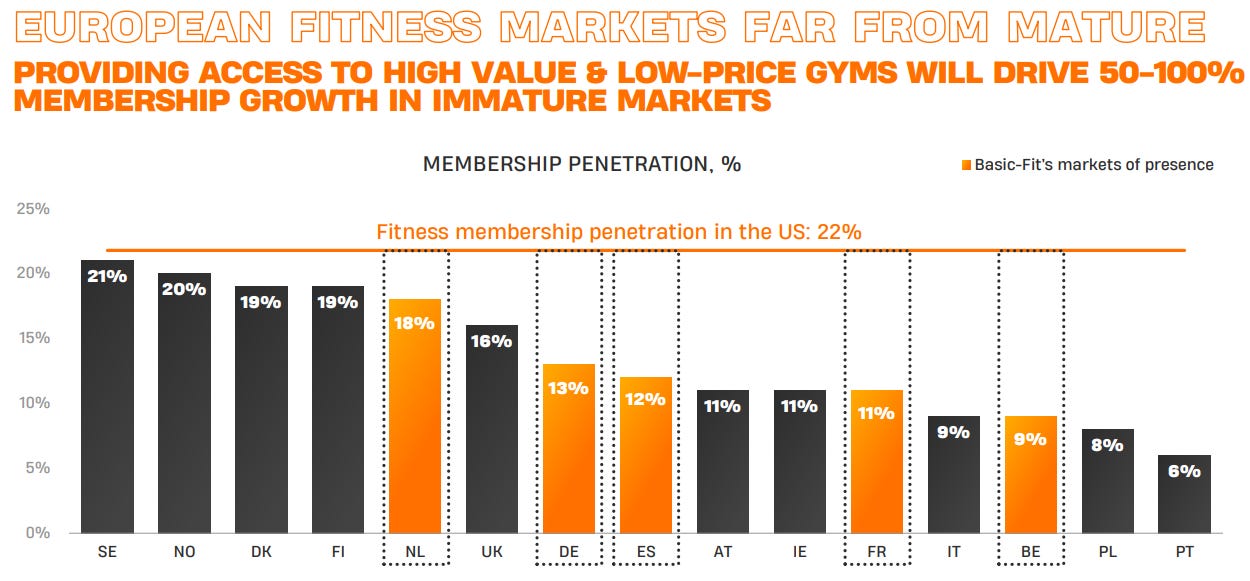

Europe also still has plenty of room for growth when it comes to gym memberships. While 22% of consumers in the U.S. visit a gym, the countries Basic-Fit operates in have much lower penetration rates, meaning a lot of potential customers are still out there.

Often, the low penetration rates are due to a lack of affordable options, and Basic-Fit is stepping in to fill that gap by expanding into new areas.

Profitability

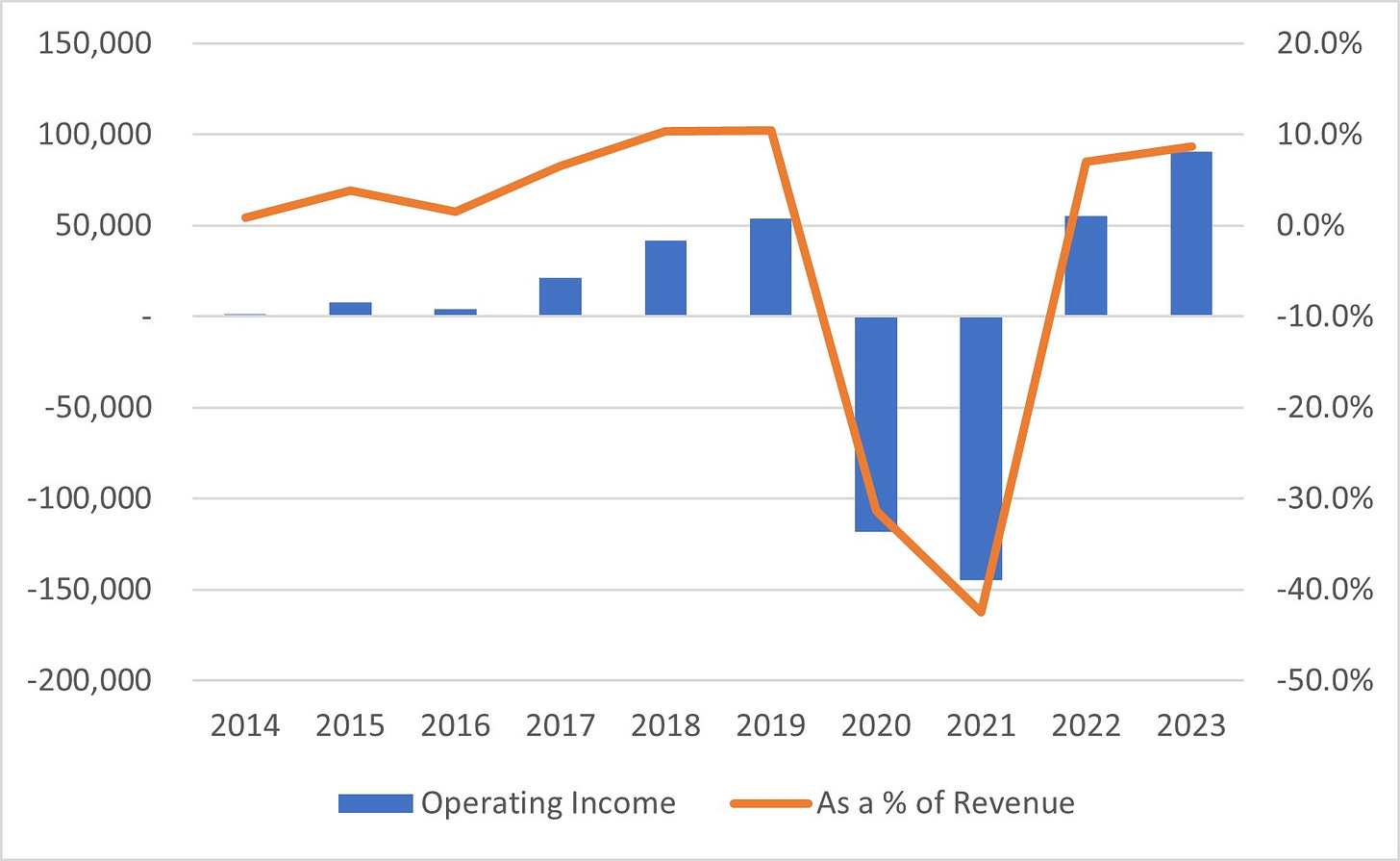

While Basic-Fit hasn’t been highly profitable so far, that’s mainly because it’s been reinvesting heavily.

Of its 1,570 clubs, only 993 are considered mature (over 24 months old and with about 3,250 members). Mature clubs are the main profit drivers, while new clubs harm profitability. If Basic-Fit stopped expanding and let all its clubs mature, operating profit would increase significantly.

We’ve never seen the full potential of the company because Basic-Fit has never stopped expanding. In 2023, the operating margin was 8.7%, with 1,402 clubs, of which 882 were mature. I can imagine operating margins doubling if Basic-Fit lets all its clubs mature.

But that’s not the company’s strategy—it’s focused on growing and plans to hit 3000-3500 clubs by 2030, so profitability will continue to suffer for a while.

Basic-Fit’s free cash flow is a bit tricky to measure because the company leases a lot of its clubs. Under IFRS 16 accounting, even though it doesn’t own the clubs, the company has to report depreciation on them. This makes its operating cash flow look higher than it really is—because of inflated depreciation—if we follow traditional free cash flow calculations.

Basic-Fit uses EBITDA less rent as a key performance figure. To get to free cash flow, we subtract taxes, capital expenditures and acquisitions, and changes in net working capital. Since rent here functions similar to depreciation for leased assets, another way to determine free cash flow is by adding back depreciation and amortization (D&A) to NOPAT—but only for the assets the company actually owns. A third way to calculate free cash flow would be the traditional method—so add back all D&A—but subtract lease payments which can be found in the financing cash flow section. All methods lead to similar outcomes, but I’ve calculated free cash flow using the first method.

This results in the following cash flows:

I included both actual free cash flow and free cash flow before growth capex to show how Basic-Fit’s profitability is hidden by its expansion efforts. Since management provides maintenance capex figures, it was easy to calculate—rather than subtracting all capex, I only deducted maintenance capex.

Based on 2023 free cash flow before growth, Basic-Fit trades at a price-to-free cash flow ratio of just 5.1x.

Return on invested capital (ROIC) isn’t particularly useful for evaluating Basic-Fit as a whole, again, due to its suppressed profitability. However, management claims that on a per-club basis, they achieve an ROIC of at least 30%. It’s important to note that the company calculates per-club ROIC differently.

Incremental ROIC (ROIIC) is more insightful, but we must be careful, especially as the company is still rebounding from the pandemic. For instance, the 3-year rolling ROIIC for 2023 looks high because 2020’s operating income was so bad. The 1-year rolling ROIIC, however, sits at 15%, and I expect it to hit around 16% in 2024. Overall, ROIC is trending up as more clubs mature and scale benefits kick in.

Financial Health

At first glance, Basic-Fit’s balance sheet looks very risky. The company has just €34.8 million in cash and equivalents against €2.7 billion in debt, including lease liabilities.

Now, a few things need clarification. €1.7 billion of that debt comes from leases. Since I’ll value the company using EBITDA less rent, lease liabilities are already treated as operating costs. Counting them as debt too would be double-counting. Therefore, debt is a more reasonable €978.8 million.

The good news is that as cash flow keeps growing, Basic-Fit won’t need to rely on debt for expansion—it can fund growth directly from its own cash flow. Management also expects to delever over time. The company’s net debt-to-adjusted EBITDA (similar to EBITDA less rent) was 2.9 in 2022, 2.6 in 2023, and 2.8 as of June 2024. The mid-term goal is to get below 2, which seems very doable as EBITDA rises and debt stabilizes.

If you’re skeptical about using adjusted EBITDA for leverage, that’s fair—but even on a net debt-to-free cash flow before growth basis, the ratio was 2.9 in 2023, which is solid. If Basic-Fit stopped expanding, it could pay off all debt within three years. In reality, probably even faster as all gyms mature.

Lastly, interest coverage ratio in 2023 using operating income is too low (2x), but much stronger using EBITDA less rent (6x). The difference comes down to the big discrepancy between operating income and operating cash flow.

Insiders

We already talked about CEO René Moos—Basic-Fit’s founder—who’s competitive, driven, and has over 40 years of experience in the industry.

Moos owns 6 million shares, or 9.1% of the company. This makes up the majority of his wealth, so his incentives are well aligned with shareholders.

Basic-Fit’s capital allocation strategy is sound, with the company reinvesting everything (and then some, through debt) back into growth. Right now, the focus should be on continuing that reinvestment while also paying down debt. Management expects debt levels to be lower by the end of 2024 compared to June 2024, which is a step in the right direction.

Moos is clearly playing the long game, prioritizing growth over short-term profitability. I like that approach.

Conclusion

Risks

While the opportunity here is great, there are undeniable risks:

High Debt

Net debt-to-free cash flow before growth is under 3, but debt is still high at nearly €1 billion. For comparison, Basic-Fit’s market cap is €1.4 billion. I would like to say it’s not a major risk, but particularly current interest expenses are high.

Expansion

Basic-Fit’s aggressive expansion is risky. Some new clubs might not hit the 30%+ ROIC target, or they could take longer than expected to mature. On the other hand, slowing down expansion could allow competitors to take up white-space in Europe. The strategy makes sense, but it’s not without risks.

Competition

The fitness industry is fragmented and competitive. Basic-Fit is by far the largest fitness chain in Europe, but U.S.-based Planet Fitness is expanding into Spain, which uses a franchise model to scale quickly. Basic-Fit is also exploring franchising, with plans to roll it out this year, but the company hasn’t shared any details yet.

Valuation

Valuing Basic-Fit is tricky. As mentioned earlier, the stock trades at just 5.1x price-to-free cash flow before growth, which looks cheap. To get a clearer picture, I built two valuation scenarios:

Scenario 1: No More Expansion

Here, Basic-Fit stops expanding immediately, lets its existing clubs mature, and focuses on cash flow generation. Obviously, this is not gonna happen, but it helps highlight the company’s underlying value right now.

I modeled a five-year discounted cash flow using only mature clubs. These are the assumptions:

2024 starts with 1,575 total clubs (per company guidance) and 1,000 mature clubs (as of September 2024).

Mature club EBITDA less rent in 2024 of €400 million (based on €188 million in the first half of 2024, with expected profitability improvements in the second half).

Maintenance capex remains at €87 million (calculated by multiplying per-club maintenance of €55 thousand by 1575).

Overhead expenses (excluding marketing) stay at €90 million.

A tax rate of 25%.

With a 0% terminal growth rate, the expected return is 13.9%—a fantastic result for a no-growth scenario.

Scenario 2: Continued Expansion

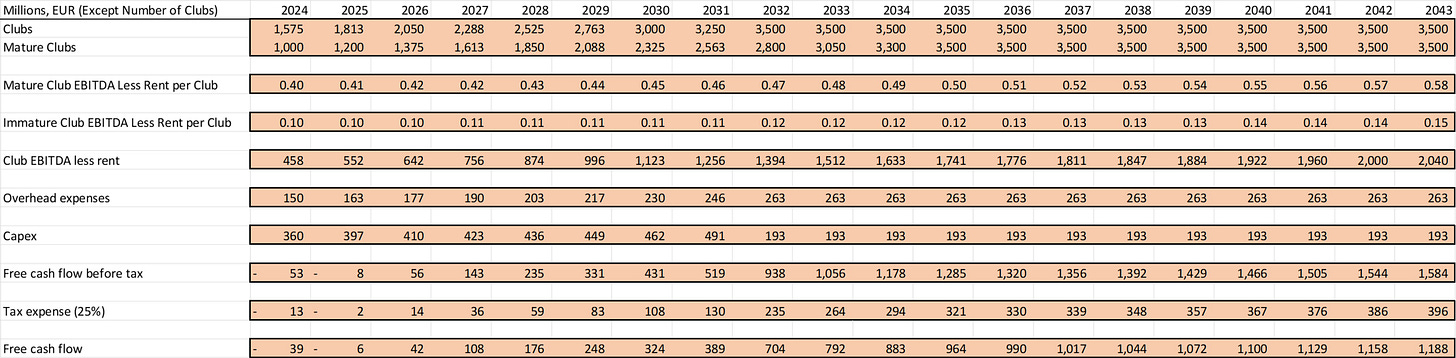

This assumes Basic-Fit keeps growing its club network to 3,000 locations by 2030, reaching 3,500 clubs by 2032, and then stops expanding. Again, some assumptions:

The forecast extends to 20 years, allowing for 10 years where the entire club network consists of mature clubs.

Early years have significantly higher capex and overhead (including marketing).

This scenario also considers profit from immature clubs, because they’re more meaningful than in the first scenario.

The projected free cash flows are as follows (click to expand):

These free cash flows suggest an expected return of 15.9%, indicating that expansion is the right strategy for Basic-Fit.

I’ll be keeping a close eye on the company and will likely start with a small position. I think risks are very low for these returns, providing investors an asymmetric opportunity.

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.

Hi SummitStocks,

We’re currently working on a school assignment and came across your valuation of Basic-Fit. We found it really interesting and were wondering if it would be possible for you to share your underlying calculations with us.

Specifically, we’re curious about how you processed certain figures from the annual report and how you worked them out in detail — such as the assumptions you made, which metrics or multiples you used, and any specific steps in your valuation model.

Thanks in advance, and keep up the great work!

Nice article, how do you calculate expected return rates?