Airbnb Stock in 2025

Why has Airbnb been such a poor investment and why is it a great opportunity today

Dear reader,

Airbnb is one of my main investments, making up about 11% of the portfolio as I’m writing this.

Since going public in 2020, its stock has gone nowhere—in fact, it’s down nearly 10%. Meanwhile, the S&P 500 is up around 60%, meaning Airbnb has fallen behind the market by about 70%.

I want to share my thoughts on Airbnb—why its stock has struggled and why I’m excited about the future.

What You’ll Read Today

Airbnb at a Glance

Why Airbnb is Underperforming

Risks

Valuation

Airbnb’s Valuation Today

Airbnb at a Glance

Founded in 2007, Airbnb is an online travel platform that connects guests with unique accommodations. The company operates a two-sided network, with hosts on one side and guests on the other.

With over 8 million active listings—from standard apartments to literal castles—Airbnb has reached an impressive scale. Its more than 5 million hosts vary from individuals renting out a spare room to earn an extra buck, often while living there, to businesses managing multiple properties.

Hosts choose Airbnb not just for its large guest base but also for the tools it offers to simplify hosting, including:

Scheduling and pricing guidance

Merchandising and listing optimization

Integrated payments and financial insurances

Community support and feedback through reviews

Co-hosting, a recently added feature that allows shared management

Guests access Airbnb through its website or app, enabling seamless booking. Travelers flock to Airbnb for its large variety of unique stays, authentic local experiences, and competitive prices.

Since 2021, the company has prioritized perfecting its core service, rolling out biannual innovations such as:

Enhanced flexibility

Curated wishlists and arrival guides

Categories and split stays

Guest favorites and group trip features

Pricing transparency

Airbnb is the largest alternative accommodation platform in the world, with a gross booking value nearing $80 billion. Booking Holdings, which operates under a handful of brands, is the second-largest player in this market and the leading online travel agency overall.

Once a hyper-growth company, Airbnb’s growth is slowing down to low double digits. But since the pandemic, the company has become highly profitable, with margins already approaching 40%.

So why is the stock struggling, particularly in the midst of a bull market?

Why Airbnb is Underperforming

Risks

Airbnb’s poor stock performance is largely due to overvaluation, but growing concerns about risks may also play a role.

Regulatory challenges have been a persistent issue since 2010, when New York first cracked down on short-term rentals. Cities worldwide have since pushed back against short-term rentals over concerns about housing affordability, community disruption, and safety.

Short-term rentals at scale were an entirely new concept when Airbnb emerged—in some cases, they weren’t even legal. While the company has since made agreements with many cities, regulatory battles seem never-ending.

Recent crackdowns in New York and San Francisco highlight the ongoing struggle. New York’s strict new regulations aimed to lower rent prices, but so far, they’ve had the opposite effect. Airbnb argues that the restrictions have:

Driven up hotel prices far beyond the national average

Reduced accommodation options in outer boroughs, hurting local economies

Made life harder for residents who rely on home-sharing in an already expensive city

And while the main goal was to combat the housing crisis, rent prices have only continued to rise—outpacing peer cities.

That said, Airbnb has learned from its early regulatory struggles. The company actively collaborates with local governments, educates hosts on compliance, and lobbies for fair regulations. Airbnb is well equipped to defend itself.

Another major risk? Competition.

The travel industry is massive and attracts constant new entrants. Airbnb not only competes with Booking Holdings and Expedia—it also faces:

Search engines (Google)

Metasearch platforms (TripAdvisor, Trivago)

Hotel chains and property management companies

With slowing revenue growth, investors seem increasingly concerned about Airbnb’s ability to sustain momentum.

But while competition is strong, Airbnb is at least as competitive. As the world’s largest alternative accommodation platform, it benefits from a powerful network effect. Moreover, its brand is so ingrained in popular culture that “Airbnb” is a verb, and it ranks as the 44th most valuable brand globally.

Valuation

The biggest reason, however, for Airbnb’s underperformance is overvaluation.

When Airbnb went public, its IPO price was $68 per share, but it opened at $145—more than a 100% premium. The stock then surged to an all-time high of over $210, pushing its market cap beyond $130 billion.

Expectations were simply too high. The stock ran ahead of itself and has since come back down to earth.

But that doesn’t mean Airbnb isn’t a massive success. Today, it’s valued at over $80 billion, a huge leap from $1 billion in 2011 and $30 billion in 2016. The stock’s performance alone doesn’t tell the full story.

The problem with Airbnb’s public offering was bad timing. The company went public in late 2020, during a wave of post-COVID euphoria, when investors were piling into speculative stocks. IPO’ed stocks all debuted at crazy valuations, and Airbnb was no exception.

Airbnb’s Valuation Today

Airbnb’s shares have had time to let their intrinsic valuation catch up. Heading into 2025, the stock looks far more reasonably priced.

The company has outlined three key areas for expansion:

Scaling the Core Business

In the latest earnings call, CEO Brian Chesky emphasized that Airbnb’s core business still has significant room for growth.

“The shortest horizon is actually just our core business. Again, we're approaching 500 million room nights booked a year. I think our core business could certainly get to 1 billion nights a year. I'm not going to put a time horizon on it, but the way we're going to do that is we're going to continue to increase quality.

For everyone who stays in an Airbnb, nine people stay in a hotel. So the question is, what if we get just one of those other people to stay in Airbnb? That's how you get to 1 billion.” (Emphasis added)

Geographic Expansion

Airbnb today is concentrated in five countries: The U.S., Canada, Australia, France, and the U.K. The company sees massive opportunities in other markets like Mexico, Brazil, Germany, Italy, Spain, Korea, Japan, India, and China.

Expanding Beyond Travel

According to Chesky, Airbnb’s biggest opportunity by far lies beyond the core business. He draws a parallel to Amazon, which started as a bookseller before evolving into a tech giant. Airbnb still relies on a single main product—short-term rentals.

While the company hasn’t revealed specifics yet, Chesky hinted at major expansion plans:

“I think Airbnb is going to go on its own journey. And what I expect is every year now, for the coming years, we will launch one to two new businesses that will generate $1 billion or more of revenue incrementally a year. […] But we have some really cool other things that we're working on and it's going to basically be starting with the nearest adjacencies around travel. And over the next decade, we're going to go far beyond travel.” (Emphasis added)

While these plans sound ambitious and exciting, the real question is whether the stock’s current valuation reflects an attractive opportunity.

As always, we must forecast free cash flow, since a stock is ultimately based on the present value of all future cash flows.

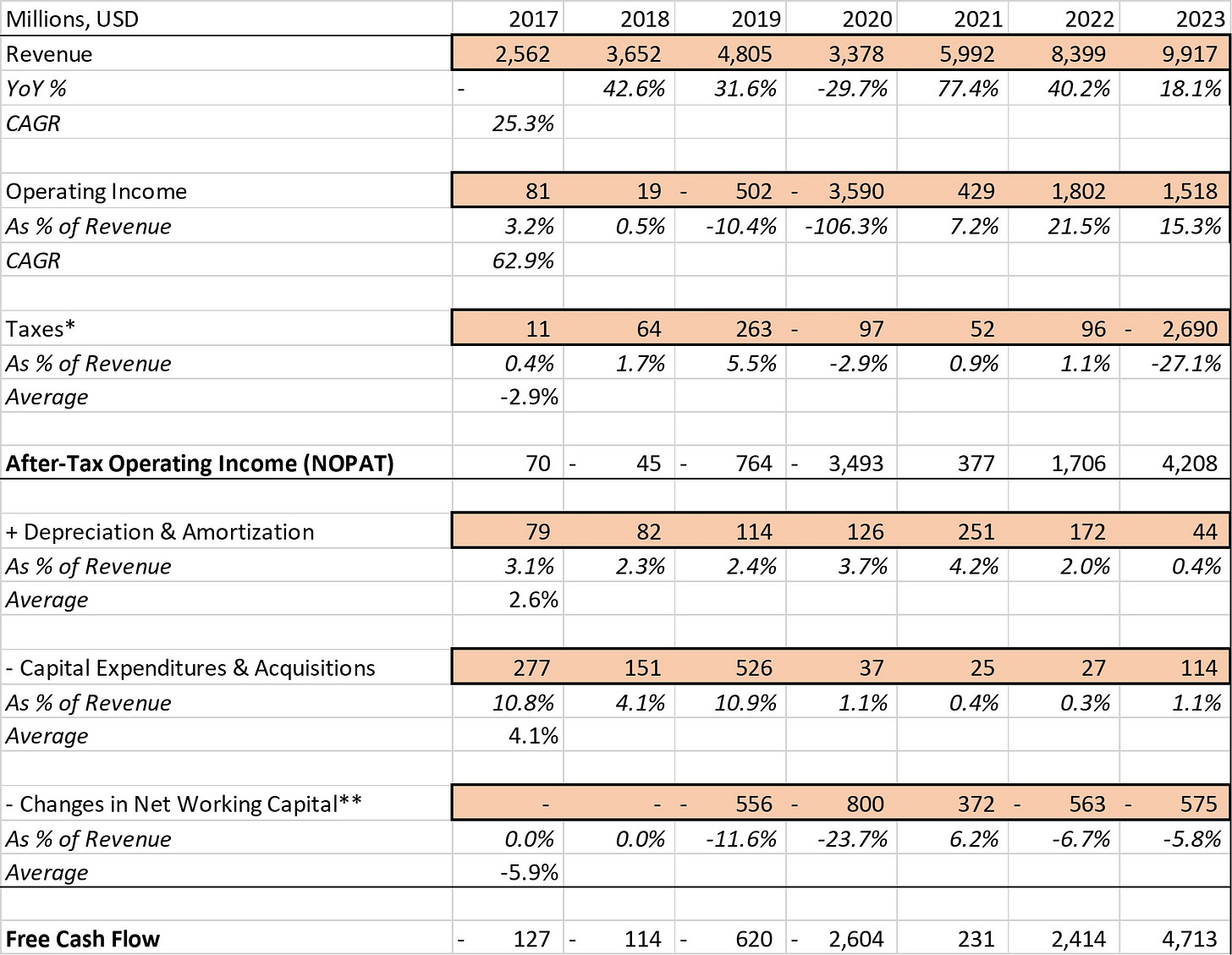

The image below shows Airbnb’s historical free cash flow, with stock-based compensation fully accounted for instead of adding it back. I bring this up because stock-based comp is a pretty big expense for the company.

It’s also worth noting that free cash flow in 2023 was unusually high due to a hefty tax benefit.

I expect Airbnb to grow revenue above the terminal rate for a long time, driven by the three growth areas mentioned earlier.

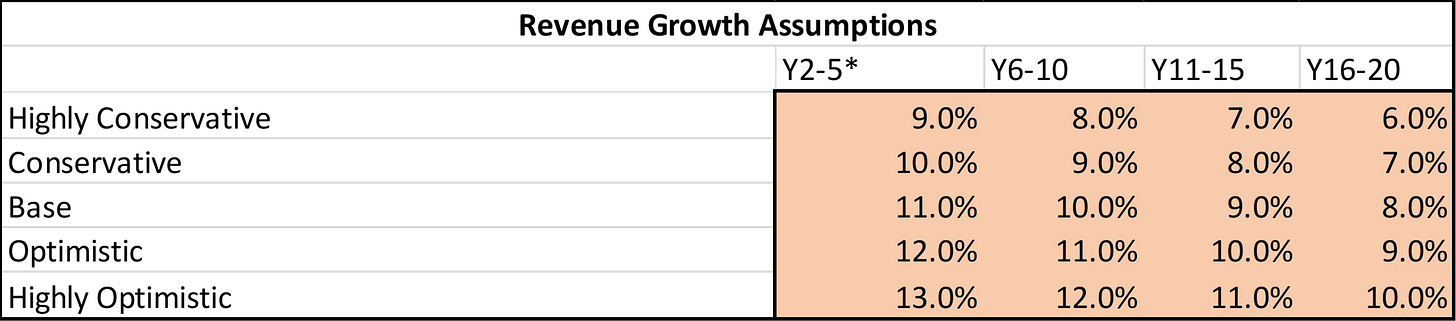

Here are my growth assumptions:

Beyond this period, I assume a terminal growth rate of 2.5%.

These growth rates are much lower than Airbnb’s historical performance and don’t account for potential expansion beyond its core business. If the company successfully executes on these plans, growth could be a lot higher.

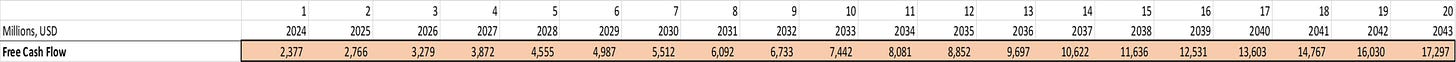

I assume operating margins of 29-41% by year 20, with a base scenario of 35%, a constant tax rate of 21% (similar to Booking Holdings), and I expect D&A and capital expenditures will remain relatively low. Below are the forecasted free cash flows in the base scenario (click to expand):

The following chart shows expected annual returns for each scenario:

I believe a return of 9% in the worst-case scenario is solid, while the base scenario suggests a return of 11%. Airbnb may not be a bargain, but it’s not expensive either. This seems like a case of a great company at a fair price.

I’m likely to increase my Airbnb position in the near future. I’ll keep you updated in my Portfolio Letter whenever that happens.

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.

I love the company its mgmt team, fcf margin and potential growth. This is a long term hold for me and I’ll love to add to my current position if opportunity presents itself

Great breakdown, thanks for this.