The Constellation Software Drawdown: A Rare Opportunity

An introduction to VMS serial acquirers and why they're in a drawdown

Some of the best-performing stocks of the past two decades have been serial acquirers. Constellation Software—the serial acquirer of software businesses—has been a 210-bagger since its 2006 IPO.

This gain cannot be overstated: a $10,000 investment at the IPO would now be worth about $2.1 million. Over the same period, the S&P 500 has gained just over 400%, turning $10,000 into $50,000—a smudge compared to more than $2 million.

Serial acquisition models are simple but powerful: buy small (software) companies, collect their cash flows, use those profits to buy more software, and keep repeating the process. That way, the snowball keeps rolling and rolling.

Great investors know the goal is to find companies with high returns on capital. But that’s only the first step. The second—and harder—step is reinvesting those returns at similarly high rates. Most profitable businesses eventually run out of good reinvestment opportunities.

The beauty of serial acquirers is that the reinvestment problem is largely solved. Attractive opportunities are abundant in the form of small, specialized software companies.

Specifically, businesses like Constellation Software, Topicus, and Lumine invest their cash flows in vertical market software (VMS).

This post is an introduction to that world: what VMS actually is, why it’s so attractive, how the serial acquirer model works, and where Topicus fits into it. Next week, I’ll dive even deeper with a full Topicus Investment Thesis for premium members.

What Is VMS?

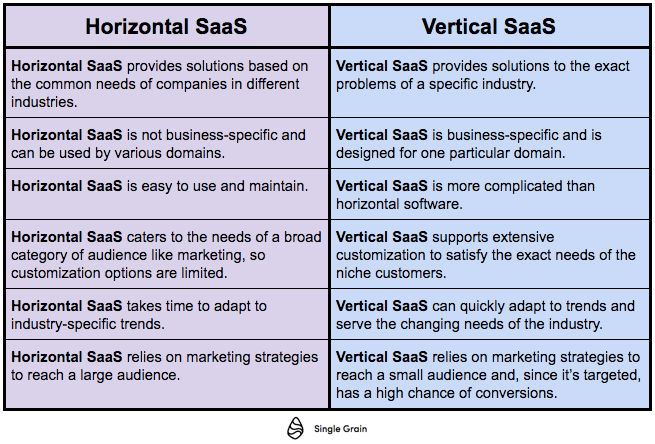

Software generally falls into two categories: horizontal and vertical.

Horizontal software (HMS) is broad and general-purpose. It serves functions, not industries. A CRM system, for instance, can help a car dealer, a bank, or a hospital all manage customer relationships in roughly the same way.

Because of that universality, horizontal software targets massive markets. Think of Salesforce, Microsoft, or ADP, whose products can be sold to nearly any business on earth.

The obvious advantage is scale. These products can reach millions of users worldwide. But there are downsides: competition is more common, customer needs vary widely across industries, and maintaining growth is expensive.

To compete, they spend heavily on sales, marketing, and R&D. Profit margins are pressured by the need to keep expanding functionality and acquire new customers.

Vertical market software (VMS) takes the opposite approach. It’s built for one industry—sometimes even a niche within an industry—and solves highly specific problems. Examples include software for 911 dispatch centers, student administration, or barbershop scheduling.

Each product addresses a small, tightly defined need. The TAM is limited, but the economics are stronger.

And since the markets are often too small for new entrants to rationalize spending, VMS companies often operate as local monopolies or oligopolies within their niche.

All this translates into low churn, high customer loyalty, and minimal development costs. Sales and marketing are efficient too, because it’s targeted and in a niche market: customers don’t have much choice.

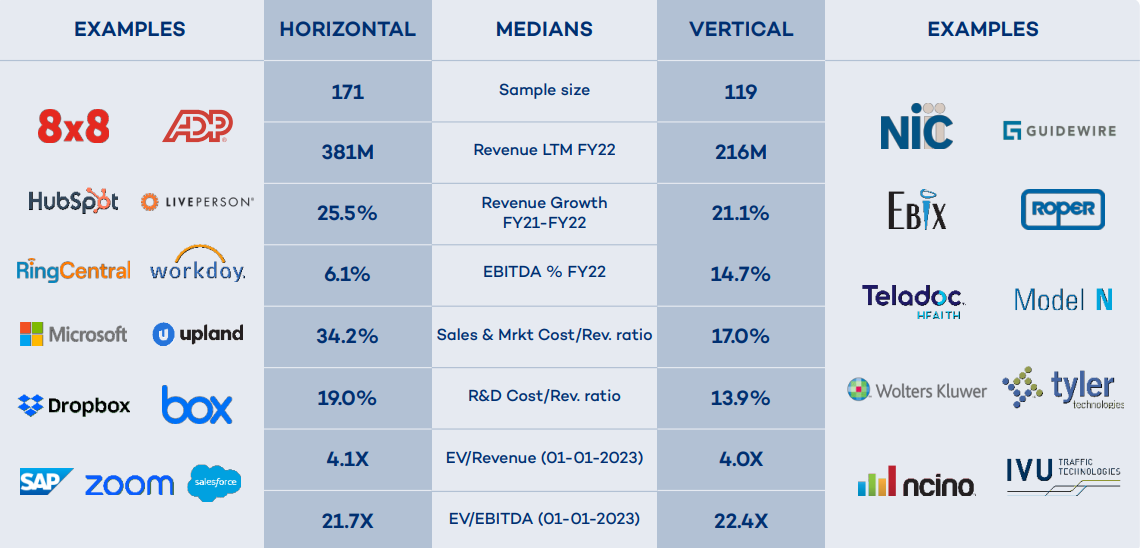

Research from Main Capital shows that VMS companies consistently spend less on both R&D and S&M compared to HMS firms. As a result, VMS businesses operate more profitably.

This combination of higher profitability, limited competition, and customer stickiness (due to limited to no options and mission-critical aspect) makes VMS more attractive than HMS.

The catch, of course, is scale. A single VMS company can dominate its niche, but it remains small. There’s a ceiling to growth when your product serves only, say, healthcare clinics or municipal governments.

The solution to this problem is the serial acquisition model.

Serial Acquirers and The Constellation Software Universe

When Mark Leonard founded Constellation Software in 1995, he didn’t invent serial acquisition, but he was first to make it work in software.

He was drawn to VMS for its high barriers to entry and limited competition. He realized that the only way to grow at scale was to own as many VMS businesses as possible.

Constellation’s model was (and still is) simple:

Acquire dozens of small VMS firms at attractive valuations

Delegate full autonomy to their founders and managers

Reinvest cash flows into more acquisitions

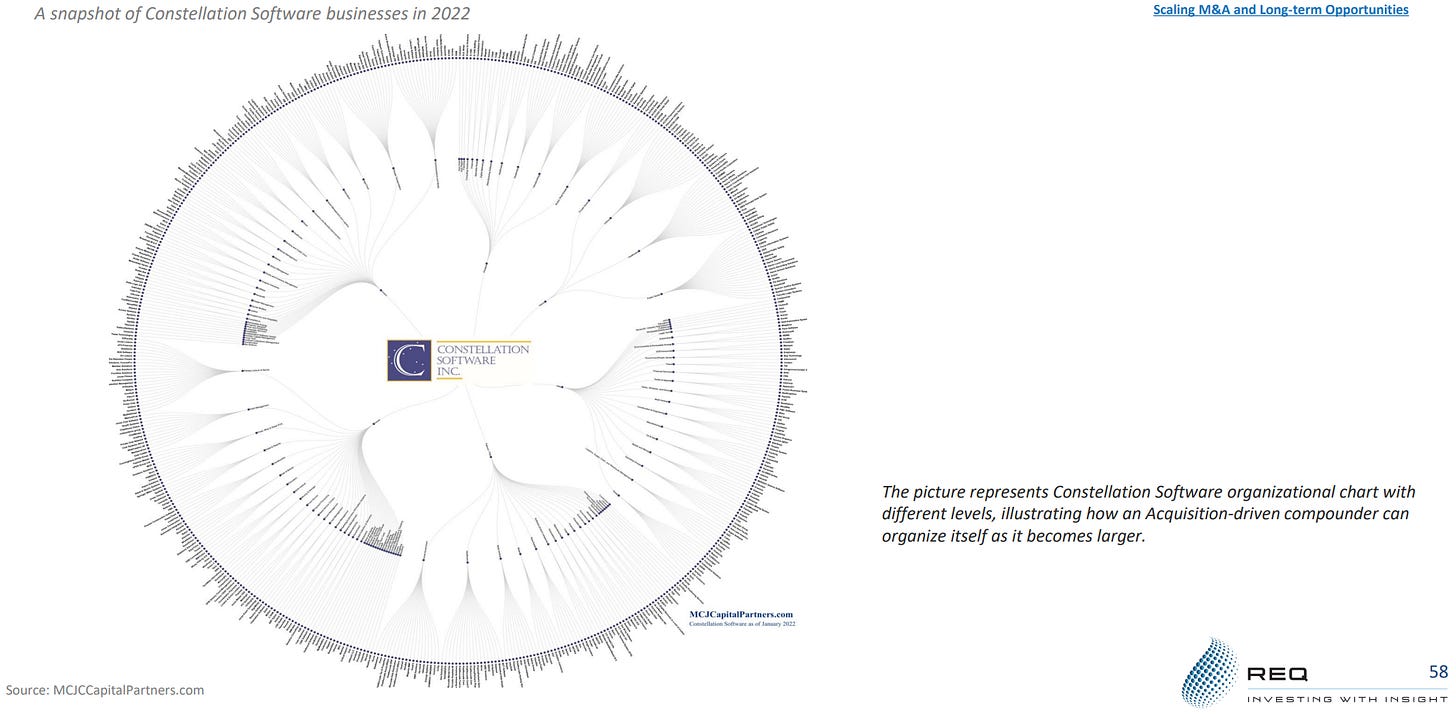

Over three decades, this constantly repeating process turned Constellation Software into a decentralized ecosystem of hundreds of small business spanning dozens of industries.

As the portfolio expanded, Constellation spun off two subsidiaries: Topicus in 2020 and Lumine in 2023.

Topicus is a combination of Total Specific Solutions (TSS)—Constellation’s European operating group—with Topicus B.V., a Dutch VMS business acquired by TSS. Topicus.com Inc. became a public company, while Constellation retained control through preferred (uneconomic) shares.

The spin-off now allows Topicus to pursue European-focused growth more aggressively. Yet Topicus remains part of the Constellation Software universe, through which it continues to benefit from Constellation’s “best practices.”

Over three decades, Constellation has built valuable experience and know-how. Since Topicus is still under its ownership, it continues to benefit from that knowledge: a decentralized culture with aligned incentives, rigorous acquisition evaluation, disciplined capital allocation, and a strong foundation of credibility and stability.

AI and The Departure of Mark Leonard

Constellation Software, Topicus, and Lumine have all sold off sharply this year, down roughly 26%, 29%, and 35% from their highs. There are two main reasons: growing fears about the impact of AI on VMS and the unexpected departure of founder and CEO Mark Leonard.

Leonard stepped down in September for health reasons, just days after Constellation’s investor call about AI’s impact on software. The timing didn’t help either, especially since Leonard seemed perfectly fine during the call.

However, Leonard built Constellation precisely so it wouldn’t depend on him. Decision-making authority is deeply decentralized, and capital allocation decisions are partly cascaded down through multiple operating groups. His absence is significant, but the system he built is self-sustaining.

Even so, the narrative right now is uncertainty.

The second reason for the selloff is AI. Investors are asking whether it will commoditize the kind of niche, industry-specific software that VMS companies have long dominated.

The fear is that anyone will soon be able to build their own software using AI, making Constellation’s legacy solutions obsolete.

Constellation tried to address these concerns head-on in a recent investor call. But the main takeaway from the call: management doesn’t yet know how AI will affect the industry.

“It’s difficult to say whether programming is facing a renaissance, or a recession.”

“We don’t know which way this is gonna go, we’re monitoring the situation closely.”

So far, AI looks more like a productivity enhancer than a disruptor. It helps developers rebuild code faster, but doesn’t reduce switching costs. Customers aren’t abandoning deeply embedded workflows just because someone can now code faster.

“AI will enable us to modernize and rebuild our solutions more effectively. But at the same time, how we maintain, troubleshoot, and bugfix our solutions, we’re still gonna have to do that whether the code has been written by AI or by humans ten years ago.”

And so to me, it seems like replacing a mature, mission-critical VMS product with an AI-first or no-code system would be a financial and especially operational challenge. A company might save on SaaS fees, but is it worth justifying taking on developer salaries, maintenance costs, security risks, et cetera? In most industries Constellation serves—healthcare, utilities, municipal systems—failure isn’t an option. The switching costs are enormous.

AI may (and very likely will) change how software is built, but now how it’s used.

Even so, Constellation also reminded investors that its valuation discipline already assumes uncertainty.

“The advantage of using a high discount rate already, is that it minimizes the terminal value in your overall assessment of the attractiveness of the investment. So we’ve got that going for us already inherently. We’re already discounting the future a lot.”

Every acquisition—whether at Constellation, Topicus, or Lumine—is tested against a high hurdle rate. In other words, their investment process already prices in a future where returns might be lower or innovation cycles faster.

Why Topicus Is The Best Bet

Constellation Software, Topicus, and Lumine are all high-quality businesses. Constellation Software is the “forefather” of Topicus and Lumine, with the latter two following in its footsteps.

Today, Constellation is valued at nearly C$80 billion (~56 billion USD), while Topicus is worth ~C$12 billion and Lumine ~C$9 billion.

Being smaller in the serial acquirer niche offers a longer growth runway. To materially move the needle, Constellation needs to make larger investments, which are harder to find. The result is a lower hurdle rate, leading to lower returns, and a lower reinvestment rate. At Topicus’s and Lumine’s sizes, it is much easier to reinvest all cash flows.

The main difference between the two is that Lumine focuses solely on the communications and media sector, while Topicus takes a broader approach, albeit in Europe. This combination of a long growth runway and stronger diversification makes Topicus, in my view, the better bet.

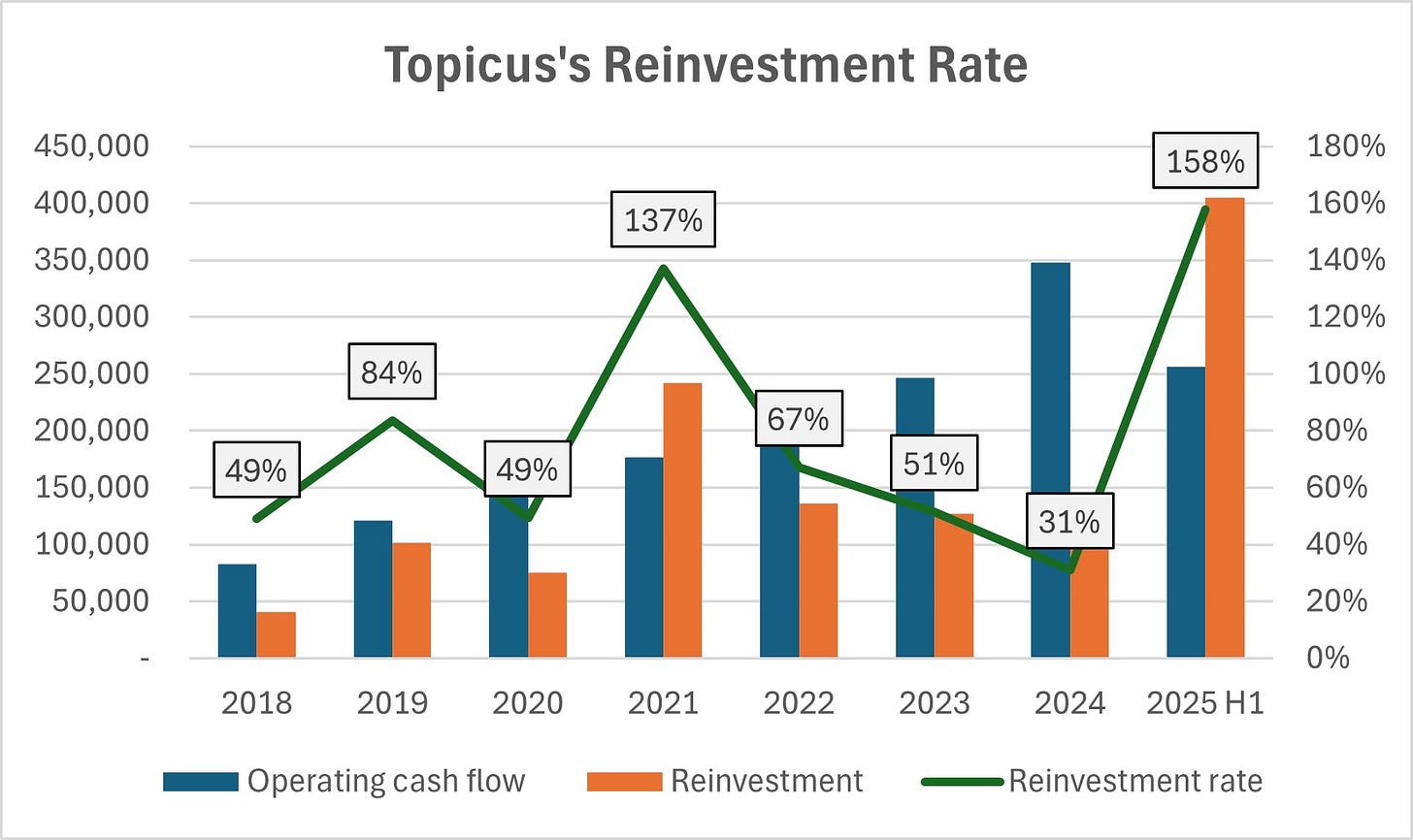

Topicus’s smaller size has allowed it to reinvest the majority of cash flows year after year, while sustaining high returns.

In most years, the reinvestment rate has exceeded ~50% of operating cash flows, with notable outliers in 2021 and in 2025 so far. From 2018 to today, the average reinvestment rate is just above 78%.

From 2018 to 2024, Topicus increased EBITA from €91 million to €342 million. Over the same period, invested capital rose from €241 million to €851 million. ROIC was 38% in 2018 and 36% in 2024, while ROIIC over the period reached 36%.

In other words, Topicus is reinvesting the majority of its cash flows at significantly high returns.

I use EBITA to measure ROIC and ROIIC because it isolates the performance of the existing VMS portfolio, ignoring non-cash amortization from past acquisitions. It represents the business’ real operating cash-generation capacity, which is also why it generally approximates operating cash flow.

Topicus’s reinvestment rate and ROIIC together translate into intrinsic value growth of 28% (78% × 36%)!

Yet, based on 2024 figures, Topicus trades at a price-to-EBITA of just 21.

The recent (and rare) drawdown makes this an attractive opportunity for deeper analysis. Topicus’s high-quality business, shareholder-friendly culture, and seemingly compelling valuation all point to a great opportunity for long-term investors.

That’s why I’ve been preparing a full Topicus Investment Thesis alongside this post, which I plan to publish next week for premium members.

Thanks for reading.

Lucas

Author & Founder, Summit Stocks

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.

Really enjoyed this breakdown of the CSU univese. The framing around VMS economics versus horizontal software is something I haven't seen articulated this clearly elswhere. What strikes me most is how the AI concerns might actually be overstated for mission-critical VMS applications. Like you mentioned, no municipal government or healthcare system is going to rip out deeply embedded workflows just because no-code tools exist now. The switching costs and operational risks are enormous. The Mark Leonard departure is definitely worth monitoring, but I agree the decentralized structre he built should endure. On Topicus specifically, that 78 percent reinvestment rate at 36 percent ROIIC is genuinely impressive. The implied 28 percent intrinsic value growth at a 21x EBITA multiple does seem mispriced given the quality. My only hesitation is whether European M&A multiples will stay as attractive if competition for VMS assets heats up. But at current prices, the risk reward looks compelling. Thanks for the thorough analysis.