Basic-Fit Is Doing Everything Right, But Shares Remain Cheap

Basic-Fit ($BFIT): Q3 results and updated valuation

Today, Basic-Fit, the largest fitness operator in Europe, released its Q3 trading update. Management only updated investors on revenue, club growth, and operational highlights—nothing about profit—but these are important business updates nonetheless.

And since Basic-Fit is one of my larger holdings, I think it’s worth sharing the key takeaways.

Below is my analysis of Basic-Fit’s progress in Q3, as well as my updated valuation.

Strong Membership, Steady Club Growth

2025 and 2026 are both transitional years for Basic-Fit. Earlier, the company announced a strategic shift: club growth would take a backseat while management focuses on improving the balance sheet and initiating share buybacks (for the first time ever).

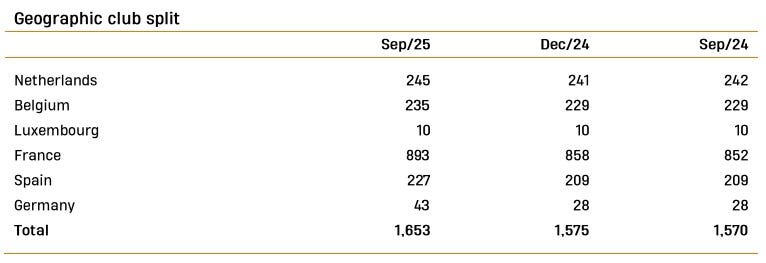

As a result, Basic-Fit has opened just 83 clubs in the first nine months of 2025, including 25 in Q3. That’s perfectly in line with its goal of 100 openings in both 2025 and 2026. The company remains on track to meet that target.

Despite the club network growing just 5% year over year, memberships rose 13% to 4.73 million, up from 4.2 million last year. September was particularly strong, as is usual when summer holidays end. In Q3 alone, 218,000 new members joined—95% higher than in Q3 last year—despite far fewer new club openings.

Revenue grew even faster, up 16% to €1.034 billion for the first nine months, driven by both member growth and the new subscription structure introduced earlier this year.

Because the membership count is expanding faster than the club network, the average members per mature club rose from 3,074 at the end of Q2 to 3,176. As I noted in my previous update:

“To reach the long-term target of €460,000 club EBITDA less rent per mature club, Basic-Fit needs ~200 more members per club, a number they believe is ‘very feasible.’”

In one quarter alone, the company added over 100 members per mature club. All of a sudden, that long-term target looks to be a lot closer.

Basic-Fit now operates 1,217 mature clubs, which is actually down from 1,219 a quarter ago. Mature clubs represent 74% of the total. I’m not entirely sure why the number of mature clubs went down, but three months is a short period for clubs to cross the maturity threshold.

Immature clubs now average just above 2,000 members, up from last year—a sign that newer locations are scaling faster than before. Each new class of openings is performing better than the last, with more pre-joiners signing up and faster ingrowth once clubs open.

Most new club openings were in France and Spain, followed by Benelux and Germany. France still has by far the largest footprint.

Germany, the youngest growth market, is benefiting from rising brand awareness, which supports faster membership ingrowth at new locations.

France remains the most important market. In Q2, Basic-Fit announced €35 million in additional staff costs to facilitate 24/7 operations. These costs are necessary because French law doesn’t yet allow unstaffed clubs, the model Basic-Fit uses elsewhere during extended hours.

In today’s update, management said those €35 million costs will be fully mitigated on a run-rate basis by year-end thanks to new membership growth. They remain optimistic that regulators will soon approve unstaffed operations, which would eliminate those costs entirely.

With that, 24/7 clubs are now available across all markets.

24/7 access, along with other improvements, has lifted Google ratings. For the first nine months of 2025, Basic-Fit averaged a 4.3 rating, up from 3.9 last year. Management considers Google ratings an important metric.

Meanwhile, 40% of new members in Q3 chose the “Ultimate” plan, the company’s most expensive subscription. CEO René Moos called this a very strong result.

In the Benelux, Basic-Fit introduced strength circuit training and “Relax & Recover” zoners in a handful of locations, the latter exclusive to Ultimate members. These include chair massages and cryo lounges. The company continues testing new ways to enhance the membership mix and drive higher adoption of premium plans.

Member satisfaction continues to improve. Average length of stay has risen to roughly 24–25 months, reflecting the payoff from better service quality and new membership perks.

Management didn’t share new information on franchising but still expects to do so before year-end.

The outlook remained unchanged. Basic-Fit’s business model is relatively consistent and predictable. Full-year revenue is still expected at €1.375 to €1.425 billion, implying growth of 13-17%. That means Q4 revenue should land between €341 million and €391 million.

Full-year EBITDA less rent remains guided at €330–370 million, despite weaker profitability in the first half. To translate this into free cash flow, remember that we need to subtract capex and taxes.

Free cash flow was negative €57.4 million in H1. Still, management expects positive free cash flow for the full year. The rebound should come from higher H2 EBITDA less rent and lower capex. Maintenance and energy costs were front-loaded in H1, and club openings in H2 are smaller and less capital intensive. Maintenance capex is also expected to decline meaningfully in the second half.

Management also plans to share more about capital allocation priorities at next year’s investor day, hopefully including potential buyback expansion, long-term balance sheet targets, and growth beyond 2026.

Should You Buy Basic-Fit Today?

As I write this, Basic-Fit’s shares are up up nearly 5% today. Since my previous update, they’ve risen about 16%. Since my deep dive back in January, they’re up over 20%.

Even so, I still believe Basic-Fit is an undervalued and misunderstood stock. Traditional valuation methods—whether a regular DCF or multiples—don’t capture the full picture here.

Understated profitability, complex accounting, and management’s use of unconventional metrics (which I’m not necessarily a fan of) make the numbers harder to interpret.

Yet everything is moving in the right direction. Despite slowing expansion, Basic-Fit remains by far the largest gym operator in Europe, and still the fastest-growing. For the first time, it’s expected to generate positive free cash flow. At the same time, the company is strengthening its balance sheet (which is much needed) and buying back shares.

I shared a valuation model for free in the Q2 update, and I’ll do the same again here, but with a few small adjustments:

Previously, I forecasted 1,300 mature clubs for 2025. I’ve revised that down to 1,100, given that the year began with just 990 mature clubs.

This more conservative assumption puts 2025 EBITDA less rent at €350 million, perfectly in line with management’s guidance.

For 2026, I now estimate 80% of clubs will be mature, down from 90% previously.

As a reminder, this DCF model calculates free cash flow in a non-traditional way, using Basic-Fit’s EBITDA less rent metric. It assumes the company reaches 3,500 clubs—its long-term target—by 2034, with no further growth beyond that.

The model also ignores any potential upside from franchising.

Based on these assumptions, the fair value comes out to roughly €50 per share. That suggests a wide margin of safety and supports the case that Basic-Fit remains a buy.

In fact, any price below €30 still looks more than reasonable. You can download the model below for free:

Thanks for reading.

Lucas

Author & Founder, Summit Stocks

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.