Q1 Results: Evolution, Amazon, Airbnb

Evolution unwarranted stock drop, and strong performances from Amazon and Airbnb

Q1 season continues, and this week three more of my portfolio companies reported results. If you missed it, you can read my previous Q1 earnings breakdown here.

What You’ll Read Today

Evolution

Amazon

Airbnb

Evolution

Let’s address the obvious first: Evolution’s Q1 results were poor and unexpected, as reflected in the stock sharp -19% reaction. This comes after an already challenging 2024.

Revenue increased by just 3.9% year-over-year to €521 million, while operating profit declined 2.7% to €303 million. The operating margin fell from 62.1% to 58.2%, due to:

A 21% increase in other operating expenses

A continued unfavorable resource mix

Rising personnel costs drive by headcount growth

Tariffs had no material impact.

Management pointed to two key drivers for the revenue slowdown:

Continued cyberattacks in Asia. It’s an ongoing issue since Q3 2024, and the company continues to try and resolve the problem.

Evolution has begun ringfencing in Europe, limiting access to its games to locally licensed operators only, a move CEO Martin Carlesund described as proactive and self-initiated, following the events in the UK. Evolution aims to stay ahead of other regulatory changes, and reaffirmed how regulation is a long-term positive.

Looking at regional performance, Europe and Asia remain weak, with both regions flat year-over-year. North America continues to grow at a healthy pace, while Latin America is up 10% year-over-year, though down sequentially. This declines is due to new regulations settling in Brazil. Carlesund noted that Latin America excluding Brazil is growing well.

Meanwhile, the operational disruptions in Georgia have been resolved. Carlesund confirmed that the Georgia strike is now “a closed chapter.”

But while growth is currently slowing—mostly due to one-time factors—there are further indications that this is only temporary.

Headcount is rising again following the Georgia strikes in 2024, driven by expansion in existing locations and the launch of new studios. In Q1, studios opened in New Jersey and Romania, with additional studios under construction in Brazil and the Philippines.

At the same time, product development remains active, with over 110 new game releases planned for 2025.

Despite the developments outlined, Carlesund understandably isn’t happy:

“Needless to say, I am not happy with the financial development in the quarter, but one must take into account that the results are impacted by necessary steps that contribute to our mission to ever increase the gap to competition.”

The second half of that statement is important. Ringfencing is a deliberate choice, not a regulatory mandate. By aligning early with regulators, Evolution seeks to strengthen its position as a reliable partner, raising barriers to entry in the industry.

A willingness to take short-term pain is usually a great indicator of a long-term aligned management team.

Even so, the market clearly didn’t like the results. But let’s take a quick glance at what’s priced in today.

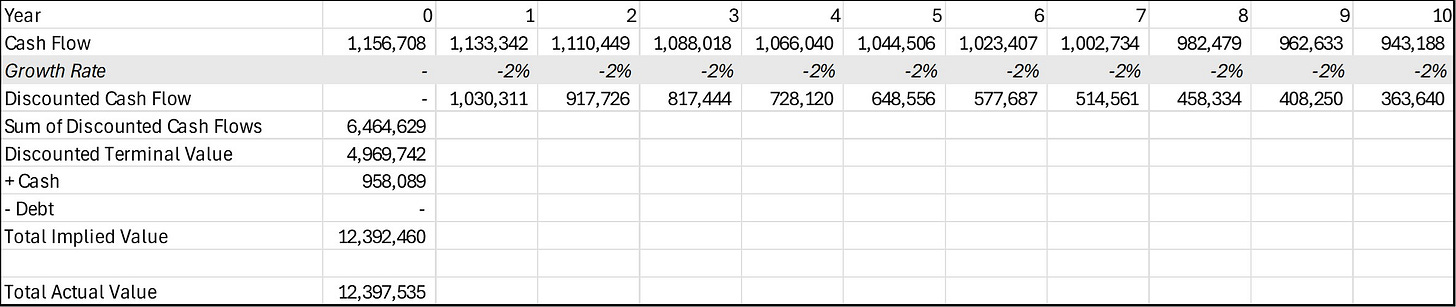

A simple 10-year reverse DCF suggests Evolution doesn’t even need to grow its free cash flow to justify today’s valuation. In fact, free cash flow can decline 2% annually.

The stock isn’t priced for minimal growth; it’s priced for declining growth.

I’ll say this: the current valuation is extremely compelling. While Evolution won’t return to its former 20%+ growth, it doesn’t need to. Even high single-digit growth will lead to outsized returns.

For that reason, I continue to hold the stock, despite a rough quarter and ongoing negative sentiment.

This post is for premium members.

Premium members get:

One high-conviction stock thesis each month (first thesis is already here)

Monthly Portfolio Letters

Stock updates & in-depth valuations

Exclusive access to our research platform Summit’s Analytics (launching next week)

Get 30% off now: only €105/year (€8.75/month)