Floor & Decor (FND) is a specialty retailer with over 250 warehouse-format stores focused on hard-surface flooring. By combining the widest in-stock selection with everyday low prices, it has built a defensible niche in a highly fragmented market.

What You’ll Read Today

Investment Case

History

Business Model

Industry Landscape

Moat

Key Financials

Capital Allocation & Management

Valuation

Investment Case

At first glance, Floor & Decor looks like a struggling retailer caught in the housing downturn. But look closer, and you’ll find a business with strong unit economics, durable advantages, and long-term ambition.

Charlie Munger once called Floor & Decor “the modern imitator of Costco”. Like Costco, FND wins through scale economics, operational efficiencies, and low pricing.

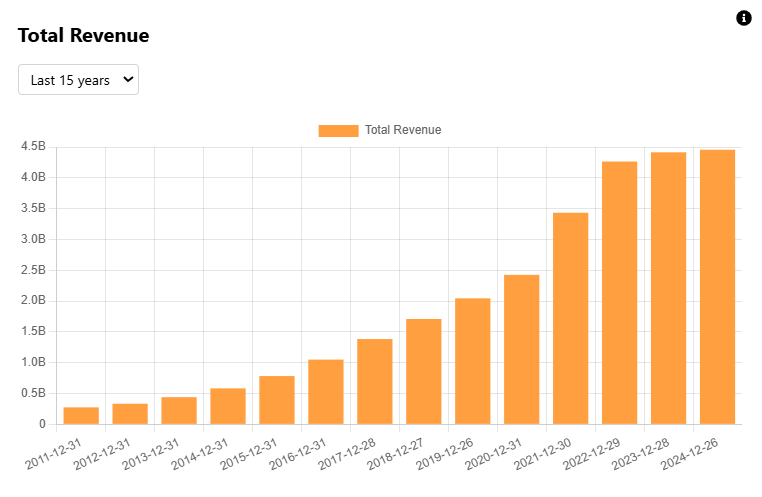

FND has grown revenue from $300 million in 2011 to $4.5 billion in 2024, compounding at a rate of 24% annually. Its warehouse-store format and focus on one product category create a moat of logistical and cost advantages unmatched even by Home Depot.

Growth has slowed since 2022, and the stock has followed. Elevated mortgage rates and reduced housing turnover have weighed on results. And because FND continues to expand through the downturn, its financials look deceptively weak.

But this isn’t a bad business by any means. With compelling store-level economics and a surprisingly wide moat, FND is a great opportunity.

What follows is a deep dive into the business model, industry, moat, financials, management, and valuation.

This investment thesis is for premium members.

To read the full article (and many future articles) consider subscribing for just €105/year (€8.75/month).

This is a limited-time launch offer at 30% off.