Shopify: E-Commerce Market Leader

A deep dive into the most advanced platform empowering entrepreneurship

Dear reader,

Welcome back to another deep dive into a wonderful company.

Today, learn all about Shopify, a market leader in e-commerce infrastructure, empowering anyone to run and manage their business online. Discover Shopify's origins, how it grew from a startup into a multibillion-dollar company, and Shopify’s prospects today.

Shopify offers small and medium-sized businesses the tools to start, scale, market, and operate businesses of any size. Its comprehensive platform enables customers to easily create and manage online stores, even providing solutions for payments, shipping, customer engagement, and more. Shopify is the one-stop shop for e-commerce. In this article, we’ll explore whether Shopify could be a worthwhile investment.

Table of Contents

1. Shopify’s History

1.1 Snowdevil

1.2 Graduation

1.3 Post-IPO

2. Shopify’s Business

2.1 How Shopify Makes Money

2.2 Shopify’s Moat

2.3 Key Financials

2.4 Future Outlook

2.5 Management

2.6 Risks

3. Conclusion

1. Shopify’s History

1.1 Snowdevil

The story of Canadian company Shopify begins in Germany, with one Tobias “Tobi” Lütke. From a young age, Tobi developed a deep interest in computers, dedicating as much time as possible to them, often rewriting game codes and even creating new ones. After completing school, he apprenticed at Siemens, a global technology conglomerate, where he further developed his programming skills.

On a trip to Canada, Tobi met Fiona McKean, who would become his partner—and indirectly, the reason Shopify is a Canadian company rather than a German one.

After moving to Ottawa, Canada’s capital, to live with Fiona, Tobi met Scott Lake, a family friend of the McKean’s and an ambitious entrepreneur who wanted to launch his own startup. Tobi, whose other passion was snowboarding, teamed up with Scott to start selling snowboards online.

Their original plan was to use existing e-commerce software to build the site, but they quickly found the available options lacking. This led Tobi to build the website from scratch, resulting in the birth of their first venture, Snowdevil.

After some success selling snowboards, Tobi and Scott realized that the real opportunity lay in the software Tobi had created. Recognizing that many aspiring entrepreneurs lacked the technical skills and resources to build their own e-commerce platforms, they pivoted. With a substantial starting fund of $200,000 provided by friends and family, Shopify was born in 2006.

1.2 Graduation

Tobi, along with Scott and Daniel Weinand, developed an intuitive product that allowed merchants to set up customizable online stores, integrate payment processing, track orders, and automate inventory management.

By 2008, Shopify surpassed $1 million in revenue. That same year, Scott Lake, who had been the company’s CEO, left to pursue other ventures, preferring the excitement of starting companies over managing them long-term.

Tobi, who had primarily focused on product development during Scott’s tenure as CEO, stepped into the role himself. Despite having a tech background and no formal business training, Tobi quickly adapted. He immersed himself in learning finance, management, and human resources. He had to become a complete CEO.

What Tobi accomplished was remarkable: despite having no business background, he taught himself everything he needed within a few weeks. Through extensive reading and guidance from venture capitalists, he learned the skills required to lead the company. His approach clearly worked, as Tobi remains Shopify’s CEO to this day.

Through several rounds of venture capital financing, the company continued to expand. Tobi compares Shopify’s journey to a school curriculum: the angel funding from friends and family represented grade school, venture capital funding brought the company into high school, and the 2015 IPO—which raised $131 million—marked Shopify’s graduation.

1.3 Post-IPO

At the time of its IPO in 2015, Shopify was already an intuitive platform designed to make commerce more accessible. In addition to providing software for building sophisticated e-commerce websites, Shopify offered an API platform and the Shopify App Store, enabling developers to create and sell apps for Shopify stores. The platform also included a mobile app for merchants to view and manage their stores, Shopify Payments to allow merchants to accept payments without a third-party gateway, and a point-of-sale solution for processing payments in physical stores.

That year, Shopify generated more than $200 million in revenue, and by 2018, the company had surpassed $1 billion in annual revenue. Shopify continued its upward trajectory, benefiting from a surge in e-commerce during the COVID-19 pandemic, which led to further growth. By 2020, Shopify had briefly become the most valuable publicly traded company in Canada, overtaking Royal Bank of Canada.

Shopify's growth didn't stop there. The company continued to innovate and expand its offerings, launching new services like Shopify Fulfillment Network in 2019, aimed at providing merchants with a competitive logistics and fulfillment solution. The company's revenue continued to climb, reaching over $7 billion in 2023.

Throughout its post-IPO journey, Shopify maintained its focus on making commerce accessible for businesses of all sizes, cementing its status as a leading player in the global e-commerce space.

2. Shopify’s Business

2.1 How Shopify Makes Money

Shopify provides merchants with the tools to start, scale, manage, and operate businesses of all sizes.

The platform stands out by offering a multi-channel front end, enabling merchants to showcase, market, and sell products across various sales channels such as web and mobile storefronts, physical locations, B2B sales, social media, and marketplaces. All of this is managed through a single, integrated back end that allows merchants to run their businesses seamlessly across these multiple channels.

I highly recommend exploring Shopify’s YouTube channel to get a better feel of how Shopify works and looks like from a merchant’s perspective.

Millions of brands worldwide use Shopify. Notable examples include:

Gymshark: This company switched from Adobe Commerce to Shopify Plus—one of Shopify’s advanced subscription plans—after Adobe Commerce failed to handle their website's traffic, resulting in eight hours of downtime and a loss of £100,000 on Black Friday.

MrBeast: YouTube star Jimmy Donaldson (MrBeast) uses Shopify to sell merchandise through his website.

Kylie Cosmetics: Founded by Kylie Jenner, this cosmetics brand relies on Shopify to manage its e-commerce operations.

As of 2024, Shopify’s cumulative Gross Merchandise Volume (GMV)—the total value of orders processed through the platform—surpassed the trillion-dollar mark. Shopify’s growth is closely tied to its merchants’ success, which is reflected in its business model.

The company distinguishes between two main revenue streams:

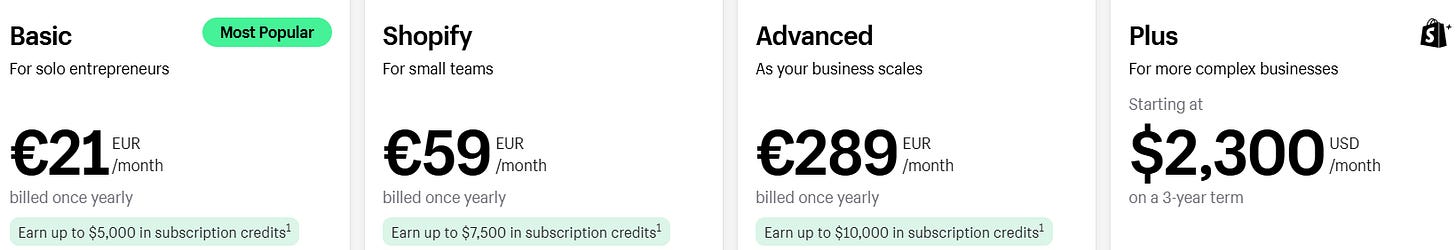

Subscription Solutions: Shopify generates revenue through its subscription plans, which cater to a range of merchants, from solo entrepreneurs to large enterprises. Higher-tier plans provide advanced tools, more staff accounts, and in-depth analytics. Shopify also earns subscription revenue from POS Pro, a solution designed for physical retailers needing a sophisticated point-of-sale system. Additional revenue comes from the sale of apps via the Shopify App Store, domain registration, and website themes.

Merchant Solutions: This segment complements subscription services by providing essential tools like payment processing, working capital, and shipping services. Shopify earns revenue from Shopify Payments, its integrated payment gateway that allows merchants to accept and process payments directly on their stores. Shopify charges transaction fees and currency conversion fees on these payments. Additional income comes from Shopify Capital, a lending service that provides merchants with funds to grow their businesses, and Shopify Shipping, which helps merchants connect with shipping carriers and manage labels and tracking for orders, for which Shopify receives fees.

Shopify’s ecosystem of products and services centers around its subscription plans, which enable users to build, manage, and scale their online stores. In addition, Shopify offers point-of-sale solutions, the Shopify App Store—where both third-party developers and Shopify publish apps to enhance functionality—Shopify Payments for payment processing, Shopify Capital for business funding, and Shopify Shipping for streamlined shipping management. Importantly, while the subscription solutions might be considered the core offering, merchant solutions generate the majority of revenue—more on that later.

2.2 Shopify’s Moat

Shopify’s economic moat is primarily driven by high switching costs, but it also benefits from network effects and intangible assets.

Shopify serves as an all-in-one solution, with merchants relying on sales and order management, inventory tracking, payment processing, marketing, CRM, shipping, and analytics. These multiple touchpoints across an organization make Shopify a "stickier" product—one that is deeply embedded into business operations. For instance, switching would be relatively easier if Shopify only handled CRM services. However, because it spans essential functions across departments, switching to another provider becomes far more difficult, costly, and time-consuming.

These switching costs are further amplified by Shopify’s multi-channel front end, which allow merchants to seamlessly manage sales across various platforms. This feature adds another layer of complexity for businesses considering a switch.

Additionally, larger merchants, who tend to have more intricate operations, face even higher switching costs. As Shopify increasingly targets larger merchants, their higher retention rates—estimated by investment research firm Morningstar to exceed 90%—provide a significant advantage in the form of recurring and more predictable revenue streams. Moreover, larger businesses are not only less likely to fail compared to small- and medium-sized businesses, but they also derive greater value from Shopify's integrated tools, making them less likely to switch platforms.

Beyond switching costs, Shopify also benefits from network effects, though to a lesser degree. The Shopify App Store, with over 8,000 apps, attracts developers who create solutions tailored to the platform’s users. As more developers build apps, the app ecosystem grows, drawing more merchants to Shopify. This self-reinforcing cycle enhances the overall value of the Shopify ecosystem and strengthens its competitive position.

Finally, Shopify has become a well-established and trusted brand in the e-commerce industry. Its reputation has helped it become the go-to platform for entrepreneurs. While not as significant a competitive advantage as its switching costs and network effects, Shopify’s brand does help differentiate itself.

2.3 Key Financials

Shopify remains a growth-focused company, continuing to prioritize revenue growth over profitability. However, as is common with larger businesses, its revenue growth has naturally slowed due to the law of large numbers. During the COVID-19 pandemic, Shopify experienced a significant surge, with revenue growing 86% year-over-year. In the past two years, growth has stabilized at over 20%, which remains impressive.

A key shift has emerged in Shopify’s revenue composition: in 2013, merchant solutions accounted for 24% of total revenue, but by 2023, this figure had soared to 74%. This change is partly attributed to the success of Shopify Payments, launched in 2013, which generates income through payment processing and transaction fees. This is what I was referring to when I mentioned that Shopify's success is closely linked to its merchants: the more sales its merchants generate, the more fees Shopify collects. Additionally, as merchants grow their revenue, they are more likely to stay with Shopify, upgrade to higher-tier plans, expand to new sales channels, ship more products, and adopt more services via the App Store, all of which generate additional revenue for the company.

In addition to revenue, key metrics include Gross Merchandise Volume (GMV), Gross Payment Volume (GPV)—the total value of transactions processed through Shopify Payments—and Shopify’s take rate. The take rate, calculated by dividing revenue by GMV, represents the portion of merchant revenue Shopify captures. GPV is particularly important as it represents the volume over which Shopify earns payment and transaction fees.

In 2023, Shopify’s GMV reached $236 billion. As seen in the exhibit, GPV is becoming a larger share of GMV, meaning relatively more merchant revenue is being processed through Shopify’s payment gateway. Additionally, Shopify’s take rate has been trending upwards, reflecting its pricing power and the continuous improvement of the platform.

Although there was a dip in the take rate during 2020, likely due to the unusual circumstances of the pandemic, the long-term trend is positive.

Regarding profitability, Shopify has mostly been unprofitable, with exceptions for one-time events. However, the company is approaching consistent profitability, having generated an operating income of $327 million in the six months ended June 30, 2024.

Shopify’s gross margins have hovered north of 50% in past years, though they fell to 49% and 50% in 2022 and 2023, respectively. This decline may well be due to the lower gross margins associated with merchant solutions compared to subscription solutions.

The company has shown improving free cash flow in recent years. Unfortunately, Shopify does use significant stock-based compensation to reward and retain its employees. While a non-cash expense, it should be subtracted from free cash flow, because stock-based compensation is a real cost to shareholders as it dilutes existing shareholders’ ownership.

Fortunately, stock-based compensation has significantly decreased in 2024, with $211 million reported for the six months ended June 30, 2024, down from $415 million the previous year. Additionally, free cash flow continues to grow solidly, suggesting that stock-based compensation will become a smaller relative cost.

Shopify’s return on invested capital (ROIC) has been low, particularly negative in the past two years due to reduced operating profits, thanks to high R&D and marketing expenses, and a $1.3 billion impairment expense in 2023. Excluding this one-time event, operating income would have been slightly negative. I expect ROIC to rise significantly as operating income improves.

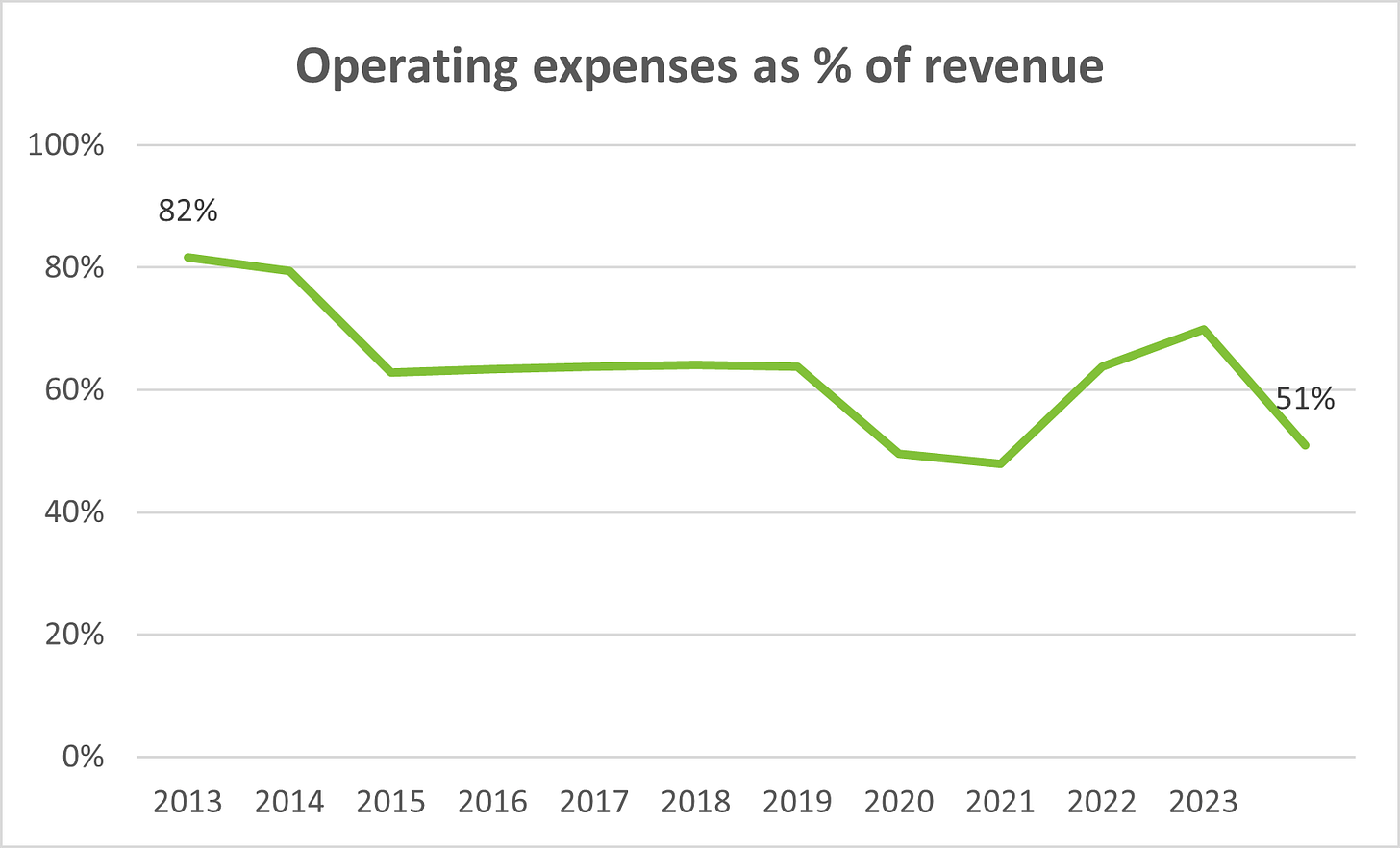

As I keep mentioning, it looks like Shopify is on track to become consistently profitable soon. This is also evident from the fact that operating expenses are shrinking relative to revenue. The main reason for this is economies of scale—essentially, as Shopify grows, it gets better at spreading out its costs, making it more efficient and lowering expenses compared to its revenue.

For a company that’s consistently been unprofitable, its balance sheet is surprisingly strong. As of its latest quarterly report, Shopify holds over $1.5 billion in cash against $1.1 billion in debt. The company has not accumulated significant debt, thanks to a large equity position, albeit achieved through substantial share issuance. Although this has led to shareholder dilution, the pace of dilution has slowed in recent years, further indicating progress toward consistent profitability.

2.4 Future Outlook

Shopify’s revenue continues to grow at high double-digit rates, while operating expenses are decreasing. For the six months ending June 30, 2024, revenue grew by 22% year-over-year, with operating expenses representing just 43% of revenue. Consequently, Shopify’s operating income exceeded $300 million. I anticipate that Shopify will maintain this trajectory and achieve consistent profitability.

Moreover, the company benefits from long-term secular trends in the e-commerce industry, which is one of the largest and still expanding. Shopify valued its total addressable market at $849 billion in 2023. With its revenue at $7.1 billion, this means that Shopify has captured less than 1% of the market so far.

Additionally, the company’s merchants hold about 2% of total retail sales in North America and 0.5% in the rest of the World. Notably, e-commerce is still a small portion of total retail sales.

The trend of e-commerce gaining market share should continue to benefit Shopify. Nevertheless, physical retail will continue to be the largest market in terms of total dollar volume for a long, long time. Shopify has successfully tapped into this market with point-of-sale solutions, omnichannel selling, and physical retail analytics, positioning itself as a comprehensive commerce solution rather than solely an e-commerce platform.

2.5 Management

Shopify’s CEO, founder Tobias Lütke, is a programmer and computer nerd at heart, with a clear long-term vision. He cares little about short-term profits, and even less about Wall Street’s expectations.

Lütke holds nearly 80 million shares of Shopify, valued at approximately $5.7 billion, and his annual compensation has been around $20 million over the past three years. This very significant stake aligns his interests with those of shareholders.

Shopify’s capital allocation strategy is sound, given its growth phase. The company does not pay dividends or buy back shares, instead directing revenue toward R&D and marketing. Stock-based compensation is decreasing relative to revenue, and Shopify has a history of acquiring small companies to enhance its platform.

2.6 Risks

As with any company, Shopify faces several risks. In my view, these are the company’s three biggest risks from an investor’s perspective:

Dependence on Small- and Medium-Sized Businesses: Shopify relies on businesses that are more vulnerable during economic downturns. However, the company is increasingly targeting larger, more stable businesses. Additionally, despite the high failure rate of small and medium enterprises, new entrepreneurs continue to enter the market, as seen in the company’s growing leads, a fancy word for anyone who signs up for a free trial. A continuous stream of new merchants should negate the negative effect of failing Shopify merchants.

Intense Competition: Shopify operates in a highly competitive and fragmented industry. Competitors include other e-commerce platforms like BigCommerce, WooCommerce, Wix, Squarespace, Salesforce, and Adobe, as well as major retail players like Amazon, eBay, and Walmart. Merchants even compete with themselves. Shopify is a market leader, however, in the e-commerce platform industry.

History of Unprofitability: While Shopify shows signs of profitability, its history of generous stock-based compensation and aggressive growth spending poses a risk. Although each metric moving in the right direction, consistent profitability remains a concern.

3. Conclusion

Shopify stands out in the e-commerce space with its comprehensive, all-in-one platform and multi-channel front end. The company’s merchant solutions, driven by Shopify Payments, have become a significant revenue driver. Despite facing risks related to small business dependence, intense competition, and past unprofitability, Shopify’s strong growth trajectory, high switching costs, and expanding market opportunities position it for future success. CEO Tobias Lütke has proven himself to be an exceptional leader, creating a multi-billion-dollar company from the ground up. Shopify is on a promising path toward sustained profitability and market leadership.

In terms of valuation, Shopify trades at around a 53 forward P/E ratio for 2025. This figure alone isn’t very informative, especially since Shopify lacks a history of profitability for comparison. While the stock appears reasonably priced based on its price-to-sales ratio, this could be influenced by past overvaluation. A key risk with a high P/E ratio is the potential for multiple contraction—where the stock’s price may not rise even if earnings per share grow, due to a shrinking valuation multiple. It’s generally better to invest in companies with a lower starting multiple. For now, Shopify will remain on my watchlist. I’ll stay patient and wait for a more attractive entry point. If that opportunity never comes, so be it. I’ve got other strong companies in the portfolio with similarly high conviction.

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.