Hi, fellow investors!

Welcome to the first monthly portfolio letter.

While we began the Investing202 Portfolio at the end of May, we started over in July as I decided to switched brokers. Since only one and a half months had passed, I felt it was not a problem to begin anew.

From now on, you can expect a monthly letter in your inbox that will discuss the performance of the portfolio and transactions made. I will also highlight other developments here and there in the stock market that I find important or interesting.

Performance

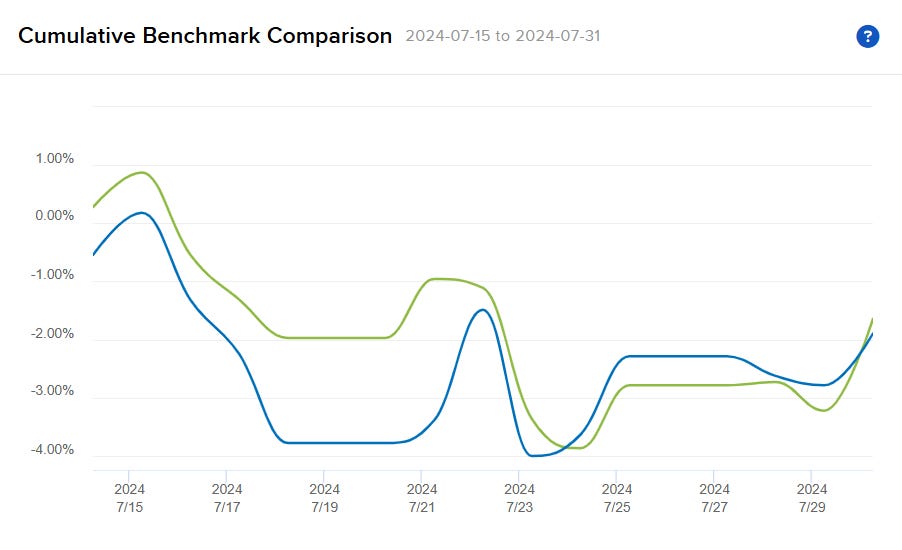

Let’s start with the performance of July, which really is quite unimportant since I switched to Interactive Brokers on July 15, meaning it’s only been two weeks since inception. Nevertheless, in July, the portfolio realized a cumulative return of -1.89%, while the S&P 500 (SPY) realized a cumulative return of -1.64%.

We slightly underperformed, but it’s completely irrelevant as of now. That being said, let’s turn to the holdings as of July 31, and discuss what I plan to do with them.

Holdings

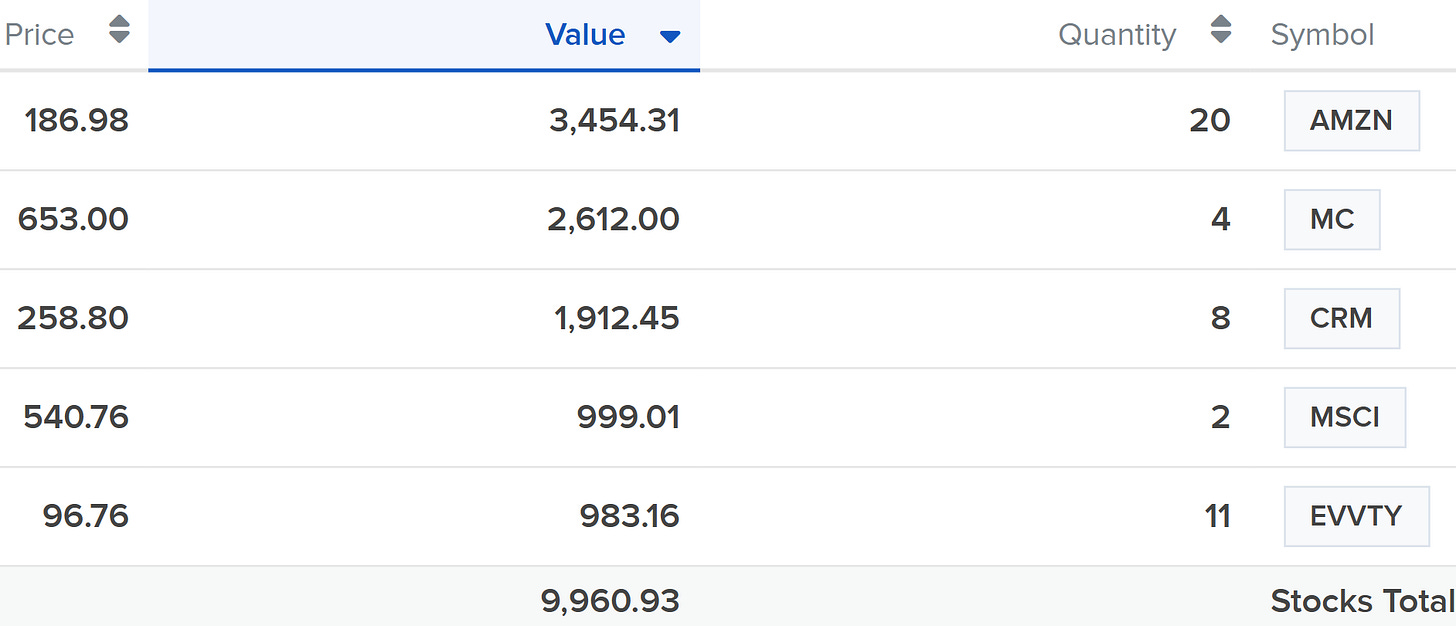

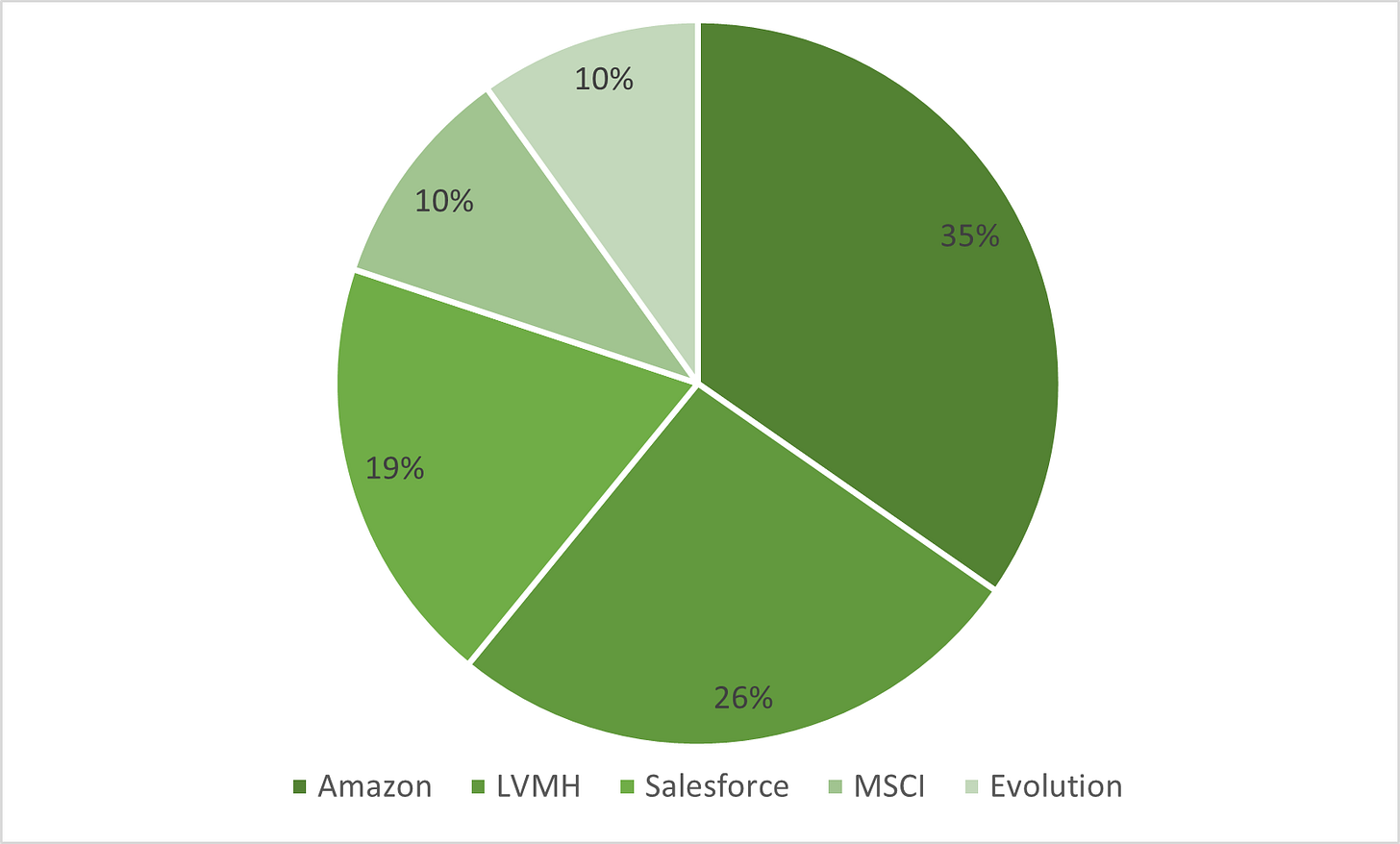

As of July 31, the portfolio consisted of Amazon (AMZN), LVMH (MC), Salesforce (CRM), MSCI (MSCI), and Evolution (EVVTY).

All holdings except for LVMH were already in the old portfolio. Besides adding LVMH, I also bought more Amazon shares, making it the biggest position by far.

Amazon is 35% of the portfolio. I have a very strong conviction in the company, which is why I’ll keep the position relatively big. Moreover, I plan to publish an updated deep dive on the company in the future, which should help properly explain why this company is my largest holding.

LVMH, the newest position, is the second largest. It is an established company with a wide moat and exceptional management. I look forward to owning shares in the conglomerate for many years to come.

Salesforce is, in my opinion, still at a decent price to add more shares, but I’m happy with the weight it has in the portfolio.

MSCI is an amazing company, but the shares have been trading up recently. I’ve decided to allocate capital towards better opportunities, and I’ll be waiting for a better price point.

Finally, Evolution has seen some share price weakness, and I might capitalize and add to my position in the coming period.

All five companies are extraordinary companies that I plan to hold for a long time.

Earnings Season

At the time of writing this first portfolio letter, we’re in the midst of earnings season, a usually turbulent and exciting period, with the biggest companies sharing how they performed over the past quarter. Often, share prices are volatile around earnings, as can be seen with one of our holdings: Amazon. The company published excellent earnings only yesterday, yet trades down around 8% pre-market. These price movements are based on emotions and irrational behavior. Analyst forecasts are deemed to be the only thing that matters, and when a company misses those forecasts, investors sell the stock in a rush. The truth is, those sellers aren’t investors. Real investors, with a long-term horizon, aren’t bothered by earnings of a three-month period, and they certainly don’t care about analyst forecasts.

So, how should you react?

In this case, Amazon hasn’t changed fundamentally. They’re growing nicely and according to plan. Drastic share price movements such as these should be viewed as opportunities rather than signs that the company is failing. Understand that the market can be wrong at times, especially during volatile periods such as earnings seasons. It is your task to determine whether the market is right or not.

Thank you for reading the July 2024 Portfolio Letter. I plan to improve the quality and utility of the Letters month by month. This letter is shorter than what I’m planning for the future, due to temporary time constraints. Bear with me, and let’s improve together.

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.