August 2024 - Portfolio Letter

Stock portfolio and watchlist of August 2024

Dear Reader,

Welcome to the second portfolio letter.

These letters will be posted at the beginning of each new month, providing an overview of the previous month’s performance and any changes made. While I will try to publish them as soon as possible, that doesn’t mean they will be hastily put together. I am committed to sacrificing an extra day or two if needed.

That being said, let’s discuss August.

August was a turbulent month, with the S&P 500 experiencing a sharp drop before quickly rebounding to all-time highs. As usual, investors panicked, creating a decent opportunity to pick up shares at discounted prices.

Unfortunately, I didn’t have significant capital available at the time, which leads me to an important question: How much cash relative to equities is ideal? Legendary investor Warren Buffett currently holds a cash reserve of $277 billion, which seems logical in a high-interest-rate environment. However, I believe in staying fully invested at all times, even during market peaks. Waiting for the next crash often means missing out on significant gains, and when the downturn finally occurs, it’s often just a higher low. Meanwhile, the market may have risen considerably, leaving those who waited congratulating themselves on their foresight without realizing what they’ve missed.

The truth is, no one knows the future. No matter how many models economists apply or how much they study the macro-environment, they can never be certain about what’s coming. Those who claim to know when the next recession or market crash will occur are, in my view, half-witted.

That said, holding cash isn’t necessarily foolish. While the future is unpredictable, corrections and crashes are inevitable, whether they’re stock-specific or market-wide. This leads me to consider whether having some cash on the sidelines in preparation for these events might be wise. Then again, that cash could potentially be more effective if allocated to cash flow-generating stocks. To hold or not to hold—that is the question.

That’s enough rambling for now.

The Summit Stocks portfolio consists of:

Amazon: One of the world's largest companies, Amazon is a leader in e-commerce, cloud computing, advertising, and streaming. The company is experiencing double-digit revenue growth, with free cash flow surging.

Amazon trades at a price-to-earnings ratio of 43 and a price-to-cash flow ratio of 39. At a glance, Amazon’s valuation seems expensive, but there’s still significant room for free cash flow growth in the short- and long-term. Besides, Amazon is an incredibly resilient and adaptive business, with a strong economic moat, making it a compelling story.

LVMH: The world's largest luxury goods conglomerate, LVMH, under Bernard Arnault's leadership, operates globally across various industries. The company owns iconic brands such as Louis Vuitton, Dior, Hennessy, and Tiffany. 2024 has been a slower year for LVMH, with no growth following a period of rapid expansion post-pandemic. However, the company is poised to return to steady growth as the luxury goods market normalizes.

LVMH trades at a price-to-earnings ratio of 24 and a price-to-cash flow ratio of 22, which I consider reasonable for a business of this caliber.

Airbnb: The most recent addition to the portfolio, Airbnb, connects travelers with hosts, benefiting from a strong network effect and brand equity. Founded in 2007, the company has promising future prospects under the leadership of CEO and founder Brian Chesky.

Airbnb trades at an attractive valuation given its future prospects, with a price-to-earnings ratio of 16 and a price-to-cash flow ratio of 17.

Salesforce: As the largest customer relationship management (CRM) company globally, Salesforce offers software and services that help businesses manage customer relationships, marketing, commerce, data, and more. The company is transitioning into a more mature phase, focusing on profitability and margin expansion while still achieving low double-digit revenue growth.

Salesforce trades at a price-to-earnings ratio of 27 and a price-to-cash flow ratio of 20, which I believe represents a fair valuation.

MSCI: A leader in indices, analytics, and data services, MSCI provides essential tools to clients worldwide, who use its indices to build ETFs, benchmark portfolios, and more. MSCI exemplifies steady and predictable growth, making it a "sleep-well" investment.

However, with a price-to-earnings ratio of 41 and a price-to-cash flow ratio of 34, the stock is currently not attractively valued. While I’d like to increase this position, adding at this level wouldn’t be wise.

Evolution: The final company in the portfolio, Evolution, is a market leader in live casino and RNG games, benefiting from significant scale advantages.

Evolution trades at a price-to-earnings ratio of 19 and a price-to-cash flow ratio of 17. Considering the risks associated with its industry, I believe the stock is fairly valued.

Below is a visual overview of the portfolio’s holdings and weightings, with Amazon remaining the largest position. I still plan to expand to 8-12 holdings, but I recognize the importance of being patient and selective when adding new positions—only the best companies will do. I was able to deposit more cash in August (unfortunately after the brief market dip) and used it to purchase Airbnb shares. I still have some cash on the sidelines, which I plan to allocate toward stocks soon.

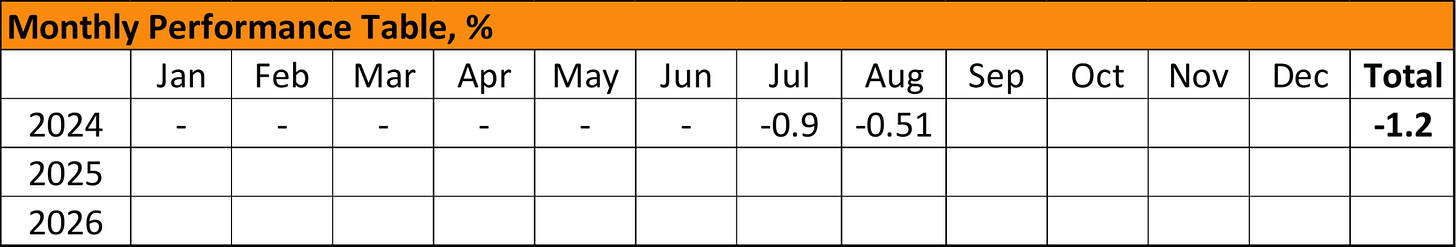

I’ve been compiling a watchlist of exceptional companies that I’d like to add to the portfolio at the right price. But before diving into this watchlist, I want to quickly highlight the portfolio’s performance for transparency.

Since inception, the portfolio has experienced two slightly negative months, primarily due to Amazon and Salesforce. Amazon has a cost basis of $182, while Salesforce’s is $255, leaving both positions only slightly in the red. The other holdings, with the exception of MSCI, are relatively flat, while MSCI is performing well.

That said, such a short timeframe is largely irrelevant and offers little to no insight into the true quality of these companies. Therefore, I’ll continue to focus on the long-term potential.

A watchlist is a useful tool for staying disciplined and patient when investing. It simplifies the buying decision, allowing for a more methodical approach. For me, quality comes first, then valuation—meaning that if a company isn’t on the watchlist, it won’t be added to the portfolio under any circumstance. No matter how cheap a stock may be, if the business lacks quality, I won’t buy it.

With that in mind, here are the companies currently on my watchlist. I consider these businesses outstanding, and at the right price, I’ll add them to the portfolio:

Adyen

Alphabet (Google)

ASML

Copart

Costco

Mastercard

Moody’s

Netflix

S&P Global

Visa

Companies not included either don’t meet my quality standards or I lack sufficient knowledge to assess them properly. This could mean I’m unfamiliar with the company, don’t understand its business model or industry, or haven’t yet gathered enough information to make a sound judgment. I plan to update and share this watchlist with each portfolio letter, though I don’t expect frequent changes.

Thank you for reading. Don’t forget to subscribe for deep dives into wonderful companies each Friday!

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.