Applying Mauboussin’s Framework to 3 Stock Crashes

Using six simple questions from Mauboussin's "Drawdowns and Recoveries" to judge if a crash is worth buying

Stock drawdowns are inevitable. In my last post about drawdowns, three key lessons stood out:

High-risk stocks that plunge the deepest tend to be poor investments if bought before the fall.

Once a trough is reached, deeper drawdowns on average deliver roughly twice the CAGR in shareholder returns compared to smaller ones.

Every drawdown should be carefully analyzed with a factual framework.

Today, I’m applying that framework to a few names from my portfolio and watchlist to judge whether they’re genuine opportunities or just falling knives.

The Drawdown Framework

Frameworks help investors stay rational when markets aren’t. A checklist helps strip away emotion and force discipline.

Mauboussin’s framework, which I outlined in my previous post, rests on six questions:

1. Are the fundamental issues cyclical or secular?

2. What does the basic unit of analysis tell you about the business?

3. How lumpy are investments in the business?

4. Is there sufficient financial strength?

5. Is there access to capital if needed?

6. Is management clear-eyed about the challenges?In practice, most of these boxes should be ticked before risking an investment. Drawdown stocks are high-risk by definition. Buying one is essentially you saying the market is wrong. And while the market can misjudge the short to medium term, betting against it requires conviction, discipline, and the stomach for discomfort.

I selected three stocks currently in drawdowns to show the framework in action. These aren’t market-wide picks but companies from my portfolio and watchlist that I know well.

Stock 1: Adobe

From its all-time high near $700 in November 2021, Adobe has been in a nearly four-year drawdown. The stock bottomed in 2022, recovered above $600 in 2024, and is now declining again.

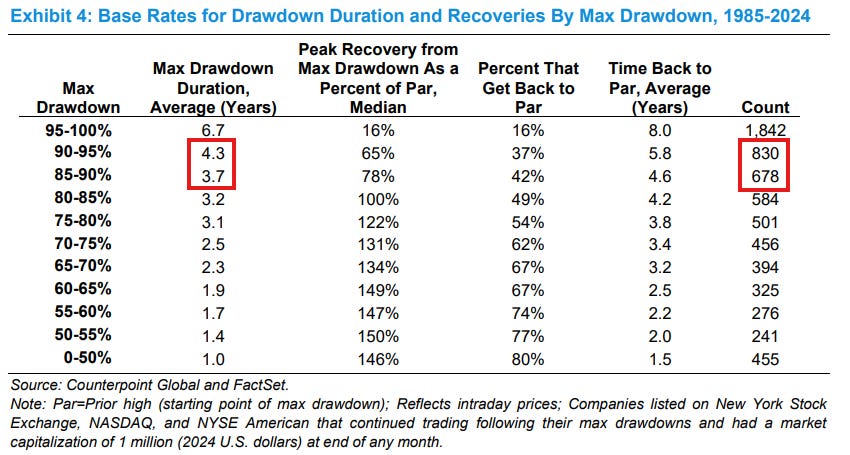

A four-year drawdown isn’t unusual. Mauboussin found that out of 6,500 U.S. companies, about 1,500 went through a four-year drawdown.

The difference lies in severity. Stocks in a four-year drawdown typically lose around 90% of their value. Adobe lost “only” about 50%.

Alternatively, you could view Adobe as entering a second drawdown starting January 2024. Since then, the stock has lost about 43% of its value, lasting nearly two years.

Either way, this is a meaningful drawdown, but the odds remain in our favor. At a 43% decline, Adobe has an 80% of returning to its all-time high, based on Mauboussin’s data. From the bottom (whenever it arrives), it would take 1.5 years to recover.

But that’s all historical data. What matters now is the framework:

1. Are the fundamental issues cyclical or secular?

I’d argue Adobe has no fundamental issues. The main risk is external: Gen-AI and competition. The current narrative is that AI is “eating” software, but narratives often stray from reality.

Adobe is being dragged down alongside software stocks like Salesforce, Monday.com, and Atlassian. This makes it cyclical, not secular.

When looking at Adobe’s revenue, ask yourself: does this look like a company in secular decline? Hardly. You could even argue AI will enhance Adobe’s business rather than weaken it. I go into detail on that in my Adobe Investment Thesis.

2. What does the basic unit of analysis tell you about the business?

Adobe creates significant value for itself and its customers. Products are sold on subscription models with high retention rates, leading to high customer lifetime value.

Customer value comes from best-in-class, feature-rich tools integrated into a single ecosystem.

3. How lumpy are the investments in the business?

Mauboussin argues that high, lumpy investments add risk in drawdowns. Adobe doesn’t face this problem. Its main investments—R&D and S&M—aren’t lumpy. Acquisitions like the failed Figma deal are exceptions, but rare.

4. Is there sufficient financial strength?

As of the latest quarter, Adobe holds $6.6 billion in debt against $5.9 billion in cash. An interest coverage ratio of 32x, strong and consistent free cash flow, and a growing backlog all signal financial strength.

5. Is there access to capital if needed?

This matters less when financial strength is already clear. Still, Adobe can issue shares or raise debt if required.

6. Is management clear-eyed about the challenges?

Adobe risks obsolescence if it mishandles AI. Management has acknowledged and embraced AI, integrating it across its products and with third-party solutions.

Some highlights from the most recent earnings call include:

“AI represents a tectonic technology shift and presents the biggest opportunity for Adobe in decades.”

“Our AI-influenced ARR has now surpassed $5 billion, up from over $3.5 billion exiting fiscal year 2024.”

“We are continuing to infuse AI into our flagship applications like Photoshop, Premiere Pro and Illustrator to help onboard new users more quickly and make existing users far more productive.”

“Firefly provides access to Adobe’s commercially safe generative AI models alongside a growing list of leading third-party models, including Google’s Imagen, Veo and Gemini Flash 2.5, OpenAI’s GPT-Image as well as Flux, Runway, Ideogram, Pika and Ray2 to name a few.”

“Firefly App MAU grew 30% quarter-over-quarter… with first-time Adobe subscribers through the app growing 20% quarter-over-quarter.”

“We have seen a direct correlation between increased use of AI and retention, and we feel very good about that.”

I believe these are all encouraging statements by management regarding Adobe’s biggest risk.

Drawdown Framework Adobe:

1. Are the fundamental issues cyclical or secular?

Cyclical, based on a narrative instead of reality ✅

2. What does the basic unit of analysis tell you about the business?

Adobe operates a highly profitable business, with high customer lifetime value ✅

3. How lumpy are investments in the business?

Investments are not lumpy ✅

4. Is there sufficient financial strength?

Yes ✅

5. Is there access to capital if needed?

Yes ✅

6. Is management clear-eyed about the challenges?

Management does not explicitly mention AI as a challenge or risk, but rather as an opportunity. It embraces and integrates AI across the business, with proven results ✅Stock 2: Novo Nordisk

From its all-time high of just over 1,000 DKK, Novo Nordisk is down 66%.

This peak was reached roughly 1.5 years ago, making the decline faster than Mauboussin’s average, where stocks dropping 65-70% took 2.3 years to reach their trough.

For now, Novo Nordisk’s trough is behind us, having reached 290 DKK in August. Relative to that trough, the drawdown is even more severe at 71%.

Historically, stocks with a 70-75% drawdown have a 62% chance of full recovery. The odds are still in our favor, but less so than with Adobe.

1. Are the fundamental issues cyclical or secular?

Novo Nordisk is clearly facing challenges: a stock doesn’t drop 70% without reason. The issues are a mix of self-inflicted missteps and external noise. Profit warnings, leadership changes, and a short-lived partnership with Hims & Hers have rattled investors.

On top of that, there’s also regulatory and political pressure in the U.S., underwhelming trial data for CagriSema and Amycretin, and intensifying competition.

The largest driver, however, is cyclical: past supply constraints have led to widespread compounding of GLP-1 drugs in the U.S.

“Despite the expiration of the FDA grace period for mass compounding on May 22, multiple entities continue to market and sell compounded GLP-1s under the false guise of personalization, and it is estimated to be around 1 million patients are on compounded GLP-1s in the U.S.”

Compounded GLP-1s in the U.S. are now illegal, yet pharmacies continue selling them, disrupting Novo’s business. This headwind should fade over time. Novo is actively pursuing the issue, filing 14 additional lawsuits in August.

Revenue and profit guidance for 2025 have been cut sharply: revenue growth is now expected at 8-14%, down from 16-24%, while operating profit growth is 4-10%, further impacted by one-time layoff costs. While disappointing, these downward revisions mostly reflect cyclical issues, not a structural decline. The long-term opportunity remains intact.

2. What does the basic unit of analysis tell you about the business?

Novo Nordisk earns revenue by selling patented obesity and diabetes drugs to patients, directly or via pharmacies, insurers, telehealth providers, etc.

What’s unique is that patients must continue using the drugs even after losing weight, making customer lifetime value extremely high. Gross margins of 85% further reinforce the strength of the business model.

The value to customers is substantial: for diabetes patients, the treatment is life-changing, while obesity is a chronic disease increasingly treated seriously.

3. How lumpy are the investments in the business?

Novo Nordisk’s investments are partly lumpy. The company manufactures its own drugs, requiring high capital expenditures, and it even acquired Catalent in 2024, a major drug manufacturer.

Large investments like these can’t easily be scaled down if demand drops. R&D, by contrast, is more flexible.

4. Is there sufficient financial strength?

As of July 2025, Novo Nordisk has total debt of 99 billion DKK (~$16 billion) against 19 billion DKK (~$3 billion) in cash. Historically, cash and debt have been balanced. With free cash flow expected at 35-45 billion DKK in 2025, the company can comfortably pay down its debt. Historical free cash flow has reached 70 billion DKK, and I expect similar levels in the near future. Interest coverage is also strong.

5. Is there access to capital if needed?

Like Adobe, Novo can raise capital via debt or equity.

6. Is management clear-eyed about the challenges?

The compounding problem in the U.S. is the biggest challenge. Management has explicitly addressed this, escalating lawsuits.

David Moore, EVP of U.S. Operations, said:

“Not to comment directly on any litigation, but I will let you know that there is nothing categorically that is off the table… And we have updated or increased our recent dialogue with FDA. And we will continue that ongoing dialogue, and we continue to think that there should be pressure that’s put on these entities that are false advertising, misleading patients with a legal API.”

Newly appointed CEO Mike Doustdar has also been vocal and active, emphasizing urgency to avoid complacency. A layoff of roughly 9,000 employees—announced earlier this month—will free 8 billion DKK, intended for reinvestment in diabetes and obesity growth, rather than boosting short-term profits.

Doustdar stated:

“Our markets are evolving, particularly in obesity, as it has become more competitive and consumer-driven. Our company must evolve as well. This means instilling an increased performance-based culture, deploying our resources ever more effectively, and prioritising investment where it will have the most impact – behind our leading therapy areas.”

He continued:

“It is always difficult to see talented and valued colleagues go, but we are convinced that this is the right thing to do for the long-term success of Novo Nordisk. We need a shift in our mindset and approach so we can be faster and more agile. Our transformation plan is designed to deliver this. By realigning our resources now, we will be able to prioritize investments to drive sustainable growth and future innovation for the millions of patients with chronic diseases globally, particularly in diabetes and obesity.”

While I’m skeptical about new CEOs making big and immediate changes, it’s reassuring that savings won’t be handed to shareholders. Management understands the problems and is actively responding, even if the outcomes are yet to be determined.

Drawdown Framework Novo Nordisk:

1. Are the fundamental issues cyclical or secular?

Largely cyclical, due to previous supply constraints ✅

2. What does the basic unit of analysis tell you about the business?

Novo Nordisk operates a highly profitable business, with high customer lifetime value ✅

3. How lumpy are investments in the business?

Investments in production capacity are lumpy, but R&D isn't ⚠️

4. Is there sufficient financial strength?

Yes ✅

5. Is there access to capital if needed?

Yes ✅

6. Is management clear-eyed about the challenges?

Management is actively trying to solve the compounding problem. The new CEO is unproven but active (whether that is a positive remains to be seen) ⚠️Stock 3: Greggs

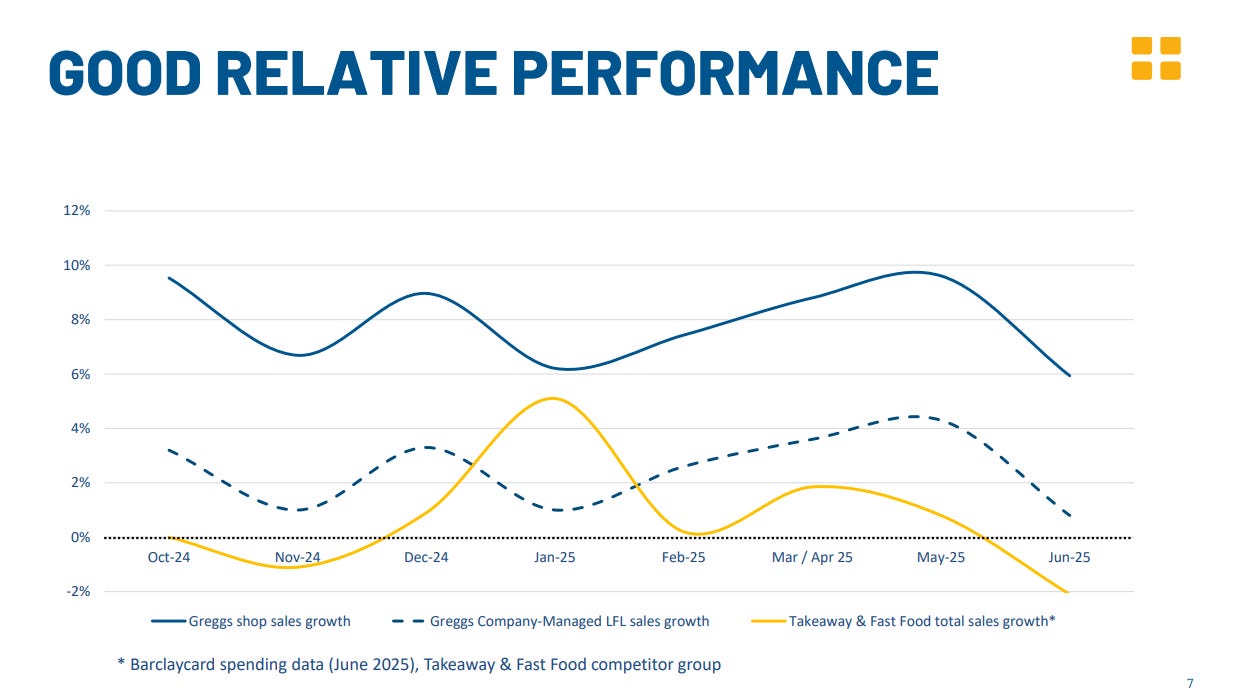

Greggs is down 46% over the past year, now trading at £16. From its all-time high, shares are down just over 50%.

The stock price trajectory mirrors Adobe: an all-time high 2021, a crash in 2022, a near-full recovery in 2024, and now another decline. From the 2024 peak, the stock is down ~50% in just over a year.

This aligns with Mauboussin’s findings: a 50-55% drop typically takes 1.4 years, and 77% of stocks in that drawdown range fully recover and then some.

1. Are the fundamental issues cyclical or secular?

Greggs faces low to negative free cash flow, a struggling U.K. economy, and oversaturation risks.

Profits are under pressure, with management projecting “modestly lower” operating profit than 2024, due to slower revenue growth, inflation, higher employment taxes, and investments in supply chain infrastructure.

Slower revenue growth is caused by the weak U.K. economy, despite ongoing store expansion.

Free cash flow has been declining due to profitability pressure and a heavy investment cycle, which will continue until around 2027. Afterward, free cash flow should rebound.

The weak U.K. economy and Greggs’s investment cycle are both clearly cyclical issues.

Oversaturation is the secular risk. Greggs has over 2,600 locations, aiming for 3,500 in the U.K. Beyond that, expansion becomes challenging. International growth has failed previously. For now, however, the runway is sufficient, and valuation post-investment cycle is attractive. I talk about this in greater detail in my Investment Thesis.

2. What does the basic unit of analysis tell you about the business?

Greggs makes money by selling food and drinks across multiple shop formats and channels. Shop economics are strong: target-store ROIC is 25%, with a hurdle rate of 22.5%, typically reached in two to three years.

Customers get convenient, affordable, and decent food at a more than fair price.

3. How lumpy are the investments in the business?

Investments in the business aren’t inherently lumpy—except during expansion amid economic weakness. It’s unfortunate timing that Greggs is currently investing heavily in distribution and store rollout, because the payoff will be delayed.

Yet store expansion can be slowed if needed. Those investments aren’t lumpy.

4. Is there sufficient financial strength?

As of June 2025, Greggs holds £32.5 million in cash against £451.4 million in debt. Most of this debt is lease liabilities; actual debt is £35 million. Interest expenses are modest relative to operating profit.

5. Is there access to capital if needed?

Greggs can access capital, though likely at higher cost given current U.K. conditions.

6. Is management clear-eyed about the challenges?

During the H1 2025 earnings call, management acknowledged macro challenges and weather effects (which also had a negative impact):

“We had a broadly improving picture until we reached June… I did contemplate showing you a beautiful correlation between year-on-year temperature change and like-for-like growth. And it’s one of the kind of most correlated graphs I’ve ever seen in my life… But that is the nature. We’ve seen it over the years. Hot weather just makes people eat less. That’s been a fact.”

Greggs continues outperforming competitors despite these headwinds.

Management also addressed the investment cycle:

“We’re coming down to the end of the high investment phase where we’ve had net cash outflows and run down the significant cash that we carried into this period. And from next year, we’ll be into this lower capex phase where we start to become cash generative again… And from 2027 onwards, we have more optionality over our cash.”

Oversaturation doesn’t only mean that growth is limited, it also opens up the risk of cannibalization. CFO Richard Hutton continued by addressing this next problem:

“I want to address the question of, is it [expansion] cannibalizing the existing estate? Well, we’ve already had one clue, which is that the total sales growth is staying steady ahead of like-for-like growth… Typically, the shops mature over 2 to 3 years. And as they mature, they tend to go on and exceed that target rate of return on investment and get beyond 30% in terms of ROI... The growth locations that we’re opening more in outperform the traditional estate... In 2024’s openings, 60% of the new shops, excluding relocations, were in an area where there was no existing Greggs within a mile... where there was a Greggs locally, we studied the impact... the transfer of sales... was only 5%.”

Greggs prioritizes convenience, opening stores in close proximity to increase visit frequency without hurting existing locations (only 5% cannibalization at most). Management clearly understands the challenges and is actively managing them.

Drawdown Framework Greggs:

1. Are the fundamental issues cyclical or secular?

Cyclical, except the long-term oversaturation risk ⚠️

2. What does the basic unit of analysis tell you about the business?

Greggs operates stores with an attractive ROIC, and the value proposition for customers is also attractive ✅

3. How lumpy are investments in the business?

Investments in production capacity are lumpy, but store expansion isn’t ⚠️

4. Is there sufficient financial strength?

Yes ✅

5. Is there access to capital if needed?

Yes ✅

6. Is management clear-eyed about the challenges?

Management is addressing virtually every issue during earnings calls ✅What the Framework Tells Us

Mauboussin’s framework takes the emotion out of drawdowns and helps us analyze better. The three cases I went through provide a sense of how to approach the framework.

Drawdowns will always happen. The job is to tell which ones are recoverable and which ones aren’t. A checklist won’t make you right every time, but it stops you from guessing.

Thanks so much for reading.

Lucas

Author & Founder, Summit Stocks

In case you missed it:

Disclaimer: the information provided is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and nothing on this platform should be construed as personalized financial advice. All investment decisions should be made based on your own research.